Introduction

Artificial Intelligence (AI) has emerged as a disruptive force in modern finance and has almost completely overhauled how operations are carried out in the industry (Tao et al., 2021). AI, which typically involves technologies such as machine learning, deep learning, and natural language processing, now dictates the mediums for financial functions. Its impact cuts across a wide range of applications—from algorithmic trading and fraud detection to customer service chatbots and robo-advisors (Ranković et al., 2023).

This rise in adoption is also evident in the projected doubling of financial institutions’ AI expenditure, expected to reach $97 billion by 2027 (Kearns, 2023). With an estimated compound annual growth rate (CAGR) of 29.6%, the financial sector is now the fastest-growing industry globally in terms of AI investment (La Croce, 2023). This exponential growth has prompted leading financial firms such as JPMorgan and Morgan Stanley Wealth Management to establish their AI infrastructures, recognizing the technology’s transformative potential (Kearns, 2023). However, this transformative potential presents a paradox: while AI is capable of driving breakthrough performances, it also harbors systemic risks that depends primarily on how it is regulated and ethically deployed (Ahern, 2021; Arner et al., 2020; Berdiyeva et al., 2021).

Recent developments in advanced AI models, such as ChatGPT and DeepSeek, reinforce the argument for the immense benefits that can be derived from AI technologies; however, their cross-border and pervasive nature also introduces novel risks that demand careful scrutiny to prevent potential widespread crises (Bahoo et al., 2024). One such critical risk is the issue of human oversight. Effective oversight requires that human decision-makers possess the ability to interpret and evaluate AI-generated outputs, to accept, reject, or modify AI recommendations based on ethical, legal, and practical considerations (Černevičienė & Kabašinskas, 2024). This ensures that ultimate responsibility remains with human operators, who can intervene to mitigate adverse outcomes and align AI applications with ethical standards. Such oversight not only ensures accountability but also enhances the responsible use of AI technologies, guarding against risks while fostering trust in AI-driven financial systems (Max et al., 2021).

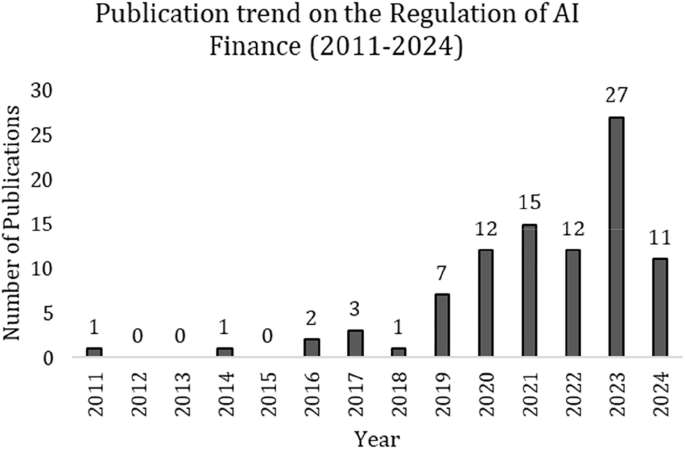

As AI in finance continues through its adoption and growth phase, it is expected that its full benefits and potential threats will become more apparent over time. This dynamic has spurred a significant surge in AI finance publications in recent years, as researchers strive to address literature gaps and identify emerging trajectories to advance the field (Goodell et al., 2023). Over the past two decades, the volume of publications has risen considerably, from an annual average of 29 to 178 articles, based on our dataset. These studies explore a wide range of topics, including optimal financial models, associated risks, and diverse applications across various facets of finance.

Since the early 1990s, when scientific research on AI in finance first emerged, numerous technologies have been adopted, redefined or replaced in response to the evolving needs of financial markets. Concurrently, the terminology and focus of research have shifted to mirror this changing landscape (Leone & de Medeiros, 2015). For researchers and finance professionals, understanding both foundational and niche themes in AI is crucial to developing technologies and research that align with current trends and dynamics. Against this backdrop, this study examines trends in AI finance research to identify key stakeholders, influential topics, and areas that are prime for further exploration to provide a structured analysis of research gaps and development trajectories.

Major research gaps remain in the literature, particularly in understanding the evolving regulatory landscape and ethical considerations surrounding AI-based finance (Brummer and Gorfine). The fast pace of AI application adoption demands that current regulatory frameworks and ethical dilemmas are critically examined, including issues of algorithmic bias and fairness (Friedler et al., 2019). Addressing these issues is essential to ensuring the responsible development and deployment of AI technologies in finance and protecting the interests of both financial institutions and consumers (Pithadia, 2021).

Regulators face considerable challenges in understanding the underlying mechanisms of complex AI systems, complicating their efforts to establish effective oversight. Similarly, consumers struggle to decipher the reasoning behind AI-generated outputs in their decision-making process. These challenges led to the emergence of Explainable Artificial Intelligence (XAI), which prioritizes transparency and interpretability in AI models (Chen et al., 2023). Moreover, the rapid pace of AI technology advancements implies that regulatory frameworks are continuously updated, which imposes substantial costs on regulatory bodies. Other regulatory challenges include ambiguous regulations (Arner, 2019), data privacy and security concerns (Lopez & Alcaide, 2020), and the lack of global regulatory harmonization (Erdélyi & Goldsmith, 2018) —factors that collectively threaten the effective and ethical use of AI in finance. The 2008 financial crisis—triggered by lax oversight, complex financial products and inadequate risk assessment—serve as a stark reminder of the consequences of regulatory failures (Vukovic et al., 2019; Gorton & Metrick, 2012). The 2010 Flash Crash also further exemplifies the risks posed by inadequately regulated AI-driven systems in causing sudden and severe market disruptions (Frömmel, 2022).

This study addresses these critical gaps through a comprehensive literature review, employing a scientometric approach to analyze the existing body of research on AI in finance. The primary objectives are twofold: (1) to identify prevailing research trends and prospects in AI finance, and (2) to investigate the applications, regulatory frameworks, and ethical considerations associated with AI in finance. The scientometric methodology provides a robust, objective framework for analyzing trends and identifying gaps in AI-based finance research. Through this approach, the study makes several novel contributions to literature. First, it employs a larger and more recent dataset to provide an up-to-date perspective on AI in finance developments. Second, it analyzes evolving trends in AI techniques, offering insights into the field’s technological progression, influential contributors, and potential areas for research (Bahoo et al., 2024). Third, by examining regulatory frameworks and ethical considerations, the study provides a guiding framework for responsible AI integration in finance. These insights are crucial for promoting innovative financial technology, robust governance standards and enhancing trust in AI-driven financial systems.

The next parts of this paper are structured as follows: Section 2 reviews the relevant literature, to provide a foundation for understanding the key themes and developments. Section 3 outlines the research methodology to describe the data sources and analytical approaches employed in this study. Section 4 presents the main findings, combining scientometric and content analyses to reveal trends and patterns in AI finance research. Section 5 delves into the regulation of AI in finance, synthesizing critical studies and highlighting key gaps. Finally, Section 6 concludes the paper by discussing the implications of the findings and proposing avenues for future research.

Literature background

Artificial intelligence in finance: evolution, impact, and regulatory perspectives

Early literature conceptualized AI primarily as a tool for automation. However, with the introduction of advanced algorithms and computational models, AI has evolved into a more comprehensive tool in recent studies (Johnson et al., 2019; Arslanian & Fischer, 2019). This evolution has resulted in the development of several theoretical frameworks for understanding AI’s role in finance. The mechanistic viewpoint focuses on AI’s capacity for automating routine tasks through rule-based systems to streamline operational efficiency within financial institutions. In contrast, the predictive analytics viewpoint highlights AI’s ability to support market analysis and decision-making, particularly through machine learning applications (Wang et al., 2021). These divergent conceptualizations demonstrate AI’s complexity and its varied applications across different financial domains.

The technological foundation underlying AI financial applications has evolved through distinct phases, each marked by significant advances in computing power, data availability, and algorithmic sophistication (Arner et al., 2020). Contemporary AI systems in finance are distinguished by their ability to process and analyze vast datasets in real-time, leveraging multiple technological components that work in concert. Machine learning models extract patterns from historical data, while natural language processing (NLP) algorithms decode unstructured textual information. Neural networks, designed to mimic human cognitive processes, enable these systems to handle increasingly complex analytical tasks (Zhang et al., 2021). This technological convergence has enabled AI to transcend its initial role in basic process automation and emerge as a sophisticated tool for financial analysis and decision-making.

The historical trajectory of AI in finance demonstrates how technological advancement has fundamentally altered financial services delivery and operations. The evolution progressed from basic rule-based automation systems in the initial stages to increasingly sophisticated applications incorporating predictive analytics and machine learning (Johnson et al., 2019). This change was more than just technical; it represented a vital shift in how financial institutions approached data analysis, risk assessment, and decision-making processes. The progression from automated task execution to complex predictive modeling shows the technology’s expanding capabilities and its growing strategic significance in financial operations.

Contemporary developments in AI finance are marked by several interconnected trends that are reshaping industry practices. Natural Language Processing (NLP) and sentiment analysis are used to understand textual data, enabling financial institutions to gauge market sentiment and make informed investment decisions (Gao et al., 2021). Explainable AI (XAI) has gained prominence as a critical factor in ensuring regulatory compliance and building user trust by making AI algorithms more interpretable (Chen et al., 2023). Robotic Process Automation (RPA) is streamlining back-office operations, reducing costs, and improving efficiency (Madakam et al., 2019). Additionally, AI-driven chatbots and virtual assistants are enhancing customer interactions by providing personalized services and resolving queries more efficiently (Iovine et al., 2023). Algorithmic trading, powered by AI, is optimizing investment strategies, offering greater precision and speed in executing trades (Arner, 2019). These trends collectively reflect the integration of different AI applications to improve the financial sector.

