The classical VC playbook is "found 100 companies and hope that one goes 100x". You might think of that strategy as "hedge your bets". It works if the odds are in your favor: say you get to make 100 bets and 1 in 80 go 100x, you profit.

I see a threefold risk hidden in the state of the VC market in the AI era:

1. Many investors like YC are now only interested in making AI bets. They are reducing the diversity of their investments on purpose.

2. It's like some guy "Claude" is a technical co-founder with every startup, steering them all towards the same ideas, the same library and framework choices, the same kinds of blog posts, the same visual styles which Claude knows well. There's a limited pool of value that Claude has to contribute to society, and everyone is competing for their slice of that pool of value, but instead of the competition increasing the size of the pool, the size of Claude's pool of value it has to contribute is fixed from the time of it training. Competition for Claude's resources reduces the value of each competitor!

3. AI changes the incentives from "contribute to open source infra" to "just write exactly the code you need right now". This means that in practical terms 100 teams go out and every team might spend 10% of their time and money writing the exact same code to solve the exact same problems that the other teams are solving. The AI will spit the same code out again and again gleefully, multiplying the maintenance burden and reducing how far the same money goes toward exploring unique ideas.

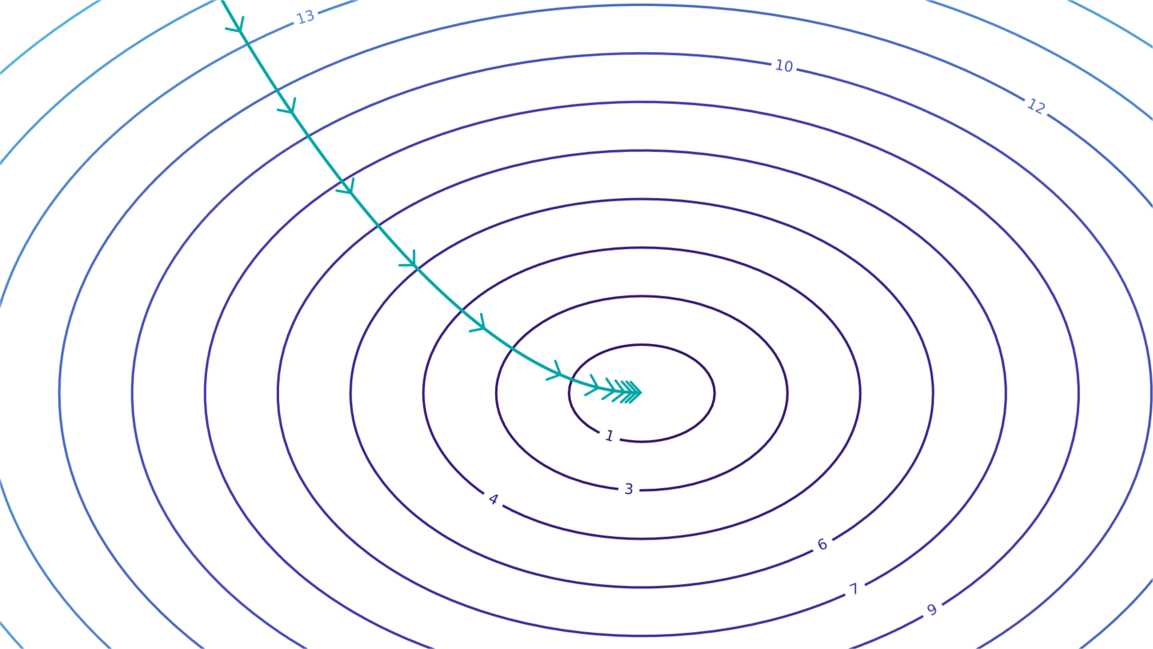

My impression is that this spells disaster for a place like YC, which depends for it economic on this math along the lines of "if you make enough bets, some of them will succeed big." That law-of-large-numbers logic only holds if the bets your make are independent, does it not?

.png)