These days, the media is struggling to keep up with WallStreetBets' latest meme stock of the day, whether it is OpenDoor, Kohl's, Krispy Kreme, GoPro, or Sydney Sweeney's American Eagle. The bigger story of the trillions in acceptable speculations sucking most of the capital out of the market is being ignored. The result is a massive imbalance in capital allocation.

Traditional meme stocks are simple: Reddit picks a target, chaos ensues. But there's another breed of inflated assets I call 'Blue-chip meme stocks'.

These aren't your cousin's YOLO plays. They're respectable companies with boardrooms and everything, except they're riding massive speculation waves based on compelling future stories.

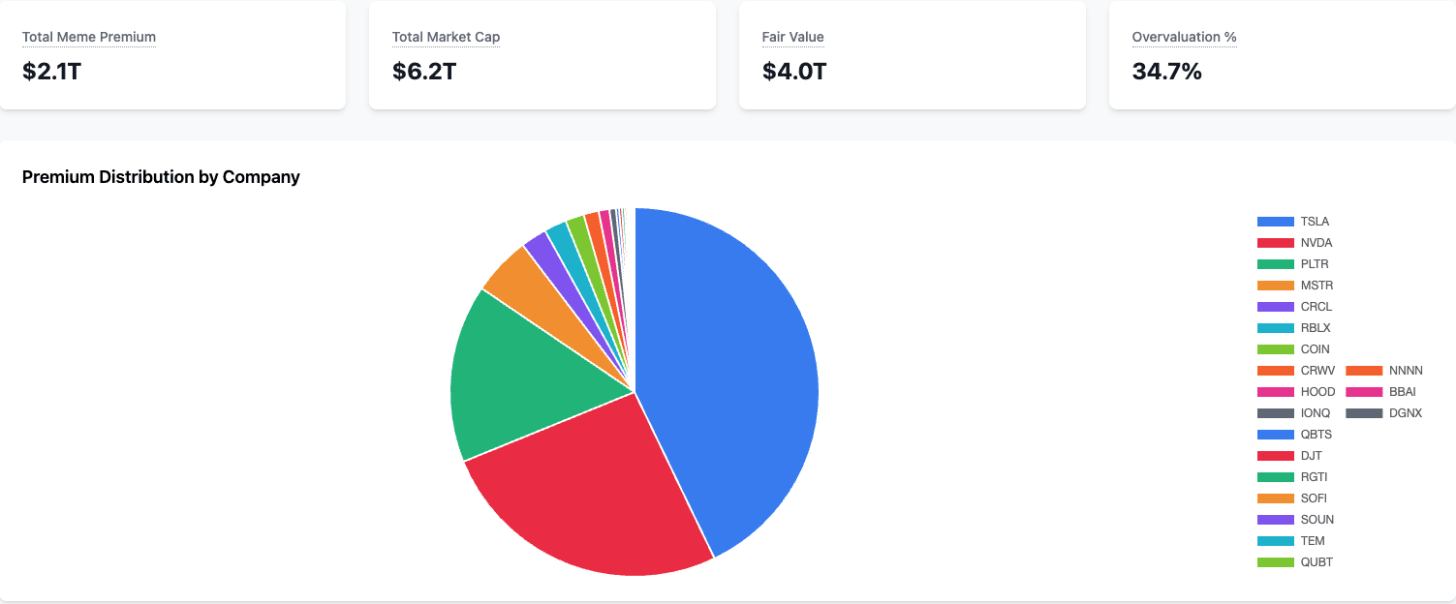

The money flooding into these stocks is staggering. We're talking trillions of dollars that could be going elsewhere, but instead are chasing the next big narrative. The graph below from Wasted on Memes shows just how much premium investors are paying for these stories—over $2 trillion as of July 28th.

The Blue-chip meme stocks are the stocks with the most media coverage; these are companies that are owned by most individuals in the form of ETFs. Those companies have huge momentum in their stock price based on how compelling their future story is. The current meta favors AI and crypto. Examples of these companies are Nvidia, Palantir, Tesla, Roblox, AMD, and recent IPOs of Circle and CoreWeave.

Take Circle, the stablecoin company. They're not even the market leader, yet their stock is up 600% since going public two months ago. The kicker? They're trading at 23 times sales with gross margins that are worse than my local supermarket.

While CoreWeave, the AI cloud-computing startup, has less than a year of cash runway, it is trading at a price-to-sales ratio of 21 after growing over 200% after its IPO.

Sometimes the speculation disease hits a company that isn't even AI or crypto. This happened to the Chinese traditional medicine company Regencell, which has no revenue and lost over $10 million in the last two years, yet has had its stock grow year-to-date by 11,000+% for no reason. These returns will make even the most WallStreetBets degenerate blush.

Now, Nvidia defenders will jump in here. 'But wait!' they'll say. 'Nvidia isn't speculative—they literally own the AI chip game!'

Fair point. Nvidia does have a monopoly on the hottest hardware on the planet. But here's where it gets spicy: with a $4.3 trillion market cap, even a modest 10% overvaluation equals $430 billion. That's not a rounding error—that's Norway's entire GDP.

Still think that's impossible? Remember the DeepSeek incident earlier this year? One Chinese startup whispered 'maybe we don't need that many chips' and—poof—$600 billion vanished from Nvidia's market cap in a single day.

As the retail investor is chasing the hype and the VCs are funding the 30th Cursor competitor, all the money moves to speculative investing. Trillions of dollars move, and many industries start getting starved of capital. Sectors that aren’t AI or crypto have a massive crisis in funding. Here's the damage:

Biotech struggles: Public markets aren’t interested, forcing startups to tighten budgets.

Cleantech funding hits 4-year low: Deal counts and investment sizes are shrinking across the board.

Fintech's 3-year slump: VC investment continues to decline for the third consecutive year.

Given the huge amount of money going into the blue-chip meme mania, we need to ask ourselves how we can take advantage of it.

As the name of the newsletter suggests, markets are not efficient, and blue-chip meme stocks are one living proof of it. The more money flows to speculative assets, the more likely other assets get undervalued. While it is not mechanically accurate, we would expect more stocks and industries to be ignored in favor of the hype. Even once-hot industries like food delivery may have better potential than a great speculative story everybody is chasing.

But if you're looking to play the speculation game itself, blue-chip meme stocks are the play that would make Charles Ponzi proud of you. If you decide to trade money in speculative plays, you need to know the rules that will make you a winner.

How great the story is determines the meme premium. The earlier you are on a story, the better you position yourself in the wave. However, the story has to be not only simple but also hard to validate. For example, Palantir made it clear they are making money selling AI to their customers, but the majority of retail investors don’t truly know what the company does. It is a classical Dunning-Kruger effect.

How active is this company on social media? You'd better get those companies in their warm-up phase, not after they are cooked. The easiest way to figure this out before most investors is to check if the company has its own exclusive subreddit. Also, check the activity and the sentiment on those subreddits. You want to see an army of followers similar to r/PLTR, which has 106k members, and r/NvidiaStock that has 80k members.

If you're betting that these stocks will compound over the next 10 years, you are probably betting on the wrong horse. For most of these stocks, the moment there is doubt in their story, capital will run away like a company distancing itself from a CEO and CPO affair scandal. You will be in a similar spot to your friend who is still holding GME stock from 2021.

Bottom Line: The market's having an identity crisis where blue chips cosplay as meme stocks and everyone's invited to the trillion-dollar costume party—just remember, when the music stops, you don't want to be the one still dancing.

.png)