Here is a funny number to chew on. Sometime in the early part of 2026, if current trends persist, Google will have a spending rate on servers that is in excess of the inflation adjusted spending levels set by the entire world in the wake of the Dot Com bust. And it will not be long before Google’s spending rate on servers – all by its lonesome – matches the spending rate during the Dot Com boom.

Right now, given all of the numbers that Google has put out, we project that it will spend $55.2 billion on servers in 2025, and that beats the anemic $51.5 billion the world spent on servers in 2009 when the Great Recession caused a 20 percent decline in server spending (these figures are expressed in 2021 US dollars) and it nearly matches the $57.7 billion that was spent worldwide on all kinds of iron in the following year.

That spending rate by Google is what happens when all of the hyperscalers, cloud builders, and now the model builders have to spend $3 million, or $4 million, or even $5 million for a rackscale accelerated computer that has coherent memory across its CPUs and GPUs to run AI training and inference so that we can augment (many think replace is a better word) the parts of human thinking involved with data retrieval and synthesis for many orders of magnitude more energy (145 kilowatts per rack compared to 20 watts for the human brain) but with a lot more speed and arguably a lot less complaining.

In the quarter ended in September, the top brass at Google said that the company, which includes the Alphabet shell company and some do-dads that are not ad serving, video serving, and cloud computing, spent $23.95 billion on capital expenditures, with 60 percent of that being for servers and the remaining amount for datacenter facilities and other gear such as networking. (For Google, it seems, a server is tuned for storage but not distinct, which we get.) If you do the math on that, you get $14.37 billion spent on servers in Q3 2025. If you take the midpoint of the new – and higher – estimate for capital expense spending for 2025, which is between $91 billion and $93 billion, and multiply by the same ratio, you get that $55.2 billion figure. And if you project out spending at the same quarterly sequential rate, which we think is probably a low ball estimate for growth in the coming year unless the GenAI bubble bursts, it is not hard to see Google spending in excess of $80 billion on servers – with the bulk of that being accelerated systems using either its homegrown TPUs or GPUs from Nvidia or sometimes AMD.

We have become so accustomed to people throwing such large numbers around that we can’t feel what an astounding amount of gear this is, and how much aggregate computation it is.

“While we have been working hard to increase capacity and have improved the pace of server deployments and datacenter construction, we still expect to remain in a tight demand/supply environment in Q4 and 2026,” Anat Ashkenazi, chief financial officer at Google, explained on a call with Wall Street analysts going over the third quarter numbers. “Moving to investments: We Are continuing to invest aggressively due to the demand we’re experiencing from cloud customers as well as the growth opportunities we see across the company.” Ashkenazi then went on raise the capex spending to a midpoint of $92 billion, plus or minus $1 billion, and added that for 2026 Google was expecting “a significant increase in capex” and would provide more insight into that after 2025 closes and it reports its number for the year in January.

Our guess is somewhere north of $130 billion, with 2026 being the local maxima in GenAI investments as powerful hardware and rising AI inference demand come together to start creating actual revenue-generating businesses.

By the way, demand is strong both for the homegrown TPU accelerators as well as the GPU accelerators that Google buys from Nvidia and sometimes AMD. (It is a pity that Google does not provide a breakdown on this.) On the call, Sundar Pichai, chief executive officer at Google as well as the Alphabet shell holding company, said that Google had just started renting out capacity to customers on its “Blackwell” GB300 instances to customers in its A4X Max instances. The B300 GPUs are aimed at AI inference and have deprecated high precision floating point processing in favor of boosting lower precision throughput but can also be used for AI training if need be. Pichai said that the “Ironwood” TPU v7p, which we covered in depth back in April, would be rentable soon.

“We are investing in TPU capacity to meet the tremendous demand we are seeing from customers and partners, and we are excited that Anthropic recently shared plans to access up to one million TPUs,” Pichai said on the call.

Back in September, based on Google’s comments about token generation rates for its complete application stack and the technical specs of the TPU lineup, we estimated that maybe 1,460 trillion tokens were generated for Google applications in August and that this would take a fleet of over 700,000 Trillium TPU v6e accelerators. It would take progressively larger number of older TPUs to get the same throughput, obviously. The Ironwood TPU system spans 24 rows of gear with 9,216 TPU v7p devices in a shared memory cluster that has 42.5 exaflops of FP8 or INT8 performance and twice the performance per watt of the Trillium TPU v6e, whose shared memory domain was only 256 devices.

Anthropic is no doubt wanting to get access to a million Ironwood devices, not a million Trilliums.

In the quarter ended in September, Google set a new record for revenues and broke through $100 billion for the first time. It raked in $102.34 billion, to be specific, up 15.9 percent year on year and up 6.1 percent sequentially. Operating income rose by 9.5 percent to $31.23 billion, and thanks to some accounting bennies, net income rose and a by 33 percent to just a hair under $35 billion in the quarter.

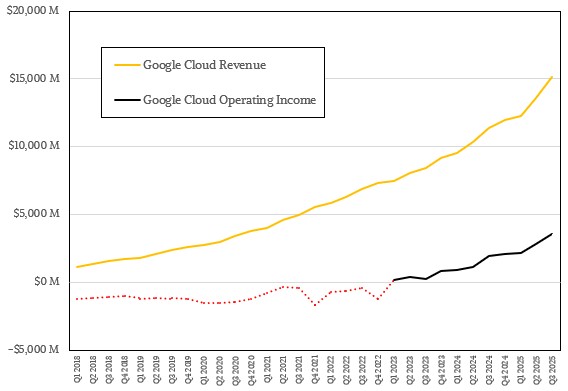

Google Cloud, the infrastructure rental arm of the company, posted $15.16 billion in sales, rising 33.5 percent compared to the year ago period, and largely because GenAI customers (and particularly large ones like model builders OpenAI and Anthropic) are spending big bucks to get their hands on any GPUs and XPUs they can. (We expect much the same story at Microsoft and Amazon Web Services.) Operating income for Google Cloud rose by a very nice 84.6 percent to $3.59 billion, but still only represented 14.8 percent of Google Cloud’s revenues. The trend for profitability has been improving over the years, particularly as Google has kept server iron on the books longer rather than just writing it off after three years as it used to do. That is not economically feasible anymore, not even for a hyperscaler and particularly not one with its core search engine and related advertising business under direct threat from GenAI.

The Google search and ads business still represented 85.1 percent of the company’s sales in Q3 2025, with $87.05 billion coming in. That was a 13.8 percent increase year on year.

We would remind you that Google could turn itself into a much bigger cloud anytime it wants to. All it has to do is designate all of its infrastructure used for its internal workloads as part of Google Cloud, and backcast financials showing how various divisions and groups allocate costs as revenue to Google Cloud. It would be interesting to see just how much Google Search, Google Ads, and YouTube really spend on infrastructure. . . . and how much Google Cloud would rent it, and at what margins.

Sign up to our Newsletter

Featuring highlights, analysis, and stories from the week directly from us to your inbox with nothing in between.

Subscribe now

.png)