Like always, you can see the code, data, and methods for this post on GitHub.

A few weeks ago, some residents of Orange County, California received a pair of worrying letters. The first came from Hoag, one of Orange County’s major hospital systems. The second came from Blue Shield of California, one of the state’s largest health insurers.

Both letters said the same thing: we are fighting with each other, and if we don’t stop fighting by July 1st July 15th, then Blue Shield will stop covering Hoag and you’ll need to find a new doctor.

The letters are the result of deadlocked contract negotiations between Hoag and Blue Shield. Each party is trying to set their preferred rates for the care Hoag provides: Hoag likely wants higher rates, while Blue Shield wants lower rates. Such negotiations usually happen quickly and quietly, but when they do spill into public, like in this case, it's often the result of an irreconcilable gap between the two parties.

Whatever the gap is between Hoag and Blue Shield, it isn’t detailed in their respective letters. The only hint at it comes from Blue Shield, which says, “Currently, Hoag hospitals are some of the highest cost facilities for our members in the region.” No further context is provided. No numbers or timeline for resolution.

This type of public payer-provider fight is increasingly common in the United States – 2024 saw a 54% increase in the number of public disputes compared to 2023. From Florida to Connecticut, health systems and insurers are duking it out in the court of public opinion like the cable companies of the 2010s. Both sides stoke outrage in the hopes of gaining a better deal, relying on the obfuscation and complexity of prices to win the vibe war. Patients are left waiting in the dark, hoping they don’t have to upend their medical care.

But this opacity isn’t inevitable. Thanks to price transparency data, it’s now possible to attach some numbers to these disputes, see where the parties actually stand, and ultimately develop an informed opinion. Hopefully, doing so will reduce payers and providers’ ability to appeal to emotions in the absence of hard data. At the very least, publishing these numbers will give patients the context they deserve.

So, as a proof-of-concept, let’s dive in and look at Hoag and Blue Shield. We’ll start with each party’s background and market position, then do some data detective work to figure out the most likely sticking point in their negotiations.

Hoag is a big player in the Orange County healthcare market. They have two major hospitals, an inpatient orthopedic institute, and a huge array of clinics, ASCs, and urgent care centers. All told, Hoag has ~620 inpatient beds and over 8,000 employees.

Hoag’s marketing heavily emphasizes care quality by citing awards, CMS ratings, and patient stories. They claim the title of “Orange County’s best health system” on their website. They seem to be positioning themselves as the premium (AKA highest quality) provider in the market.

Hoag’s main competition seems to be UC Irvine Medical Center, the other large (400+ bed), high acuity (CMI > 1.5) provider in Orange County. Hoag also competes with medium-sized, urban hospital networks like Providence and MemorialCare, whose facilities have similar bed counts, care acuity, and payer mixes.