Looking ahead, the financial industry is set to be influenced by a number of new developments in AI. For instance, quantum computing promises to deliver unmatched computational power for complex financial modeling and optimization (Woerner & Egger, 2019). AI-based fraud detection systems are evolving through advanced anomaly detection algorithms to enhance security and mitigate risks (El Hajj & Hammoud, 2023). Continuous advancements in neural networks and deep learning are expanding AI’s ability to analyze unstructured data, such as images and audio, for applications in fraud prevention and customer service. Augmented Intelligence, which emphasizes collaboration between humans and AI, is gaining traction as a decision-support tool in complex financial scenarios (Tao et al., 2021). Furthermore, the integration of blockchain and AI is paving the way for decentralized, transparent, and secure solutions, particularly in areas such as smart contracts and digital identity (Kshetri, 2021). These emerging trends highlight the ongoing evolution of AI in finance, pointing to a future where its influence will be more pervasive and transformative.

These developments of AI in finance have also been extensively studied through bibliometric approaches. Seminal works by Chen et al. (2023), Tao et al. (2021), Goodell et al. (2021), and Ahmed et al. (2022) have explored the foundational elements, thematic underpinnings, and research clusters in AI literature. These studies employ techniques such as co-citation analysis, bibliometric coupling, NLP-based bibliometric approaches, and integrated CiteSpace analysis to uncover evolving research trends in AI-based finance. Chen et al. (2023), for instance, focus on Explainable AI (XAI) in finance, noting a significant increase in publications since 2013. Their research notes a transition from traditional finance research toward more inclusive and diversified applications, accompanied by improvements in non-interpretable models and a growing emphasis on risk and ethical considerations. Other studies also identify three principal literature clusters within AI finance: (1) portfolio construction, computation, and investor behavior; (2) financial fraud and distress; and (3) sentiment inference, forecasting, and planning. These clusters show the major applications of AI in finance (Goodell et al., 2021). Ahmed et al. (2022) observe a surge in literature on Machine Learning (ML) and AI finance, with the United States, China, and the United Kingdom emerging as the top contributors. This global distribution of research highlights the international significance and interest in AI applications within finance, and the leading role these countries play in its exploration and development.

The global perspectives, however, vary on how AI is regulated. Efforts to address ethical concerns, regulatory gaps, and privacy issues related to AI applications have revealed divergent views across different regions, with limited literature available to quantitatively or qualitatively determine the best approaches (Lee, 2020). The European Banking Institute advocates for robust and centralized governance to address risks and regulatory fragmentation, particularly in cross-border FinTech trade, while the United States has adopted a more decentralized approach that raises concerns about standardization and harmonization (Azzutti et al., 2022; Ahern, 2021). The issue of regulatory arbitrage has also emerged from this disconnect, with AI platforms for tokenization, crowdfunding and cryptocurrencies being at the forefront of providing unfair advantages to some users. Explainable AI (XAI) has been proposed to help regulators access sufficient information for better-informed regulations. Regulatory Technology (RegTech) is also emerging as a potential solution to streamline AI compliance, while regulatory sandboxes are facilitating innovation and testing in controlled environments (Boukherouaa et al., 2021; Lee, 2020). Nevertheless, measuring the performance of AI regulation remains challenging due to the lack of standardized metrics. Current trends suggest a shift toward risk-oriented regulatory approaches that prioritizes flexibility and adaptability in governing AI in finance. As the financial industry continues to embrace AI, the literature on AI regulation is expected to evolve, offering new insights into the ongoing transformation of the financial landscape and addressing the critical balance between innovation and ethics. This study aims to explore this dynamic, laying the groundwork for future research, policy discussions, and AI development in finance. By doing so, it seeks to make a pioneering contribution to the field.

Theoretical framework: Institutional influences on AI-based finance

Institutional theory, as advanced by DiMaggio and Powell (1983), provides a robust theoretical framework for understanding the complex dynamics of AI-based finance. This theoretical perspective asserts that organizations are significantly influenced by the norms, rules, and regulations embedded in their institutional environments. Institutional isomorphism, which manifests in three forms—normative, coercive, and mimetic—offers a lens through which to examine how organizations adapt to external pressures and shape their operational strategies (Peters, 2022). This framework is particularly relevant for addressing the research objectives of this study, as it explains the mechanisms by which institutional forces drive the adoption and evolution of AI in finance.

The first research objective, which seeks to systematically review AI-based finance literature to identify prevailing research trends and prospects, aligns closely with the concept of normative isomorphism. Normative pressures, rooted in shared values and expectations within the financial industry, play a pivotal role in shaping research agendas. These pressures encourage the adoption of AI applications that align with societal norms, such as ethical practices, transparency, and innovation (DiMaggio & Powell, 1983). For instance, the growing emphasis on ethical AI frameworks and the pursuit of improved financial practices reflect the influence of societal expectations on institutional behavior, as highlighted by Meyer and Rowan (1977). This suggests that financial institutions and researchers are guided by a collective commitment to advancing responsible and socially acceptable AI applications.

The second research objective, which explores the regulatory framework and ethical considerations associated with AI integration in finance, is tied to coercive isomorphism (Dubey et al., 2019). Coercive pressures, exerted by regulatory bodies, compel financial institutions and researchers to adhere to specific ethical standards and regulatory requirements. Regulatory authorities, as coercive forces, play a critical role in shaping the institutional environment within which AI-based finance operates. This element is crucial to governing the adoption and use of AI technologies in finance. Scott (2012) reinforces this perspective in their study to show the profound impact of regulatory influences on institutional practices. As financial institutions navigate the complexities of AI adoption, they must balance efficiency and risk management while complying with changing regulatory demands.

In addition to normative and coercive pressures, mimetic isomorphism offers a third strategic element that influences organizations’ adoption of AI in finance. Organizations often face uncertainty when integrating new technologies and, as a result, mimic the practices of industry leaders who have successfully implemented AI. By emulating these strategies, institutions seek to reduce uncertainty, enhance legitimacy, and achieve similar outcomes (DiMaggio & Powell, 1983). This mimetic behavior is particularly evident in the financial sector, where institutions look to early AI adopters for guidance on best practices and risk mitigation. The mimetic aspect of institutional theory thus provides a critical lens for understanding the diffusion of AI technologies and the trends shaping them.

Data and Methods

Data and sample

Data collection and preparation

The data for this study was sourced from Scopus, a leading database renowned for its extensive coverage of peer-reviewed research in finance (Pattnaik et al., 2024). Scopus is widely regarded as one of the most accessible databases, housing numerous high-impact finance journals and offering advanced search functionalities that are particularly suited for bibliometric and scientometric analysis (Ahmed et al., 2022). To ensure the dataset was both comprehensive and representative, a carefully curated set of search terms was synthesized from relevant literature, capturing the breadth and depth of the subject matter (Bahoo et al., 2024; Biju et al., 2023; Goodell et al., 2021).

A thorough examination of references was conducted to address potential inaccuracies in the bibliometric and bibliographic data, such as duplicate entries resulting from manuscript reporting. This proactive approach is highly recommended in the literature for its ability to enhance the accuracy, visualization, and interpretation of bibliometric data (Donthu et al., 2021; Zupic & Cater, 2015). Duplicated articles were identified and removed from the dataset. For example, duplicates of studies by Vahidov and He (2009) and Kosala (2017) were detected and excluded to ensure the integrity of the dataset. After eliminating duplicates and irrelevant entries, the final dataset comprised 2,183 articles. The data selection procedure is presented in Table 1.

Data collection period

The data is collected for the period between 1989 and 2024. The year 1989 was chosen as the starting point due to its historical significance, marking the onset of the dot-com bubble era, a pivotal period in the evolution of AI in finance. The dot-com bubble, also referred to as the internet bubble, was a phase of intense speculation in the late 1990s and early 2000s, characterized by the dramatic rise and subsequent collapse of stock prices for internet-based companies (Leone & de Medeiros, 2015). This speculative bubble was fueled by the proliferation of internet-based businesses and the widespread optimism about the transformative potential of the Internet in commerce and communication.

The aftermath of the dot-com bubble witnessed significant advancements in AI technologies and their growing relevance to the finance industry (Dobre et al., 2020). By analyzing this period alongside the dot-com bubble, the study provides valuable insights into how AI has been utilized to address financial challenges and capitalize on emerging opportunities in the wake of major market disruptions. This extended timeframe allows for a detailed examination of the evolution of AI in finance, capturing both its historical roots and its contemporary developments.

Methodological framework

The study employs a scientometric approach that uses quantitative tools to analyze bibliometric and bibliographic data. The methodology follows the four-step procedure for literature reviews outlined by Donthu et al. (2021), which includes (1) defining the review aims and scope, (2) selecting analysis technique, (3) executing data collection and analysis, and (4) reporting the findings. The main aim is to explore the intellectual development of AI within finance research by analyzing the bibliometric structure, which captures publication trends related to articles, authors, institutions, journals, and countries.

In addition to the scientometric approach, the study integrates content analysis to summarize contributions to the research topic and identify research gaps. The dual methodology enables a detailed performance analysis of key contributions, using tools such as VOSviewer and RStudio (biblioshiny) (Ahmed et al., 2022). Scientometric analysis, one of two science mapping strategies, extends beyond bibliometric analysis by analyzing scholarly works and their findings to identify significant patterns and trends within the research area (Yang et al., 2020).

