Hey all, Jason here.

I hope my U.S.-based readers are enjoying a long Memorial Day weekend! Sadly, I do not get Monday off.

For those heading to Amsterdam for Money2020 Europe in a couple of weeks, I plan to be onsite at the event on Wednesday, as well as attending Pipe’s happy hour on Monday, the Oscilar/This Week in Fintech event Wednesday, and hopefully swing by Finch Capital’s event Wednesday as well. If you’ll be in town and want try to catch up, drop me a line!

Congrats to my friends at Gilgamesh Ventures on the news that they’ve raised a new $20 million fund — keep up the good work!

And, finally, if your email client clips this post due to length, you can read the full thing on web here.

💰 Help Keep Fintech Business Weekly accessible to all: in an era where it feels more difficult than ever to parse hype from reality, I've made a conscious decision not to paywall Fintech Business Weekly. But doing the research and analysis to bring you well-informed, deeply-reported stories takes time -- and money (really, you don't want to see my PACER bill, let alone my lawyer's.) Looking to get in front of Fintech Business Weekly's 85,000+ readers and listeners? Get in touch about sponsorship options: [email protected] To help keep Fintech Business weekly accessible to all, please consider upgrading to a paid subscription if you haven't already!Evolve’s bank holding company, Evolve Bancorp, Inc., appears to be insolvent, based on paperwork it filed with the Federal Reserve in mid-February 2025 for the period ending December 31, 2024.

A bank holding company is a corporate entity that owns a controlling interest in one or more banks, but does not itself offer banking services.

There are a variety of reasons why it can be advantageous to own a bank through a bank holding company, including that holding companies can typically raise capital more easily than their bank subsidiaries. A holding company may provide greater flexibility in managing capital, including through dividend payments and share repurchases. Holding companies can also own non-bank financial entities, like insurance or brokerage firms.

For 2024, Evolve’s holding company’s operating income consisted solely of about $1.5 million in dividends upstreamed from its bank entity. The holding company’s operating expenses were primarily composed of about $2.9 million in interest expenses on its debt.

As of the end of 2024, apart from the underlying equity it holds in the bank entity, Evolve’s holding company has just $37,000 in cash and about $2.5 million in other assets.

Meanwhile, the holding company owes nearly $51 million in long-term borrowings, in part from 10-year notes the holding company issued in 2021 and 2022. The fixed-to-float notes, which have a total par value of $31.5 million, have a five-year call option and reset to SOFR plus 3.32% five years after issuance.

The consent order Evolve Bank and the holding company entered into in June 2024 prohibits either from paying dividends without prior regulatory approval.

That means that the holding company’s only real source of income, dividends paid by its bank subsidiary, have to be signed off on by the Federal Reserve — though, in Q1 2025, Evolve swung to a loss, meaning it would be unlikely to pay dividends even absent the restriction.

Looking at the bank holding company’s limited assets, other than the equity in the bank subsidiary, vs. the nearly $51 million in outstanding debt, it appears as though it is currently insolvent.

Bank holding companies can file for bankruptcy, but doing so is quite rare. The failure of a bank holding company is nearly always tied to the failure of a bank subsidiary. Bank holding companies pose unique challenges in the bankruptcy processes, as was recently seen when Silicon Valley Bank failed and its holding company went through a Chapter 11 process.

Further back, in 2011, Americawest Bancorp, the bank holding company for AmericaWest Bank, went through a strategic Chapter 11 bankruptcy as part of an idiosyncratic recapitalization transaction in the wake of the 2008 global financial crisis.

A representative for Evolve didn’t respond to an inquiry about the holding company’s financial condition or if it planned a capital raise for the holding company.

Any capital raise would likely be substantially dilutive to existing shareholders, which include Evolve founder and former chairman Scot Lenoir and members of his family.

Key takeaways:

Mercury cofounder and CEO Immad Akhund often characterized compliance as an obstacle to get around, multiple sources say.

Mercury customer Flipper Devices’ Russia links caught FDIC’s attention during Choice Bank exam.

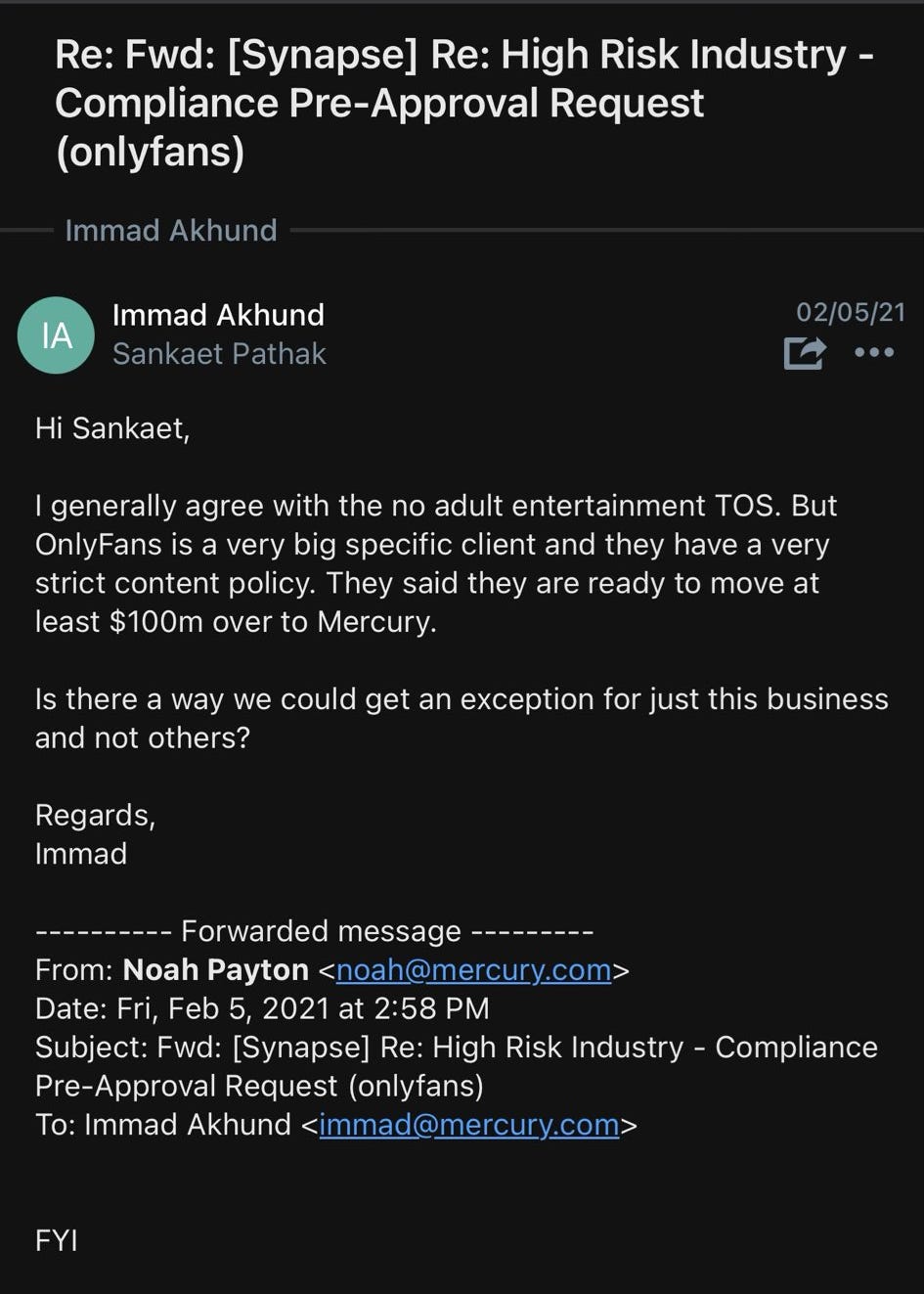

Mercury CEO Akhund personally sought an exception to onboard “creator” app OnlyFans, commonly used by adult entertainers.

Conversations about Goldman Sachs becoming a bank partner were derailed by Goldman’s insistence on handling account onboarding.

