By Adam Ozimek

Protectionists love talking about the auto industry. Believing it offers a potent example of the harms of globalization, their arguments have long been politically attractive to politicians on both left and right. Most recently they have justified the Trump administration’s 25 percent tariffs on auto imports by emphasizing the long-term decline of the industry.

It is time to set the record straight.

The protectionist argument for insulating the American auto industry from foreign competition not only draws the wrong lessons from history, it gets the history itself wrong. It rests on four myths, all of which I debunk in this analysis:

- The U.S. auto industry has collapsed.

- Globalization caused the death of Detroit.

- Japanese imports nearly destroyed the auto industry in the early 1980s…

- … until auto protectionism saved it.

Once these myths are set aside in favor of a clear, accurate understanding of the auto sector and its history, there is no reason to be optimistic that the Trump administration’s protectionist approach to the sector will work as intended. Indeed the case for it falls apart entirely.

I. The Auto Industry: Doing Just Fine?

The backdrop for President Trump’s tariffs is the idea that the auto industry has been decimated by globalization. “No one anymore, on the left or the right, denies that globalization has fractured the U.S., both economically and socially,” writes Joe Nocera at the Free Press. “It has hollowed out once-prosperous regions like the furniture-making areas of North Carolina and the auto manufacturing towns of the Midwest.”

The situation is so dire, Steven Miller warns, that “if we stayed on this current path, within a few years there would have been no US automobile industry.”

Such claims of vast deindustrialization ring true for certain manufacturing industries. Some goods really did stop, or mostly stopped, being made in the United States because of globalization.

Apparel, for example, is a quintessential globalized good, its factories shifting across the globe in search of the lowest labor costs. The United States once made a lot of clothes. Today it employs more than 90 percent fewer workers in apparel than it used to, and produces 90 percent less of the output. Apparel was a classic “China Shock” industry, where imports caused substantial and long-lasting economic disruptions in the parts of the country where it used to be concentrated. [1]

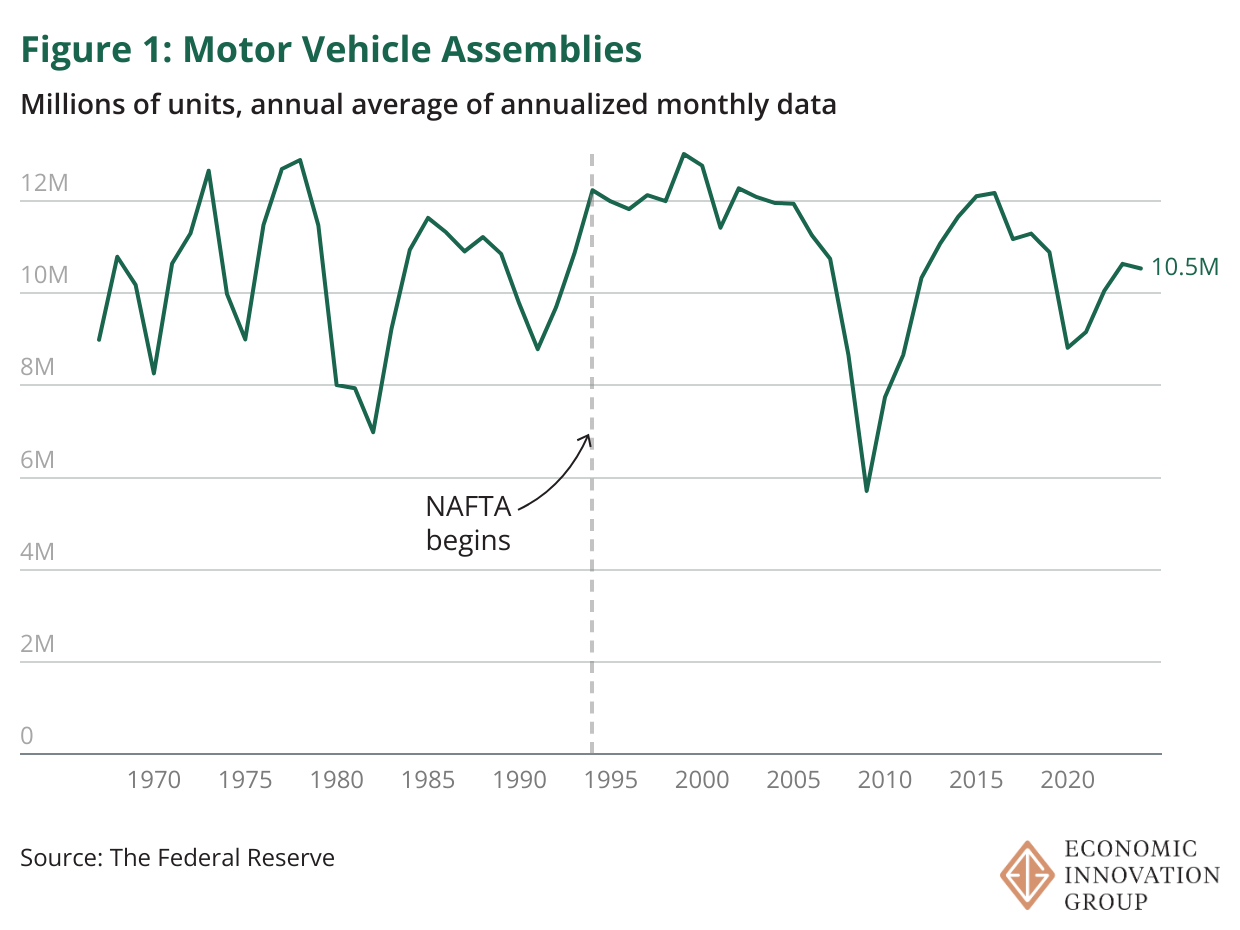

But the domestic auto industry is different. It remains alive and well, with 10.5 million vehicles assembled in American factories last year. This number is down from the peak of the post-NAFTA boom period, but it is well above the depressed years of the 2000s and nearly equals the average of 10.3 million annual vehicles made in the pre-NAFTA period dating back to 1969.