While bibliometric analysis focuses solely on the quantitative assessment of literature, scientometric analysis incorporates qualitative evaluation, measuring the impact of scholarly works and interpreting scientific citations to identify practical applications of research findings (Linnenlueke et al., 2020). However, scientometric analysis has limitations due to its subjective interpretations of scholarly works and the potential for misjudgment in assessing the implications of research findings (Olawumi et al., 2021).

Method selection

Analytical Techniques

Citation analysis is employed to evaluate the performance of various stakeholders in the scientific field and identify key scientific contributors. Additionally, network analysis techniques—such as keyword co-occurrence, trend analysis, co-authorship analysis, and bibliographic coupling—are applied using VOSviewer and RStudio (biblioshiny). VOSviewer enables the assessment of leading contributors, while RStudio, through the Bibliometrix package, facilitates bibliometric tests through a graphical interface (Aria & Cuccurullo, 2017; Van Eck & Waltman, 2010). These tools are widely recognized for their effectiveness in analyzing bibliometric data (Alshater et al., 2022; Paltrinieri et al., 2023).

Scientometric Analysis

The scientometric analysis includes processing large datasets to identify publication trends, uncover emerging topics, and visualize thematic evolution. Co-citation analysis tracks foundational knowledge by examining frequently cited references, bibliographic coupling shows thematic clusters by analyzing shared references among articles, and co-occurrence analysis maps topical trajectories by examining the frequency of keyword associations. These techniques, supported by the modularity of networking nodes based on the Louvain algorithm, enable the identification of co-cited references, clusters of articles, and author-specified keywords (Waltman et al., 2020; Jeong et al., 2014; Lu & Wolfram, 2012; Boyack & Klavans, 2010).

Louvain algorithm for network analysis

The modularity of networking nodes from the Louvain algorithm is a fundamental concept in network analysis that facilitates the identification of community structures within complex networks. Developed by Blondel et al. (2008), the Louvain algorithm is widely utilized for community detection due to its efficiency and scalability. At its core, the algorithm iteratively optimizes network modularity, a measure that quantifies the degree of community structure within a network. Modularity represents the extent to which the division of nodes into communities enhances the density of connections within communities while minimizing connections between them (Newman & Girvan, 2004). In other words, networks with high modularity exhibit strong intra-community connectivity and sparse inter-community connectivity, indicative of distinct and well-defined communities.

The Louvain algorithm operates by iteratively optimizing modularity through two phases: the local moving phase and the global aggregation phase. In the local moving phase, the algorithm locally optimizes modularity by iteratively moving nodes between communities to maximize the increase in modularity. This phase continues until no further improvement in modularity is achievable. Following this, the global aggregation phase begins, during which nodes within the same community are aggregated into a single node, creating a coarser representation of the network. This two-phase process is repeated iteratively until a maximum level of modularity is attained. The mathematical definition of modularity (Q) can be described as:

$$Q=\frac{1}{2m}\mathop{\sum}\limits_{i,j}\left[{A}_{{ij}}-\frac{{k}_{i}{k}_{j}}{2m}\right]\delta \left({c}_{i}{c}_{j}\right)$$

(1)

In this expression, \({A}_{{ij}}\) denotes the weight of the edge (link) connecting vertices \(i\) and \(j\). The value of \({k}_{i}\) is the sum of the weights of all edges connected to vertex \(i\), represented by \({\sum }_{j}{A}_{{ij}}\). The variable \({c}_{i}\) signifies the class or community to which vertex \(i\) is allocated. The delta function \(\delta \left(u,v\right)\) equals ‘1’ when \(u\) equals \(v\) and ‘0’ otherwise. Additionally, \(m\) is calculated as half of the sum of all edge weights attached to vertex \(i\), denoted by \(\frac{1}{2}{\sum }_{j}{A}_{{ij}}\).

The Louvain algorithm for community detection facilitates iterative modularity optimization (Blondel et al., 2008). Initially, every node in the network is assigned to its own community. Then, for each node \(i\), the algorithm computes the change in modularity \((\Delta )\) by relocating \(i\) from its current community to each neighboring community \(j\) that \(i\) is connected to. The change in modularity is determined as:

$$\Delta Q=\left[\frac{{\sum }_{{in}}+2{k}_{i,{in}}}{2m}-{\left(\frac{{\sum }_{{tot}}+{k}_{i}}{2m}\right)}^{2}\right]-\left[\frac{{\sum }_{{in}}}{2m}-{\left(\frac{{\sum }_{{tot}}}{2m}\right)}^{2}-{\left(\frac{{k}_{i}}{2m}\right)}^{2}\right]$$

(2)

Here, \({\sum }_{{in}}\) represents the total sum of weights of the links within the community to which node \(i\) is being relocated. \({\sum }_{{tot}}\) signifies the total sum of weights of all links to nodes in the community that node \(i\) is being relocated into. The variable \({k}_{i}\) denotes the weighted degree of node \(i\), where degree indicates the number of links associated with the node. \({k}_{i,{in}}\) represents the sum of weights of the links between node \(i\) and other nodes in the community it is being relocated into. Lastly, \(m\) denotes the total sum of weights of all links in the network. After calculating \(\Delta Q\) for all communities that node \(i\) is linked to, the node is assigned to the community resulting in the greatest increase in modularity. The modularity of networking nodes from the Louvain algorithm enables the identification of cohesive communities or clusters within networks, providing valuable insights into the underlying structure and organization of complex systems. The concept finds applications in various fields, including social network analysis, biological networks, and information retrieval, facilitating the understanding of interconnected systems and their functional components.

Results and Analysis

Publication trends in AI finance

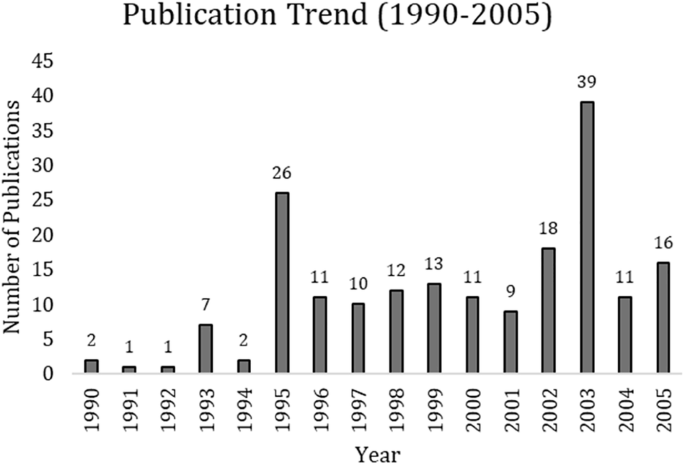

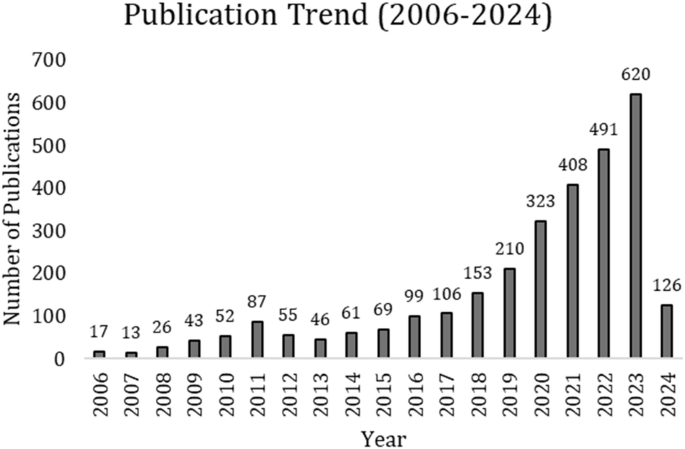

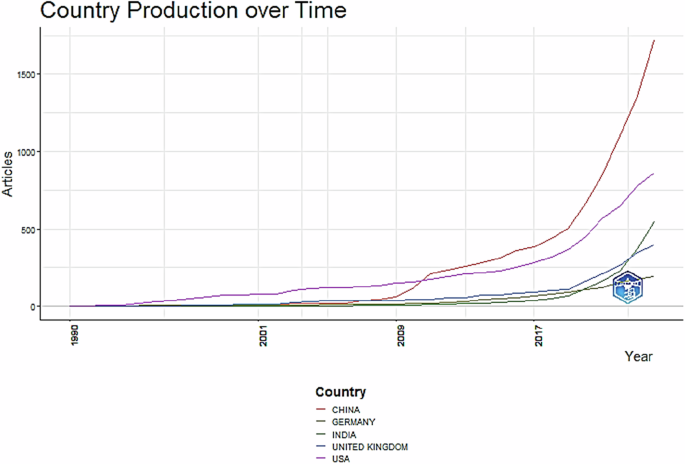

The volume of published articles in the field of AI finance serves as evidence of the academic fervor surrounding this domain. The longitudinal trend sheds light on pivotal periods of expansion and evolution within the discipline. Figures 1 and 2 illustrate the trajectories of publication outputs spanning from 1990 through the first nine months of 2024. A significant surge in publication occurred in 1995, with 24 articles published. This period marks the emerging stages of incorporating neural networks and genetic algorithms for autonomous analysis of market data and subsequent trading decisions, primarily driven by hedge funds and investment banks (Wong & Selvi, 1998). The next years witnessed a steady growth trajectory in publication output, culminating in an evident spike in 2003, during which the number of publications rose to 33—an increase from the average of 7. This spike represents the maturation and wider adoption of advanced machine learning methodologies tailored for stock market forecasting and analysis. Following the spike, the volume of publications exhibited a marked increase, reaching a peak of 348 articles in 2023. This increasing trend is set to continue in 2024, with the initial nine months of the year already surpassing the total publications recorded in 2023. Such sustained growth shows the rapid diffusion of AI technologies within the financial landscape and the corresponding rise in academic interest in this field (Pattnaik et al., 2024).

