In my last post I asked if tariffs, antitrust remedies, distribution dissatisfaction and non-iOS competition make any impact on how customers perceive the company. Let’s begin with tariffs.

Broadly, tariffs are unpredictable and politically arbitrary. The greatest harm may come not from the misallocation of capital among nations but from the inability to plan and thus the non-allocation of capital altogether. A cessation of investment is a recipe for stagnation if not poverty but it’s not a management challenge. In most situations it behooves every manager to do nothing. Therefore it’s no more interesting to devise a strategy for tariffs as it would be to devise a strategy for volcanic activity.

But still, how does it affect the relationship with the customer? One could argue that tariff-induced price increases might cause a decline in demand but there are always going to be alternatives for consumers. Let’s not forget that tariffs are being offered as punishment for US customers only and the US is less than 40% of Apple’s business (“Americas” is about 42% and that includes Canada, Mexico, Central- and South-America.) The rest of the world has already been punished to varying degrees with higher prices due to customs fees, value added and other taxes. This is why there was a thriving smuggling pipeline from the US to rest-of-world for as long as Apple has been in business.

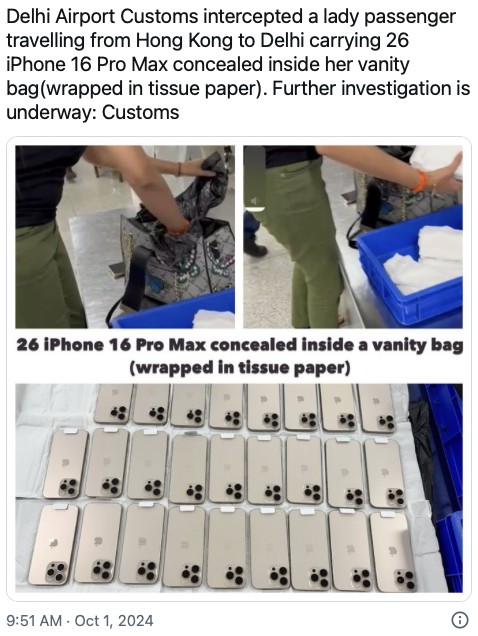

The smuggling of products across borders without payment of taxes on trade is called the grey market and is neither new nor small. The grey market for electronics is estimated to range from 6% to 8% of the global market, worth up to $60 billion. Some studies suggest that 13% of global consumer sales involve products sold outside the manufacturer’s intended market with the electronics segment above 14%. The share of Apple sales generated through grey channels may be somewhere in the upper part of that range.

Even 10% of Apple sales being grey market could come as a shock to many but it shouldn’t. Many Americans may be unaware of this because the US has been the source of grey exports with couriers smuggling products from there to almost every other location on earth. This is mainly because the US is among the least taxed consumer products markets.

Perhaps the pipeline will soon reverse direction.

American couriers queuing in foreign Apple Stores hoping to bring home some “duty free” iPhones or doing it for friends, family or for a fee is certainly foreseeable. Prohibition era alcohol smuggling was a vast industry for the US, mainly from the Caribbean and Canada. Drug smuggling has been a vast industry since then. Consuming contraband is therefore not beneath US consumer dignity. Organizing this on a large scale enables criminal gang formation and it might appear harmful for a brand to be associated with such activity. But again, reflecting on this historically, it does not normally detract from the brand that it is the subject of smuggling. Marlboro, Dewars and other toxins retained their cachet throughout their smuggling to and from various markets. Firearms, tobacco and alcohol are as desirable now as they were when constrained to the point of exclusion.

When I was young it was common to see Levi’s jeans and boxes of American cigarettes being used as currency behind the Iron Curtain and nobody would argue that those brands suffered as a result.

Today, even with higher prices, satisfaction among non-Americans is not worse than with Americans, taxes and governmental pilfering notwithstanding. In other words, prohibitionism does not work in eliminating demand or brand value. Tariffs are a mild form of prohibition and therefore their value impact is quite limited.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.

.png)