Over the next few years, Big Blue may not build the biggest AI business in the world by any stretch of the imagination, but we do have confidence that it will build a collection of AI products and services that are among the most profitable. And the company has not done a very good job articulating this to customers, partners, and Wall Street.

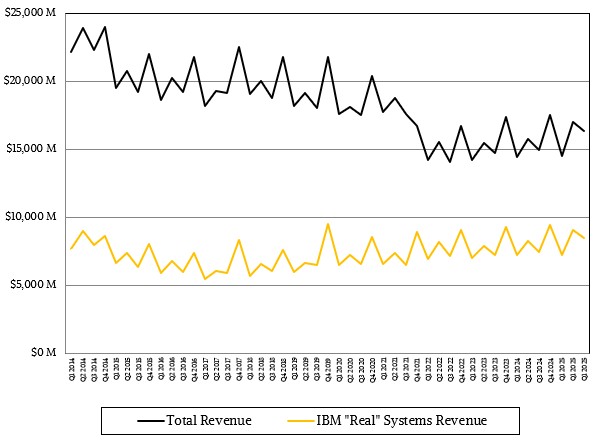

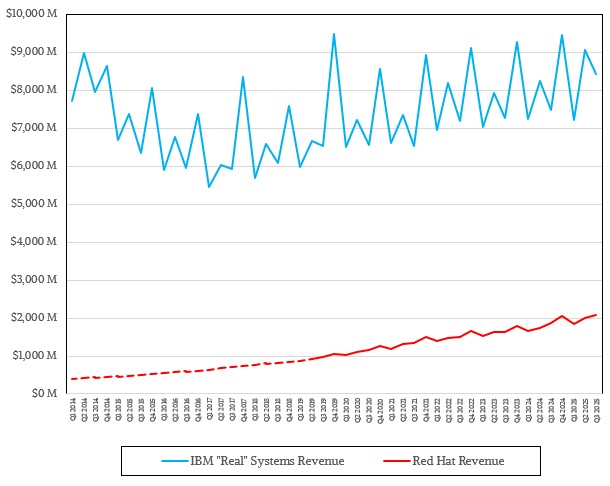

International Business Machines is an infrastructure company that dabbles in higher level and lower level stuff in the datacenter from time to time, and it is finally growing faster than global gross domestic product instead of flat-lining. This is progress, and progress that IBM has paid for by acquiring Red Hat and HashiCorp and adding features to its Power and z systems to support AI, and despite its abandonment of an HPC business that drove a reasonable amount of revenue through the national labs and academic HPC centers but never made the company any profits.

IBM may have sold off its Microelectronics division a long time ago, but it still designs its own Power and z system processors and it still does fundamental research in circuits and packaging because it has a stake in the outcome and it can also create intellectual property that others will license at a profit. Similarly, thousands of researchers and consultants have deep expertise in hundreds of industries, with knowledge of optimal processes and algorithms that can be used to increase efficiencies for businesses and governments. Big Blue has the expertise to help customers learn how to deploy AI, and its own Client Zero creation of AI applications to run its own business units – notably in sales, supply chain, and human resources – were expected to drive $2 billion in annualized “productivity savings” and will hit an annualized rate of $4.5 billion as 2025 comes to a close.

As we pointed out a few months ago, IBM is saving more money on its bottom line than it is making selling AI hardware, software, and services. But eventually this will change, and that is because IBM has well over 100,000 enterprise customers who will look to it for systems that can do AI in a measured, secure, and familiar way. They cannot afford to buy scads of GPUs, much less learn a new platform. They want AI integrated into what they have, and the modifications that IBM has made with its Power and z processors, including adding matrix math units to them and augmenting them with its homegrown “Spyre” AI inference accelerator, as well as the RHEL.AI and OpenShift.AI augmentations for its Linux and Kubernetes platforms, are what customers need.

Moreover, a new generation of code assistant, called Project Bob, is based on Anthropic’s Sonnet 4.5 models and has scrapped two separate code assistants based on IBM’s own Granite models that the System z and Power Systems divisions were working on separately. This assistant will eventually run in Linux partitions on IBM’s systems and use Spyre accelerators to do its inference, and it is created because IBM knows that around 70 percent of its Power Systems customers and nearly all of its System z customers create their own back office applications rather than buy them from Oracle (which supports IBM’s platforms) or Microsoft (which does not).