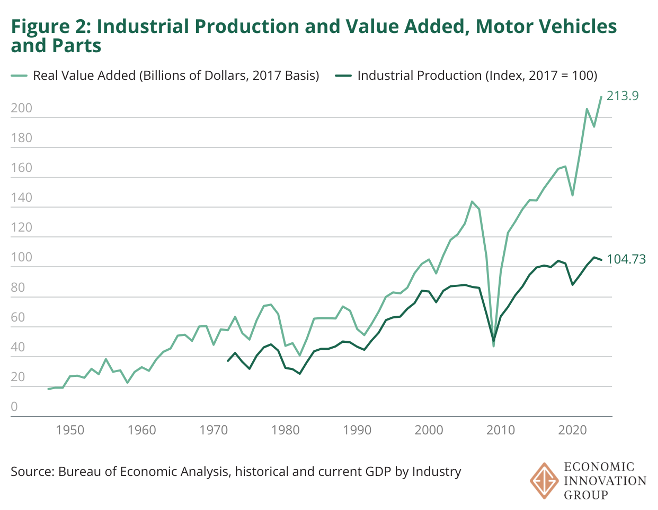

And these production numbers actually fail to capture the true strength of the industry. The economic value of the cars being made has climbed substantially through the years. As a result, real value added and industrial production — two different ways of measuring actual output — are now at all-time highs.

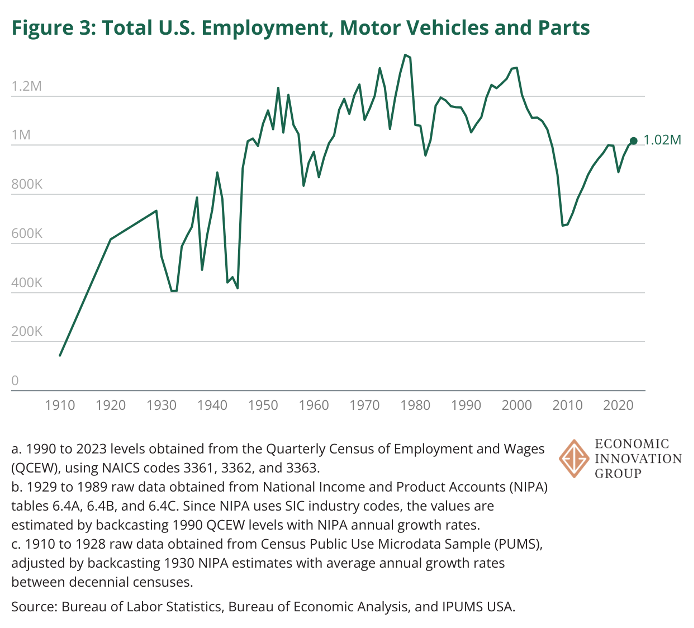

What about jobs? The auto industry today employs 1 million workers. Between 1950 and the signing of NAFTA in 1993, it averaged 1.1 million workers, just slightly higher. [2]

So much for Myth 1, the persistent notion that the American auto industry has collapsed. With output at all-time highs and employment hardly lower than in the time before NAFTA (the biggest globalizing event for the auto industry in recent decades), the evidence goes hard in the other direction.

II. The Detroit Whodunnit

But we are left with a puzzle. The perception that the auto industry has been decimated — and decimated specifically by globalization — is widespread. Where does it come from?

The likely answer is that in Detroit, the decline of the auto industry is certainly not a myth. But its very real decline was caused by competition not with the rest of the world, but with the rest of the United States.

The deindustrialization of Detroit is typically understood as a phenomenon of the 1970s and 1980s, and it is therefore blamed on the growth of trade during this period. But the fact is that auto investment and employment had started moving out of Detroit decades earlier.

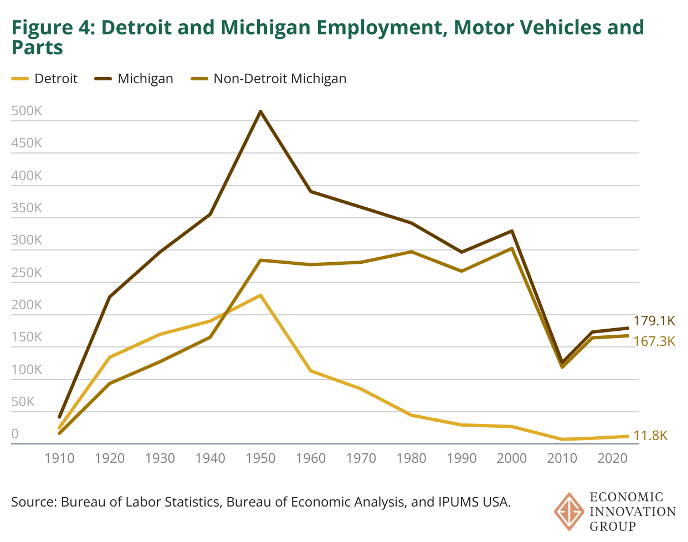

I pieced together data from a variety of sources, which shows that auto manufacturing employment in the City of Detroit had already peaked in 1950, at just over 220,000 workers. [3]

By 1970 the biggest declines had already occurred, with employment falling by more than half, to fewer than 100,000 jobs.