Mercury and its very online cofounder and CEO Immad Akhund, like many in Silicon Valley, embrace the framework of “first principles” thinking, numerous people who have worked with him and the company have told me.

The approach, popularized by investors like Berkshire Hathaway’s Charlie Munger and tech heroes that include Elon Musk, is a problem solving and reasoning technique in which one decomposes a problem into its basic, fundamental components, and then searches for a solution by addressing each of those individual components, from the ground up, setting aside “traditional wisdom.”

While first principles thinking can be a powerful mental model for approaching complex, difficult-to-solve problems, it is arguably less well suited to challenges that may defy logical solutions — which, yes, does include aspects of the financial, banking, and payments systems, especially due the United State’s idiosyncratic and, often, byzantine approach to regulation.

Silicon Valley’s first principles and, to deploy the oft-used cliche, move fast and break things approaches have run up against and prevailed over seemingly arbitrary regulatory constraints in the other industries: Uber and Airbnb built their businesses by thumbing their noses at local municipal regulators and, eventually, were generally successful at lobbying to have their business models legitimized.

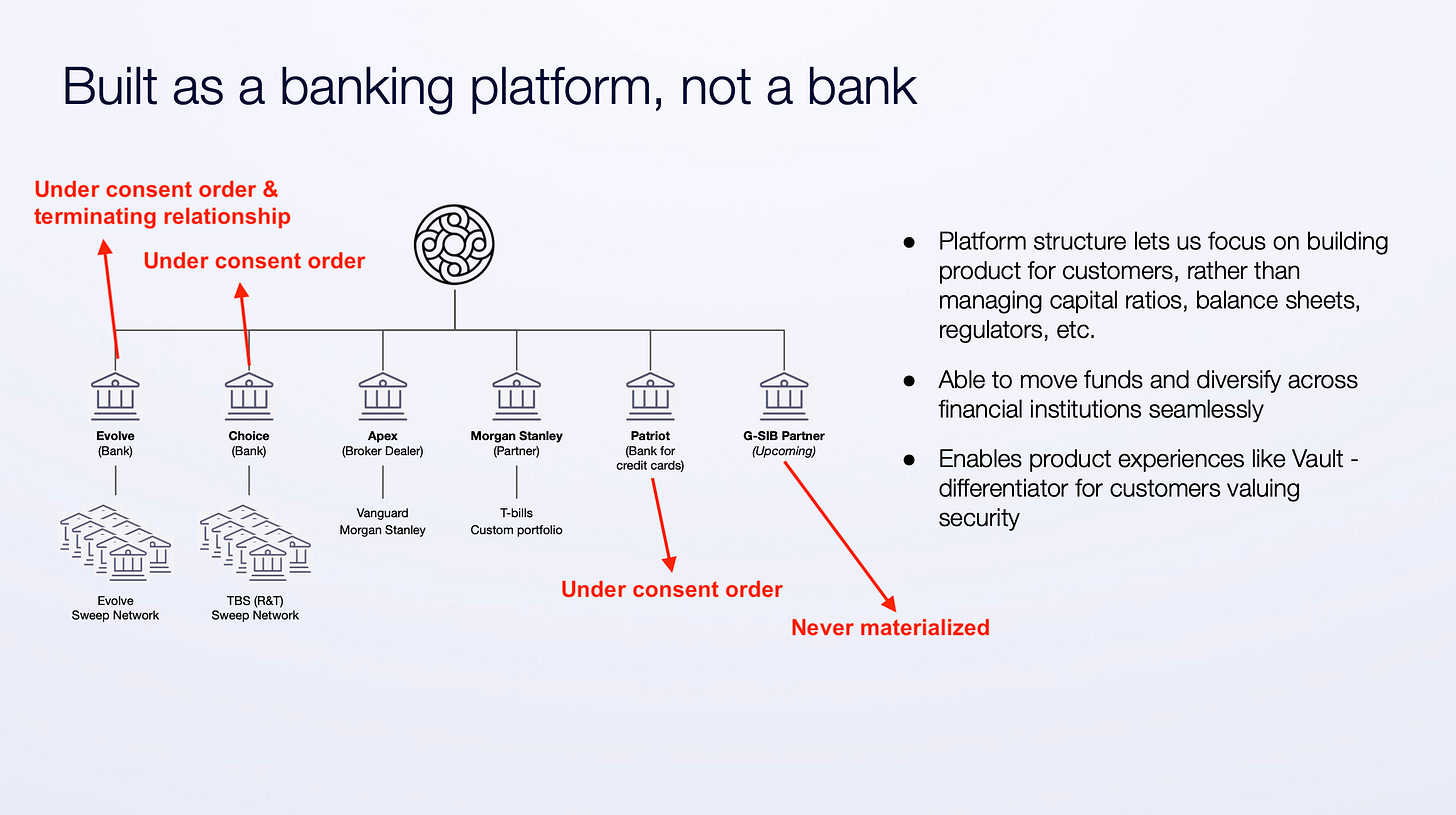

The disrupt first, ask questions later approach has been less successful in fintech, as evidenced by the plethora of banks getting enforcement actions related to their fintech partnerships and the catastrophic collapse of Mercury’s one-time partner Synapse, which has left depositors out of pocket as much as $95 million and still searching for answers.

For Mercury, the goal has been to use first principles thinking to solve pain points traditionally associated with business banking, especially for newly formed companies, startups, and immigrant founders and to offer a polished, differentiated UX lacking in traditional banks’ platforms.

The company has sought to eliminate as much friction has possible, from account opening to sending payments and user permissions management — mundane but time-consuming tasks that even the most profitable big banks have done little to improve on in decades.

But, in financial services, reducing friction can lead to increasing risk — something that appears to have been the case with Mercury, as evidenced by the large number of foreign accounts it courted but later would need to remediate, its willingness to move quickly to scoop up accounts leaving SVB after its failure, its blindness to or tolerance of higher risk accounts like Moscow-incubated Flipper Devices, and Mercury CEO Akhund’s effort to personally secure a policy exception for adult content creator app OnlyFans.

Mercury offers the allure of “free,” charging no monthly fee and imposing no minimum balance requirements, which is typically not the case for business accounts at established banks. Mercury also offers free domestic and international wires and competitive foreign exchange rates, potentially significant savings for some firms, especially those operating internationally and across different currencies.