Evaluation of top scholars in AI finance research

Our bibliometric analysis employs complementary metrics—the H-index and total citation counts—to provide a multidimensional assessment of scholarly influence in AI finance research. While total citations capture broad impact, the H-index offers insights into sustained scholarly influence by balancing publication volume with citation count. Table 2 presents a detailed analysis of the field’s top 20 scholars, incorporating multiple bibliometric indicators, including total publications, first publication year, H-index, and G-index scores. The G-index differs from the H-index in that it assigns greater weight to highly cited papers within a researcher’s publication portfolio.

The citation analysis reveals an interesting pattern in the field’s intellectual leadership. The highest total citation counts are associated with scholars who have made singular but highly influential contributions, exemplified by Pan Wen-Tsao (Oriental Institute of Technology), Das Sanjiv R. (Santa Clara University), and Chen Mike Y. (University of California), who have published relatively few papers (1-2 articles each) but achieved substantial impact. This pattern suggests that groundbreaking individual contributions have played a crucial role in shaping the field’s theoretical foundations.

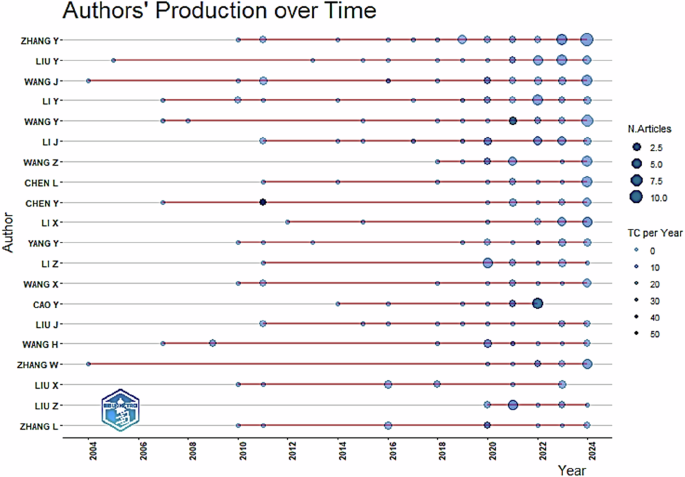

In contrast, the H-index rankings show authors who have consistently maintained their publication activity. With publication portfolios that range from 12 to 25 papers, Liu Yang (University of Goettingen), Wang Jiaqi (University of Technology), and Cao Ying (University of Alberta/Hebei Finance University) emerge as prominent figures in this category. The geographic diversity of these scholars’ affiliations—distributed across Germany, Australia, Canada, and China—depicts the field’s global nature and suggests different regional approaches to AI finance research.

Figure 3 illustrates the publication patterns of the 20 most prolific scholars in the field, revealing a notable concentration of research output between 2020 and 2024. This clustering not only indicates intensifying academic interest but also suggests that the field has entered a period of accelerated theoretical and methodological development. The temporal distribution also highlights the potential gaps in the literature, particularly a lack of longitudinal studies that track the evolution of AI applications in finance over extended periods.

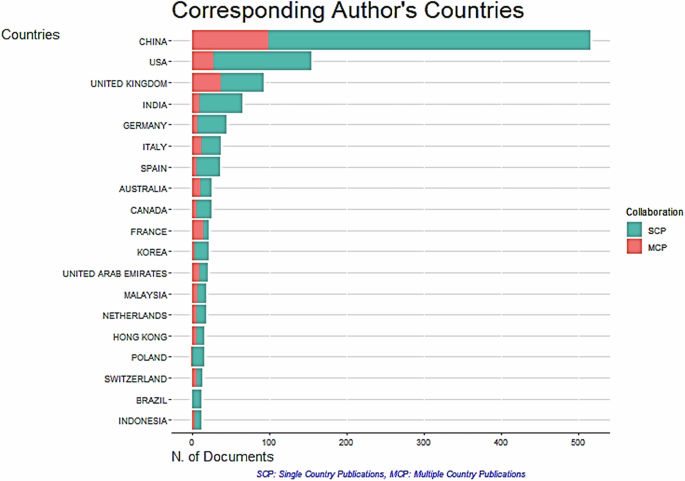

Leading countries in AI finance research

The analysis of geographic contributions to AI finance research shows distinct patterns of scholarly activity and collaboration networks. As shown in Table 3, the analysis examines both total citations and total link strength of countries, with the latter measuring the connections between countries based on their co-citation frequency. The results reveal a triadic dominance of China, the United States, and the United Kingdom, with these countries accounting for a substantial proportion of the field’s intellectual output. While the United States historically led in citation impact, China has emerged as the leader in publication volume, suggesting a shift in the global research landscape Fig. 4.

Figure 5 illustrates the temporal evolution of research output by leading countries. The United States’ early dominance (1990–2011) gives way to China’s emergence as the primary contributor post-2012. This transition coincides with broader trends in AI research and development, reflecting changing patterns of technological innovation and institutional investment. The United Kingdom and India have also established themselves as significant contributors, creating a more diverse and competitive research environment.

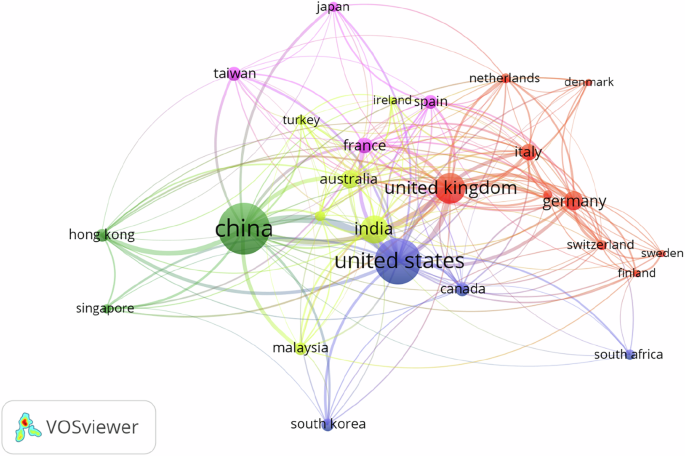

This evolving landscape is further illuminated by the network analysis of international collaboration (Fig. 6), which employs fractional counting techniques to normalize co-authorship patterns, following established bibliometric methodology (Van Eck & Waltman, 2010). By setting minimum thresholds of five co-authored documents and 590 citations, we identify robust patterns of country co-authorships. The resulting network reveals complex collaborative relationships, with China demonstrating strong bilateral ties with the United States, United Kingdom, Hong Kong, Taiwan, and Australia. The United States maintains diverse collaborative networks, particularly with European and Asian partners, while the United Kingdom shows strong integration within European research networks, particularly with France, Spain, and Italy.

Leading institutions in AI finance research

Table 4 shows the leading institutions in AI finance research based on publication volume. These institutions, by sponsoring top researchers, contribute significantly to AI finance research. The results indicate that 16 of the top 20 positions are occupied by Chinese institutions, with Hefei University of Technology, Wuhan University, Hunan University, and the University of Chinese Academy of Sciences collectively contributing 124 publications to the dataset. China’s dominance in institutional leadership reflects its prioritization of AI research and investment. Institutions from Hong Kong, the United Arab Emirates, the United Kingdom, and Poland also join the top rankings to provide representation to other regions.

The key takeaway is that country-level research priorities can influence universities’ research focus and knowledge transfers within institutional networks. With the growing focus on AI, more institutions are expected to incorporate AI research in their research and funding priorities.

Analysis of influential publications in AI finance research

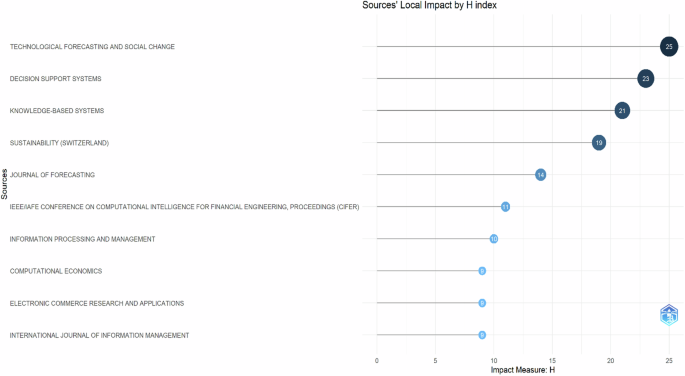

The dataset consists mainly of articles from Q1 and Q2 journals, with a significant majority of papers from Q1 journals. Conference proceedings and review papers were also included in the analysis. As shown in Tables 5 and 6, Decision Support Systems, Knowledge-Based Systems, and Technological Forecasting and Social Change emerge as the top three most influential journals based on global citations, collectively contributing 114 publications to the corpus. These journals, along with the Journal of Forecasting, also rank as the leading journals in terms of publication volume.

However, we observe from the field classification that only two of the top 20 ranked journals are finance-based. This suggests that AI finance research is more often published in interdisciplinary fields or journals primarily focused on technology and systems. The Journal of Behavioural and Experimental Finance and Research in International Business and Finance stand out as the most active finance-specific journals in AI-related research.

Conference proceedings and book series also play a crucial role in exploring research issues in AI finance. The most prominent of these sources are the IEEE Technology and Engineering Management Society Conference, Handbook of Computational Economics, and the International Conference on Information and Knowledge Management. The CIFER conference and AIMSEC proceedings are the two most productive conference and proceeding sources with 57 and 40 publications, respectively.

