There’s a growing debate around whether the projected $200B in OpenAI revenue (per The Information) represents new spending or just a reshuffling of existing digital dollars.

To think about it clearly, it helps to zoom out:

The past 25 years of the internet have mostly been about mix shift, not market expansion. Total ad spend grew roughly with GDP, but online’s share went from 0% → 70%.

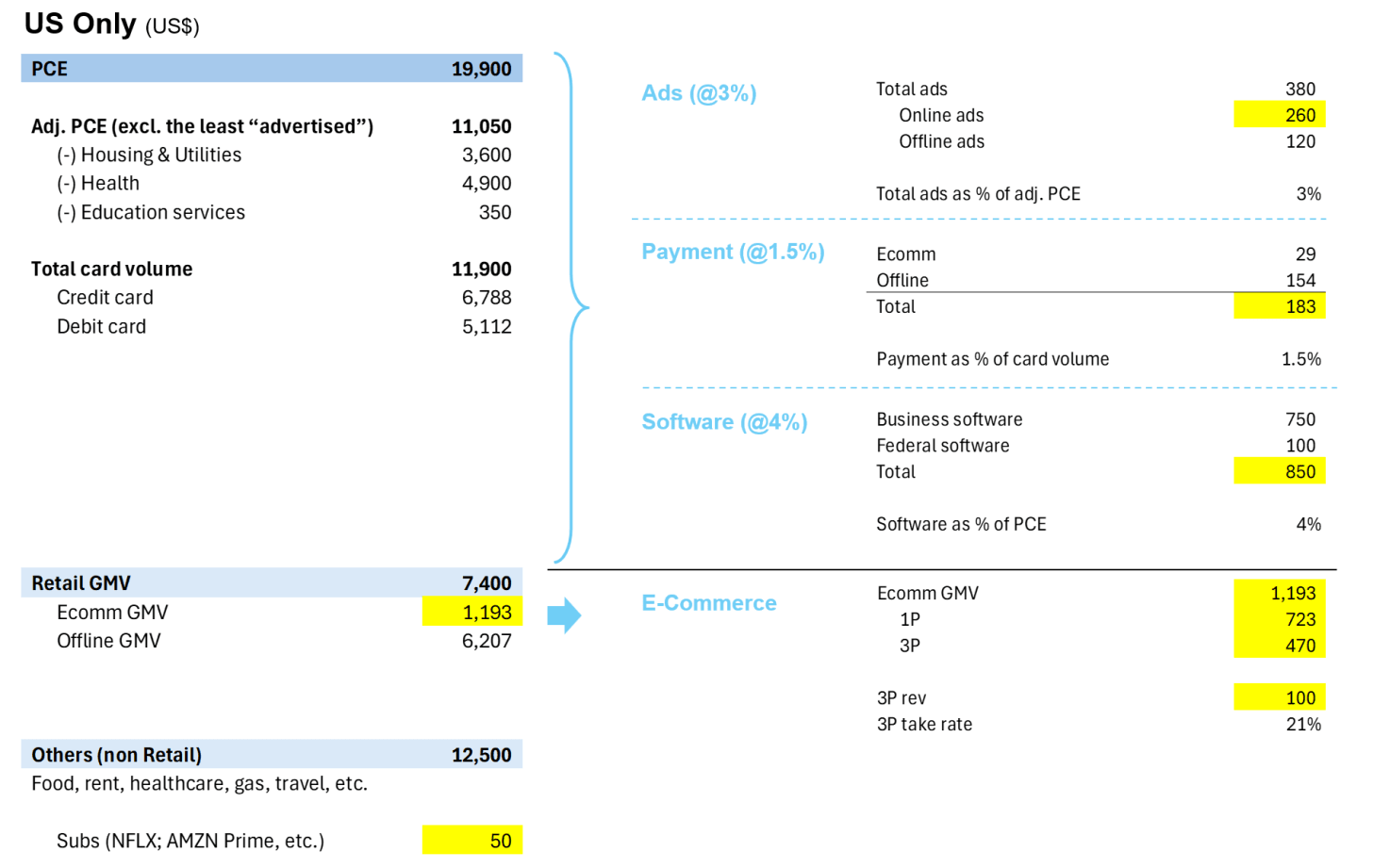

e.g. Today, U.S. ad spend totals about $380B/year, ~70% of which (~$260B) is online.

Within that, Google’s U.S. ad rev is roughly $140B; Meta’s about $70B.

Ads = ~3% of adjusted PCE, meaning that on average, U.S. businesses spend about 3% of total consumption on advertising. (Of course, DTC brands might spend 20%, while Target spends 1%.)

Total “online rev” across all major categories:

Ads: $260B = 3% of adj. PCE

Payments: $180B = 1.5% of card volume

Software (SaaS + Cloud): $850B = 4% of PCE

E-commerce: GMV$1.2T; ~$100B 3P take-rate revenue

Online subscriptions ( NFLX 0.00%↑ , AMZN 0.00%↑ Prime, etc.): $50B

^That’s the digital economy we know— GOOGL 0.00%↑ , META 0.00%↑, AMZN 0.00%↑ , MSFT 0.00%↑ , NFLX 0.00%↑ .

Now layer in AI.

If OpenAI really does $200B in rev—let’s say $100B from the U.S.—where does that money come from?

Two options:

Cannibalize existing spend (ads $180B + ecomm take-rates $100B). Winner vs. Losers?

Create new markets—basically a new “digital tax” on the $20T U.S. PCE base.

The bull case: AI expands the total pie. Historically, major productivity waves—like IT in the 1990s—drove real PCE growth: goods got cheaper, wages rose, and spending increased.

Alternatively, AI could lift corporate margins, allowing companies to reallocate savings toward higher ad spend, software budgets, and take-rate fees.

.png)