Cursor is probably the most impressive startup of the past few years:

Broke $100m ARR in 12 months

Reportedly cracked $200m little later

TechCrunch then said it hit $300m less than a year after that.

Those revenue stats make raising $1b+ at a $10b valuation and doing it all with 60ish people look easy.

Anecdotally, I don’t know any engineers who don’t use Cursor (or something like it). It’s even more impressive that Cursor’s hypergrowth isn’t vague “traction” measured by user numbers.

Where ZIRP era startups struggled to convert user numbers into revenue numbers, Cursor monetized well from the start.

In this new series, we’ll analyze the pricing/monetization of popular startups and see why it works and what could be better. Today, we’ll feature Cursor’s pricing.

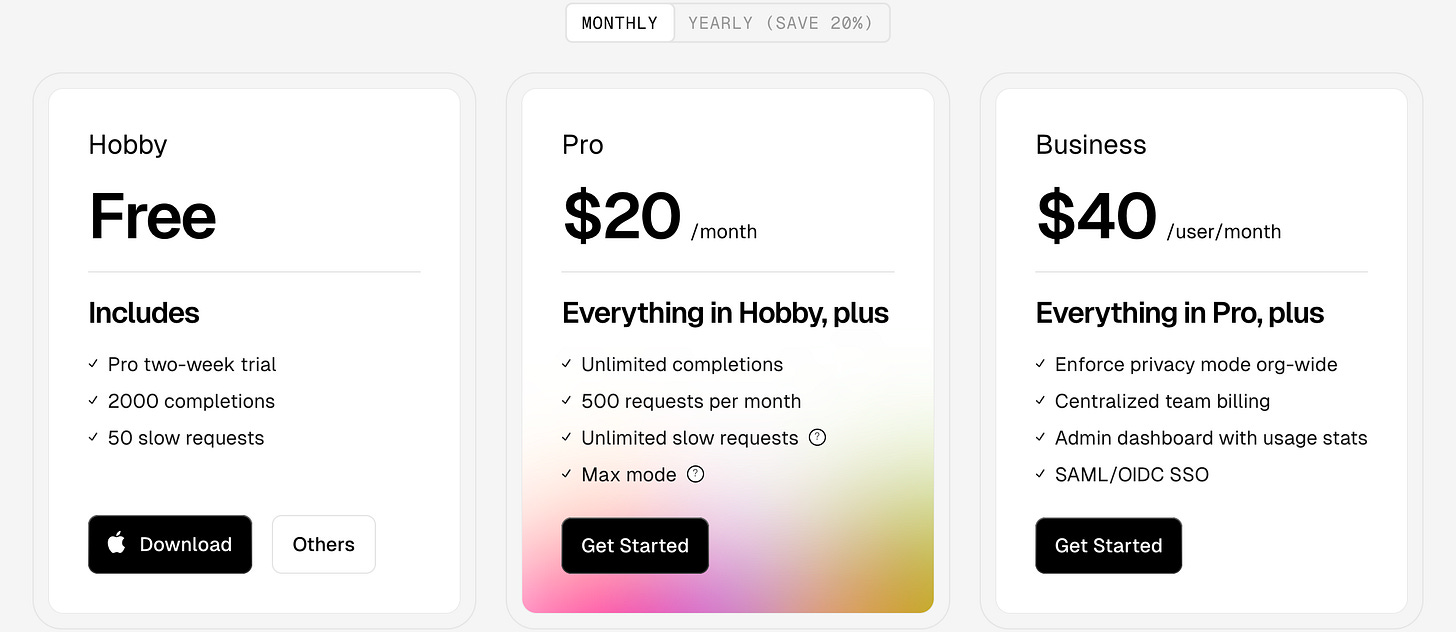

Cursor’s pricing is a simple freemium model: There’s a free plan, paid plan, team plan, and an option to talk to sales for enterprise.

Because AI companies rarely offer unlimited use (thanks, marginal costs!), most subscriptions include some amount of usage. We always study the metrics companies employ to measure usage.

The pricing features two core billable metrics:

Completions: This is code autocomplete.

Requests: An actual prompt to an AI and its response.

Requests take more AI tokens than completions, so they’re more limited than completions. The two secondary metrics are interesting too:

Slow requests: Slower AI is cheaper, so Cursor can include them in the free tier. They also offer a fallback for Cursor subscribers who have used up all of their requests.