Figure 7 illustrates the local impact of the publication sources in AI finance, measured using the H index. This metric measures how influential a publication source is within its regional context by analyzing citations from sources within the same region. Among the sources analyzed, four Q1 journals emerge as the most locally influential: Technological Forecasting and Social Change, Decision Support Systems, Knowledge-Based Systems and Journal of Forecasting. The most influential conference and proceeding within this study is IEEE/IAFE conference on computational intelligence for financial engineering proceedings (CEFR) lead in the conference and proceeding category. This pattern of influence aligns with our earlier citation analysis, reinforcing the prominence of these outlets in shaping regional discourse in AI finance research.

Keywords analysis

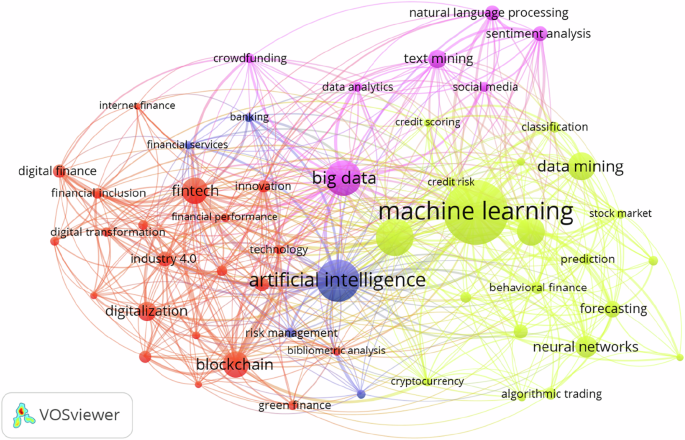

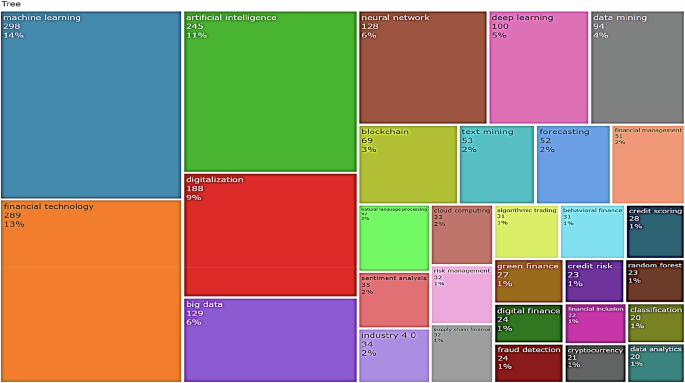

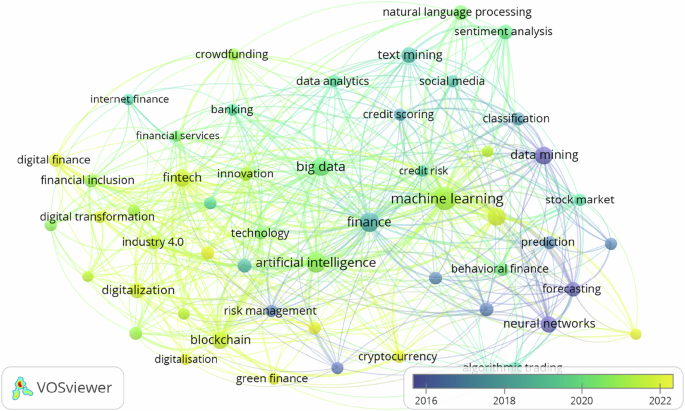

Identifying relevant keywords from the Scopus dataset is necessary for understanding the evolution of research in AI Finance. Figure 8 presents the top 45 keywords used in AI finance research using keyword co-occurrence analysis with a threshold of 15 minimum occurrences. The analysis shows three main clusters: technological foundation (machine learning, artificial intelligence, neural networks), application domains (financial technology, digital finance, risk management), and methodological approaches (big data, cloud computing, data mining). These keyword clusters clearly connect the main issues or research areas in AI finance literature. For instance, artificial intelligence exhibits strong links to digital finance, cloud computing, risk management, and supply chain finance, while machine learning is associated with stock market analysis, forecasting, and neural networks. Typically, financial technology is linked with financial inclusion, crowdfunding and lending. To provide a more holistic perspective of the major keywords in literature, a treemap of all relevant keywords with their occurrence frequencies is shown in Fig. 9 using the Biblioshiny package from RStudio. The treemap shows the number of counts and percentage in relation to the whole set of author keywords to identify the most common keywords in AI finance literature.

The treemap analysis confirms the VOSviewer visualization that machine learning, financial technology, artificial intelligence, digitalizaion, big data, neural network, deep learning, data mining and forecasting dominate the literature. These keywords collectively constitute 70% of the all author keywords in the dataset. Figure 10 also presents the keyword occurrence trend over time. The keywords in yellow show current research focus areas. These include digital finance, financial technology, financial inclusion, green finance, random forest, cryptocurrency and artificial intelligence. These focus areas represent current trends in digitization, inclusivity, sustainability and technological innovations. And present opportunities for scholars seeking to contribute to knowledge.

The size of the nodes indicates the frequency of occurrence, while the curves between the nodes show the keyword co-occurrence. The shorter the distance between the two nodes, the larger the number of co-occurrences of the two keywords. The colors show the recency of the frequency of keywords. Keywords that are gaining popularity in recent years are shown in yellow.

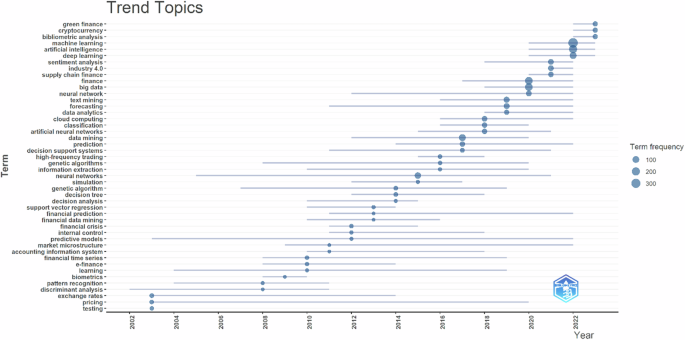

A trend analysis is used to show the topic trends over the years as a complement to the keyword overlay visualization from VOSviewer (Fig. 11). The most significant concentration of keyword usage (biggest bubbles) is witnessed in 2022, when machine learning, financial technology and artificial intelligence dominated AI finance research. Earlier trends in 2003 focused on exchange rates and testing of finance theories using artificial intelligence. Notable peaks emerged in 2010 (financial time series), 2013 (security of financial platforms), and 2015 (support vector machines). This trend is followed by data mining and artificial neural network in 2017, neural networks in 2019, big data in 2021 and green finance, digital finance, decentralized finance and fintech adoption in 2023–2024.

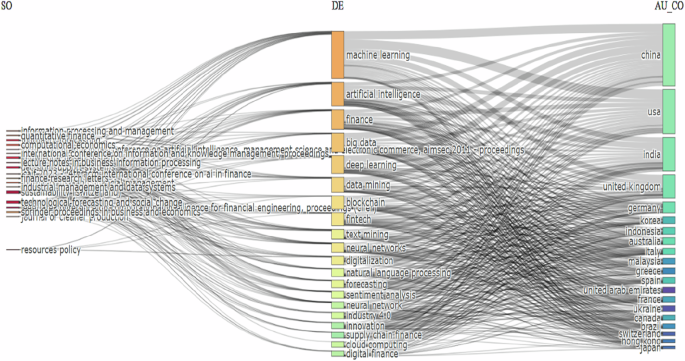

Figure 12 illustrates the three-field plot between the top 10 keywords, sources and countries. China, the USA, the India and the United Kingdom emerge as the major research contributors with a focus on machine learning, fintech, artificial intelligence, finance, deep learning, big data, data mining, digitalization, block-chain and neural network. These topics are prominently featured in leading journals, including Information Processing and Management, Lecture Notes in Business Information Processing, Journal of Forecasting, Knowledge-Based Systems, Decision Support Systems, Sustainability, and Technological Forecasting and Social Change.

Citation analysis

The citation analysis identifies seminal works in AI finance research using three distinct metrics: global citations, local citations, and reference patterns. The results of the analysis are presented in Tables 7 and 8.

The most globally cited articles, Pan (2012), Das and Chen (2007), and Ngai et al. (2011), established foundational methodological approaches in algorithmic optimization, sentiment analysis, and fraud detection, respectively. Pan’s (2012) introduction of the Fruit Fly Optimization Algorithm for financial distress prediction has spawned numerous algorithmic innovations, particularly in predictive modeling applications (Li et al., 2020; Hussain & Papastathopoulos, 2022; Hu et al., 2018; Vyklyuk et al., 2013). Das and Chen’s (2007) pioneering work on sentiment extraction from stock message boards also influenced subsequent developments in sentiment analysis algorithms, particularly in handling noisy financial data (Nassirtoussi et al., 2015; Chatterjee et al., 2018).

