This is a neat story. According to Dylan Martin of CRN, Intel plans to spin-off its Networking and Edge business (currently the NEX business unit) as was outlined in an internal company memo. This seems like a confirmation of what Max and the Reuters folks reported was being explored back in May. This is an interesting one to say the least. I thought it wasd worth discussing.

Intel Looking to Spin and Sell its Networking and Edge Business, Per CRN

Intel has been moving some of its key products out of its NEX business unit, such as its edge processors and some of its interconnect technologies. Also, Intel’s Altera business that also sells into the networking and edge space has already been put on the chopping block with Silver Lake Buying a Majority Stake in Altera from Intel. That deal is expected to close later this year.

If you have been following our Substack, we have been covering some of the challenges in the NEX business for some time. For example, major acquisitions such as Barefoot Networks, the InfiniBand assets from QLogic, and more in the network space have fallen flat for over a decade.

Intel’s $100B+ Acquisition Blunders by Patrick Kennedy

And How Pat Gelsinger Stopped the Bleeding

Then AI happened. For folks that are not aware, AI is absolutely changing the adoption of high-end network switch and NIC solutions. Web servers, database servers, and more are not driving the adoption of networking as fast as vendors like NVIDIA and Broadcom can make parts. Instead, it is the AI systems and networks that are voraciously deploying leading edge networking. Intel almost joined in that when Intel Bid for Mellanox. Ultimately, Jensen outplayed Bob and NVIDIA has created a networking business that would likely be valued at well over Arista’s valuation if it were standalone.

NVIDIA Outplayed Intel for Mellanox in 2019 and Added $100B of Market Cap in 2024 by Patrick Kennedy

How Jensen’s Vision Beat Bob’s Financial Model

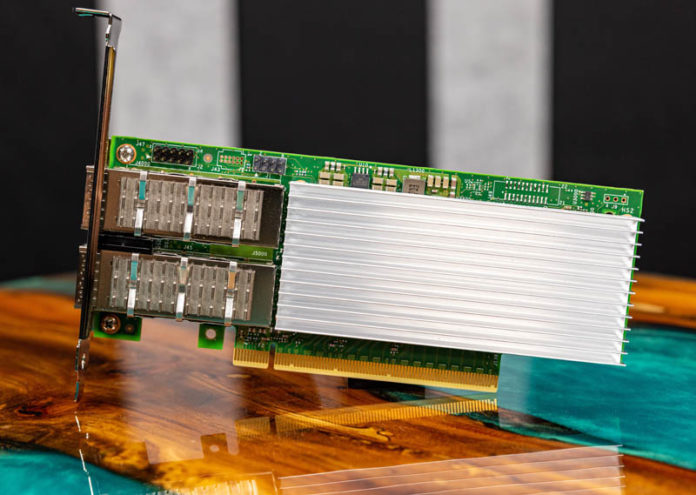

The Intel networking business has fallen quite a bit behind. The Intel i225-V 2.5GbE NIC went through many revisions and ultimately an Intel i226-V was released. We just saw New Intel E610 NICs for Low Power 10Gbase-T and 2.5GbE and Intel E830 200Gbps NICs this year and have not even gotten them in the lab yet.

Intel E610 Launch Slide

Intel E610 Launch SlideWhile Intel is just releasing its 200GbE generation, NVIDIA and Broadcom have had 400GbE NICs in the market for some time. You can already buy PCIe Gen6 NVIDIA ConnectX-8 NICs for 800GbE connectivity. 200GbE is simply way behind for 2025. Intel sees this more as trying to capture the volume market, but in the 2010’s, Intel was keeping pace with 10GbE and 40GbE transitions and was not two full generations behind. Later this year 400GbE is coming to even to lower-cost networks (just wait we have photos that we cannot share yet.)