Max mode: Max mode maximizes the capabilities of coding AI. They’re priced by the token, which enables Cursor to expand revenue on top of subscriptions.

(For the extra nitpicky, the word “unlimited” in any SaaS ToS is usually subject to fair use provisions, which reserves the vendor’s right to refuse service if they abuse the service).

This means Cursor is doing a version of usage-based pricing: They’re limiting usage within a subscription.

There are 3 main reasons why a limited-usage subscription is right for Cursor:

Before AI, SaaS margins often topped 80-90% because each individual user was basically free. Unless you did video hosting at scale or directly sold infrastructure, your costs didn’t differ that much between a power user or a dormant one.

Now that difference could mean the difference between losing money on a subscription or capturing 80% margins.

Cursor is well-insured against this because their most compute-intensive feature is priced by the token with a 20% margin over the API provider.

For the free plan, you can view the AI usage as customer acquisition cost. The paid plans are likely modeled so that using 500 requests leaves Cursor with some margin while anyone who doesn’t use all 500 requests is bonus margin.

If you offer AI via subscription, you need to insure yourself against power users who can drive margins negative. Without knowing Cursor’s costs, I can’t say anything about their margin.

But what I can say is that Cursor nails another fundamental of pricing.

What you charge for should reflect how your product creates value. For example, a cybersecurity company should never charge by the scan. The value proposition is that you’re always aware of threats, so it should always be running.

For Cursor, the value is making engineers more productive by helping them ship more code in less time. The actions they take to accomplish that are completions and requests, which is exactly what Cursor charges for.

Even if customers would save money by paying for pure usage, you’d constantly have to monitor your usage and upcoming payments. And even with cost control, engineers would overthink whether they really want to use that completion or request—and fail to become more productive.

Plus, it’d violate the third essential of good pricing/monetization:

Most people think pricing is about magnitude—how much you can charge without customers leaving. But pricing is just as much about buying experience.

Mentally, it’s easy to answer the question “Will I pay $200 a year for Cursor?”. It’d be a lot harder to answer that question for “$n per million tokens” because you need to estimate how much you’ll consume (which is hard, especially for abstract metrics like tokens).

Cursor grows a lot like Figma grew: Individual engineers use it, buy it, recommend it and ultimately demand it from their manager. That’s why it has to be easy to buy, with transparent pricing.

It’s a nice touch that $20/month seems to be the default pricing for tools like ChatGPT, Claude, etc. which makes it even easier to understand.

That said, if I was working on monetization/pricing at Cursor, here’s what would keep me up at night:

Cursor checks all the major boxes of pricing an AI product well. But the question in AI is always around margins. SaaS Revenue has always followed a power law, where 80% of your revenue comes from 20% of customers—because your margin was more or less the same, independent of usage.

Now that math isn’t true anymore if you charge a subscription. A more important thing in AI is margin monitoring: Understanding how much money you actually make from your customers.

If you’re not using a usage-based billing system like Lago, it can be hard to actually surface that data because usage, billing and related systems are disparate an are hard to turn into a single dashboard.

Now, if Cursor were worried, about margins, there’s a step they can take:

Cursor CEO Michael Truell shared on a podcast that Cursor is building its own coding-focused LLMs. It turns out you can do a lot with a $1 billion war chest.

This is typical CapEx: Instead of continually paying for AI APIs, building their own models in-house (a large one-time investment) permanently lowers Cursor’s costs, improves their margins and shields the company from price fluctuations from Anthropic and OpenAI.

Finally, they may themselves become API providers owning their own models, access to which they can sell to customers.

There’s a hidden cost to companies that grow rapidly: Failed payments. While Stripe is pretty universally acceptable, no payment provider is perfect. But most in-house billing systems aren’t payment provider-agnostic.

If Stripe (or another payment provider) doesn’t cover a country you have a customer in, you can’t get paid by a segment of your customers. Same if that payment provider goes down, erroneously shuts down your account or just fails payment for some other reason (this happens constantly).

If you use a system like Lago, that looks different and you can simply plug different payment providers in to offer more payment methods to your customers. But none of those things are threatening the company.

Overall, Cursor is doing a great job monetizing in a way that makes sense for its market and product.

Cursor’s challenge isn’t product-market fit or monetization. It has those two things nailed. But Cursor might be the first real-time case study of how to build real margins in AI-powered SaaS.

We’ll be watching.

.png)