Ngai et al. (2011) reviewed 49 articles on data mining techniques employed in detecting financial fraud and critical research gaps, particularly in money laundering and mortgage fraud detection. Following their review, several studies attempted to address these gaps, as documented by Hilal et al. (2022), with significant advances in credit card fraud detection (Rtayli & Enneya, 2020; Gomez et al., 2018) and money laundering prevention (Paula et al., 2016; Charitou et al., 2020). However, certain areas, notably insider trading and mortgage fraud, remain underexplored, possibly due to data accessibility constraints.Ngai et al. (2011) reviewed 49 articles on data mining techniques employed in detecting financial fraud, including techniques such as neural networks, logistics models, decision trees and Bayesian belief networks. The study identified a predominance on data mining techniques applied in the area of insurance fraud and less focus on other fraud areas like money laundering, mortgage fraud and stock market fraud. Outlier detection and visualization techniques were also not actively used. The authors also proposed that increasing availability of financial data and decreasing cost sensitivity on financial fraud detection models (FFD) will improve data mining techniques. In efforts to resolve these gaps, Hilal et al. (2022) in a more recent review study identified significant publications to tackle the issue of credit card fraud (Rtayli & Enneya, 2020; Gomez et al., 2018; Wang et al., 2018), money laundering (Paula et al., 2016; Charitou et al., 2020) and securities and commodities fraud (Federal Bureau of Investigation (2011)). The study reinforces that research on other forms of financial fraud, such as insider trading and mortgage fraud is lacking and the scarcity of financial fraud cases in these areas may account for this limitation.

Local citation patterns reveal distinct thematic priorities within the AI finance community. The adoption of robo-advisory services has gained particular prominence (Belanche et al., 2019). Robo-advisors —AI-driven financial technologies that provide financial advice with minimal or no human intervention—have experienced rapid growth, especially during the COVID-19 pandemic (Maiti et al., 2020). Investment in this technology is projected to reach $4.66 trillion by 2027 (Cardillo & Chiappini, 2024). While robo-advisors are expected to expedite financial services and improve financial inclusion, the technology remains in its early stages, with ongoing improvements in model efficiency and gradual market penetration.

The findings of Belanche et al. (2019) on how cultural factors and user familiarity influence adoption have informed subsequent research on robo-advisory services (Cardillo & Chiappini, 2024; Belanche et al., 2023). Studies on credit risk prediction in supply chain finance by Zhu et al. (2019) and financial statement fraud detection techniques by Hajek and Henriques (2017) round out the top 3 most locally cited papers.

Analysis of locally referenced articles complements the citation analysis by examining niche papers that might be overlooked due to lower overall citation counts. Zetzsche et al., (2021), Brieman (2001), and Hochreiter (1997) lead the highly ranked references with 38, 26 and 21 local citations, respectively (Table 9). The papers focus on market in crypto-assets, random forests, and long short-term memory. Their work covers crypto-assets, random forests, and long short-term memory networks, with a primary focus on financial market forecasting, including bitcoin’s emerging role as electronic cash and investment asset.

Most articles in this category explore AI techniques for stock market prediction covering textual analysis (Loughran and McDonalds, 2011; Antweiler and Frank, 2004), sentiment analysis (Bollen et al., (2011)), fintech ecosystems (Gomber et al., 2018; Lee &Shin, 2018) stochastic optimization (Kingma, 2014), and deep learning (Goodfellow, 2016).

The citation patterns reveal the field’s evolving research agenda. Early works focused primarily on algorithmic development and optimization; however, recent studies address broader questions surrounding technology adoption, regulatory frameworks, and financial inclusion. AI in finance is expanding beyond pure technical advancement to deal with its wider impact on society.

Further analysis

Thematic evolution of keywords

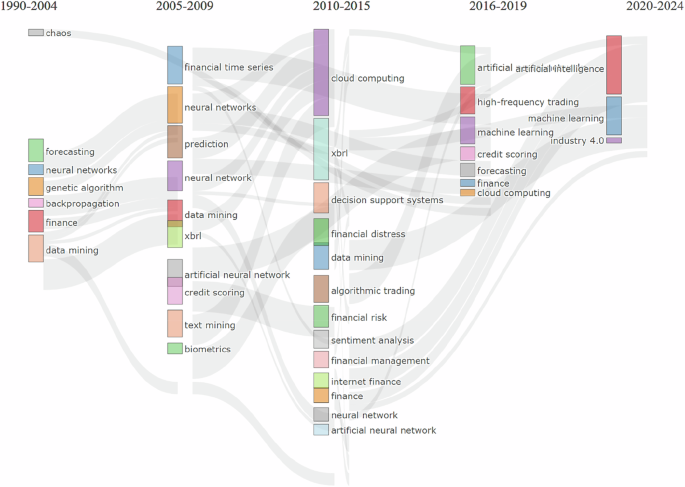

Research focus in AI finance literature has evolved based on contemporary trends and scientific relevance. Through co-occurrence analysis of author keywords examined temporally, we can trace the thematic evolution of topics. Figure 13 shows the dataset divided into five developmental periods, each marked by distinct research themes and technological innovations.

The foundational period (1990–2005) marked the initial integration of AI technologies into financial applications, with particular emphasis on risk management, fraud detection, and trading strategies. This era witnessed the emergence of fundamental methodologies, including data mining, neural networks, and economic forecasting. While innovative, this period of technological experimentation, exposed limitations of early AI applications in finance. The lack of sufficient regulatory frameworks and control mechanisms for these technologies would later contribute to vulnerabilities exposed during the 2007–2008 financial crisis.

The crisis response period (2006–2009) brought a shift toward more sophisticated analytical approaches. Research expanded to include text mining, eXtensible Business Reporting Language (XBRL), and biometric finance models, to reflect a growing emphasis on data standardization and analytical rigor. The focus turned to enhancing financial system robustness through improved credit assessment, market forecasting, and cybersecurity measures.

The consolidation phase (2010–2015) addressed systemic vulnerabilities while enhancing operational efficiencies. Cloud computing infrastructure, decision support systems, and sentiment analysis capabilities emerged during this time. The integration of big data analytics significantly advanced the field’s analytical capabilities, enabling more comprehensive financial modeling and risk assessment.

The transformation period (2016–2019) heralded the mainstream adoption of advanced AI technologies, particularly deep learning and sophisticated machine learning applications. This era introduced diverse approaches to credit scoring and broader AI integration across financial services. Research focus shifted from individual technological applications to holistic approaches to financial system transformation.

The contemporary period (2020–2024) represents a synthesis of previous developments, with research clustering around three primary domains: financial technology, artificial intelligence, and machine learning. This integration reflects the field’s maturation, where technological innovations are increasingly viewed within the broader context of financial system transformation. The convergence of these themes suggests a growing recognition of technology’s interconnected role in finance.

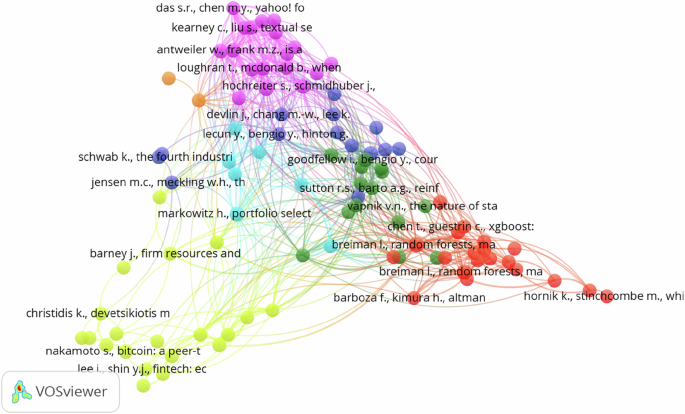

Knowledge foundations of AI research in finance through co-citation analysis

The semantic associations of co-cited references uncovered through co-citation analysis illustrate a field’s knowledge foundations (Donthu et al., 2021). Figure 14 presents the co-citation map of references cited at least eight times by articles in the review corpus. The co-citation analysis reveals that AI research in finance draws upon existing research from five foundational clusters: bankruptcy prediction and machine learning techniques (red nodes), fintech ecosystems (dark green nodes), deep learning and neural networks (blue nodes), credit scoring and asset selection (lemon green nodes), and stock market predictions using sentiment and textual analysis (violet nodes). Notably, the largest foundational clusters relate to bankruptcy prediction and machine learning techniques (red nodes) and fintech ecosystems (dark green nodes).

Each node represents a cited reference. Each color of nodes represents a semantic cluster of references based on thematic similarity. The size of nodes represents the degree of local citations wherein larger nodes reflect greater intensity of local citations. The link between nodes represents co-citations. The size of the link between nodes represents the degree of co-citations wherein thicker links reflect greater co-citation intensity.

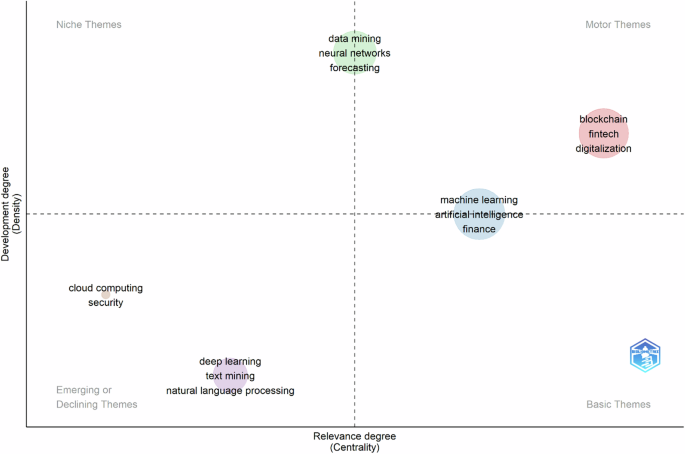

Thematic clusters by Walk Trap

A walk trap algorithm from RStudio’s biblioshiny feature is employed to cluster author keywords in the bibliometric data with a threshold of 250 keyword co-occurrences to identify distinct research categories. The resulting thematic map (Fig. 15) shows these categories in a matrix of niche themes, motor themes, emerging or declining themes and basic themes. Niche themes represent specialized finance topics with relatively low occurrence but significant future impact potential. Motor themes show high co-occurrence in literature and are considered influential in AI research. Emerging or declining topics exhibit fluctuating research interest, either gaining or losing popularity within the research community. Basic themes serve as foundational building blocks for advanced research. These categories may interact based on the given research theme. The thematic map identifies five clusters of AI research: machine learning, financial technology, big data, text mining and financial management, each containing several AI research topics explored in literature.