An important nuance is that many of these lost jobs migrated to other parts of Michigan, at least for a while. So while auto employment was collapsing in Detroit, the rest of Michigan managed to hold auto employment stable for another five decades until the 2000s, when it started falling everywhere in the state.

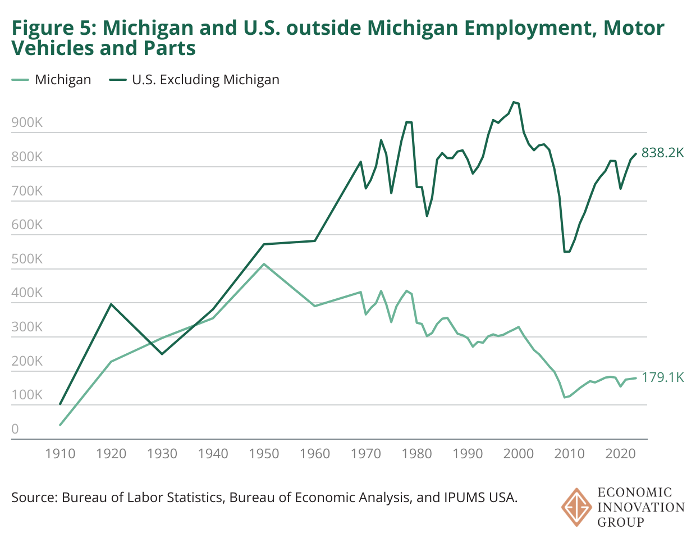

The steady employment outside of Michigan did not, however, do anything to offset the big declines in Detroit. For all of Michigan, both Detroit and ex-Detroit combined, employment also peaked in 1950 and, except for a couple of blips, has been mostly in decline since. Because although the Big 3 (Ford, General Motors, and Chrysler) were moving some jobs from Detroit to other parts of Michigan, they were moving even more jobs out of the state entirely.

The exodus from the city proper is also evident in the investments of the Big 3. From 1946 to 1956, they built 25 new auto plants in the broader Detroit metro area, but not a single one within the City of Detroit itself. In 1940, 58 percent of Ford’s assembly plants were located in the City of Detroit. By 1956, none were. [4]

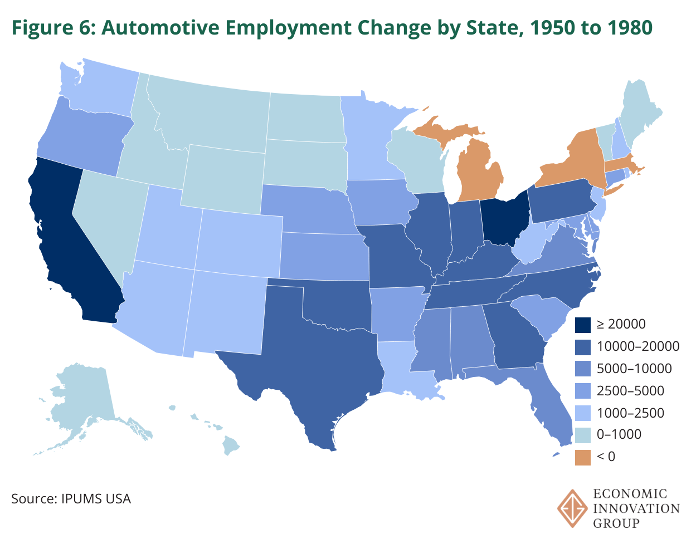

The historical record paints the picture. Henry Ford II announced in 1950 that his company’s investments would no longer be concentrated in their established industrial centers. By the mid-1960s, Ford had made major investments not just in the southern states of Alabama, Tennessee, and Georgia, but also in New York and New Jersey.

For its part, GM made investments in Indiana, Ohio, Illinois, New Jersey, Mississippi, and California, while Chrysler invested in New York, Delaware, Indiana, and Ohio — all by the late 1950s.

These investments and the jobs that followed them did not occur as a result of foreign car companies establishing their factories in the south and other parts of the country. That came much later. Long before the Big 3 were seriously challenged by foreign automakers, they themselves had begun decentralizing auto investment out the industrial hub of Michigan and spreading jobs and investment across the rest of the country. [5]

So globalization couldn’t kill Detroit because Detroit was already dead. Or at least dying.

And it really was a story of decline in Detroit almost exclusively. From 1950 to 1980, auto employment even in most of the Rust Belt states expanded. The gains in Ohio, Indiana, and Illinois exceeded those of any southern state.

If not globalization, what drove this push out of Detroit?

One big factor was the militancy of local unions. Consider what happened at Ford’s River Rouge Complex. Located in the Detroit suburb of Dearborn, it was once the largest integrated factory in the country with 93 structures, 90 miles of railroad track, and 53,000 machine tools. Its workers belonged to the United Auto Workers (UAW) Local 600 union. Throughout the 1940s, the Local 600 organized hundreds of strikes that would routinely shut down production at River Rouge.

Citing this union activity as the cause, Ford Motor company relocated production to other parts of the country — building a stamping plant in Buffalo, NY, an engine factory in Brook Park, OH, and other factories in Tennessee and California.