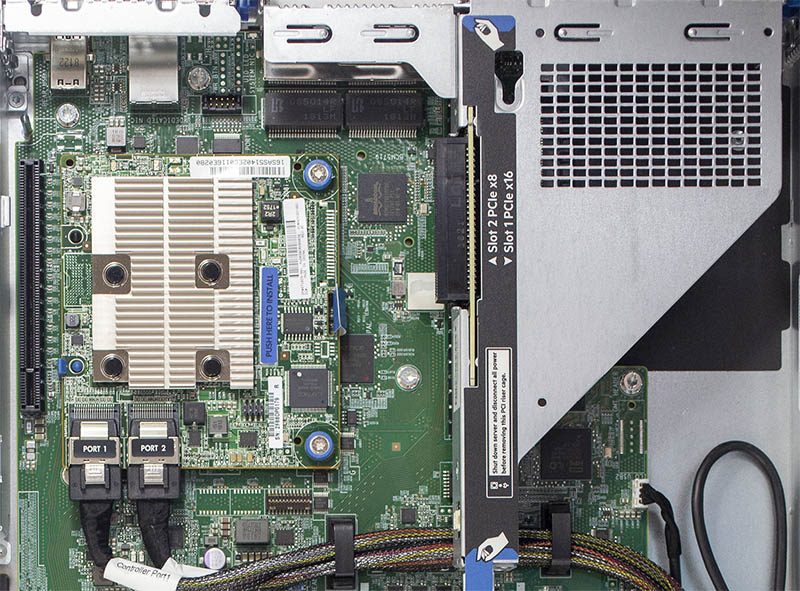

Intel is getting way behind at the high-end, but we need to take some context. When you buy a server, usually there is lower-speed networking. For example, one may use lower-speed networking for the management and orchestration dashboards, sending remote logfiles, and so forth on a higher-end server. Those NICs are included either onboard or in add-in cards in many servers. As a result, they move a lot of units. If you are buying a server today, the two dominant players are Broadcom and Intel. Those two companies do battle over each system because if you sell a base NIC into a system, it moves volume. We covered a fun case with the HPE ProLiant DL325 Gen10.

HPE ProLiant DL325 Gen10 Gen1 With Broadcom NIC And FlexLOM Open

HPE ProLiant DL325 Gen10 Gen1 With Broadcom NIC And FlexLOM OpenAs you can see in the shot above, there is a Broadcom quad 1GbE NIC installed in the DL325 Gen10. Later when we purchased the system, that Broadcom NIC was removed and an Intel i350 put in its place.

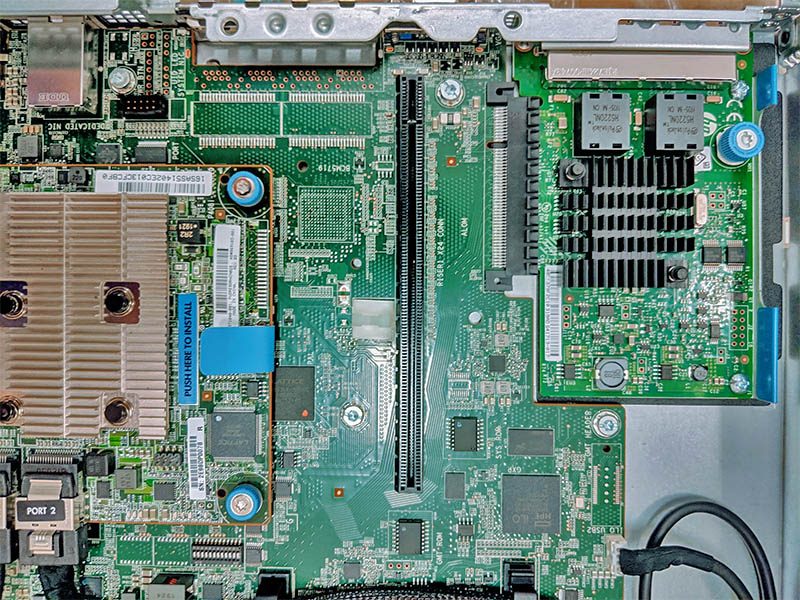

HPE ProLiant DL325 Gen10 Gen2 With De Pop Broadcom NIC And Intel I350 FlexLOM Slotted

HPE ProLiant DL325 Gen10 Gen2 With De Pop Broadcom NIC And Intel I350 FlexLOM SlottedThe rumor is that Broadcom got designed into the system, then raised prices. To counter this HPE decided to install a FlexLOM with Intel instead. Both Intel and Broadcom do not like to admit to this, but OEMs tell us that there is bundling. If you have an Intel Xeon server, you often see Intel NICs. If an OEM uses PCIe switches, or SAS controllers, then that is a good entry point for Broadcom’s bundling. NVIDIA is pushing its NICs into systems to remove Broadcom and others from the mix. To avoid getting trapped by this bundling, formats like the OCP DC-MHS end up easing some of the pressure.

OCP DC MHS Demo At HPE Discover 2025 Cards

OCP DC MHS Demo At HPE Discover 2025 CardsThat is just looking at the server business, but there is a lot more to it. Intel sells into other segments including wireless, service providers, telecoms, and other embedded markets.

Final Words

Intel NEX plays in a wide array of markets where bundling is common, but also there is limited competition. In many markets, getting designed-in also means selling a lot of units over time. It feels like it is also a business that might find a buyer or investor like Altera as a financial investor rather than a strategic deal. It will be interesting to see who eventually invests in NEX. Hopefully, we get an answer soon but it sounds like Intel will retain a stake in the company. Also, we hope that through the transition the pace of innovation picks up.

.png)