I set up through Stripe Atlas

What’s your current MRR?

Delaware Franchise Tax due March 1

You should be building the future, not stressing over #taxes #delaware #bookkeeping. Meet TaxHero - the simplest AI-powered tax app for startups starting at just $10/month.

We handle bookkeeping, IRS 1120 federal filings, and Delaware franchise taxes so you don’t have to. All designed for startup founders by startup founders.

![]()

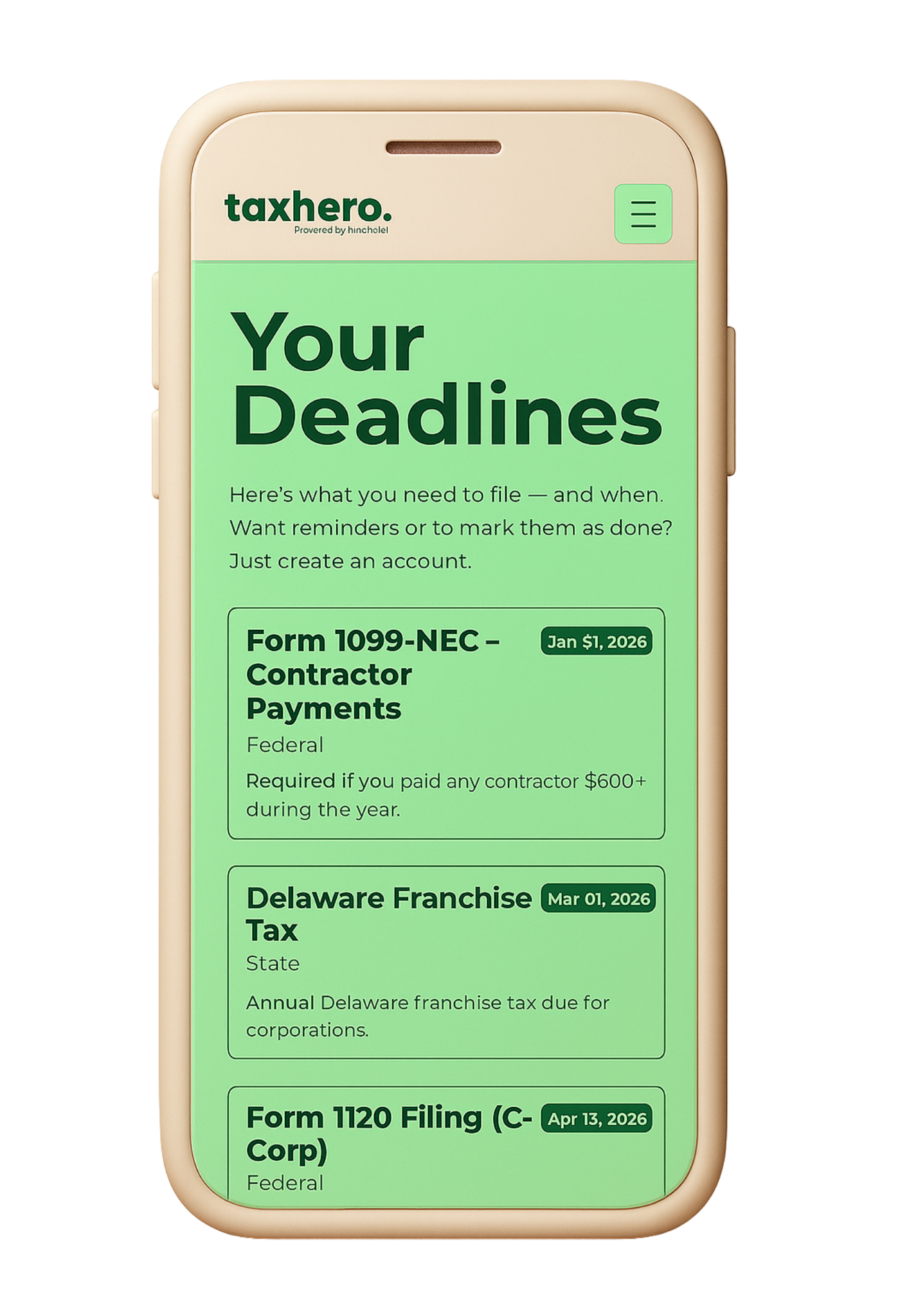

Stay on top of the deadlines

Never miss a deadline, we track every tax deadline and notify you so you’re never caught off guard.

![]()

Let AI do your bookkeeping

Every dollar tagged, sorted, and ready - no charts, spreadsheets, no guesswork.

![]()

File taxes while you sleep

AI guides your U.S. tax filings - fast, accurate, and handled.

Build on Richie AI - the platform trusted by 390+ fintechs to analyze business finances. That same engine powers TaxHero, giving you startup-grade precision.

Upcoming Deadline: Act Now

We can help you if you missed a deadline

Mark deadlines as 'Do It Yourself'

![]()

Smart Check-In

Answer a few questions and get a personalized tax calendar instantly.

![]()

Tax Deadlines, Tracked

Deadlines update automatically as your business changes. No stress.

![]()

Upload Bank Statements

Just drag & drop your PDFs or CSVs. AI takes care of tagging everything.

![]()

File Taxes with One Tap

Submit your federal 1120 or Delaware Franchise Tax without ever opening TurboTax.

What is the Delaware Franchise Tax and when is it due?

It’s a flat annual fee for being incorporated in Delaware — not a tax on your revenue. Most startups can reduce it to $400 using the right calculation method. Due every year by March 1.

Do I need bookkeeping if I’m just getting started?

Yes! Even if you have zero revenue, tracking your expenses early saves money and stress later. TaxHero helps you auto-tag expenses from bank statements as you grow.

What forms do I need to file if I pay contractors?

If you paid any freelancer over $600, you’ll need to file Form 1099-NEC by January 31. Don’t worry—TaxHero will remind you and guide you through it step-by-step.

I got a $8,000 Delaware tax bill. Is that real?

It’s a default estimate. Most early-stage startups can reduce it to $400 using the “assumed par value” method. TaxHero shows you exactly how to file with that calculation.

What’s the difference between bookkeeping and accounting?

Bookkeeping is daily expense tracking. Accounting is year-end tax filings. TaxHero helps you handle both automatically—no spreadsheets needed.

What startup expenses are tax-deductible?

Software, marketing, founder salaries, legal fees, even Zoom Pro. If it's a legit business expense, you can usually deduct it. We help you track and categorize automatically.

What do I need to incorporate in Delaware?

Just choose a name, hire a registered agent, and file the certificate of incorporation. You can do this via Stripe Atlas, Clerky, or Doola—and TaxHero syncs with all of them.

Can I start a US company if I live abroad?

Yes. Founders from anywhere in the world can start a Delaware C-Corp using services like Stripe Atlas. TaxHero is built for global founders with US companies.

Can I file my taxes by myself?

You can—but it’s risky. With TaxHero, you upload your data, review auto-generated tax forms, and file confidently without needing a CPA for simple filings.

![]()

Taxes without the complexity

With AI-powered bookkeeping and tax filing, you stay focused on what matters: building your startup.

.png)

![AI-powered humanoid robot demo [video]](https://news.najib.digital/site/assets/img/broken.gif)