Between 1941 and 1960, employment in the River Rouge Complex fell from 90,000 workers to just 30,000. [6]

The Big 3 were not avoiding all unions. In a 1950 speech about Ford’s new investments to the Buffalo Chamber of Commerce, Henry Ford II praised Buffalo labor leaders as forward-looking, and Buffalo itself as “the place where an organization can get work done — where good production cooperation is possible.”[7] It was specifically the local unions of Detroit that compelled the Big 3 to find new places to set up factories.

The decentralization trend accelerated in the 1970s when foreign automakers began establishing their own factories in the United States, and then continued for decades beyond the 1980s.

The desire of the foreign automakers to avoid Michigan and its unions was even stronger than it was for the Big 3. A letter from Mitsubishi to U.S. Representative Mary Rose Oaker, written in 1985 to explain why Cleveland, Ohio had been rejected as the site of their first plant, makes their rationale explicit: “The rule of thumb we have been using in our site selection process is to avoid going right into the heart of any existing heavily automobile industrial region.” [8]

And while Nissan chose Smyrna, TN in 1980 for a variety of reasons, Tennessee’s status as a right-to-work state was a big one, as it was “far enough from the industrial North to be beyond the reach of the UAW.” [9] As the first manager of that plant said, “You won’t get the cooperation necessary to build a quality product with the union.” [10]

Michigan now has about 280,000 fewer auto jobs than it did in the 1950s, a decline of roughly 60 percent. [11] For the United States as a whole, auto employment is only down 4.7 percent — further showing that the struggles of Detroit and Michigan are less about the decline of the American auto industry and more about its relocation elsewhere.

Another way of understanding the trend: If Michigan had simply maintained the same share of American auto jobs as it had in the 1950s, meaning it did not lose any production to other states, then it would only have lost 21,000 auto jobs since then, not the 280,000 it actually did lose.

Should the federal government have done more to help Detroit weather its deindustrialization? Maybe. A strong argument can certainly be made for it. But no argument can be made that protectionism would have helped, as tariffs and other trade barriers have absolutely nothing to do with internal competition between states.

III. Japanese Imports and the Crash of 1979–82

While the struggles of Detroit started back in the 1950s, a genuine crisis for the wider American auto industry did not arrive until nearly the end of the 1970s. But when it finally hit, it hit hard.

More than 400,000 auto workers lost their jobs between 1978 and 1982 — a staggering 30 percent decline — as the industry confronted its biggest challenge since the Great Depression. Domestic auto production had collapsed. American companies made fewer than 7 million vehicles in 1982, a 46 percent decline from their output just four years earlier.

Some of the loudest voices from across the political spectrum placed the blame on Japanese imports. Demands for protectionist policy came not just from anti-trade crusaders but also from important figures inside the presidential administrations of both Jimmy Carter and Ronald Reagan. (More on the effects of their policies later.)

Was globalization, and specifically the flood of auto imports from Japan, responsible for the crisis?

The first point to make is that foreign competition did not arrive overnight. It had grown steadily over a long period. The first auto import was the Volkswagen Beetle, from West Germany, in 1949. Cars from the European automakers Austin Healey, MG, Jaguar, and Volvo arrived next. [12] In 1957 came the first Toyota imports, followed by the Datsun Bluebird from Nissan the next year.

These early imports were no threat to domestic automakers, who were dismissive of the new competition — especially the Japanese imports, which Detroit perceived as “shoddy, tinny” cars that “rattled and fell apart.” [13]

That initial perception was largely right. Toyota’s first imports were designed for low-speed driving on Japan’s famously bumpy urban roads. The fast speeds of American highways caused them to overheat and, yes, sometimes rattle and fall apart. Toyota stopped importing them within a few years and went back to the drawing board. [14]

But gradually the pressure from foreign competition increased. In the 1950s, the Big 3 carmakers were a comfortable oligopoly and faced little pressure to innovate. That would soon change.

As of 1957, only 4 percent of cars sold in the United States were foreign imports. [15]) Exactly a decade later, the share had tripled to 12 percent, and foreign imports had climbed to more than a million cars per year for the first time. The Volkswagen Beetle continued leading the way as the nation’s best-selling import. [16]

Japanese companies had meanwhile pioneered new and shockingly effective production methods, pushing their cars to the forefront of quality and cost. The cars were also, finally, well matched to American roads and drivers. In 1974, imports from Japan by themselves exceeded a million cars, boosting total foreign imports to more than 2.5 million — a fifth of all cars sold in the United States. [17] [18]

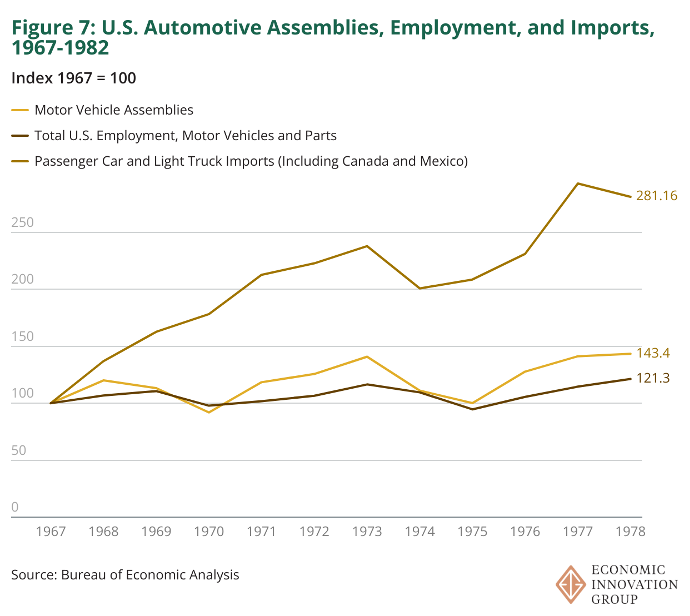

And yet despite the globalization of the industry, the steep rise in imports had failed to devastate American producers. Instead, domestic production and employment from the late 1960s to the late 1970s had risen together with imports.

