content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Charles Hoskinson has pushed back against the persistent narrative that Cardano’s lack of USDC and Tether support stems from strained relations or a refusal to pay integration fees. Speaking during a recent X Space, the Cardano founder laid out a detailed account of the platform’s ongoing engagement with both Circle and Tether, stating explicitly: “We talk to Circle probably every month to two months. We’ve engaged with Tether numerous times.”

Cardano Needs DeFi, Then USDT And USDC

Hoskinson framed the issue not as a matter of neglect or friction, but rather as a question of network maturity and leverage. “Circle offered to come to Cardano back in 2021,” he said, recalling a $3 million proposal that was ultimately declined by the Cardano Foundation. “They just said no, which was just unbelievable to me. But that was that.” According to Hoskinson, stablecoin issuers such as Circle and Tether base their decisions largely on total value locked (TVL) and the depth of the DeFi ecosystem—two metrics where Cardano has consistently lagged behind Ethereum and Solana.

With Cardano’s TVL hovering between $300 million and $400 million, compared to Solana’s $8 billion and Ethereum’s more than $100 billion, Circle and Tether remain unconvinced that an integration would be commercially worthwhile—unless the network itself or its founding entities were to mint significant volumes of the stablecoins to kickstart liquidity. “The proposition on the table is go create an integration for an exotic chain you don’t understand a lot about… and release it into a DeFi market which is a rounding error to the markets that you’re currently in,” Hoskinson said, adding that stablecoin providers have in the past requested $100–300 million worth of pre-minted issuance to justify the effort.

Hoskinson stressed that this is not about animosity or unwillingness to engage: “It’s not like we’re on bad terms with these companies.” Instead, he argued, the absence of USDC and USDT is a rational outcome of market dynamics and value distribution. “If the founding entities are willing to put a lot of cash up and get stuff minted, that might be. But in lieu of that, it’s not for people at that size,” he said.

He also challenged the belief that securing Circle or Tether would fundamentally transform Cardano’s DeFi sector. “People seem to think that the inclusion of Circle and Tether will somehow magically supercharge the Cardano ecosystem. That’s just not true. It’s the opposite,” Hoskinson asserted. “If you have a thriving DeFi ecosystem, ample stablecoin options are an organic consequence of that. But thriving stablecoins don’t cause you to have a thriving DeFi ecosystem.”

Highlighting Algorand’s experience—where hundreds of millions in USDC were minted but had little effect on its DeFi traction—Hoskinson warned against mistaking presence for impact. Instead, he called on the Cardano community and ecosystem actors to focus on building internal capacity. “Build up the stablecoins,” he said, reiterating plans for a Cardano sovereign wealth fund intended to bootstrap ecosystem liquidity. “The proposal will come out at Rare Evo. And I think it’ll put that first $100 million in.”

He also noted the potential for Bitcoin DeFi to serve as a Trojan horse: if Cardano can become a stablecoin issuance platform for Bitcoin and Lightning Network users, the incentives for Circle and Tether to onboard may increase organically. “Bitcoin DeFi will bring a shit ton of TVL if it’s done correctly into the Cardano ecosystem,” he said. “I told them I’d be willing to do it for free.”

Hoskinson closed by condemning the reduction of nuanced, strategic considerations to social media scapegoating. “On Twitter, everything I’ve just told you goes from this nuanced answer to: the reason Tether and Circle are not on Cardano is either they hate Charles Hoskinson… or Charles is not willing to pay the price,” he said. “There’s no price tag on the table.”

Until Cardano’s DeFi ecosystem can offer serious TVL and user demand, he suggested, no amount of negotiation or goodwill will be enough. “You always strategically negotiate from a position of strength,” Hoskinson said. For now, that means building—internally, deliberately, and from the ground up.

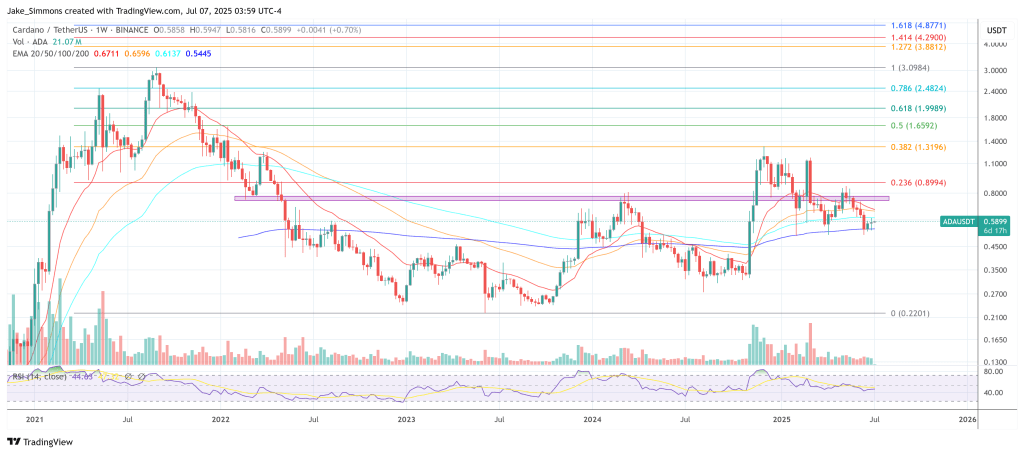

At press time, ADA traded at $0.5899.

Cardano price, 1-week chart | Source: ADAUSDT on TradingView.com

Cardano price, 1-week chart | Source: ADAUSDT on TradingView.comFeatured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

.png)