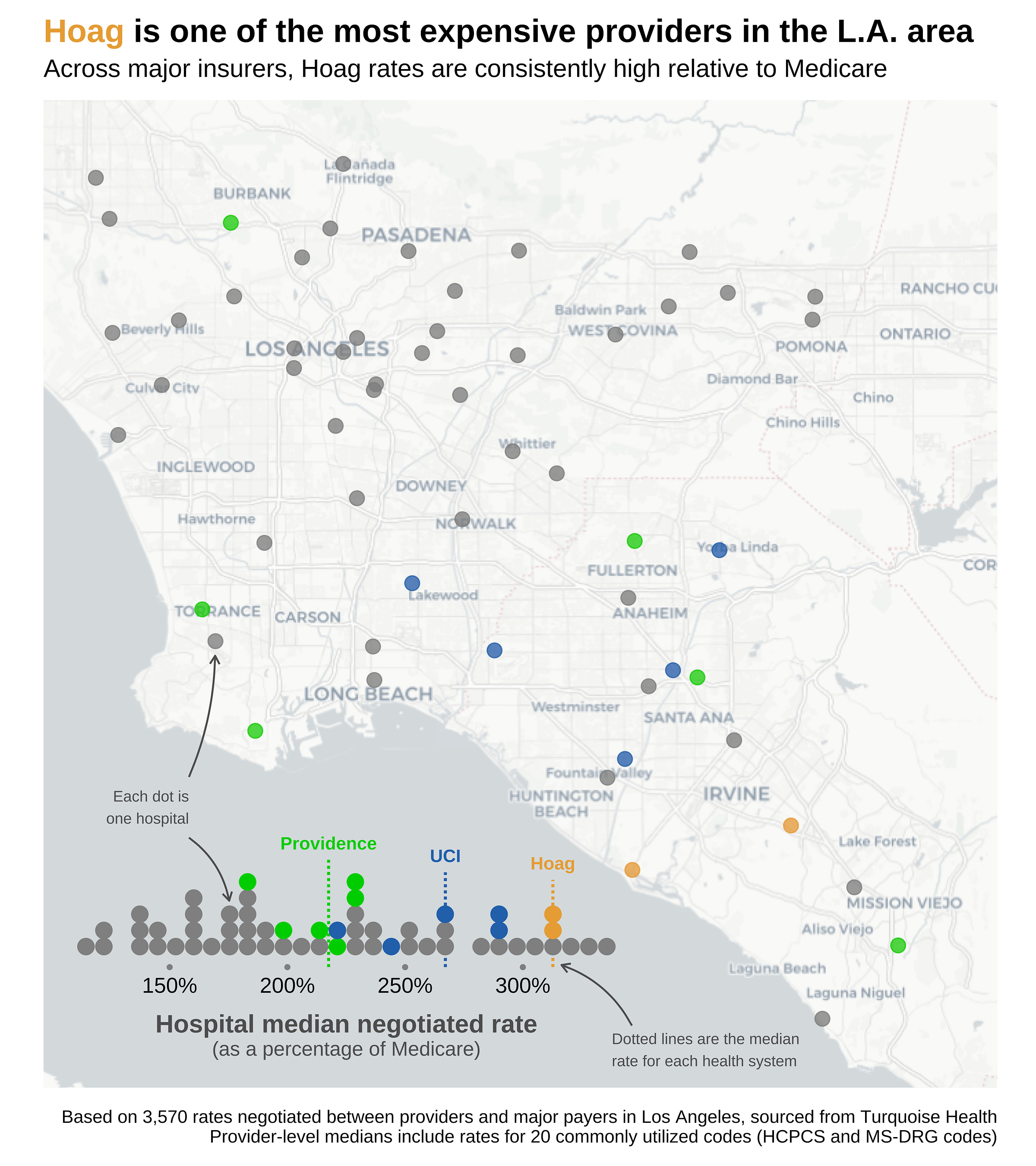

However, Hoag is much more expensive than its competition. The map below shows the median negotiated rate for major hospitals in Los Angeles, relative to Medicare benchmark rates:

Hoag prices are high, even relative to large academic medical centers like UCI and USC. The two Hoag hospitals shown here are the Newport Beach and Irvine locations, and both hospitals share the same set of high negotiated rates. The only hospitals more expensive than Hoag are a few Adventist outliers and St. Mary’s in Long Beach. Cedars-Sinai, perhaps LA’s most well-known hospital, is just below Hoag.

This map has some caveats. It doesn’t show every hospital (some are excluded for lack of data, Kaiser is excluded because it’s an HMO). It relies on a (carefully chosen) sample of rates for 20 representative procedures. And it only includes rates from 5 major insurers. But the conclusion here is robust, changing the particulars doesn’t change the overall takeaway: Hoag’s premium care comes at a premium cost.

But what about Blue Shield? Let’s take a look at the other party in this fight.

Blue Shield of California is the third largest health insurer in California (~15% commercial market share), behind only Kaiser (at 37%) and Anthem/Elevance (at 24%). Based on aggregated claims data, I estimate Blue Shield has slightly higher market share in Orange County (around 18%).

Blue Shield has a history of publicly feuding with California hospitals. In 2024, it settled a (much spicier) contract negotiation with Providence Health, followed by a similar negotiation with Stanford Health in Northern California. It is currently negotiating with both Hoag and the UC health system, with both contracts set to expire on July 1st.