In 1978, when imports hit a record high of more than 3 million vehicles, American auto producers had their best year ever, with 12.9 million cars assembled.

If globalization had been destined to eviscerate the auto industry, it would have happened much sooner.

As for what did bring about the crisis of 1979–82, the likely culprit was the cratering of consumer demand throughout the American economy, which itself had various causes.

An oil shock in 1979 had pushed inflation above 10 percent. The Federal Reserve responded by raising interest rates to nearly 18 percent in March of 1980 and then keeping them elevated for several more years. The unemployment rate spiked and nearly reached 11 percent at the end of 1982, by far its highest level since the Great Depression. Quite simply, fewer people were making money, and the cost to borrow it was prohibitive.

That auto sales fell as they did should therefore have been no surprise.

Domestic auto companies took the biggest hit. Roughly 40 percent fewer vehicles made in the United States were sold in 1982 than four years earlier. Disappearing revenues forced American automakers to cut $10 billion in costs, leading to factory closures and layoffs. [19]

Chrysler was pushed to the brink of bankruptcy and needed a federal bailout from the Carter administration in the form of a $1.5 billion dollar loan guarantee. Ford stock fell by more than half, and its credit was downgraded by ratings agencies. [20]) (Ironically, Ford might also have faced bankruptcy, or at least been forced into a merger, were it not for its profitable overseas operations. In a sense it was saved by globalization. But protectionists tend to leave out that bit of the story.) [21]

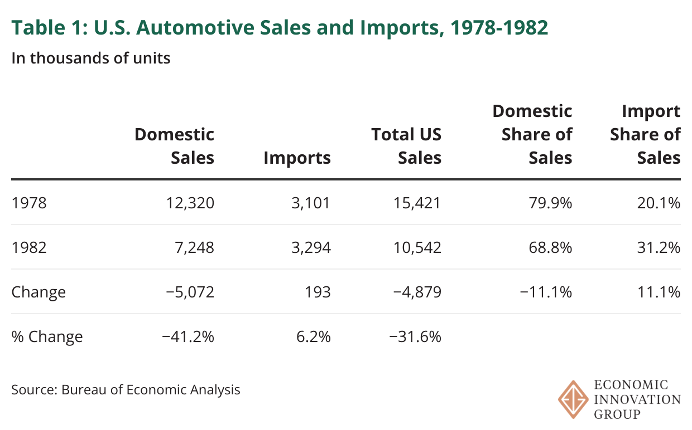

During this time, sales of imports were more resilient, rising from 3.1 million vehicles to 3.3 million between 1978 and 1982 (see Table 1 above). Because the sales of American-made vehicles had fallen so much, importers dramatically increased their share of the market — setting the stage for what came next.

Import competition, especially from Japan, became the scapegoat for the domestic industry’s problems. Demands for protectionism then followed. Ford and the United Auto Workers filed a complaint with the U.S. International Trade Commission (ITC), which included a warning from the UAW president: “The auto industry here is in danger of losing up to one-third of the U.S. market permanently if action is not taken rapidly.” [22])

But the ITC rejected the claim, denying that imports were a “substantial” cause of the industry’s problems. [23] Simple math, with the help of a thought experiment, strongly supports the ITC’s argument.

Counterfactual 1: Imagine a counterfactual world in which demand had not crashed. Annual sales of vehicles remained steady at 1978 levels throughout the crisis years. But in this counterfactual, foreign importers still increased their market share by the exact same amount as they did in reality, rising from 20 to 31 percent of all sales in 1982.

In such a world, American producers would have sold 10.6 million vehicles in 1982. This is fewer than the number sold in 1978, but only by 14 percent — which may not be great, but is still just a third of the decline that happened in real life (a 41 percent decline).

Put another way, American producers in this counterfactual would have sold roughly the same number of vehicles as in 1976, just three years before the crisis started.

Counterfactual 2: Now imagine an entirely different counterfactual, one in which demand does crash (as indeed it did in real life), but foreign importers fail to gain any market share, remaining at 20 percent of vehicles sold in the United States.

In this world, American automakers would have sold 8.4 million vehicles, a 32 percent decline — much closer to the actual catastrophe that happened in the real world.

Conclusion: Forced to choose between the collapse of demand (a 32 percent decline) or the rise of imports (14 percent decline), it is clear which counterfactual path the industry would have chosen.

—————————————

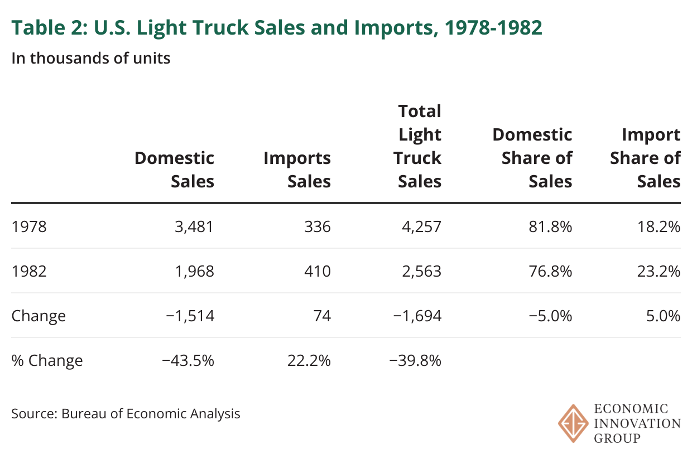

A close look at truck sales offers another reason to doubt imports were the problem. [24]

Imports of light trucks rose 5 percent between 1978 and 1982, which was weaker growth than the 11 percent rise for imports of all vehicles. Yet despite the slower growth of truck imports, sales of domestic trucks actually fell by more than sales of domestic vehicles overall (see Table 2).

