One of my favourite artworks at the Tate Gallery is this one by Yves Klein.

Don’t adjust your browser settings–it really is just a solid rectangle of blue, International Klein Blue to be precise.

The artist made 200 paintings exactly like this one over more than a decade, taking great care to hide the brushstrokes and emphasizing their uniformity by refusing to title or sign them. After his death, his widow had trouble keeping track of the canvases, eventually giving them arbitrary numbers just to stop herself mixing them up. Nevertheless, Yves always claimed they were all absolutely distinct, saying “Each blue world of each painting, although the same blue and treated in the same way, present[s] a completely different essence and atmosphere.” It’s hard to tell whether he was serious or pulling a fast one, but he did manage to sell loads of them–all at different prices of course.

Klein’s blues are just one example of a seemingly fungible commodity that’s been cleverly differentiated. Consider:

Conflict-free diamonds, whose only distinction from similar carbon-crystal gems is in their more ethical provenance.

Vodkas, which are all colourless, odourless, and tasteless and therefore identical, but which are marketed very differently and creatively. For instance, the CMO of Belvedere once told me that his campaigns were aimed at getting as many people as possible to hate his drink, thus boosting its snob appeal among the tiny minority who could afford it.

Stationary bicycles were pretty samey until Peleton strapped on an iPad to bring a screaming coach into your exercise experience.

As in these examples, selling the run-of-the-mill guarantees demand; when millions of people are already buying similar products, you can be sure you won’t wind up with a warehouse full of unsaleable Segways or Juiceros. If, at the same time, you can distinguish your commodity from everyone else’s in a meaningful way, you’re going to be printing money.

Software and digital goods seem by nature to be the epitome of commodities; after all, any program or file is ultimately just a series of 1s and 0s that can’t be adulterated or flavoured, right? Except that even those binary digits can actually have meaningful and valuable attributes beyond their on/offness:

They can be legal or illegal, depending on whether you downloaded them from a legit source or a dodgy one (provenance again!).

They can have useful affordances, such as plugging smoothly into standard sockets and thus letting users cobble together the contraptions that run the modern Internet. See Stripe, Cloudflare, Auth0, and a host of other obscure, interchangeable, and vital services.

They can be tracked on a slow, immutable public database, so everyone knows you’re the “owner” of Bored Ape number 4036 (warning: this strategy has a limited shelf life, to say the least).

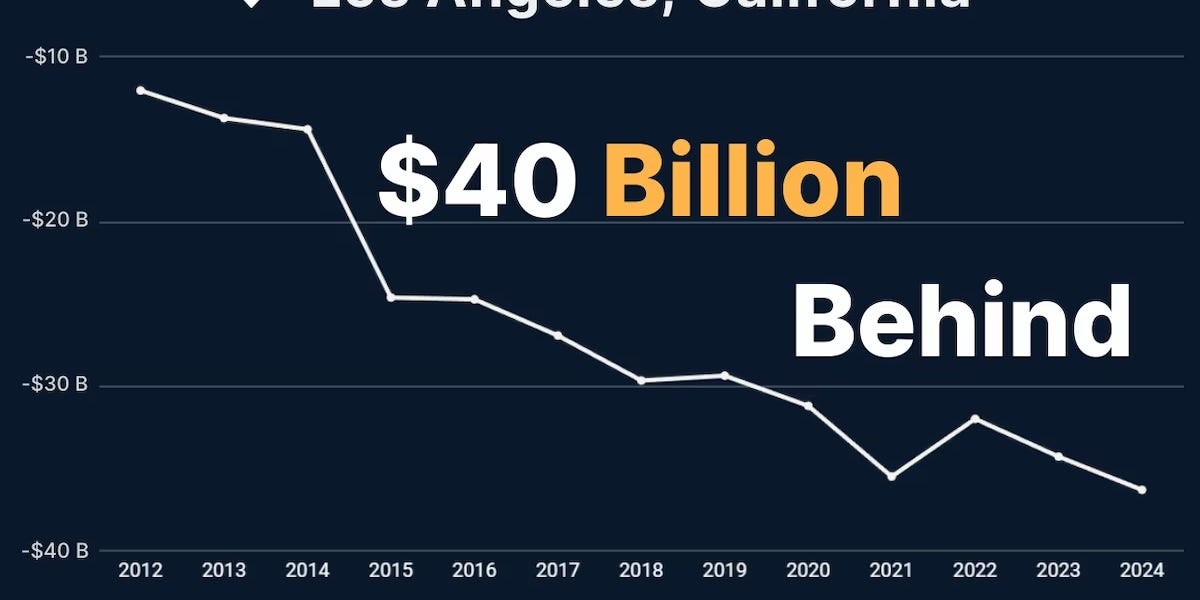

Despite these clever differentiation tricks, history shows that software nevertheless becomes commodified at great speed. In the 1990s, setting up an online store required weeks of fiddly coding and asking your users to install their own encryption software, but just a decade or two later Wix and Shopify and a host of competitors have moved these tasks decisively into the Clear domain, accessible to anyone with just a few clicks. Generative AI tools are even more rapidly following a similar path toward fungibility: just the other day I heard a pitch from an “AI provider” whose service resells another service that itself repackages ChatGPT. When you can’t even see the bottom of the stack, you know the value of the lowest layer is trending to zero. As I said in my DeepSeek email a few weeks ago, we should expect near-term consolidation in this space, leaving us with a few large providers that we’ll select based on price or preference, not unique features.

The real puzzle for me though is why so few companies make use of my favourite software de-commodification method: creating aggregated data sets based on the behaviour of users, and then offering insights and products based on this unique, exclusive pool of information. At TIM Group we dominated our niche market, sending millions of messages every year from equity trading desks to hedge funds, but we didn’t stop there. We combed the traffic for anonymised insights and sold the trend information back to the market, which gobbled it up. The key was amalgamating and then mining the data we already had—something I see far too seldom in the organisations I work with around the world. Just last week I met two CEOs from opposite sides of the planet whose firms are, like Smaug, sitting on a mountain of data treasure with no plans for it to speak of. I’m helping both to take advantage of what they have, but how many more of you are unaware that right under your nose are “countless piles of precious things, gold wrought and unwrought, gems and jewels, and silver red-stained in the ruddy light”?

This first appeared in my weekly Insanely Profitable Tech Newsletter which is received as part of the Squirrel Squadron every Monday, and was originally posted on 17th February 2025. To get my provocative thoughts and tips direct to your inbox first, sign up here: https://squirrelsquadron.com/

.png)