Hewlett Packard Enterprise is going through yet another restructuring to reduce costs, something we have seen a lot of in the past two decades and a half decades since it acquired Compaq to become a volume server peddler as well as high end system supplier for enterprises.

But this time is a little bit different in that HPE is, like other OEMs and indeed other companies in all industries, trying to figure out how to deploy AI to have better engagement with customers and lower costs.

We don’t know much about how AI is impacting employee levels, and every company is going to not want to talk about how AI is replacing people even if this is the case because this is going to be an increasingly sensitive issue.

This is, in fact, the issue that will define our time in history.

The workforce reduction program announced in March was to reduce its headcount of around 61,000 by 2,500 and to have another reduction of 500 people by attrition, over a period of 12 to 18 months, eliminating about $350 million in annual costs when it is said and done. The plan is to have this restructuring done by the end of this fiscal year, which comes to a close at the end of October. The headcount at the end of Q2 F2025 was 59,000, so the restructuring is proceeding apace and this is, by the way, the lowest employee count that HPE’s enterprise business has had since absorbing Compaq in the wake of the Dot Com Bust in 2001.

“We are reducing management layers and flattening our organization because flatter is faster, enabling swifter decision-making and improving agility across functions,” Antonio Neri, HPE’s chief executive officer, said on a call with Wall Street analysts going over the numbers, adding that it was accelerating its cost-cutting efforts under a program internally known as Catalyst, which is widening out its efforts to boost growth and cut costs. Catalyst has four prongs: Layoffs, operational efficiency, portfolio optimization, and using AI across the business, Neri explained. And then, he actually provided some details on the AI effort:

“As part of Catalyst, we want to make it easier to do business with us, simplifying our offerings, streamlining our sales processes and aligning our team internally to be more responsive to customer needs. In addition, we will be leveraging AI to improve efficiency across our business. As an example, we are adopting an agentic AI initiative as part of our campaign. Within finance, HPE and Deloitte co-developed Zuora AI CFO insights agents built on Nvidia’s advanced AI stack and deployed on our own HPE private cloud AI platform. This strategic move will transform our executive reporting. We are turning data into actionable intelligence, accelerating our reporting cycles by approximately 50 percent and reducing processing costs by an estimated 25 percent.”

“Our ambition is clear: A leaner, faster, and more competitive organization. Nothing is off limits. We are focused on rethinking the business, not just reducing our costs, but transforming the way we operate. We will keep you regularly updated on our progress.”

It would be interesting to know how these models were trained, how much iron they run on, and how much human work they replace. We don’t expect such answers publicly, but you can bet that the HPE sales reps are talking about it as they do into the Global 2000 to try to make deals.

In the May quarter, HPE’s sales were $7.63 billion, up 5.9 percent year on year. Due to a $1.4 billion impairment of goodwill – which we think is for inventory of Nvidia “Hopper” H100 and maybe H200 GPUs – HPE booked an operating loss of $1.11 billion, compared to an operating gain of $415 million in the year ago-period. At a price of about $200,000 for an eight-way HGX node based on H100s, that impairment works out to be about 7,000 nodes with just under 56,000 GPUs. Had these machines been converted to system sales, that $1.4 billion would have driven about $2.63 billion in sales.

We believe further that these Hopper GPUs were expected to be pushed predominantly through GreenLake utility priced deals that must have had provisions to allow customers to stop the deal and ask HPE to go out and get “Blackwell” GPUs because this seems to have happened.

This has been fixed.

“In Q1, I said that the demand, the orders we booked, shifted very rapidly to Blackwell,” Neri said on the call. “And that clearly is now what we’ve seen. And the way we drive this process now, remember, some of the customers, not all of them, is prepayment. And that means that unless they prepay us, we don’t buy inventory. So that’s point number one. And point number two is that, on the previous generation, that inventory has been decreased dramatically. There’s still demand, but our exposure on the older inventory is significantly lower, and we are adequately reserved at this point in time.”

So even with the writeoff for the impairment, HPE is still selling the old H100 and H200 iron. We hope, for its sake, it can find homes for all of those GPUs, and find it hard to believe that someone, somewhere, is not willing to use Hopper iron when Blackwell gear is more expensive and more scarce, even if it is clearly better. Someone has to make-do other than HPE.

Anyway, when all of the accounting math was done, HPE booked a $1.08 billion loss in Q2 F2025, which was no fun at all, and burned $1.76 billion of its cash hoard, which ended the quarter at $11.67 billion as it is still pressing regulators to complete its $14 billion acquisition of Juniper Networks, which was announced way back in January 2024.

HPE’s Server division had sales of $4.06 billion in the second quarter, up 4.9 percent, but operating income fell by 43.4 percent to $241 million as the company is still struggling to get its discounting on systems in order as it wrestles with very aggressive moves by Dell, Lenovo, and the ODMs in the X86 server market.