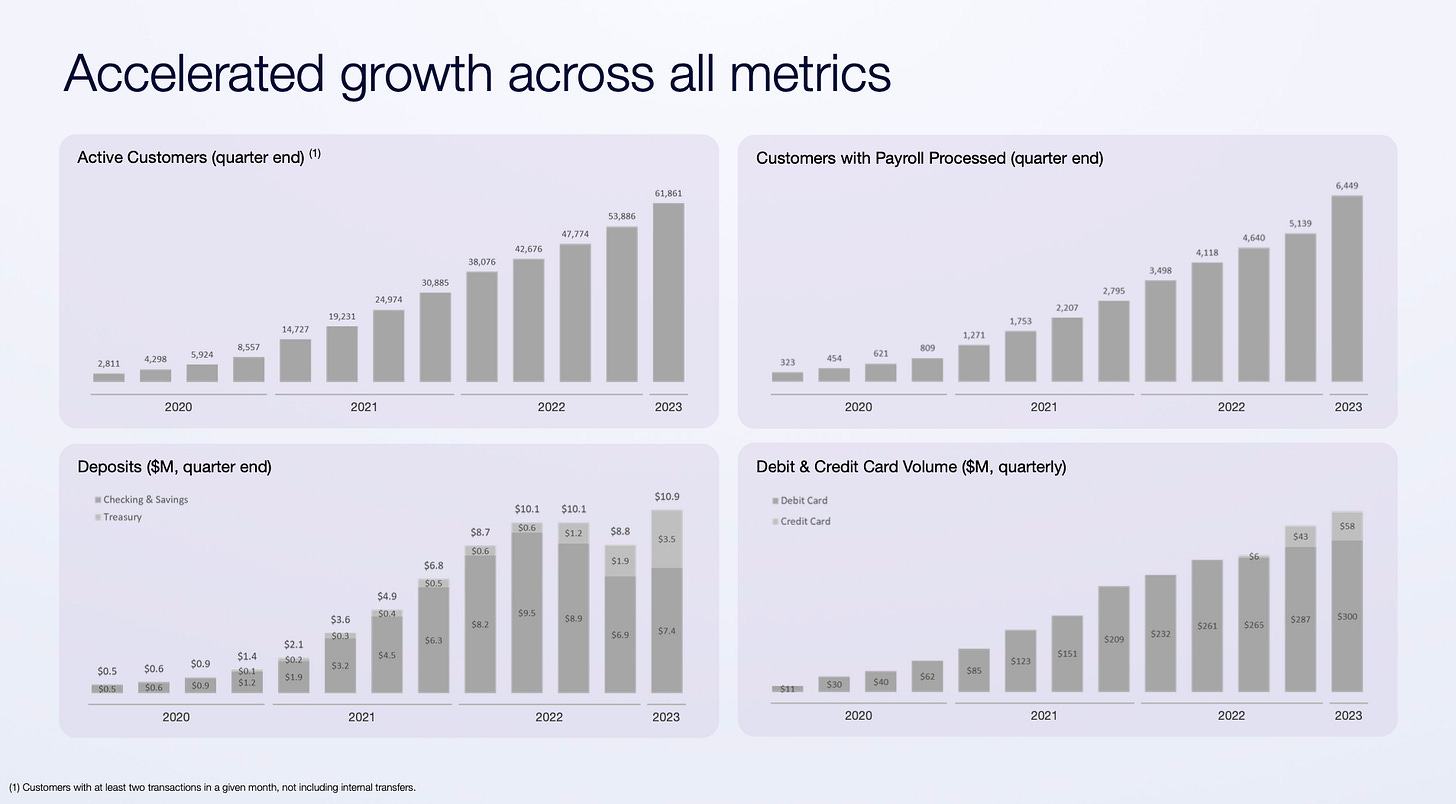

And, it certainly would appear, that Mercury has built a better mousetrap, as evidenced by its rapid growth. The company announced it had raised $300 million in new funding in March 2025, saying at the time that it has over 200,000 customers on its platform.

The company didn’t specify the total amount of those customers’ deposits, though when Mercury announced its Series B, in July 2021, it said its bank partners, Evolve and Choice, held more than $4 billion in customer funds.

That had grown to an aggregate of nearly $11 billion in deposits as of Q1 2023, according to a copy of a fundraising pitch deck obtained and reviewed by Fintech Business Weekly.

But, unlike in true software businesses, extremely rapid growth is often a red flag in banking and payments — the businesses Mercury is ultimately in, whether it describes itself that way or not.

And some of Mercury’s swift increase in its customers and deposits may have come from a willingness, whether intentional or not, to serve companies other U.S. banks would not or could not.

In the course of reporting this story, Fintech Business Weekly reviewed hundreds of internal documents and spoke to more than two dozen current and former employees of Mercury, its former middleware platform Synapse, and its bank partners Evolve Bank & Trust, Choice Bank, and Column.

Sources were granted anonymity given the sensitive nature of the topics being discussed and out of fear of retaliation.

“Immad couldn’t care less about risk and compliance,” a source who worked with the Mercury CEO told me.

Instead, Akhund’s top priority was “the pursuit of ultimate customer experience, at the expense of any minimum of compliance or risk management,” the person said.

Another person familiar with Mercury’s approach to compliance describe it as akin to “a fraternity that’s about to get kicked off campus.”

Internally, Akhund often described compliance as a barrier to be overcome, coaching staff that, if they experienced a “compliance barrier” that was preventing them from being successful, to challenge it until they were able to overcome or get around it, people familiar with his thinking said.

Perhaps no part of the customer journey is more important than the start: opening an account. Mercury has long emphasized the “frictionless” nature of its account opening process — something that for companies, especially recently formed entities, is often anything but fast.

In fact, Mercury specifically marketed itself to newly formed companies, paying sites like LLC University and Firstbase, which guide foreign actors through the process of setting up a U.S. company entity, to refer those new created companies to Mercury.

Mercury, until early 2024, allowed companies to open accounts using a registered agent address or P.O. Box to demonstrate they had legitimate business operations in the United States — a requirement most all U.S. banks have for businesses to open accounts — even when the companies were actually based largely or entirely overseas.

To facilitate a low-friction onboarding process, historically, Mercury would do little beyond a “check the box” exercise of collecting relevant documentation, but would rarely if ever undertake customer due diligence or enhanced due diligence, people familiar with Mercury’s processes said. For much of its existence, Mercury historically has lacked a framework to evaluate and assign a customer risk rating, instead formulating and using a customer’s “sickness” score (sick as in slang for cool) to inform what level and priority of support to give them, people familiar Mercury’s processes said.

The sources also said that the collection of documentation of companies’ ultimate beneficial owners, the shareholders or officers who actually controlled the companies’ accounts, was uneven at best, with Mercury often only collecting documentation on a single UBO, even when a company had more than one ultimate beneficial owner.

The combination of Mercury’s prioritization of the “ultimate customer experience” and strategy of targeting newly formed companies, often with foreign owners, predictably drove a flood of potentially higher-risk accounts.

At the peak, more than 50% of Mercury accounts and deposits held at Evolve and Choice were largely if not entirely based outside of the U.S. — and that Evolve and Choice weren’t even aware of this at the time, people familiar with the situation said.

Representatives for Evolve and Choice Bank did not respond to questions about the provenance of accounts and deposits in the Mercury-linked account at their institutions.