Macroeconomic conditions — the weak economy, rising gas prices, high unemployment — were going to be a problem for the industry regardless of imports.

While rising imports left the domestic auto industry more fragile than it otherwise would have been, they were just one among many problems. A lack of competition in the post-war period had lulled the Big 3 into a period of sclerosis, low innovation, and labor costs that had grown much faster than productivity. [25] The problems were most visible at Chrysler, which, in 1978, a year of record-high auto demand, lost $205 million and found itself $1 billion in debt. [26]

The domestic automakers also struggled because they simply weren’t making enough of the small cars that customers wanted when gas prices skyrocketed. They believed that small cars were a “profitless hole.” Their unwillingness to make a quality, affordable, small car in the 1960s was so obvious that UAW president Walter Reuther asked Lyndon Johnson to suspend antitrust enforcement and allow the Big 3 to collaborate on one. [27]

The growing share of imports no doubt placed competitive pressure on domestic producers. But in a healthy macroeconomic environment in which total demand was strong, as it had been for the decade prior to the crisis, there would have been no crisis regardless of rising imports.

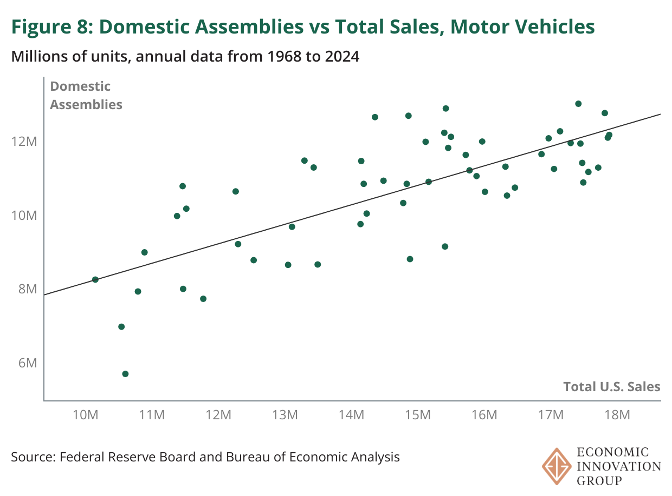

The dominant effect of consumer demand on the American auto industry can also be shown using statistics and a simple chart. In Figure 8 below, for each year between 1968 to 2024, the number of vehicles sold in the United States is plotted against the number of vehicles assembled inside the country (a measure of production).

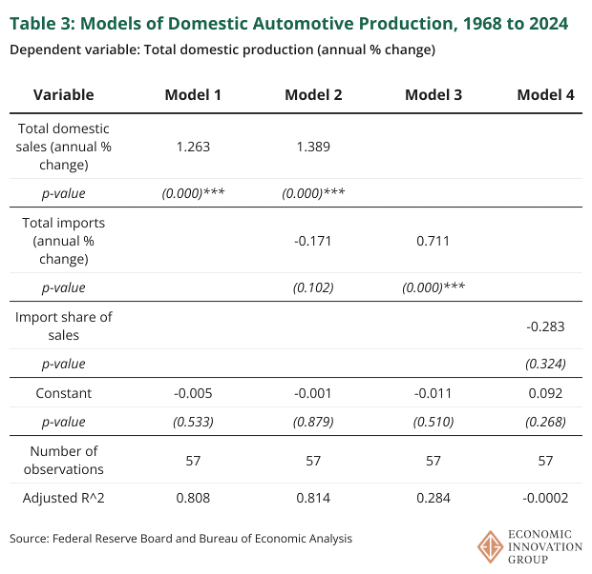

The precise relationship is that every 1 percent increase in total vehicles sold is associated with a statistically significant 1.2 percent increase in domestic production.

In contrast, neither the import share of sales nor the percent change in imports has a statistically significant effect after controlling for total sales (Table 3). In fact, if total sales are not controlled for, higher imports are correlated with higher domestic production.

A good market swamps everything, benefitting producers both domestic and foreign.

IV. A Protectionist Success Story?

Nonetheless, the scapegoating of Japanese imports and the mass layoffs at the Big 3 led to mounting pressure on policymakers to respond.

The Reagan administration found itself caught between its free trade principles and its campaign promise to help American auto workers. As a compromise, the administration pressured the Japanese government into imposing voluntary export restraints (VER), which limited exports of Japanese autos into the United States. For three years, starting in 1981, Japanese carmakers combined were allowed to sell no more than 1.68 million cars per year to American buyers.

The goal was to give the American auto industry “breathing room” — a phrase that pops up again and again in contemporary reports and the congressional record. The industry was in a crisis, and this was the plan to help it adjust.

Did the policy succeed?

There are two reasons to doubt it. First, it had no significant effect on the primary goal, which was to help the Big 3 get through the crisis. Second, contrary to protectionist claims, the policy is not why Japanese automakers now produce so many cars from inside the United States.