Server operating margins were 5.9 percent in the quarter, about half the normal rate over the past couple of years. HPE is now sacrificing some revenues to boost margins, but the operating margins are still dropping as more lower-margin AI deals are entering the mix. HPE also has inventory issues for future AI system orders that are shaving operating income, but Neri says that HPE will be able to get operating income above 10 percent of revenue as it exits Q4 F2025, which is close to the average over the past several years of 11.5 percent.

The Hybrid Cloud division, which includes all HPE storage products as well as GreenLake utility-priced gear and software, had $1.45 billion in sales, up 15.7 percent, and operating income of $78 million, up by a factor of 7.8X compared to the $10 million in the year ago period.

The steady freddy Financial Services division posted $194 million in sales, and brought $89 million of that to the middle line.

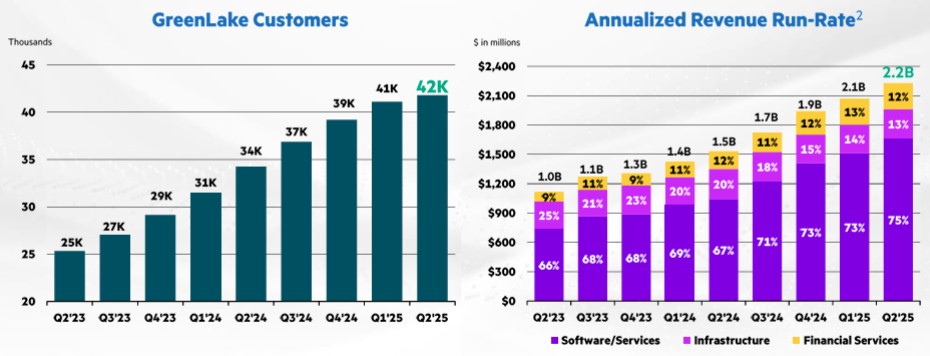

GreenLake customer growth is slowing, with only 1,000 customers added in the quarter, bringing to total to 42,000 worldwide. The annualized run rate for the GreenLake business inched up to $2.2 billion, compared to $2.1 billion in Q1 F2025 and from $1.5 billion a year ago. The trick will be if HPE can drive more stuff through the GreenLake program when it peaks at somewhere between 45,000 and 50,000 customers, if this is indeed the trend the company is on.

Everyone is keeping track of HPE’s AI systems business like a hawk, which has a very different profile of rival Dell, which has some AI model makers that qualify as hyperscalers as customer (xAI is the big one), and Supermicro, which has much fewer enterprise server customers and a handful of key hyperscalers buying a lot of its gear (again, xAI buys Supermicro iron as well).

Our model shows that HPE had a little bit more than $1 billion in AI system revenues – meaning they were delivered and accepted by the customers – in the second quarter, with $3.2 billion in backlog and $9.34 billion in cumulative orders since HPE first started talking about “APU System Revenue” and “APU Cumulative Orders” and “APU Backlog” in Q1 F2024, which we backcast into fiscal 2023 in our model.

Neri said on the call that in Q3 HPE would deploy a large AI system order booked earlier this year, and added later in the call that it would be one of “the largest GB200 deployments so far in the world.”

The interesting bit, as far as we are concerned, is that 33 percent of HPE’s AI system revenues in the quarter came from enterprises, not service providers or model builders, more than double the share of Q1 F2025. We are watching this enterprise AI trend very carefully, and when we have more data, we will plot it out on the chart above.

If you back out AI systems, then traditional, general purpose servers drove $3.05 billion in revenues in the second quarter, up 3.1 percent but down 9.7 percent sequentially as Nero & Co exercise discipline on server pricing. AI systems represented 24.8 percent of sales, which is not as high as the penetration HPE had for AI systems in Q3 and Q4 in fiscal 2024 but which was higher than in Q1 in fiscal 2026.

“We are focused in all segments of the market, but we participate with discipline – where we see a path to gross margin accretion and obviously, working capital that eventually translates into free cash flow,” Neri said when asked about how HPE was attacking AI and traditional servers compared to Dell. “What I saw there is probably a couple of large opportunities that we decided not to participate in. And if you look at their results, it’s fair to say that actually on the profitability, we will see what they’re going to do. But my view is that in enterprise, we are all in, and we see that momentum. In sovereign, we are all in, and we see the momentum as you see more in the next few weeks. And then in service provider, we will participate where we believe we can sustain that 10 percent operating margin and still sustain our revenue as we go forward.”

When you add it all up and do some spreadsheet magic on it, we think HPE’s core systems business, which we have tracked over the decades in many different incarnations, drove $6.13 billion in revenues in the second quarter, up 6.2 percent, with an operating income of $391 million, down 23.1 percent. This includes sales of systems (servers, storage, and switching) as well as systems software and financing for this stuff and this is following the normal ups and down cycles for the company since fiscal 2018.

Sign up to our Newsletter

Featuring highlights, analysis, and stories from the week directly from us to your inbox with nothing in between.

Subscribe now

.png)