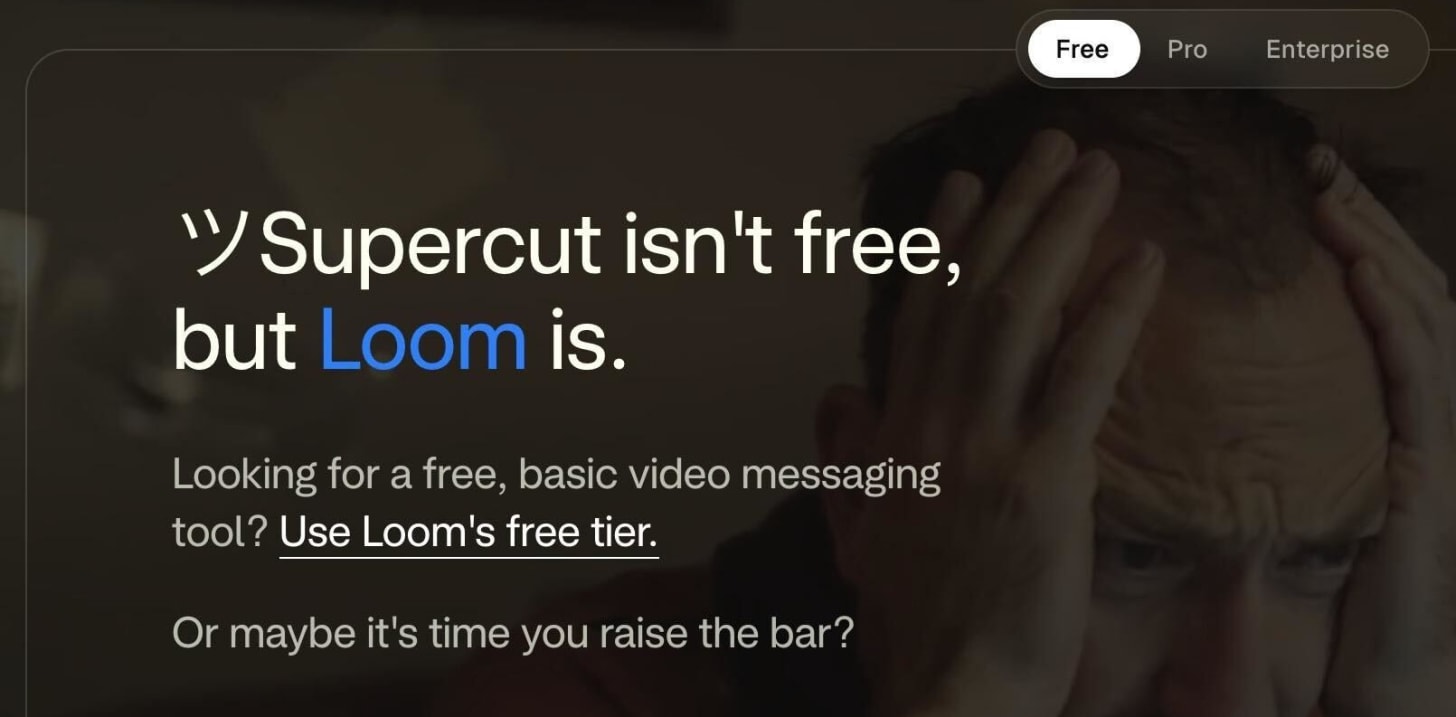

“What the hell is this marketing?” It was one of the comments in an internal discussion about how Supercut manages the lack of a free subscription plan.

It’s actually a smart move. Smarter even than it may initially appear. However, before we get to that, let’s pause for a moment.

Removing a free option—or at least making it utterly unworkable—is becoming a new trend. After two and a half decades of getting us accustomed to freebies, it is a pivotal change.

In the 2000s, Google rewired the way we think about internet products. It started with Gmail, which offered unprecedented 1GB of space, while its competitors at the time provided storage in the single-digit megabytes for free tier users. A couple of years later, with Google Sheets, Docs, and Slides, we got a free alternative to one of Microsoft’s cash cows of the time—Office.

Google wasn’t fast to monetize its products. They were already flush with revenue from ads. Yet, their approach became the new playbook.

Start with a free offer to get traction.

Rely on a functional, albeit somewhat basic, feature set to gather the pool of customers.

Convert some of them to paid tiers later.