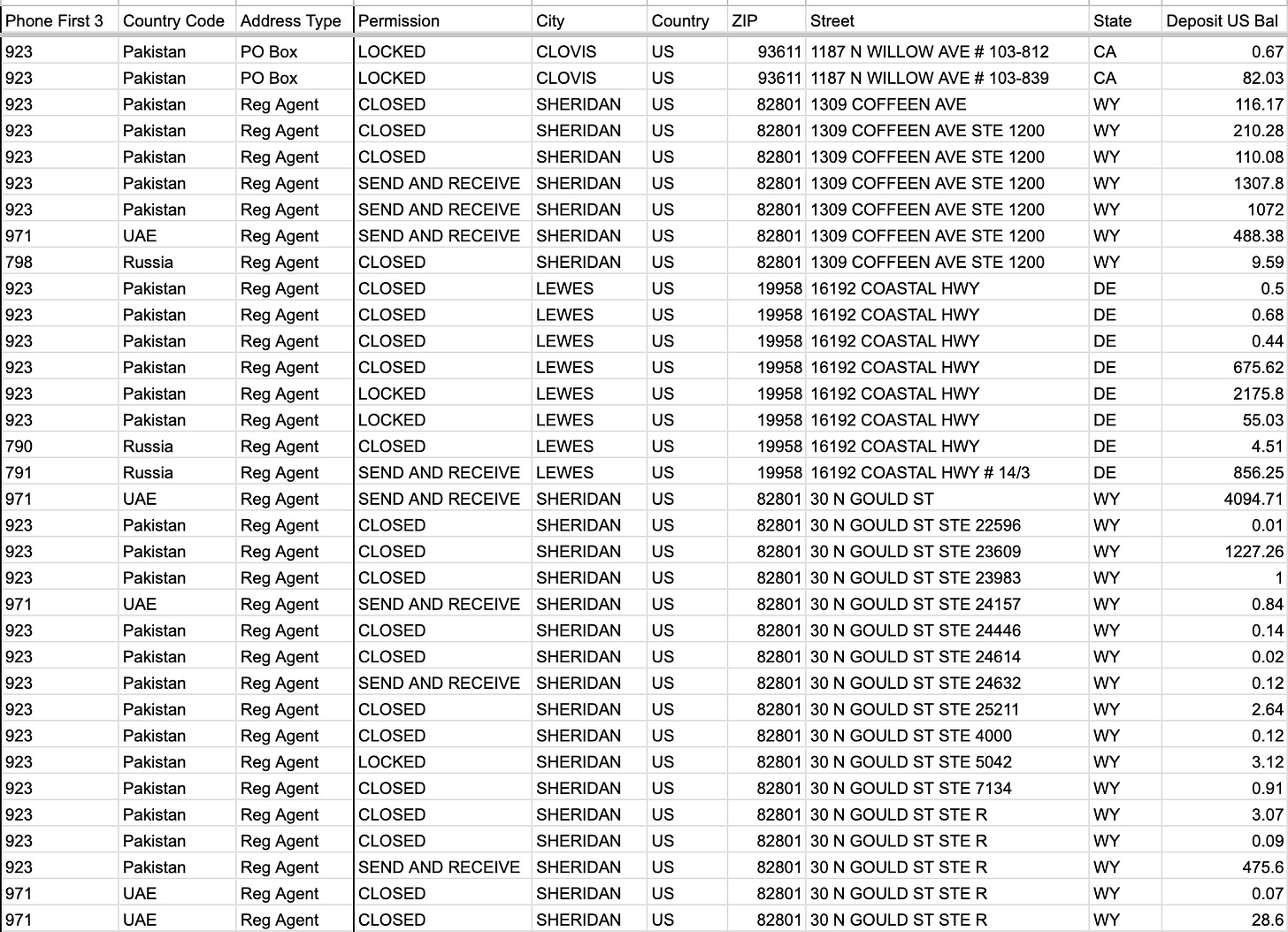

An analysis of Mercury accounts at Evolve, based on data as of October 2022 that was released in the Russia-linked hack of the bank, revealed that more than 13,000 accounts, comprising nearly 20% of Mercury accounts at Evolve, used the same five registered agent addresses.

A closer examination of those accounts revealed a material number that had obvious indicators, including phone numbers and IP address, associated with them that demonstrated links to higher-risk jurisdictions, like the United Arab Emirates, Pakistan, and Russia.

An analysis of those accounts with commercially available business identity and risk tools revealed possible sanctions hits for eight companies out of 136 that were screened. While two appeared to be likely false positives, nonetheless, the possible OFAC hits would require additional investigation to remediate.

It’s not clear whether or not Mercury screened and, as necessary, remediated any alerts prior to opening accounts for these companies.

The emphasis on a frictionless experience went beyond onboarding and included the goal of making payments, including international transfers, as streamlined as possible. Transaction monitoring, people familiar with the company’s practices, seemed to be a barrier to that.

Mercury briefly engaged a popular industry vendor for transaction monitoring, but, sources familiar with the matter said, deactivated because it was generating too many alerts. The company ultimately embarked on a project to build its own transaction monitoring and other compliance-related tools, something that could allow the company to better control what potential issues were detected, logged, and available in a future audit, people with knowledge of the situations said.