Table 10 shows the quantitative features of the thematic maps. Themes are categorized and ranked based on multiple metrics. Callon centrality measures theme influence within the broader research network, while Callon density evaluates internal theme cohesion. Rank centrality and density metrics provide relative measures of thematic significance and concentration, respectively. Cluster frequency quantifies thematic prevalence, offering insights into research intensity across domains. These metrics collectively provide information about the structure, centrality and connectivity of the various research streams.

Machine learning stands out as both a basic and motor theme, encompassing essential applications such as neural networks, deep learning, data mining, and algorithmic trading. This dual nature reflects its importance as both a technological foundation and an innovative catalyst for predictive analytics and automation. The strong interconnections between credit risk assessment, fraud detection, and behavioral finance applications suggest a well-established research area that continues to evolve.

Financial technology represents the most influential research cluster today, showing particularly robust centrality measurements. This domain—which includes artificial intelligence, digital finance, and financial inclusion—highlights the increasing focus on democratizing financial services through technology. These themes serve as crucial bridges connecting traditional financial research with innovative technological applications that expand access and enhance financial literacy.

The big data and analytics cluster shows unique patterns over time, with research intensity that rises and falls, indicating an area still finding its footing. While essential to AI applications in finance, shifting density metrics point to changes in research focus, possibly reflecting technological maturation and evolving practical needs. Crowdfunding exhibits similar patterns, with research interest tracking alongside market developments and regulatory shifts.

Text mining and natural language processing function as dual-nature themes—simultaneously foundational and emerging—with growing centrality indicators. Their application to unstructured financial data represents a significant frontier in AI finance research. The dual nature also suggests their importance for future innovations, particularly in analyzing market sentiment and processing financial communications.

The financial management cluster, despite lower occurrence frequencies, show high specialization, particularly regarding cloud computing and security applications. This niche positioning, paired with strong internal density measurements, indicates a focused research area addressing critical operational and security challenges in AI-enabled financial systems. The cluster’s focus on infrastructure and security concerns also underscores its essential role in ensuring the practical viability of AI financial innovations.

Thematic clusters of AI finance research through bibliographic coupling

Using a minimum of 100 citations, six main research themes are drawn from the present dataset through bibliographic coupling. These themes classify AI finance research over the studied period. Table 11 presents these clusters and the top articles that relate to them.

Theme 1: Digitalization, Servitization, and Financial Transformation

AI and machine learning technologies have triggered the rise of concepts like digital servitization and financial transformation that are reshaping finance today. Digitalization involves integrating digital technologies into business processes and changing service delivery methods while servitization represents a transition from product-focused models to service-based offerings enabled by digital tools (Kohtamäki et al., 2020). These twin forces are actively redefining financial models, strategies, and performance metrics across the industry.

Research increasingly shows the critical connection between digitalization, servitization and financial performance. Examining the “digitalization paradox”, Kohtamäki et al. (2020) discovered a non-linear, U-shaped relationship linking these elements. The study found that when firms combine higher digital investment with service-oriented strategies, financial outcomes improve significantly. This finding suggests firms should not pursue digital transformation in isolation—this strategy works best when integrated with service-focused business models. Abou-Foul et al., (2021) reinforced this outcome, noting that IoT-based digitalization specifically enhances market offerings and drives better financial results. Both research streams converge on a key insight: digital technologies deliver optimal financial potential only when coupled with flexible service models.

Big Data Analytics has emerged as another essential tool for financial strategy development, enhancing decision-making and risk management (Kushawa et al., 2021). AI’s growing integration into financial services—from predictive analytics to automated customer service—is fundamentally transforming traditional operations. The insurance sector particularly benefits from Robotic Process Automation (RPA), robotics, and AI, which automate repetitive tasks such as data entry and document processing to accelerate operational digitalization. Beyond improving data management, AI enables personalized insurance products and maintains customer engagement through robotics and chatbots, effectively shifting focus from traditional offerings toward service models. This allows insurance firms to cut operational costs, improve efficiency and allocate resources more strategically while enhancing risk management and optimizing portfolios. Some digital insurance advisors have gone further by incorporating gamification (Grgurevic & Stroughair, 2018) and human-centric AI approaches (Pisoni, Díaz-Rodríguez (2023)) to attract clients. Palmié et al. (2020) argue that innovations like robo-advisors, predictive analytics, and fraud detection systems are fundamentally reshaping financial services through personalization, automation, and decision-making efficiency. Yet, despite AI’s deployment in finance, its broader implications for management skills remain surprisingly unexplored (Gupta & George, 2016).

The disruption from AI extends beyond individual firms to the entire FinTech ecosystem. Traditional institutions now face the challenge of adapting to ecosystem-driven transformation that fosters innovation across financial services (Christensen et al., 2018). Fuller et al. (2019) highlighted that FinTech innovations do not develop in isolation but thrive through collaborative ecosystems. This insight points to an important new research direction: understanding the mechanisms that enable commercialization and scaling of AI-based financial technologies within these ecosystems. At the strategic level, Alkaraan et al. (2022) investigated how companies communicate their Industry 4.0 transformation in annual reports and its impact on financial performance. Their work highlights that strategic investment decision-making practices aligned with technologies like AI, cloud computing, and big data analytics have become increasingly important drivers of financial performance. Interestingly, ESG practices appear to moderate the relationship between digital transformation and financial success, suggesting sustainability is becoming intrinsically linked to corporate financial strategies (Shiyyab et al., 2023; Lim, 2024).

FinTech’s sustainability contribution is further illuminated by Pizzi et al. (2021) through their ReSOLVE conceptual model. They propose that FinTech solutions—including secure payment systems and alternative financing options like tokenized crowdfunding—help SMEs transition toward sustainable business models by integrating circular economy practices. This complements the multi-attribute decision-making framework by Soni et al. (2022) for selecting optimal Industry 4.0 technologies to enhance sustainable supply chain finance for SMEs. Their framework prioritizes IoT, cloud computing, big data, and analytics, as critical tools for improving SME competitiveness and working capital management.

Luo et al. (2022) further strengthen the case for AI’s role in improving financial performance and risk management within supply chains. Their testing of a custom optimization algorithm combining support vector machines (SVM) with AdaBoost demonstrated significant improvements in credit risk assessment and financial performance. This adds weight to the argument that AI-driven models are becoming essential tools for financial transformation, especially in supply chain finance optimization.

Despite these promising advances in AI-based financial transformation, several research gaps remain. More attention is needed on integrating AI with human oversight in financial decision-making, particularly in balancing automation with ethical standards and skill development. More research should explore ecosystem innovation mechanics, especially how FinTech ecosystems sustain and scale disruptive technologies. And while financial performance has received considerable attention, the long-term sustainability and resilience of digital servitization strategies in finance remains understudied. Future research could examine how these strategies adapt to changing market conditions and evolving regulatory environments.

Theme 2: AI-Driven Financial Forecasting and Text Mining

The financial sector has witnessed a remarkable transformation in textual data analysis through AI-driven forecasting methods. Text mining has become a critical approach for extracting meaningful insights from the vast array of unstructured data found in financial reports, press releases, news coverage, and social media (Shirazi & Mohammadi, 2019). Market efficiency depends on incorporating all available information—a task that has become increasingly challenging given today’s information deluge. The sheer volume and complexity of financial textual data now exceed traditional analytical capabilities, prompting the use of natural language processing (NLP) and machine learning techniques that enable institutions to process data at previously impossible scales.

Natural language-based financial forecasting (NLFF) stands out as a pivotal development, employing semantic modeling and sentiment analysis to predict market movements. Xing et al. (2018) note that these methods are evaluated primarily on forecasting accuracy, correspondence between predictions and outcomes, and performance in trading simulations. Yet challenges persist, particularly regarding volatility in trading strategies and market anomalies like the “20-minute theory” (LeBaron et al., 1999) and the “Monday effect” (Lakinishok & Maberly, 1990). These issues highlight demands for more sophisticated models capturing nuanced market behaviors. Xing et al. (2018) advocate developing specialized resources, online predictive frameworks, and comprehensive evaluation methods to enhance NLFF applications. Interestingly, Day and Lee (2016) observed that sentiment derived from different financial sources produced varying impacts on investment outcomes.

The research community has responded with innovative approaches. Malo et al. (2014) developed the Linearized Phrase-Structure model to strengthen financial lexicons by identifying semantic orientations within specialized financial language. Oliveira et al. (2016) took a different approach, using microblogging data to construct stock market-specific lexicons for sentiment analysis. Chan and Chong (2017) further expanded these capabilities by creating a sentiment analysis system that captures both individual terms and contextual phrases. Das and Chen (2007) emphasized the importance of classification algorithms in enhancing sentiment analysis precision and reducing misidentifications. In a broader investigation, Atkins et al. (2018) determined that financial news proves more valuable for predicting market volatility than direct price movements. These advances highlight text mining’s crucial role in capturing investment sentiment—an increasingly vital factor in market prediction.