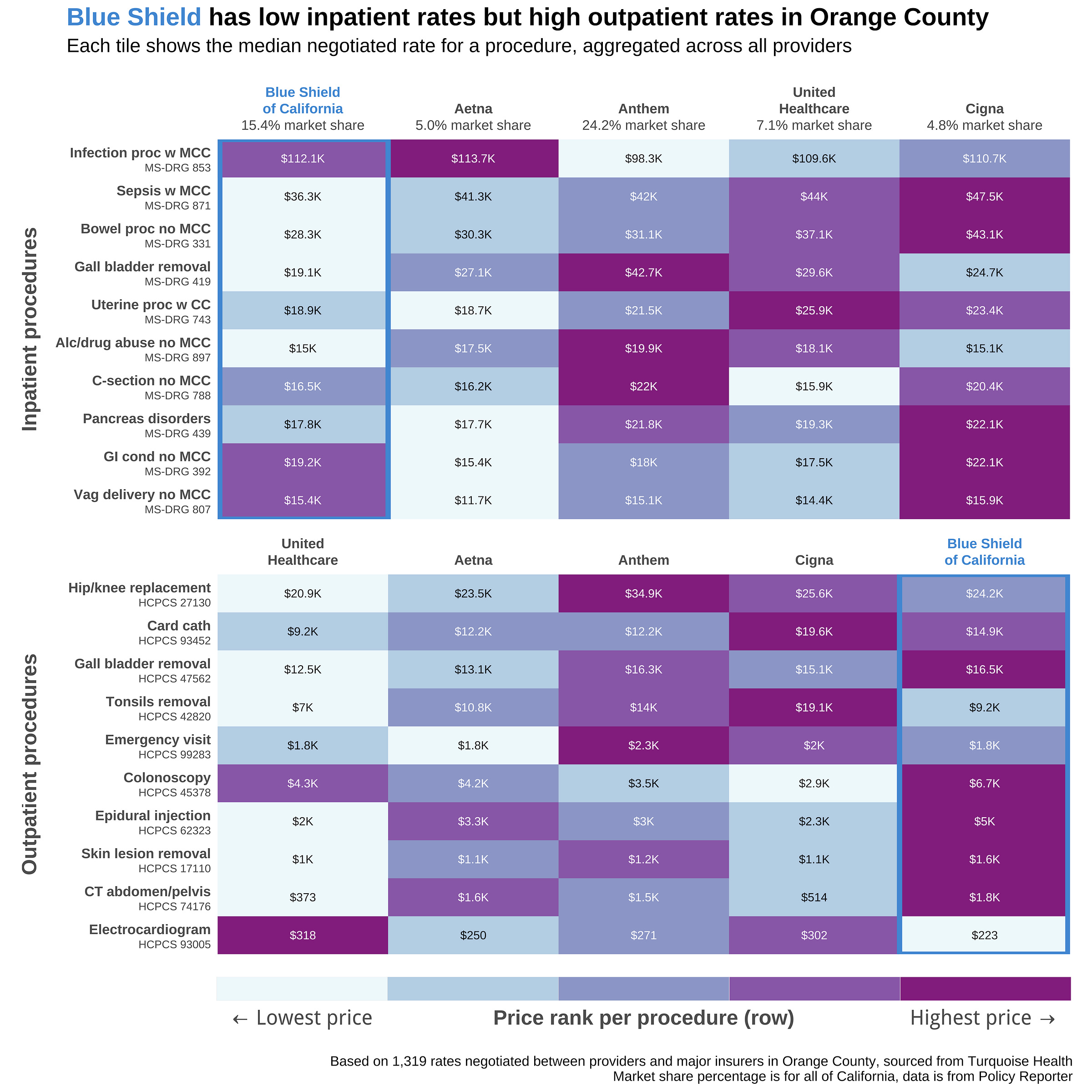

In Orange County, Blue Shield’s main competition (besides Kaiser) is for-profit insurers with similarly large networks. Here’s how Blue Shield stacks up:

Basically, Blue Shield is weird. Relative to other major insurers in Orange County, Blue Shield has the lowest inpatient rates and the highest outpatient rates. Their rates are particularly high for cheap(er) procedures like CT scans and colonoscopies. From the outside, it’s hard to know the reason for this split. It’s possible that Blue Shield is offering higher outpatient rates as a tactic to make providers take a cut on their (typically higher cost) inpatient rates.

So, Hoag is expensive relative to other hospitals. And Blue Shield is a bit idiosyncratic but is probably in the middle or top end of payers. If they’re both near the top of their respective markets, why are they still fighting?