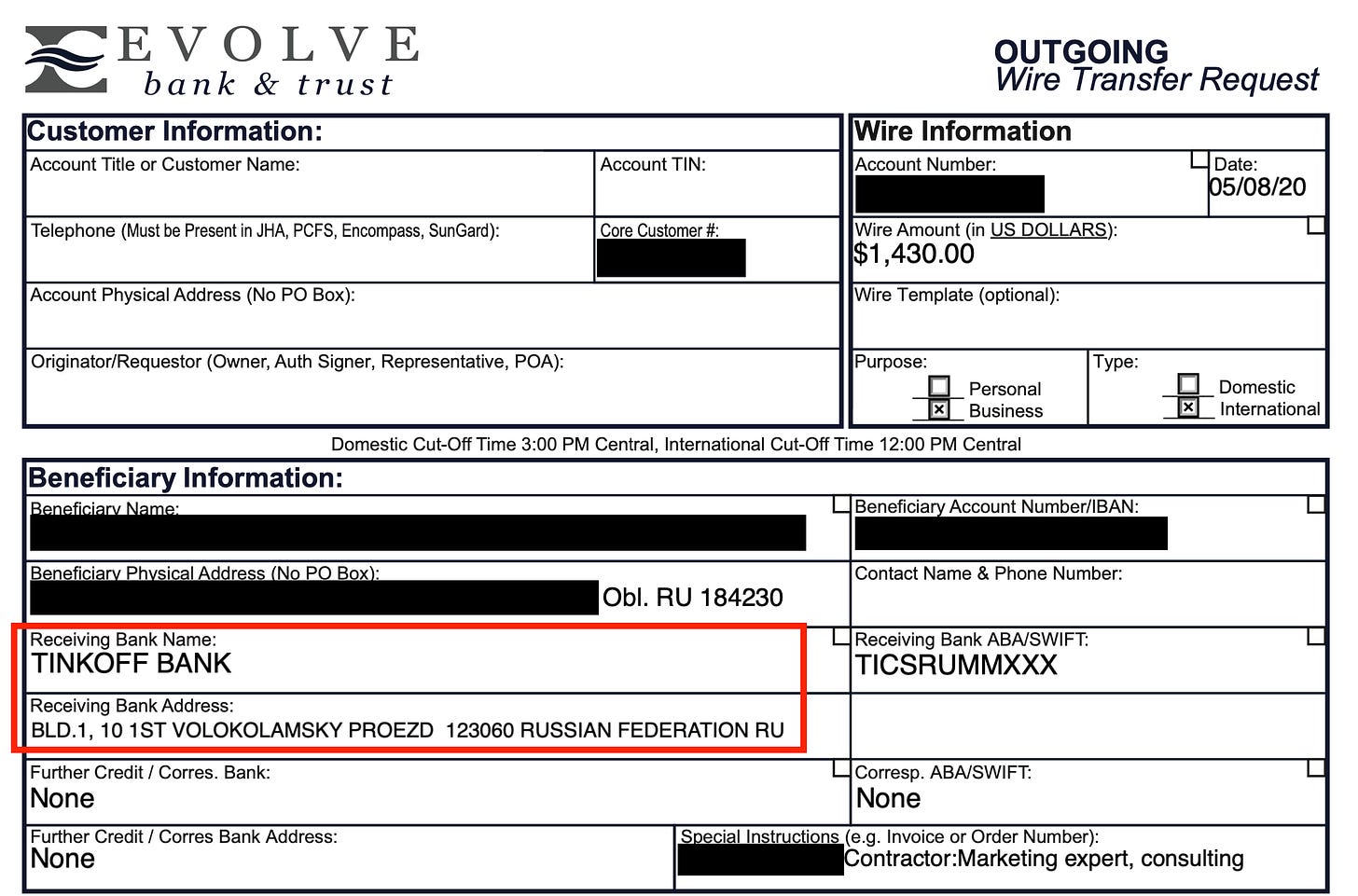

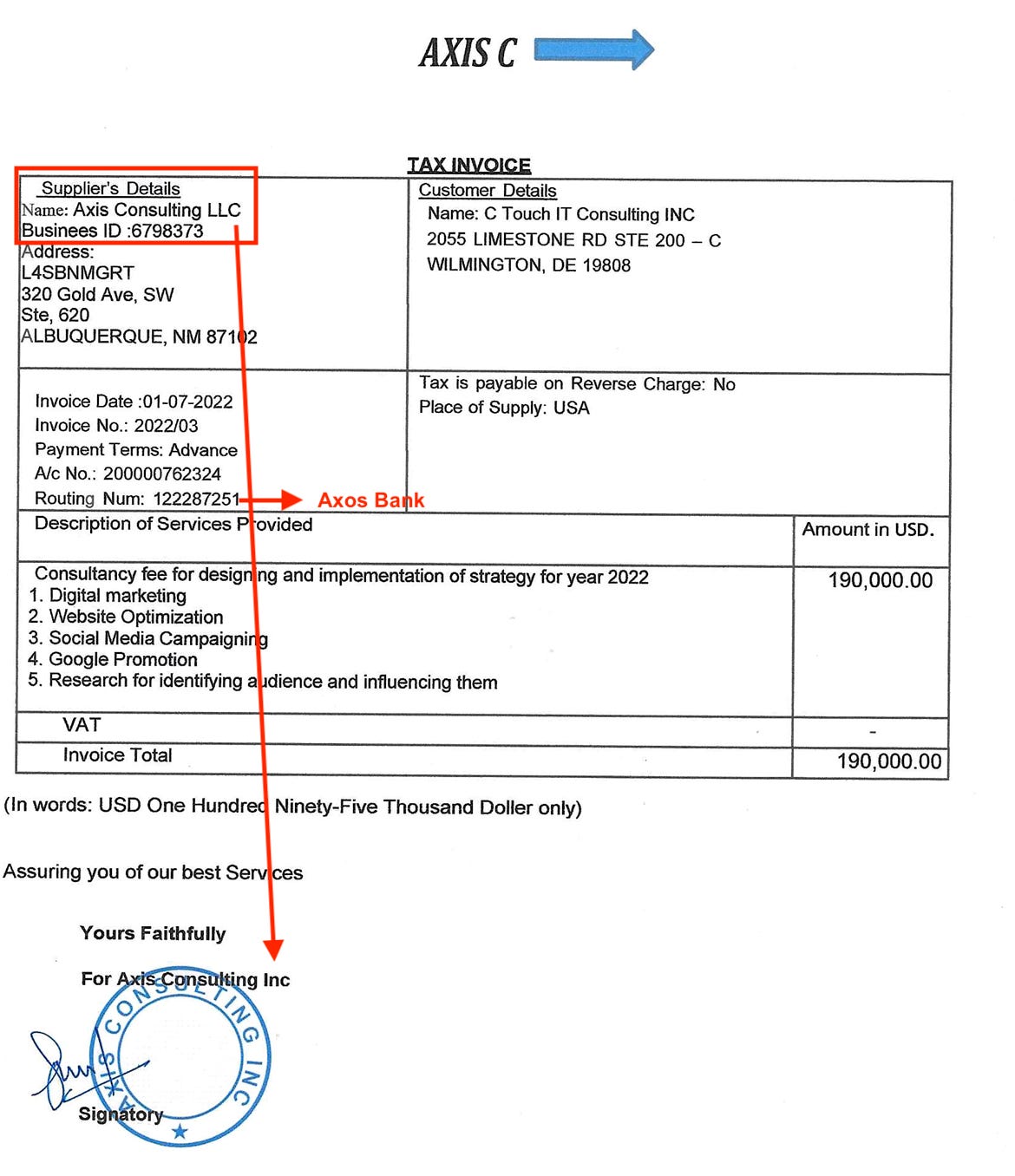

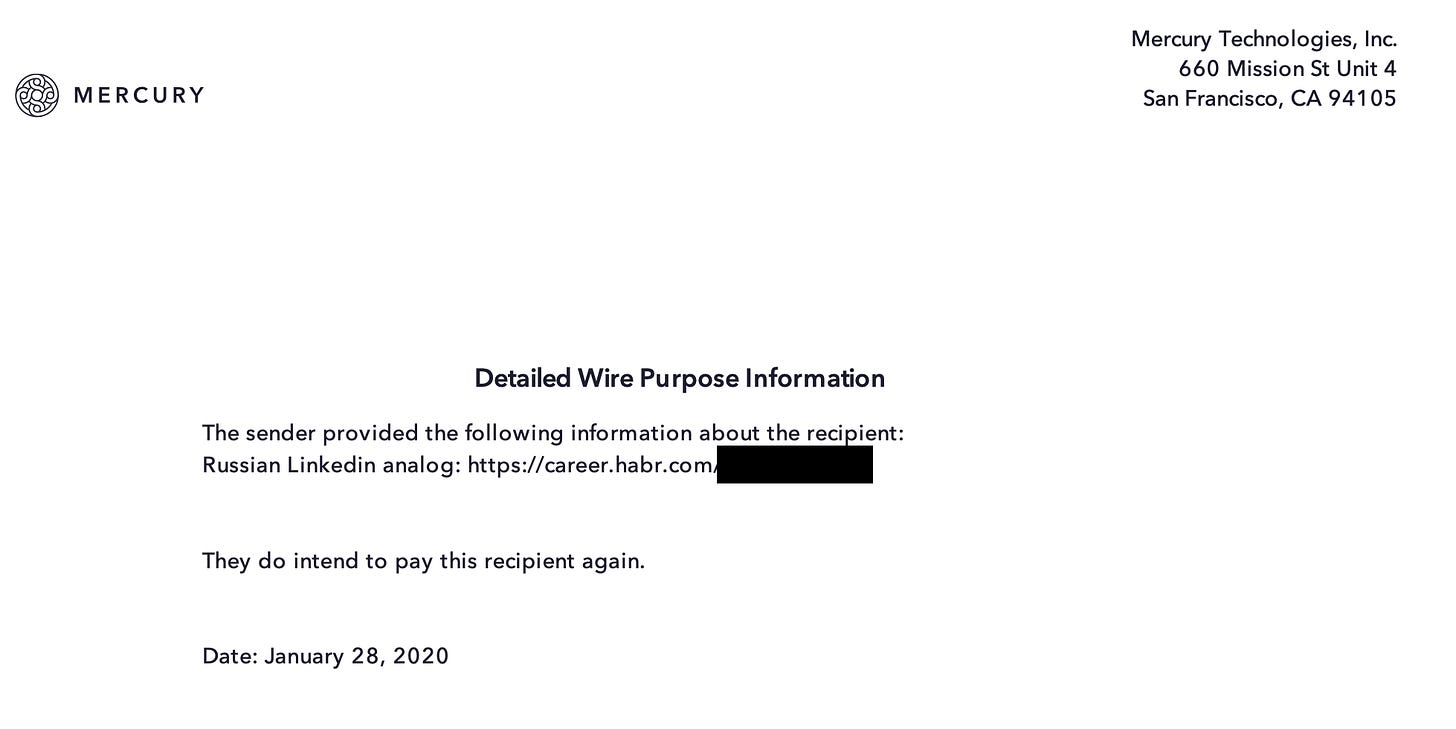

Despite the uneven approach to transaction monitoring, there were examples of outgoing wires for which Mercury, Synapse, or Evolve collected additional documentation.

Fintech Business Weekly obtained dozens of such records for Mercury accounts at Evolve, which appear to be supporting documentation for higher-risk international wire transfers, from a publicly accessible domain (eg non-encrypted, no login required) that was part of Synapse’s IT infrastructure.

Examples of supporting documentation include wire transfer requests on Evolve forms that lack customer information, dubious looking invoices, and Mercury wire instructions that simply referenced users’ resumes or social media profiles.

How Mercury handled issuing and shipping cards tied to companies’ accounts also demonstrated its dedication to customer experience. Historically, Mercury would ship payment cards nearly anywhere — regardless of what address was actually listed on a given company’s Mercury account, people familiar with Mercury’s practices said.

The practice potentially could run afoul of U.S. and foreign anti-money laundering regulations, Mercury’s bank partners’ policies, and card network policies, as well as creating a significant fraud risk.

Mercury also memorably allowed a customer to conduct a card transaction in Cuba, a comprehensively sanctioned jurisdiction, as previously reported by The Information’s Michael Roddan.

When the customer, an Argentina-based firm with an account at Mercury, attempted to use their Mercury card in Cuba, the transaction was blocked. The Mercury staffer who handled the issue, unfamiliar with sanctions and financial crime compliance, simply removed the rule blocking the transaction, people familiar with the matter told Fintech Business Weekly.

But once the situation was detected, rather than self-report the transaction to FinCEN, Mercury spent significant time and resources trying to develop a defensible legal opinion to justify not doing so, those with knowledge of the situation said. Mercury ultimately did not self-report the transaction.

The upshot of combining an emphasis on low friction with targeting newly formed offshore companies? Fraud and money laundering, numerous people with knowledge of the matter said.

A source close to Mercury’s first bank partner, Evolve, said, “Mercury has facilitated billions of dollars of fraud and laundering by transnational actors.”