Various NLP architectures have also been applied to financial fraud detection, including hierarchical attention networks, GPT, artificial neural networks, and XGBoost (Craja et al., 2020; Hajek & Henriques, 2017). Kumar and Ravi (2016) revealed in their review that text mining in finance primarily addresses foreign exchange rate prediction, stock market forecasting, customer relationship management, and cyber fraud detection. Long short-term memory networks show particular promise for stock price prediction when combining sentiment data with market indicators (Borovkova & Tsiamas). By contrast, convolutional neural networks demonstrate greater effectiveness when analyzing order book data from foreign exchanges (Tsantekidis et al., 2017; Gunduz et al., 2017).

Social media analytics combined with text mining also presents fresh opportunities for financial decision-making. Schniederjans et al. (2013) demonstrated how mining social platform content could enhance impression management strategies, potentially improving financial outcomes. This finding suggests properly analyzed social sentiment offers meaningful insights into investor behavior, further establishing NLP’s importance in modern finance.

Beyond market predictions, text mining and data analytics address customer retention challenges across financial services, especially in retirement markets and banking (Shirazi & Mohammadi, 2019). The ability to anticipate customer decisions through textual interactions gives institutions powerful tools for relationship management. NLP techniques also help synthesize finance literature, identifying research trends and highlighting future research directions (Goodell et al., 2021; Cockcroft & Russell, 2018; Raman et al., 2024; Horobet et al., 2024).

Future work should explore hybrid approaches combining multiple machine-learning methodologies to strengthen financial forecasting. Integrating sentiment analysis with deep learning models like GPT or HAN could improve prediction accuracy by capturing both short-term sentiment shifts and underlying trends. Real-time predictive modeling remains notably underexplored; researchers might investigate how real-time text mining from news outlets and social platforms could enhance trading algorithms, creating more responsive approaches to market fluctuations.

As this field evolves, developing specialized lexicons and models will be crucial for advancing forecasting techniques. With unstructured financial data growing exponentially, the need for sophisticated NLP frameworks capable of processing this information at scale becomes increasingly important. These developments will not only enhance forecasting accuracy but also deepen our understanding of market dynamics, investor psychology, and fraud patterns, opening numerous avenues for further investigation.

Theme 3: Machine Learning in Credit Scoring and Risk Management

Credit scoring and risk management practices, through machine learning applications, have evolved to meet the growing demands for more precise default prediction and risk assessment. While conventional credit systems typically focus on default probability (PD), newer approaches focus on profitability and risk evaluation capabilities. Serrano-Cinca, Gutiérrez-Nieto (2016) developed a profit scoring Decision Support System (DSS) for peer-to-peer (P2P) lending markets, arguing that predicting internal rates of return (IRR) is essential for sustainable lending. Their findings suggest that traditional logistic regression methods often inadequately capture profitability metrics, whereas multivariate regression and CHAID decision trees demonstrate significantly better performances for these specific objectives.

The credit industry faces mounting operational pressures and regulatory requirements that diminishes reliance on conventional logistic regression in favour of ensemble and multi-classifier systems. Ma et al. (2018) documented LightGBM algorithm’s effectiveness for default risk prediction in P2P lending, identifying key predictors across loan characteristics, financial indicators, credit history, and personal information. Fintech lenders increasingly incorporate alternative data sources to expand credit accessibility. By analyzing non-traditional information—including online purchasing patterns, insurance claims history, and utility payment records—these platforms enhance risk assessments while extending credit to previous underserved market segments (Kshetri, 2021; Jagtiani & Lemieux, 2019). This approach improves default prediction while potentially reducing credit costs through more precise risk evaluation (Jagtiani & Lemieux, 2019). In a unique application, Netzer et al. (2019) demonstrated how text mining combined with machine learning could predict borrower default probabilities by analyzing written loan applications, revealing unexpected correlations between specific writing patterns and subsequent default behavior.

Practical adoption of machine learning models in credit scoring still remains somewhat limited, partly due to inconsistent modeling procedures across the industry. Montevechi et al. (2024) surveyed ML techniques for consumer credit risk assessment—including decision trees, support vector machines (SVM), and various neural network architectures—yet found many remain underutilized in actual practice. Addressing this gap, Ala’raj and Abbod (2016) proposed a classifier consensus system that combines outputs from multiple classifiers to optimize credit scoring outcomes to show the growing recognition that collaborative approaches may yield superior results.

Model explainability also represents a limitation in adopting machine learning in credit decisions. Industry practitioners typically employ tools like Shapley Additive Explanations (SHAP) to enhance model interpretability—essential for regulatory compliance and stakeholder trust (Al Shiam et al., (2024)). In day-to-day applications, decision trees and random forests have proven particularly effective for short-term credit risk evaluation (Butaru et al., 2016; Montevechi et al., 2024). Default risk factors vary considerably across financial institutions, requiring customized risk management strategies rather than one-size-fits-all approaches. Big data analytics integration can substantially improve systemic risk measurement for credit assets, yielding insights beyond traditional modeling capabilities (Butaru et al., 2016). Other valuable machine learning applications include decision support systems for bank ratings and early-warning mechanisms alerting institutions to emerging risks (Doumpos, Zopounidis (2010)).

Future studies should prioritize establishing industry-wide standards for machine learning models in credit scoring to enhance practical implementation and cross-institutional comparability, particularly regarding alternative data incorporation. Strengthening collaboration between academic researchers and industry practitioners could help bridge persistent gaps between theoretical advances and practical implementations. The integration of machine learning with comprehensive data analytics in credit scoring will prove increasingly vital for refining risk assessment methodologies and promoting responsible lending practices across the financial ecosystem.

Theme 4: Digital Finance, Inclusion and Sustainability

Digital financial inclusion involves the deployment of technological platforms to extend financial services to underserved populations, addressing barriers of physical access and eligibility requirements. The full potential of these platforms continues to be constrained by issues of limited connectivity, inadequate financial literacy, and insufficient social awareness. Success also requires localizing financial offerings to match consumer realities (Aziz & Naima, 2021). Financial institutions continue to leverage AI and blockchain technologies to gather client information and secure transactions to improve service delivery in traditionally underserved communities (Inairat & Al-kassem, 2022; Demirkan et al., 2020).

The fintech revolution has enabled banks and financial startups to embrace more sustainable operational models, strengthen risk management, and develop genuinely customer-focused services. Blockchain implementation, beyond merely securing online transactions, enhances transparency throughout financial processes, thereby widening inclusion opportunities (Demirkan et al., 2020). These developments nonetheless bring increased financial intermediation, regulatory challenges, and heightened privacy concerns—issues that demand stronger regulatory frameworks to mitigate emerging risks (Wang et al., 2020).

Beyond expanding access, digital finance demonstrates capacity to support broader economic sustainability. Razzaq, Yang (2023) utilized web-crawler technology alongside a super-efficiency SBM model to evaluate inclusive digital finance, finding that technological transformation promotes environmentally conscious growth by stimulating enterprise innovation and tackling energy poverty. Their research shows that fintech advances sustainable practices and positions digital tools as vital catalysts for both financial access and environmental stewardship.

Despite promising advances, legitimate concerns have emerged regarding AI’s impact on achieving the 2030 Sustainable Development Goals, particularly those related to financial inclusion. Truby (2020) contends that algorithmic financial decision-making can potentially undermine the SDG agenda through inherent biases, ethical governance gaps, and transparency deficiencies. These observations suggest the necessity for anticipatory regulatory requirements to ensure AI applications foster inclusive, equitable financial ecosystems. Responsible AI deployment, supported by robust ethical frameworks, remains essential for meaningful financial inclusion.

The use of AI in digital finance also presents both opportunities and challenges. Yuan et al. (2021) note that elevated financial risk can impede adoption of AI and complementary technologies in financial sectors, especially across G7 nations where risk minimization directly influences technological innovation and sustainability efforts. Thoughtful policy frameworks must balance innovation against prudent risk management to ensure digital finance continues supporting both economic development and environmental goals.

Blockchain technology maintains its pivotal role in cross-border payment systems and customer needs identification, establishing foundations for more inclusive financial markets (Zhang et al., 2020). Fintech firms, employing AI applications, also work to ensure traditionally marginalized groups—particularly low-income populations—can actively participate in financial markets (Fazal et al., 2024; Mhlanga, 2020). Mhlanga (2020) specifically notes AI’s contribution to digital inclusion through enhanced risk detection capabilities, fraud prevention mechanisms, and strengthened cybersecurity measures. AI-powered chatbots and support systems further improve accessibility by providing responsive customer assistance.

Mobile money transfer innovations have also significantly reduced exclusion of high-risk populations from financial services, enabling market participation that were previously unavailable to them (Park & Mercado, 2018). Blockchain implementations and cryptocurrencies, including Bitcoin, have helped mitigate currency-related risks (Paul et al., 2019). Online payment platforms paired with social networks address information asymmetry problems in credit markets, effectively resolving credit rationing challenges that historically limited access for underserved communities (Wang et al., 2020).

Arner et al. (2020) argue that AI and fintech are key drivers of financial inclusion due to two main factors: first, the implementation of electronic Know Your Customer (e-KYC) protocols simplifies account opening processes and helps marginalized groups build digital identities; and second, interoperable electronic payment systems facilitate smoother financial transactions. These innovations not only make it easier for marginalized groups to access financial services but also reduce operational barriers for financial institutions, creating a more inclusive and efficient financial ecosystem.

Prioritizing the development of integrative frameworks that harness AI, blockchain, and fintech innovations while addressing ethical governance concerns, transparency requirements, and regulatory compliance challenges is necessary in this sphere. Balancing innovation against consumer protection will remain crucial in ensuring digital finance advances both inclusion and sustainability objectives.

Theme 5: Financial Fraud Detection through Data Mining and AI