It was completely aligned with the default VC tactic, which prioritizes growth over profit. The emergence of huge businesses that started with no clear monetization strategy (Facebook, anyone?) but succeeded wildly at building traction only strengthened the importance of the free offer.

The trade-off was simple. The downside of onboarding a free user was limited.

Whatever the offering, it was already there, so no additional cost here.

Support was limited to some FAQs and self-help articles, so it was only a one-time cost, and we could justify it for all users, not only the free ones.

Infrastructure costs were the only moving part. However, it was marginal. How much storage and traffic can free small-scale users exploit?

The upside, on the other hand, was significant.

Word-of-mouth marketing is the cheapest way to increase traction.

Some products have a built-in growth engine, too (”I’m using it, so join me there to collaborate, maybe you’ll like it and start using it in other contexts as well.”).

Finally, the larger the base of free users, the larger the target for potential upsells.

Let’s say we can convert only 1% of free users to a paid tier. If one subscription covers the infrastructure cost for at least 100 free customers, then we win. And since the costs of running free-tier users were so negligible, it was way more than 100.

And that all adds up even before we apply VCs’ playbook of growth over profit. Investors would be happy to pour more money into a venture as long as it presents them with ever-growing usage numbers.

The rise of AI changed many things, but not much in the trade-off laid above. Save for one thing.

The cost of AI processing power is disproportionately higher than that of traditional SaaS cases. As an industry, we have yet to figure out how to make AI infrastructure sustainable.

It’s not without reason that AI tools have set limits on their free version based on AI processing power.