The conclusion of the crisis

The most important reason the American auto industry eventually did get through the macroeconomic crisis was that the macroeconomic crisis ended. December of 1982 was the last month of the recession. By then, interest rates had fallen all the way to their 1979 levels, while real gas prices (gas prices adjusted for inflation) had fallen halfway back to their pre-crisis levels. [28]) [29])

The economic stage was set for the auto industry to start recovering in 1983. That is exactly what it did, with total vehicle sales that year returning to 96 percent of the pre-crisis average. By 1984 they were 12 percent above it. [30] And after having lost a combined $8 billion during the crisis, profits for the Big 3 hit a record $10 billion in 1984. [31]

Profits were so high, in fact, that they enabled the UAW to negotiate a deal that included, for the first time, the infamous “jobs bank” requiring the automakers to find new employment for laid-off workers and continue paying them until then.

Another factor helping domestic producers was their rollout — better late than never — of fuel-efficient small cars with front wheel drive, which started in 1979 and 1980. These cars were introduced, notably, before the Voluntary Export Restraints on Japan went into effect. Included among them were the Chrysler K and GM X series. [32]

While the improved economy and industry adjustments put an end to the crisis for the Big 3, it’s far less likely that VER played much of a role. The policy had little impact until the crisis was already over. The collapse in demand was so severe that even if the export restraints had been introduced earlier, during the worst years of the crisis, the VER’s limit on Japanese imports would not have been binding.

In other words, automakers importing from Japan would have sold close to the maximum allowable 1.68 million cars between 1979 and 1982 anyways. How do we know? Econometric evidence shows that VER only started raising the cost of Japanese imports — demonstrating the effect of having curbed their supply in the American market — in 1984 and 1985. And the effect did not become statistically significant until 1986. [33]

A report from the International Trade Commission is consistent with only minor effects in the first few years, increasing domestic production by an estimated 75,000 units in 1981 and 128,000 in 1982. [34] These figures amount to just 1 percent of total industry sales those years.

The ITC concluded that by 1984 the impact had become more substantial, with domestic auto sales 620,000 vehicles higher than they would have been without VER. By this time, of course, the crisis was long over.

This story is also reflected in perceptions at the time. At a hearing of the U.S. Congress Joint Economic Committee in 1985, Acting U.S. Trade Representative Michael Smith said “one could argue that for the first year or so the price only gradually increased. By the time of the fourth year, the additionality was very clear.” [35]

Despite the accumulated evidence that VER had no meaningful effect until after the crisis had passed, it was extended beyond its initial term of three years. It remained in place until 1994, more than a decade beyond the conclusion of the crisis it was meant to address.

Japanese factories, inevitable

That protectionism did not achieve its intended purpose might seem like a closed case for declaring the policy a failure. But protectionists have another reason they love the policy of Voluntary Export Restraints: they believe it caused Japanese automakers to build plants inside the United States, thereby employing American workers rather than competing against them.

As with the notion that VER led the way out of the crisis, this post hoc rationalization is unsupported by the actual evidence.

The protectionist argument relies on two assumptions. The first is that protectionism pushes firms to invest in the United States. The second is that this investment then leads to permanent long-term changes for the domestic industry even though the protection itself is temporary. The temporary protectionism in this case is the VER, and the permanent long-term change is that Japanese automakers relocated their production inside American borders instead of just importing more and more.

One problem for this theory is that Japanese investment was definitely not the Reagan administration’s goal when it negotiated this policy. Nor was it the goal of the Big 3 when lobbying for it. They simply wanted “breathing room” for American automakers to get through the crisis.

The UAW had been appealing to Japanese automakers to invest in the United States throughout the 1970s, but for them too the goal was not to attract new investment. Its aim instead was to increase unionized employment. And just like the Reagan administration and the Big 3, the union didn’t get what it wanted either. By the late 1980s, the UAW was suggesting that even the American factories of Japanese companies should be constrained by quotas. [36])

As such, if VER worked to increase Japanese investment and employment in the American south, it did so while failing to achieve what those who actually fought for it wanted. Hardly a rousing endorsement of the idea that protectionism “works.” [37]

But more importantly, the theory is simply wrong. The United States was not on a path to entirely import-based production, so it follows that the VER did not prevent this outcome by bringing the Japanese automaker to America. There are many good reasons, on the other hand, to believe that powerful magnets would have pulled the Japanese automakers to eventually produce vehicles in the United States even if VER had never existed.

The first is that producing in the country where the vehicles will be consumed not only reduces the risk of future protectionism, it also reduces exchange rate risk. Exchange rate fluctuations nearly bankrupted Jaguar in the United Kingdom and Saab in Sweden in the late 1980s, resulting in their absorption by Ford and GM respectively. [38]

Second, the economics of the auto industry compel production to move closer to the buyer once demand reaches a certain level. Automobiles are what economists Thomas Klier and James Rubinstein call a “bulk-gaining industry.” They write:

“An assembled motor vehicle occupies a much greater volume and is more expensive to ship than the sum of its individual parts. Consequently, carmakers have selected assembly plant sites that minimize their costs of shipping finished vehicles to dealerships.” [39]

Estimates of economies of scale in the industry suggest that an auto assembly plant should produce around 200,000 to 300,000 units to be cost efficient; engine plants should produce around 400,000 units; and transmission plants more than 500,000 units. [40]

It therefore makes sense for producers to wait until a local market demonstrates a persistent and sustainable demand for their products before making large investments needed to produce at efficient quantities. When vehicles are demanded in small quantities, it makes more sense to import.

