content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Bitcoin faced renewed selling pressure this week as large investment funds pulled money out at a pace not seen in months.

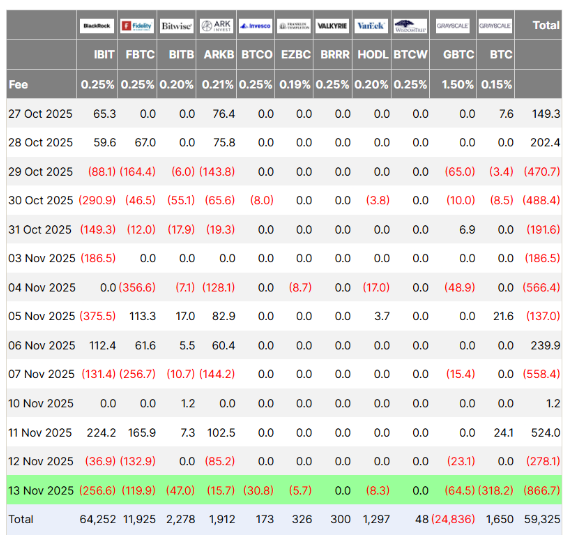

Reports from Farside Investors showed that spot Bitcoin ETFs recorded about $866 million in withdrawals on Thursday, a sharp move that arrived even after the US government reopened following a 43-day shutdown.

The flow of money leaving these funds caught the attention of traders who had expected a stronger reaction once political uncertainty cleared.

Heavy Withdrawals Hit Major Bitcoin Funds

According to new data, this wave of outflows marked the second straight session of losses for US-listed spot Bitcoin ETFs.

A separate reading from SoSoValue pointed to nearly $897 million leaving those products on the same day, suggesting widespread pullback from institutional players.

The shift surprised some market watchers because ETF inflows had been one of the main drivers of Bitcoin’s strong run earlier in 2025.

Those who entered Bitcoin 6 to 12 months ago have a cost basis near 94K.

Personally, I do not think the bear cycle is confirmed unless we lose that level. I would rather wait than jump to conclusions. pic.twitter.com/i9a5M0xnMW

— Ki Young Ju (@ki_young_ju) November 14, 2025

Ki Young Ju of CryptoQuant warned that the broader uptrend could weaken if Bitcoin falls below $94,000, which he identified as the average buying level for holders who entered during the past six to 12 months.

XRP Fund Shines Amid Market Pressure

While Bitcoin funds struggled, one new altcoin product posted an unusually strong debut. The Canary Capital XRP (XRPC) ETF reached $58 million in first-day trading volume, according to Bloomberg ETF analyst Eric Balchunas.

That figure barely topped the $57 million logged by a Solana ETF earlier this year, but it still ranked as the biggest opening among roughly 900 ETF launches in 2025.

Reports also noted that Ether ETFs faced $259 million in withdrawals on Thursday, while Solana ETFs extended a 13-day run of inflows by adding another $1.5 million.

Rate Cut Doubts Add To The Slide

Bitcoin slid under the $100,000 line on Friday and traded around $96,900 by 00:00 ET (05:00 GMT). It dipped to an intraday low of $96,650, pressured by fading hopes of a Federal Reserve rate cut in December.

Markets now price about a 45% chance of a 25 basis point cut at the December 10-11 meeting, down from 63% a week earlier.

The government shutdown created gaps in official inflation and jobs data, leaving the Fed with fewer signals to work with and keeping traders cautious about taking on risk.

Mixed Sentiment As Crypto Heads Into The Weekend

Institutional demand has been cooling, shown by repeated outflows and slowing treasury purchases. Some analysts believe the market has been in a quiet bearish phase for months.

Hunter Horsley of Bitwise said the downturn may be closer to ending than many assume, although broader risk markets have offered little support.

Others caution that continued ETF withdrawals could extend Bitcoin’s losing streak, which is now headed toward a third week.

Featured image from Unsplash, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

.png)