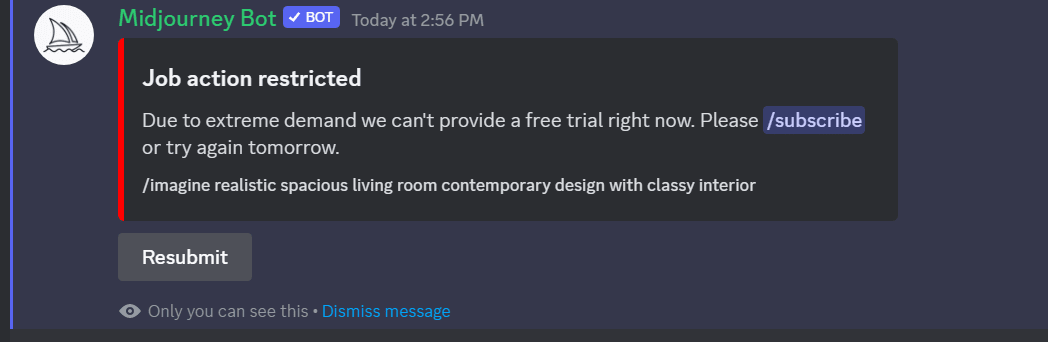

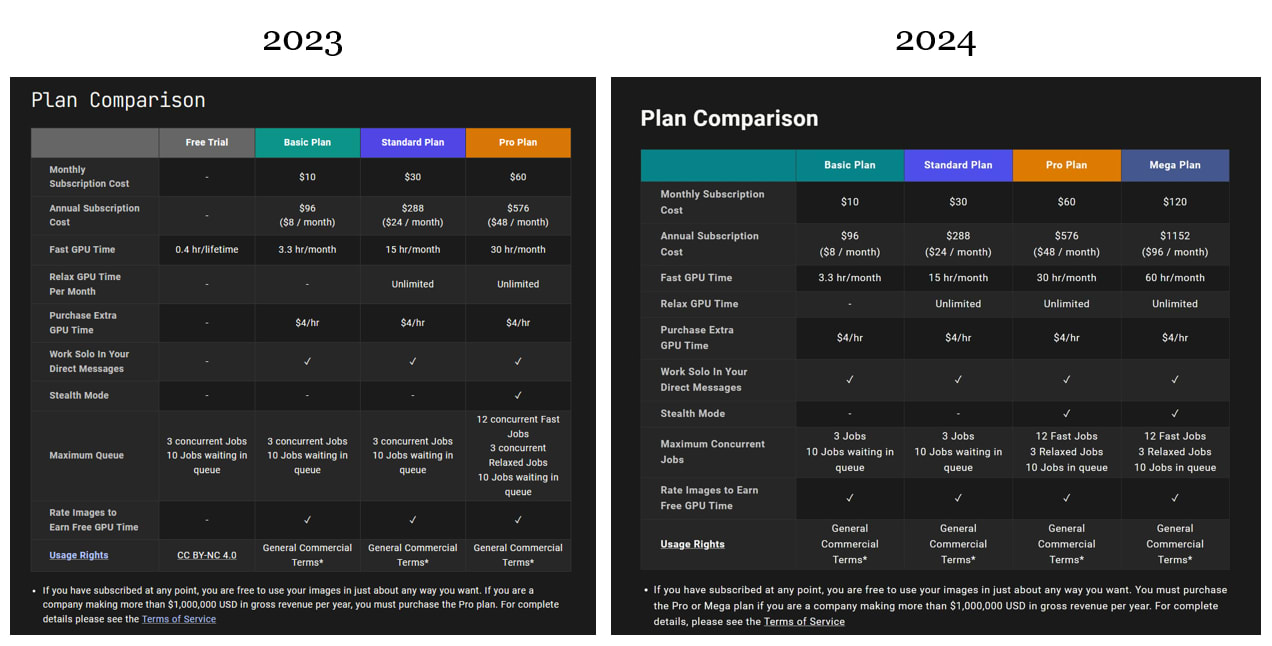

We can consider the Midjourney example from 2023. They could squeeze a margin from $10 per ~3h of GPU time offer (with the basic plan). However, how many of the free users could that margin sustain?

We don’t know the exact math here, but a few at most. Probably not even that. And the longer the freeloaders kept using the service, the more costly it became.

Midjourney must pay Google for its AI infrastructure for each image generation job, regardless of whether it is under a paid or free subscription.

Suddenly, the trade-off behind free-tier users no longer looks attractive.

We witness a rapid evolution of how product startups treat free users.

The first step was making the free offer borderline useless. The late experience of running free-tier Midjourney jobs was awful. Or, should I say, trying to run them?

The servers tended to be “busy” all the time. Thus, they were unable to process the unpaid customers’ jobs. In reality, that was probably a strong push toward paid tiers just before Midjourney got to the next step.

The second step is removing the free option altogether. Which promptly happened soon after.

OK, removing the free tier is not necessarily a viable strategy when trying to generate early traction. However, once you’ve validated Product-Market Fit, and you switch to growth, it’s a different game altogether.

It used to be true that a paying customer is better than a free user, and that, in turn, is better than a non-customer.

Now? A paying customer is still the best. Then a non-customer. A free-tier user? Avoid like the plague.

The balance between potential upside and potential downside has shifted. The cost of adding another user is non-negligible, so the potential for generating future revenue must be significant enough to justify maintaining this option. Otherwise, it’s a surefire way to bleed money long-term.

Considering the above, it’s no wonder that Lovable (and alike) don’t reveal a tiniest bit about their costs. Also, don’t be surprised if their free option disappears soon.

So let’s go back to Supercut’s “what the hell is that” marketing. The key bit of information is that their product heavily relies on AI.

They don’t want to venture into free-tier land. It doesn’t make any sense for them. In fact, the more they rely on AI infrastructure, the less appealing a free user is to them.

Supercut adds a positive spin to that decision. “Hey, you want free? Here’s our competitor that offers precisely that.” It’s cute, isn’t it? You don’t even need to look for a free option. It paints a picture of a healthy competition. “We’re good at this, while they are good at that. Pick your poison.”

Sounds like a selfless move? It’s anything but.

See, a free version of Loom offers at least some AI features (like transcriptions). So, Supercut sends freeloaders to the competition, actively loading Loom’s costs.

Supercut chooses to play only for the paying part of the pie. And of course, Loom will have a much easier way to convert their free customers to a paid tier than Supercut to attract them from the market. Yet Loom will pay dearly for this advantage.

The game most likely is not worth the candle.

We experience a shift in the perceptions of digital products and what constitutes the most basic offering.

There’s no shortage of products where AI plays an absolutely pivotal role. For those, an old-school approach to free users is a lethal disease. Don’t expect them to stick to the old playbooks.

For products that are not AI-native but incorporate AI features, the economic shift is not as brutal. Still, the balance between the potential upside and the potential downside of sustaining free users is changing for the worse. Expectations for conversion rates will only get steeper.

The lack of a free tier will then become increasingly popular. That, in turn, will affect customers’ expectations. For 20 years, we were taught to expect a free meal. Not anymore.

For product companies, the new norm is to avoid free users like a plague. The basic paid tier is the new free tier. Consumers, whether they want it or not, will follow suit.

That’s actually good news for the early-stage startups.

.png)