The person added that, “Once [Mercury] realized Evolve would be exiting over half of the customers and not looking the other way anymore, Evolve provided zero value to them.”

Referring to Evolve’s founder Scot Lenoir, the cofounder and CEO of Mercury’s former middleware partner Sankaet Pathak, and Mercury cofounder and CEO Immad Akhund, the person said, “The trio of them were willingly blind to running a criminal laundering enterprise.”

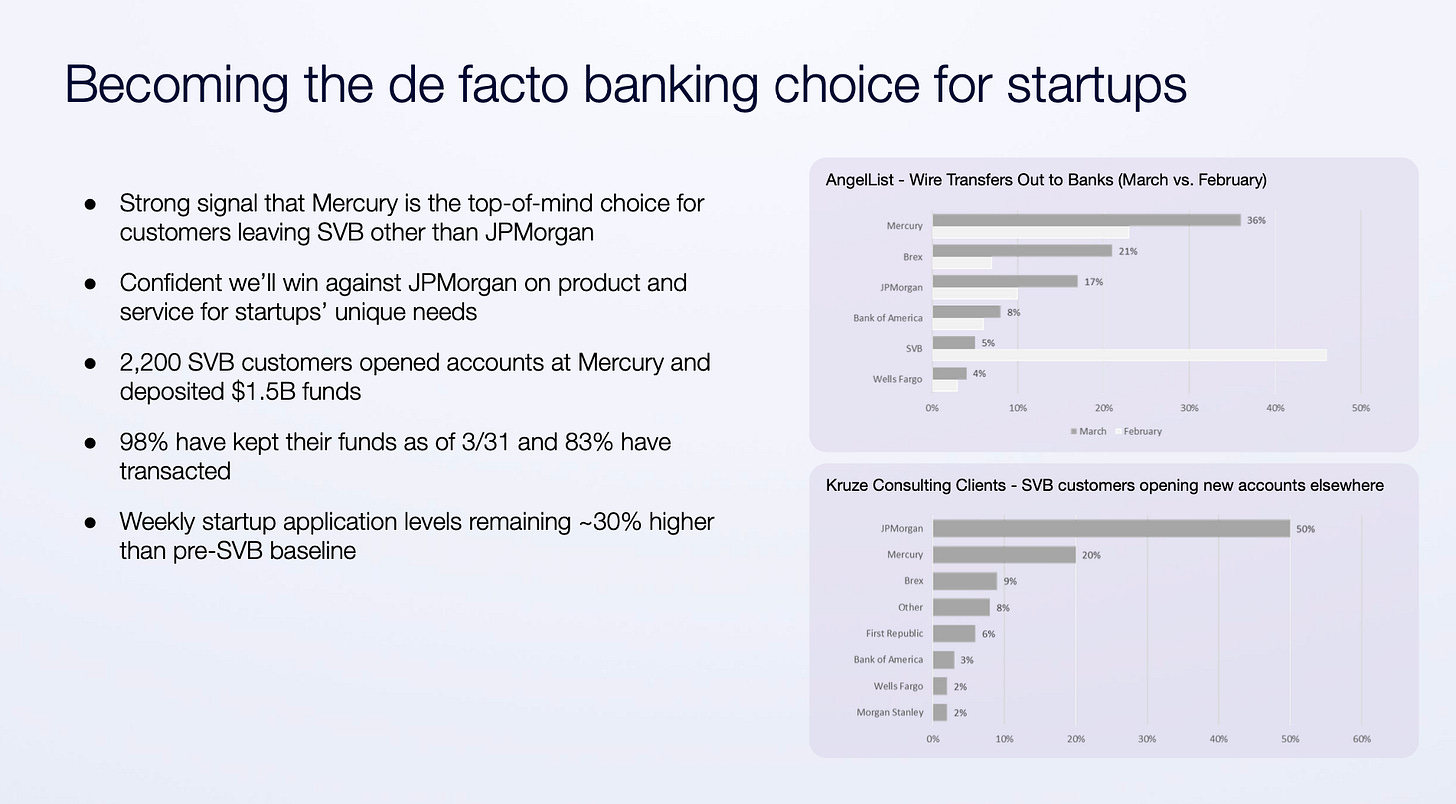

Mercury’s willingness to move quickly enabled it to benefit handsomely from the collapse of Silicon Valley Bank in March 2023.

This isn’t a secret — Mercury CEO Akhund has spoken about it extensively and content on the company’s site mentions it as well. For example, in this blog post, a startup founder impacted by SVB’s collapse who migrated to Mercury over that fraught weekend described the process as follows:

“The timeline was literally: Sunday afternoon submission, [which took] no longer than ten minutes, and then by Sunday evening we were approved and ready to fund. I think we had our funds in there by Monday morning. So it was less than 24 hours from applying to [having an] account — and that’s with the backdrop of it being on a Sunday when everything was a bit hectic.

For startups, speed can be way higher up the list [of priorities] than for legacy businesses — and we will always choose our products based on convenience and speed. So I think nailing that gives you an edge.”

Not mentioned publicly was Mercury’s willingness to onboard Virgin Islands- and Cayman Islands-incorporated entities, popular with VCs and investors, despite lacking policies, procedures, or a defined workflow for doing so, people familiar with the situation said.

The decision to prioritize speed paid off, with Mercury onboarding 2,200 former SVB customers, who brought $1.5 billion in deposits with them, according to internal Mercury documents from the time.

According to data cited in Mercury’s April 2023 pitch deck, Mercury was the second most popular choice for customers fleeing SVB, behind only the largest bank in the United States, JPMorgan Chase.

Why customers that had just experienced the catastrophic failure of SVB would choose to move their funds to Mercury, where they would be held by small, unsophisticated community banks, instead of a “too big to fail” bank, where their deposits implicitly would be fully backed, is an interesting question.

It’s true that Mercury, through its bank partners, offered sweep networks that could boost deposit insurance coverage, as well as Mercury’s treasury management offering.

But, industry experts told Fintech Business Weekly, there may also have been a self-sorting bias, in which riskier firms that would have been less likely to be approved at JPMorgan Chase or other too big to fail banks chose fintechs like Mercury and Brex instead.

Mercury’s early decisions to emphasize frictionless experiences and courting firms that operated largely outside of the U.S. likely contributed to the issues Mercury’s partner banks faced with their respective regulators.

Choice Bank, Evolve, and Patriot, which issues Mercury’s I/O credit card, were hit with enforcement actions in January 2024, June 2024, and February 2025, respectively.

While consent orders, as a practice, do not list specific programs that may have contributed to the regulators taking action, Mercury was by far the largest program at Choice and Evolve, and the infamous Cuba transaction occurred on a Patriot-issued card, according to prior reporting.

All three orders focus on BSA/AML issues like the ones Mercury’s seemingly lackadaisical approach to onboarding and transaction monitoring could have given rise to.

Ultimately, the increased scrutiny on Mercury-opened accounts at Choice and Evolve led to the need to remediate accounts that only listed registered agent addresses, with Mercury abruptly offboarding customers in higher-risk jurisdictions that included Ukraine, Nigeria, Croatia, the Philippines, and even Mercury CEO Akhund’s home country of Pakistan.

Akhund justified the move at the time by saying the operational overhead wasn’t worth it given the small size of the accounts, writing in a post on X, “[T]he number of customers in these countries is very small (<1% of Mercury deposits), but it was putting a lot of strain on our operational teams and all of our financial partners (partner banks, treasury, payments, etc). We’ve seen the regulatory environment become stricter recently, which has made us change our approach to certain situations.”

It’s not entirely clear that Akhund always went along with offboarding higher-risk countries willingly, however.

Sources with knowledge of the situation said that Mercury’s BSA Officer Sumeet Abichandani once had to wait until Akhund was on a sabbatical before offboarding certain high risk jurisdictions.

The concepts of risk ratings, due diligence, KYB, and transaction monitoring can all be a bit abstract.