This was no different in the Dot Com boom, when Sun Microsystems, EMC, and Oracle because the poster children for Web infrastructure. IBM created Web middleware from open source tools, added integration with existing platforms and enterprise support, and wrapped RISC systems running Unix and then X86 systems running Windows or Linux around its systems to in turn run this Web infrastructure. And it made plenty of money. It also created integrated versions of the software stack that could stay completely on Power or z iron, and many customers opted for this, driving up sales of IBM’s indigenous systems.

Wall Street is not nearly as patient as IBM’s customers are conservative, and so there was an impendence mismatch between investor expectations and corporate expectations in the wake of IBM reporting its financial results for the third quarter this week. But here’s the thing. Just because Wall Street doesn’t understand what IBM is doing does not mean IBM, and its customers, do not understand what it is doing. IBM knows it cannot be the next big thing. But it knows it can be Big Blue for those 100,000 customers, and that is precisely what it is going to do.

In the quarter ended in September, IBM brought in $16.33 billion in sales, up 9.1 percent year on year. Gross profits rose by 11.2 percent to $9.36 billion, and importantly net income came in to $1.74 billion, which was 10.7 percent of revenues and which was a whole lot better than the $317 million loss IBM had in the year ago period.

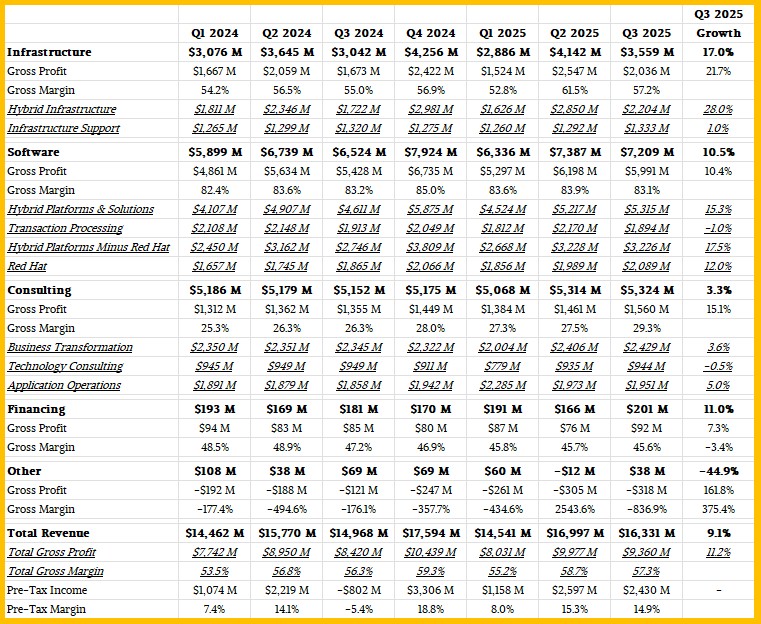

For those of you who like the details, we have done a breakdown of revenues and gross profits by groups and divisions for IBM since the beginning of 2024. We have kept some of the older categories for trend analysis. IBM consolidated a few divisions two quarters ago, and eventually we will have the time to backcast the new divisions into the old data. But for now, the chart above and the table below shows the old divisions in the Software and Consulting groups.

IBM exited the third quarter with $14.89 billion in cash and equivalents, which gives it some cash to do minor AI acquisitions as it goes into 2026 and beyond. We do not expect any silly acquisitions, like trying to buy one of the big model builders like OpenAI or Anthropic. (It would not be financially feasible even if it was desirable.)