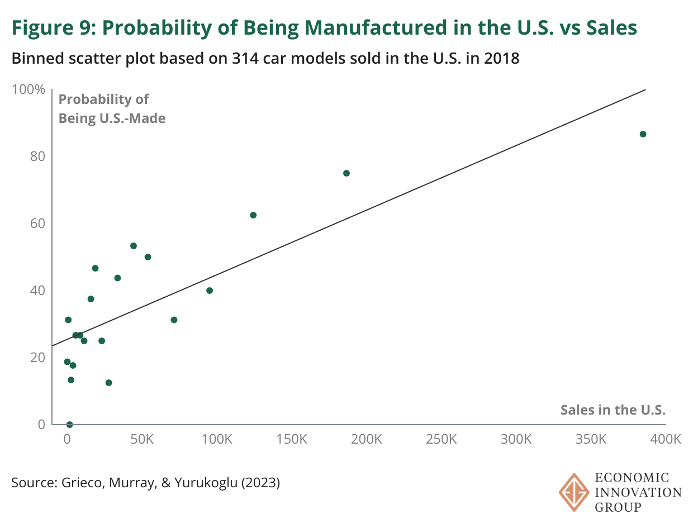

Evidence for this dynamic can be seen using data from a recent Quarterly Journal of Economics paper on the auto industry. [41] In 2018, the most recent year that data is available, there were 74 models of car sold in the United States by non-Japanese foreign auto companies. Only 11 percent of these models were assembled domestically, and another 5 percent in Mexico and Canada combined. But among the models with more than 100,000 vehicles sold, 60 percent were assembled in America. Looking at vans, trucks, and SUVs, roughly half the models with sales above 100,000 vehicles were assembled in the United States versus just 15 percent of all models.

Looking across all 314 models in the data for 2018 (Figure 9) shows that as sales go up, vehicles become far more likely to be assembled inside the United States.

Japanese automakers were coming because they were producing hit cars, and it is simply good business to make hit cars near the customers. At best, VER might have slightly accelerated a process that was occurring anyway — though as Jordan McGillis at City Journal points out, to whatever extent that is true, it happened at the expense of consumers looking for affordable, high-mileage cars. [42]

Indeed, the economics of the industry was already attracting investment from foreign automakers long before VER.

- Volvo had announced in 1973 that it would build a $100 million factory in Virginia with the capacity to assemble 200,000 cars a year and would employ 3,500 workers.

[43]

The factory was built, but the plan was ultimately cancelled as a result of falling demand, and the factory switched to making buses instead. [44] - Volkswagen opened a $250 million factory in Westmoreland, PA in 1978 to assemble Rabbits. [45]

- Honda was manufacturing motorcycles in the United States by 1979. When the motorcycle factory was confirmed in 1977, Honda executives said that if production went as expected, “it is our present intention to start manufacturing automobiles by expanding the plant site.” [46]

- The decision of whether to build an American plant was in front of the Nissan board for 10 years before the oil shock of 1979. The hesitance was about the concern that Detroit would fail to get its act back together and leave them with factories that were not competitive. [47]

Undoubtedly, the 1980s and 1990s brought a much more rapid pace of factory building in America by foreign automakers. But if avoiding VER had truly been the reason for it, the trend would have been limited to Japanese automakers. It wasn’t.

Instead, both Japanese and non-Japanese automakers from abroad were shifting production to the United States or the other NAFTA countries whenever production of a given vehicle reached a high enough level. Automakers first tested the market with imports at smaller volumes, and then accommodated higher volume models with regional production.

Japanese automakers were coming to the United States in such big numbers because, in addition to having become the most productive auto companies in the world, they were making cars that were hugely popular with American drivers. The same is true for Korean and many European automakers now — even though the VER never applied to them and it expired more than three decades ago.

Finally, I have focused so much of this analysis on VER and the events of the early 1980s because they loom so large in the story told by protectionists, but I have not yet mentioned perhaps the most trenchant example of auto protectionism that continues to this day. Originally intended as a temporary policy, a retaliation against Europe for their tariffs on American chicken imports, the United States has upheld a 25 percent tariff on imported light trucks since 1964. [48] The result has been less competition, fewer choices, and higher prices for American buyers of these vehicles. [49]

VER lasted a decade longer than it was meant to, but at least it finally did end. The light truck tariff reveals the danger of implementing a policy that initially is not meant to be permanent but turns out that way nonetheless. A new protectionist policy can be sticky, leading to political apathy and status quo bias as policymakers accustom themselves to it, fearing the backlash from the protected industry if they try to undo it. In the case of the truck tariff, a policy response in an unrelated trade war ended up remaining in place for more than six decades — and counting.

—————————————

To summarize, the policy of Voluntary Export Restraints failed in its intended goal of giving American automakers breathing room during the crisis of 1979–82. It then did give them a windfall — by forcing American drivers to pay higher prices — after the crisis had passed. Data and the economics of the auto industry support the likelihood that the Japanese companies were destined to eventually open American factories in greater numbers regardless of VER, just as other major auto producers did after VER had expired.

As industrial policies go, this one was hardly a riveting success to be emulated.

Conclusion

This history matters. By enacting 25 percent tariffs on auto imports, the Trump administration has once again decided that globalization is the problem and protectionism the solution.

Supporters will point to the decimation of the American auto industry as demonstrating the need for trade barriers. This claim is false.

Protectionists will doubtless continue pointing to the entrenched economic struggles of Detroit and Michigan as proof that globalization was indeed the villain. This too is false.

And they will point to VER as an example of how temporary, targeted protectionism works in the auto industry to generate substantial new industrial growth. False yet again.

The arguments in favor of tariffs are not just based on mistaken interpretations of the history of the auto industry. They are based on a deep and persistent misreading of the history itself.

A clear and accurate understanding of the past reveals the flaws in the policies of the present.

.png)