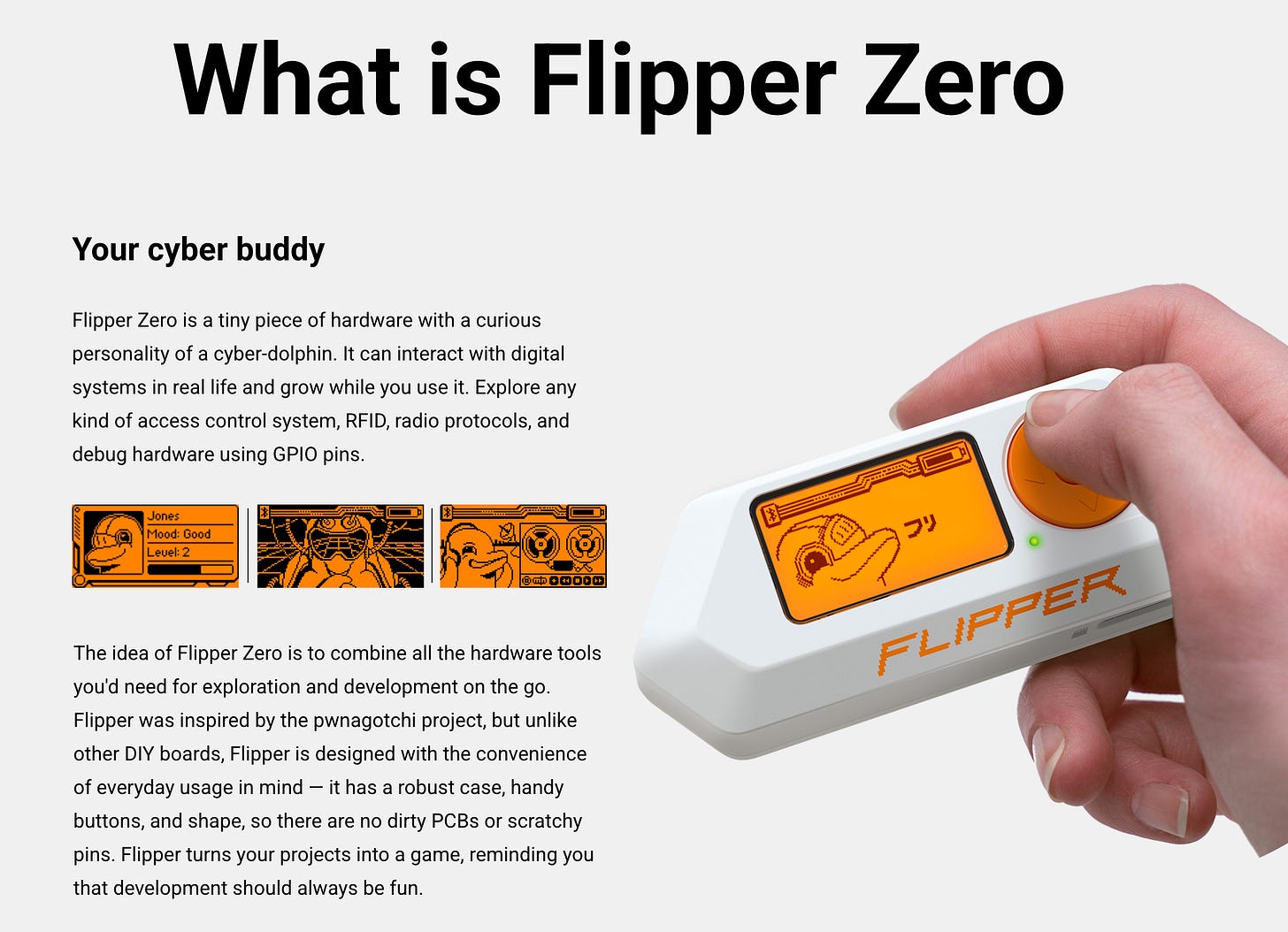

But Mercury customers like Flipper Devices Inc. more concretely illustrate the risks of a low friction process designed to enable foreign actors to open U.S. bank accounts.

Flipper Devices Inc. is, according to its website, based at 2803 Philadelphia Pike in Claymont, Delaware. That address, though, is home to a package shipping and business center, not Flipper Devices’ actual operating location.

That didn’t stop Flipper Devices from using that address to open accounts at Mercury, according to records released in Evolve hack and confirmed by sources familiar with the situation.

The real story behind Flipper Devices, including potential links to Russian actors under sanctions for suspected interference in the 2016 U.S. presidential election, is far from simple.

A 2023 report from Swedish IT and information security research firm Simovits AB details the Moscow origins of the company, including numerous red flags that should have raised alarms when it applied to open an account with Mercury.

Flipper Devices makes a hand-held diagnostic tool that can monitor, clone, and emulate RFID signals, radio protocols, and access control systems.

While ostensibly for use by “white hat” security professionals to conduct audits or penetration testing, the device can also be used for a wide variety of nefarious purposes, such as cloning building keycards or garage door opener signals, assisting in penetrating wireless networks, or emulating the contactless chip in a credit or debit card, for example.

According to the Simovits report, whose authors Fintech Business Weekly spoke with for this piece, the company and the tool it produces were originally born in the Neuron Hackspace in Moscow, Russia. The formed co-CEO of that hackspace, Pavel Zhovner, is also the CEO of Flipper Devices.

That same hackspace was also listed as the registered address for Esage Labs, a doing-business-as name used by two underlying entities. According to the Simovits report, Esage Labs worked in the “digital weapons” and security testing space and had demonstrable links to the Russian federal security service, the FSB, and the Ministry of Defense. Esage Labs, along with other Russian companies and individuals, were added to the OFAC SDN list, following Russia’s interference campaign in the 2016 election.

Zhovner, the former co-CEO of the hackspace and CEO of Flipper Devices, has a history of questionable cyber activity, including running a “Distributed Denial of Service” attack website, sabotaging Russian activist Alexi Navalny’s blog, and building a tool to circumvent Ukraine’s blocking of Russian IP addresses, the Simovits report says.

As of 2023, about 20 Flipper Device employees were based in Russia, based on their LinkedIn profiles at the time. By August of that year, many employees had updated their profiles to reflect being based in Tbilisi, Georgia, apart from the company’s management, who claimed to be based in Dubai.

Presently, the company appears to have a physical presence in London, where it lists an office address near the Greenwich station on the Jubilee line.

Of about 50 employees listed on LinkedIn, many list their location as London. Only one, a part-time advisor who appears to be originally from Russia, lists a location as being in the United States.

The Flipper Device itself hasn’t been without controversy. According to the Simovits report, shipments of the device to Israel, Germany, Brazil, and the United States have been flagged by customs and either refused entry and returned or destroyed.

The company has also had issues in the past with payment processors. In 2022, PayPal blocked the company’s account and withheld about $1.3 million in Flipper Device’s funds, without providing the company a clear explanation, according to the firm’s posts on X at the time.

Flipper Device’s New York-based law firm, which boasts expertise in international and Russian law, sent PayPal a demand letter and was ultimately able to secure the release of the company’s $1.3 million.

