content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

On-chain data reveals the Bitcoin holder groups are largely participating in distribution, but one key cohort is showing strong accumulation instead.

Bitcoin Accumulation Trend Score Says 1,000 To 10,000 BTC Holders Are Buying

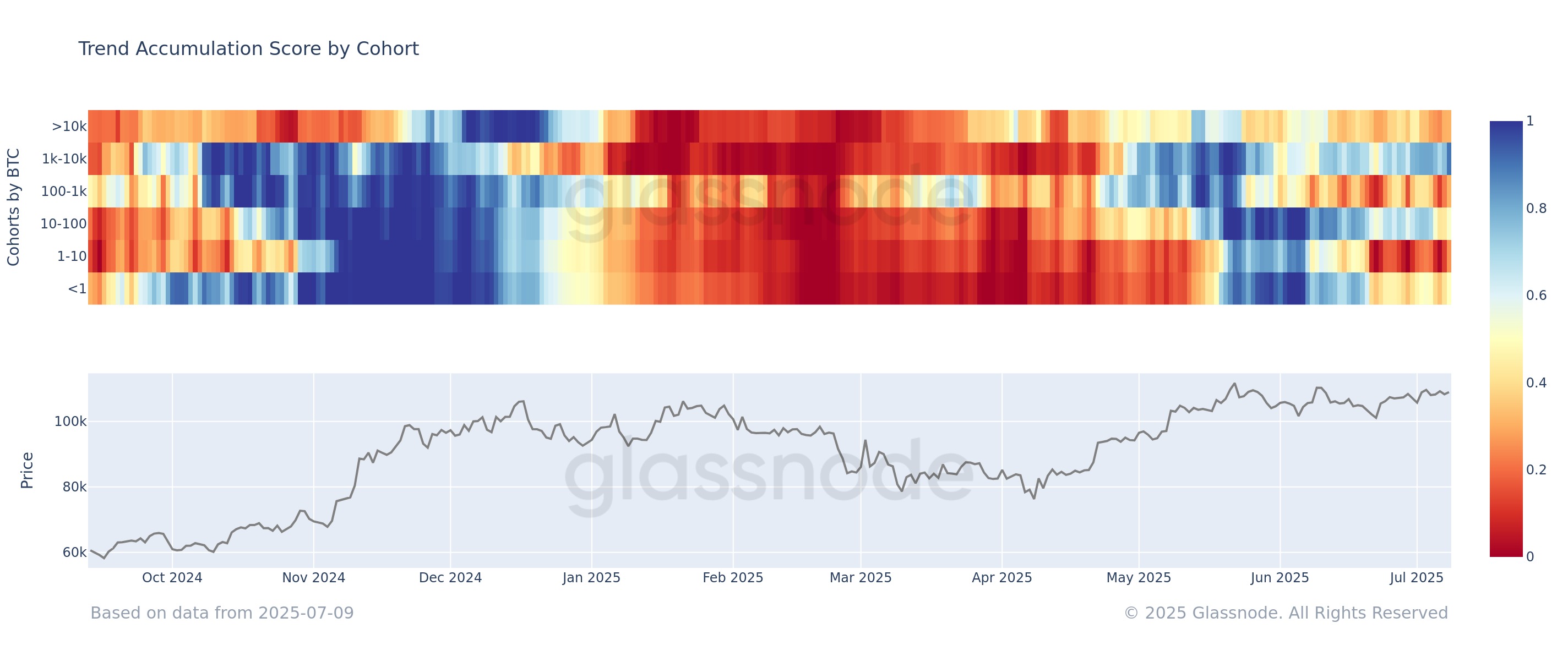

In a new post on X, the on-chain analytics firm Glassnode has shared an update on how the Accumulation Trend Score is looking for the various Bitcoin investor cohorts.

This indicator tells us about whether the Bitcoin holders are accumulating or distributing right now. It takes into account for two factors when determining this: the balance changes happening in the wallets of the investors and the size of the wallets involved.

The metric represents the market behavior as a score lying between 0 and 1. Naturally, as the wallet size is also considered, larger entities have a bigger influence on this score.

When the indicator is under 0.5, it means the large investors (or a large number of small entities) are taking part in distribution. The closer is the value to 0, the stronger is this behavior.

On the other hand, the metric being above the mark suggests the market is in a phase of accumulation. For this side of 0.5, the extreme point lies at 1, corresponding to the strongest possible buying behavior.

Now, here is the chart shared by Glassnode that shows the trend in the Accumulation Trend Score separately for the different segments of the Bitcoin userbase:

As is visible in the above graph, the Bitcoin Accumulation Trend Score leans towards being red for most of the investors, indicating that distribution is being followed.

The cohort that’s displaying the strongest selling behavior is the 1 to 10 coins one. This group includes the retail hands, who are among the smallest of entities on the network.

While the market as a whole has been distributing, one cohort has stood out: the 1,000 to 10,000 BTC holders. At the current exchange rate, the bounds of the range convert to $109.5 million at the lower one and $1.095 billion at the upper one. Thus, this group represents the big-money traders, popularly known as the whales.

From the chart, it’s apparent that the Accumulation Trend Score of the cohort is very close to 1, suggesting that these humongous entities are showing near-perfect accumulation behavior.

The trend is in sharp contrast to what the retail investors are displaying. “This divergence highlights a clear split in conviction between small and large holders,” notes the analytics firm.

It now remains to be seen whether the bullish conviction being shown by the whales would pay off, or if the investors exiting now would turn out to be the smart ones.

BTC Price

At the time of writing, Bitcoin is floating around $109,500, unchanged from one week ago.

Featured image from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

.png)