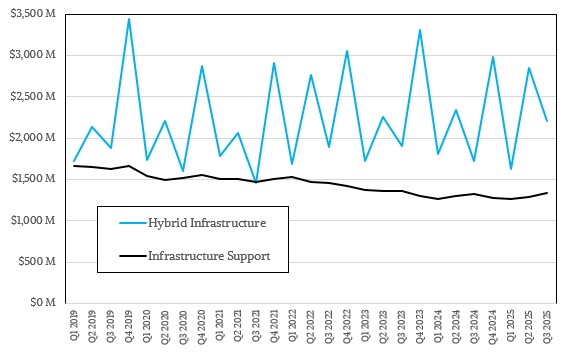

Thanks to the Power11 and z17 server upgrade cycles, which got going this summer, IBM’s Infrastructure group had a sales bump of 17 percent to $3.56 billion. System z mainframe sales were up 60 percent, and that is expected given that the “Telum II” z17 ramp started earlier in 2025 than did the Power11 ramp. (We need a code-name for Power11. . . . ) Distributed infrastructure, which is IBM’s combination of products sold by the Power Systems and Storage divisions, had a 10 percent increase, which was a whole lot better than the declines seen as the Power10 chips came to the end of their cycle.

Add it up, and IBM’s datacenter hardware business – which it calls Hybrid Infrastructure because it includes sales of System z and Power Systems capacity sold on the IBM Cloud – was up 28 percent to $2.2 billion. Infrastructure support rose by 1 point, and in our model that came out to $1.33 billion. Pre-tax income was up 52.6 percent to $644 million, and represented 18.1 percent of sales.

IBM said on the call with Wall Street analysts that Software group revenues were a little bit soft in Q3 2025 as customers prioritized the acquisition of hardware over software, but added that in the long term, traditional back office software revenues – for operating systems, middleware, databases, and transaction processing software – would rise.

In Q3, Software group posted $7.21 billion in revenues, up 10.5 percent. In our model, Red Hat accounted for $2.09 billion of that, up 12 percent and also lighter than the 14 percent to 15 percent that IBM is shooting for each quarter for Red Hat.

IBM’s transaction processing software had a 1 point decline to $1.89 billion, and that means all of its other software – databases, middleware, and development and automation tools – accounted for $3.23 billion, up 17.5 percent. Software group had a pre-tax income of $2.37 billion, up 20.6 percent and comprising 32.9 percent of total software sales.

IBM’s Consulting group had $5.32 billion in sales, up 3.3 percent, with pretax income of $686 million, up 22.7 percent and comprising 12.9 percent of revenues. This is a tough business and it is IBM’s least profitable one at that. But it is often what gets Big Blue in the door, and this is particularly true with AI.

Jim Kavanaugh, IBM’s chief financial officer, said on the call with Wall Street analysts that IBM added around $1.5 billion in incremental GenAI consulting bookings in Q3 and that the number of projects booked more than doubling from the year ago period. GenAI consulting, Kavanaugh added, represented 22 percent of IBM’s $31 billion consulting backlog.

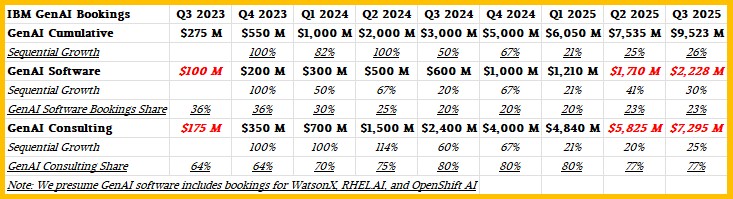

IBM has only been talking about GenAI revenues since Q3 2023, so we don’t have a lot of trend data. But here is what we know and modeled:

As usual, items shown in bold red italics are our estimates.

To date from Q3 2023, IBM has more than $9.5 billion in bookings for GenAI software and services. GenAI hardware has been embedded in Power10, Power11, z16, and z17 systems, so it is hard to extract that value out even if matrix math units were helping drive sales, but sales of Spyre accelerators will be clearly aimed at AI since they are no good for any other kinds of work. If IBM prices Spyre correctly and makes its use transparent for Power and z shops, Spyre can double the Power Systems revenue stream in the coming years and maybe do the same for the System z line.

A lot depends on the performance of Spyre accelerators on real inference models and how inexpensive and easy IBM makes it for its customers to choose Spyre over Nvidia or AMD GPUs. One thing we know for sure: None of these 100,000 enterprise customers really wants to run their AI in a public cloud, and they really don’t want to fight OpenAI, Anthropic, xAI, Microsoft, Amazon Web Services, Google, and others to try to get dozens to hundreds to thousands of them to do their AI training and inference.

Sign up to our Newsletter

Featuring highlights, analysis, and stories from the week directly from us to your inbox with nothing in between.

Subscribe now

.png)