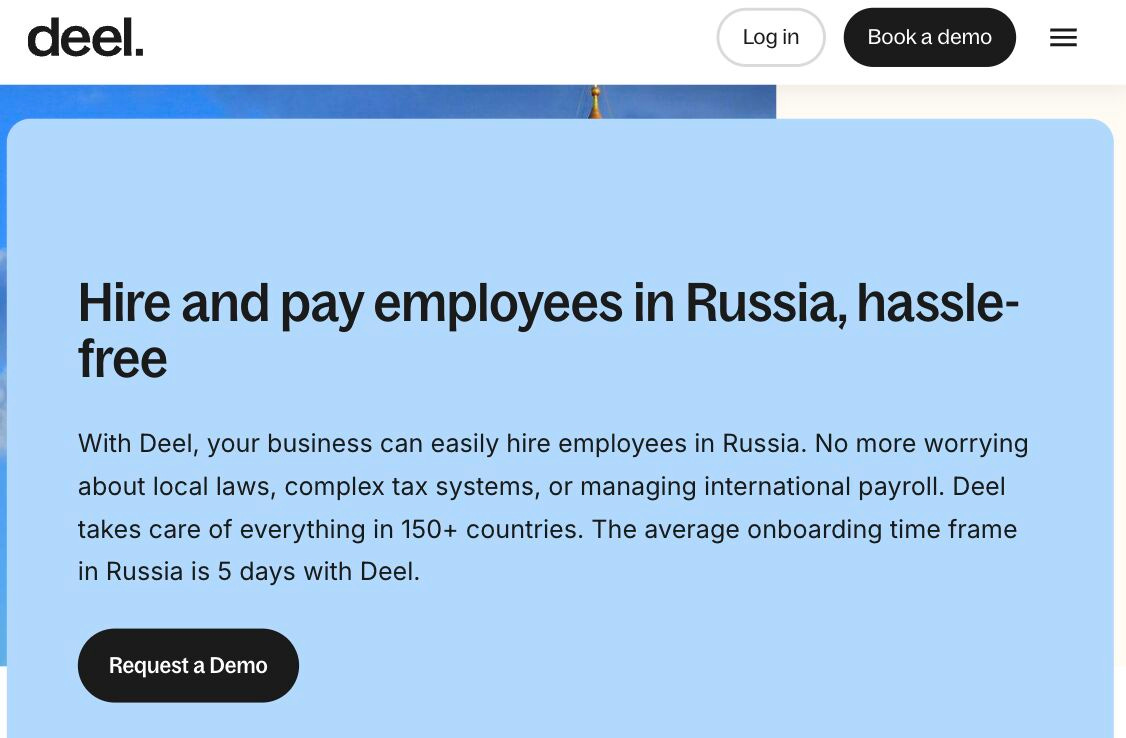

An analysis of Flipper Device’s payment activity with Mercury, based on records obtained by Fintech Business Weekly, reveal a pretty anodyne transaction history that includes typical business expenses like services from Adobe, Dropbox, and Google, as well as nearly $2.8 million processed by Flipper Device’s payroll service, Deel.

Deel, currently embroiled in a high-stakes Silicon Valley spy drama with arch rival Rippling, shares a common investor with both Mercury and Synapse: a16z.

As recently as January 2025, Deel’s website boasted that the company made it “hassle free” to hire and pay employees and contractors in Russia. Asked about this at the time, a Deel representative said those pages on its site were out of date and that they would be removed.

The Flipper account did catch the attention of regulators, with the FDIC asking Choice Bank about the account during its 2023 exam, people familiar with the situation said.

It wasn’t the device itself that examiners were worried about, those sources said, but rather the companies apparent links to Russia.

Mercury, Evolve, and Choice Bank did not respond to requests for comment about their relationship with Flipper Device Inc.

Mercury’s “risk on” approach wasn’t limited to a willingness to open accounts for companies that were really based outside of the U.S.

The company sought to onboard “creator” service OnlyFans, best known for hosting adult content creators, which was first reported by The Information in March 2024. That piece cited Evolve’s decision not to onboard the pornography app as a point of tension between fast-growing Mercury and its first bank partner.

Now, Fintech Business Weekly can confirm, it was Mercury CEO Akhund who was the driving force behind the company’s effort to persuade Synapse and Evolve, or another of Synapse’s bank partners, to take OnlyFans’ business.

Internal emails obtained by Fintech Business Weekly between Mercury’s Akhund and Synapse cofounder and CEO Pathak show Akhund acknowledging that the terms of service Mercury agreed to disallowed “adult entertainment,” but seeking an exception anyway — pointing to the commercial opportunity by saying that OnlyFans “are ready to move at least $100m over to Mercury.”

Pathak did his best, reaching out to Evolve founder Scot Lenoir, who, according to texts reviewed by Fintech Business Weekly, didn’t appear to be familiar with the nature of OnlyFans business. Pathak explained to Lenoir that OnlyFans was “like Instagram except creators get paid. Lots of creators are adult entertainment though.”

When Lenoir asked, “What are the adult entertainers selling?”, Pathak responded that “they have nudes on it,” but also celebrities, giving the example of rapper Cardi B.

Lenoir ultimately demurred, suggesting Pathak check with another of Synapse’s bank partners instead.

Mercury’s Akhund followed up with Pathak on February 9, 2021, requesting an update, only to be told that OnlyFans was a no-go.

Being prevented from onboarding OnlyFans to Mercury may have been a blessing in disguise, however.

While OnlyFans was less well known prior to the pandemic, there was already some reporting at the time Akhund advocated for onboarding the company that its service was alleged to facilitate sexual and human trafficking, child sexual abuse material, and money laundering.

Since then, similar allegations about OnlyFans have only multiplied, including that self-proclaimed “mysogynist” influencer Andrew Tate and his brother used the service to traffic women and dodged paying taxes, and an extremely troubling seven part exposé by Reuters, among others.

If you’re a non-bank fintech like Mercury, your business literally lives or dies by your relationship with your regulated bank partners.

While it’s unknown exactly to what extent Mercury may have contributed to the regulatory enforcement actions against Choice, Evolve, and Patriot, it would surely give any new potential bank partner pause.

In the wake of the collapse of SVB, there was, understandably, renewed attention to the limits of FDIC deposit insurance and a flight to safety in the form of too big to fail global systemically important banks (G-SIBS).

Recognizing the change in sentiment post-SVB, Mercury sought a relationship with a G-SIB.

But conversations with Bank of America and JPMorgan Chase went nowhere, sources familiar with the conversations said.

Talks with Goldman Sachs, trying to develop its own banking-as-a-service franchise as part of its nascent Platform Solutions business at the time, went a bit further. But, Goldman insisted it would need to handle customer onboarding processes, estimating new account opening would probably take “about a week,” people with knowledge of the matter said. Such a lengthy and high-friction process was a dealbreaker for Mercury, and the discussions petered out.

But with its relationship with Evolve fraying and Choice under a consent order, Mercury still needed a new bank partner, both for redundancy and to power its continued growth.

In October 2024, Mercury officially announced its new partnership with “developer infrastructure” bank Column.

Column, launched by Plaid cofounder William Hockey, which officially launched in April 2022, is surely distinct from Evolve or Choice; it was purpose built from the ground up to support a partnership-driven banking business model.

Still, that doesn’t mean there aren’t risks in its relationship with Mercury.

A company’s culture, including how it views compliance, typically comes from the top — and Mercury’s CEO has a record of demonstrating what could be described as disdain for legal and regulatory constraints, those who have worked with Akhund said.

One compliance professional who has interacted with Mercury and Akhund warned, “He’s surrounded himself with a bunch of sycophants. They’re not going to do the thing that needs to be done because they think it’s stupid, or it’s not first principles thinking.”

An engineering staffer that has worked with the company expressed concerns about its honesty, saying, “The bigger issue is that they're manipulative and actively lie to partners.”

Asked about the prospects for any new bank partners of Mercury, the engineer continued by saying, “Mercury will chew those partners up and spit them out as soon as it becomes slightly advantageous. Almost certainly. Depending on the size of the bank, they'll leave them holding the bag and consent orders as well.”

The compliance professional made an equally blunt assessment, saying, “I don’t know any other bank that would want to bank a company like Mercury.”

Representatives for Mercury, Evolve Bank & Trust, and Choice Bank did not respond to requests for comment. A representative for Column declined to provide a comment for publication.

CFTC Rocked by Exits and Sanctions as Crypto Reform Awaits (Bloomberg)

Forcing Bank Deposits to Subsidize Stablecoins: the GENIUS Act (Adam Levitin/Credit Slips)

The Supreme Court Is Just Making Stuff Up About the Fed (Adam Levitin/Credit Slips)

The Chime Test (Fintech Takes)

Looking to work with me in any of the following areas? Email me.

Now available: buy my best-selling book, Banking as a Service: Opportunities, Challenges and Risks of New Banking Business Models, here

Vendor, partner & investment opportunity advice and due diligence

Fintech advising & consulting

Sponsoring this newsletter

News tip or story suggestion — reach me on Signal at mikulaja.01

.png)