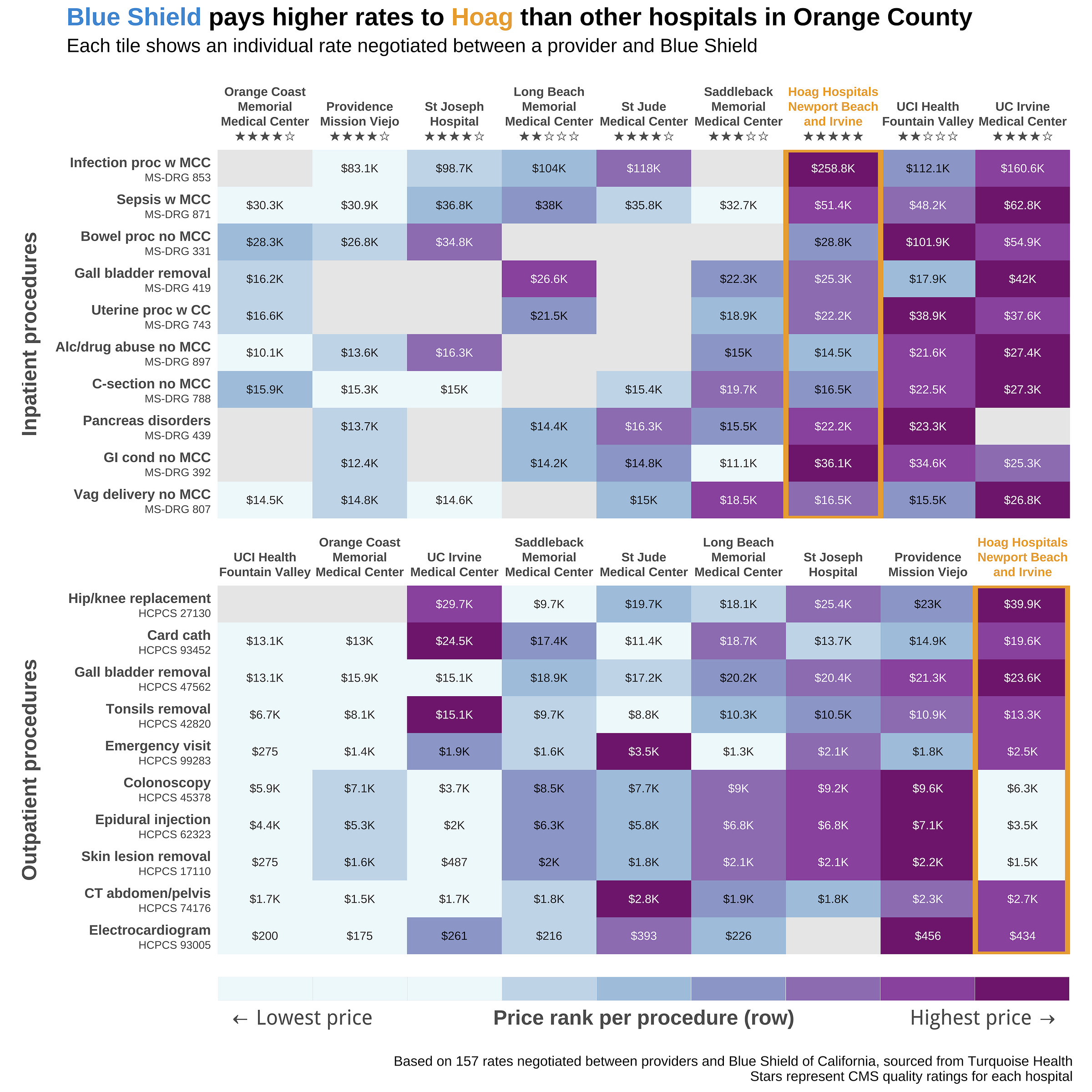

To return to Blue Shield’s hint from their press release, “Currently, Hoag hospitals are some of the highest cost facilities for our members in the region.” Let’s see if that’s true:

So Blue Shield isn’t lying. Hoag really is an outlier among their Orange County providers. They have the highest outpatient rates (by a large margin) and are behind only UCI for inpatient rates. I think the story here is actually pretty simple – Hoag is just really expensive for Blue Shield.

To flesh this out and speculate a bit, I think each party is looking at a different set of comparable providers.

Hoag positions itself as the premier hospital in Orange County, offering the highest-quality care. They’re likely comparing themselves to other top-end providers like UCI, USC, and Cedars-Sinai and demanding the same compensation. Hoag is banking on their brand and betting that Blue Shield needs them to maintain a strong network in the area.

Meanwhile, Blue Shield is comparing Hoag to the other regional hospitals in Orange County and finding that it’s one of the most expensive providers on their books. Blue Shield is probably trying to bring Hoag’s rates in line with systems like Providence and MemorialCare, and is betting they can strongarm Hoag using their market share.

Of course, there are probably lots of other sticking points here, overall cost is just the big, obvious one. Hoag’s Medicare cost-to-charge ratios are high for inpatient care, indicating that they’re not making much money on the inpatient side. It’s possible that they’re pushing for higher inpatient rates or more favorable (i.e. flexible) contract types.

Ultimately though, the dispute between Hoag and Blue Shield likely boils down to a fundamental disagreement about the value of Hoag's care, with Hoag emphasizing its quality and Blue Shield focusing on cost relative to other regional providers.

Blue Shield and Hoag aren’t the only players having this kind of fight. The media covers dozens of disputes like this each year, and almost none of that coverage includes hard numbers or data.

That opacity is strategic. Healthcare is emotionally charged, and when negotiations go public, it’s easier for both sides to appeal to emotion than to defend their financial demands. Providers invoke loyalty and quality. Insurers warn about affordability and access. Patients, meanwhile, are left vulnerable, anxious, and uninformed – forced to choose sides in a game with no clear score.

But that can change. Price transparency data lets us peek behind the curtain. It offers a concrete foundation for patients to form their own opinions and avoid being used as leverage. Patients deserve visibility into the processes that affect their healthcare – and we’re here to provide it. Subscribe for future articles that bring clarity, context, and data to the complex world of healthcare.

.png)