Maryland’s new 3% tech tax, which took effect July 1, aims to raise revenue from digital services. But without multistate cooperation, it risks creating more compliance and administrative chaos and less of a fiscal windfall.

The levy, tucked into this year’s Budget Reconciliation and Financing Act, is expected to raise hundreds of millions of dollars in revenue over the next two years. It’s an admirable attempt by the state to modernize its tax base.

Although the tax may narrow the budget gap on paper, its implementation may tell a different story in a digital economy that is agnostic to state borders. Instead of taxing consumption (end users), Maryland is doing something less efficient by taxing business inputs—the tools companies use to operate—from web hosting and email hosting to data processing.

Maryland is rolling out an administratively burdensome, unique state levy that could defer investment and burden vendors with new costs that outstrip the tax itself.

But due to the nature of digital service use—and the limits of any individual state’s power to tax—Maryland can’t just apply a uniform tax to the cost of all digital services. It first must require vendors to calculate how much of a service is actually used inside the state.

That’s far from a straightforward calculation. Vendors must obtain pre-approval from the state comptroller, issue a separate certificate for each transaction, and then track user in-state use allocation for each sale. No other state does this, so the compliance infrastructure needed to meet these demands will have no broader use—at least in the near term.

That functionally leaves businesses that operate across state lines with a choice: Build or purchase Maryland-specific tax systems, risk miscalculation and the potential for audit, or simply refuse to offer their services in Maryland.

This means that for cloud vendors, software service providers, and other information technology firms, the actual economic incidence isn’t just the 3% rate—it’s the long tail of compliance that comes with it. The result is a tax compliance nightmare wildly out of sync with how business functions.

Even if the tax were simple to administer, it would still violate a basic principle of good tax policy: Don’t tax business inputs. Taxing a thing is a marvelous way of disincentivizing that thing—and we don’t want to do that for business investments.

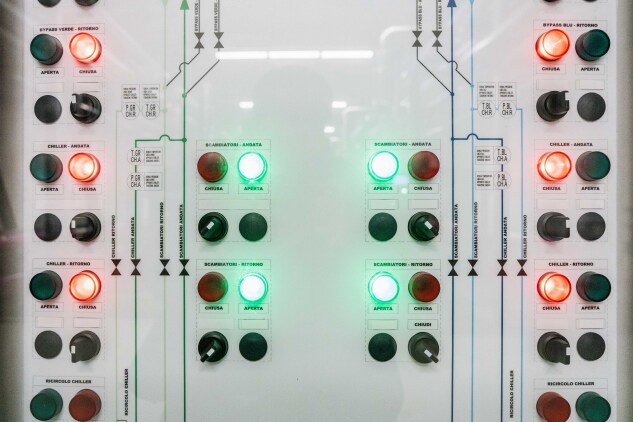

A control panel for the geothermal air conditioning system for data rooms at Aruba SpA’s Global Cloud Data Center IT3.

Photographer: Francesca Volpi/Bloomberg via Getty Images

Maryland’s tech tax explicitly targets the kinds of foundation on which companies rely to operate in the modern economy—services such as data hosting and software development. They aren’t luxuries or nice-to-haves that can be taxed as a proxy for progressivity; they’re necessities. Taxing them invites distortion.

The economic consequences of such a one-off tax are predictable. Some companies will reroute operations to avoid the state entirely; some vendors simply won’t offer their services in Maryland. Others will pass along the costs—not just the levy, but also the underlying compliance burden it imposes—to businesses that will then pass on the cost to consumers.

In the latter case, when all the tax burdens that can be shifted are shifted, Maryland end users will face higher prices. A 3% tax directly on end users will start to look like a comparative bargain.

To be clear, Maryland’s desire to modernize its tax code isn’t wrongheaded—the sales tax base should evolve with the economy. But a lack of regional buy-in risks turning modernization into isolation.

The problem with taxing infrastructure within a border, in a borderless economy, is that it’s functionally a flee-on-impact tax. The tax collapses under its own mobility and takes existing state tax revenue with it.

The most sensible policy avenue forward would be through multistate coordination, which could mean working through existing structures such as the Streamlined Sales and Use Tax Agreement or building a new digital services compact with partner states. Even a relatively small bloc of partner states could raise the cost of avoidance and make it harder for businesses to justify opting not to sell into the tax’s bloc.

For that approach to work, states would need to adopt a few things at a minimum: uniform definitions, harmonized sourcing rules, and aligned exemption policies.

Absent the ability to partner with other states, Maryland could offset some of the compliance costs by moving the burden from business inputs and onto final consumption—taxing the end-user, not the tools used to serve them.

A sales tax on business inputs, after being shifted to end-users, risks being significantly inflated by related calculation and compliance costs. In other words, a 3% tax on business inputs likely will lead to price hikes of much more than that.

Maryland should do more than just expand its base if it wants to modernize its tax system. Tax policy must match how the 21st century economy functions. Failing to acknowledge these realities may produce a short-term revenue bump followed by a subsequent exodus of the businesses that Maryland is banking on for long-term growth.

Maryland may learn a broader lesson in the coming years: In a digitized economy, states don’t just compete on rates—they compete on administrative clarity and coherence. They aren’t merely taxing software—they’re testing how much administrative burden businesses are willing to absorb before they pull up stakes and take their operations elsewhere.

Unless it changes course, the real cost won’t be measured in lost revenue but in missed opportunity.

Andrew Leahey is a tax and technology attorney, principal at Hunter Creek Consulting, and practice professor at Drexel Kline School of Law. Follow him on Mastodon at @[email protected]

Read More Technically Speaking

.png)