Greetings from Read Max HQ! In today’s edition, some thoughts on predictions markets and suckerfication crisis facing American men.

As every week, a brief reminder that this newsletter is funded by paying subscribers, whose support and generosity allows me to keep at least one newsletter every week open to all readers. If you’ve been enjoying the weekly column as a free rider, please consider returning the favor that paying subscribers are implicitly doing for you by upgrading to paid: For about the price of one beer a month, you’ll ensure that I can continue to entertain you, inform you, bore you, weird you out, etc.

Among the funnier subplots in the run-up to this week’s elections has been the social-media marketing campaigns of popular predictions markets like PolyMarket and Kalshi, which have been tweeting insanely misleading slop touts like so:

If you haven’t encountered them before, predictions markets are effectively non-sports sportsbooks where you can place wagers on the outcome of events like elections, but they’re structured much more explicitly like financial markets, where your wager is treated as a futures contract that can be sold rather than as a “bet” that you’re “cashing out.”

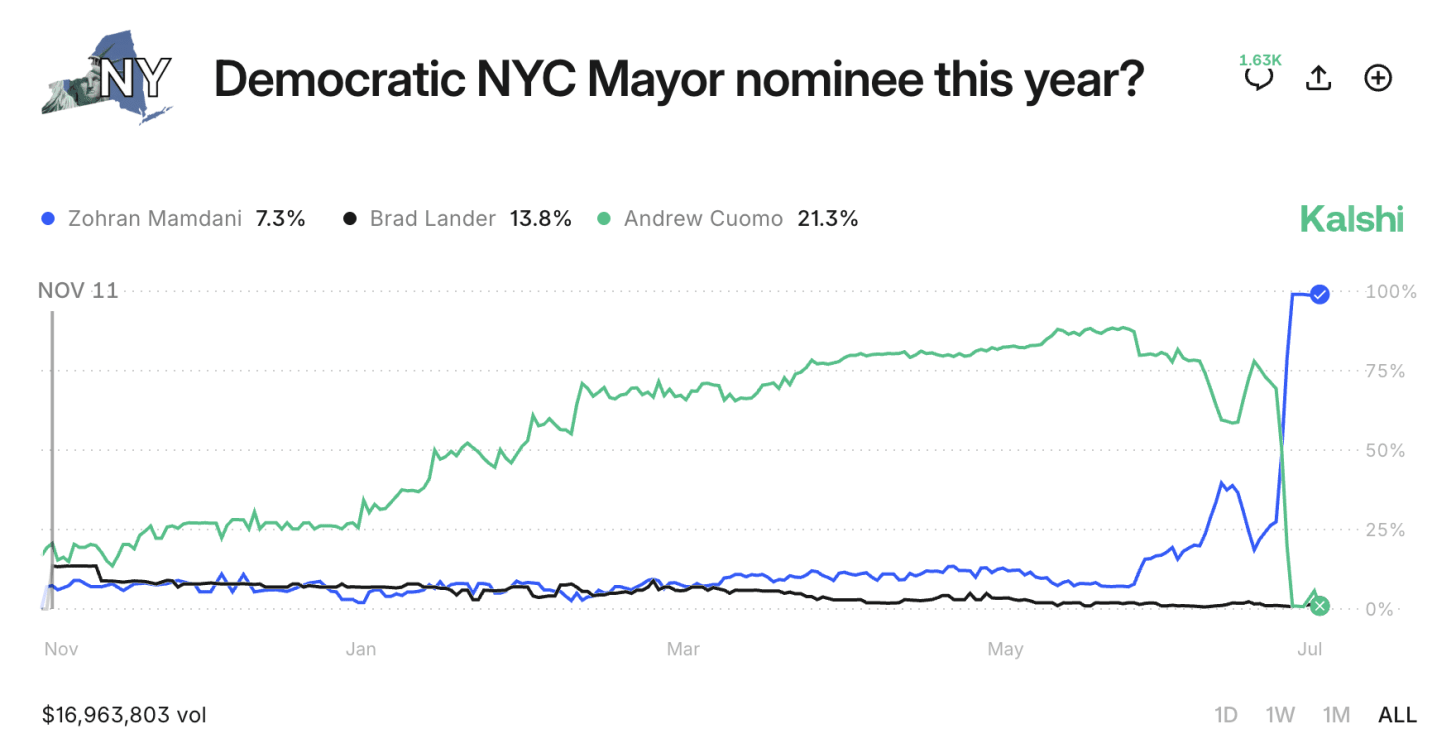

Around this time last year, e.g., you could have “bought” for about 20 cents a futures contract guaranteeing a payout of $1 if Andrew Cuomo won the N.Y.C. Democratic Primary--a more sophisticated way of saying “bet on Cuomo to win at +400 odds.” You could have then “sold” those contracts around Cuomo’s peak in late May for around 90 cents--i.e., cashed out your wager at -900 odds--and made a tidy profit. Or, you could have held on to the bitter end, hoping to quadruple your money, and lost it all.

There’s a lot of academic economic literature around predictions markets, which are particularly beloved for converting “the wisdom of the crowd” into implied odds. (At least, when the markets are large and liquid.) If a “Cuomo to win the N.Y.C. Democratic Primary” contract is selling for 90 cents--suggesting a low-risk bet without much upside--that means that most people expect him to win. (More specifically you might say that if the wager is trading at that price, conventional wisdom is assigning a 90 percent probability to Cuomo victory.)

But if you thought, at the time, that Zohran Mamdani was likely to win--or, even, if you thought he was more likely to win than the “implied odds” were suggesting at that moment--you could buy contracts at about 7 cents, expecting the price to rise, thereby putting “skin in the game,” and, depending on the size of your wager, updating the odds to reflect your new estimation of the election. And, without even needing to risk your own money, you can use predictions markets as a rough measurement of “conventional wisdom,” for at least certain, potentially narrow values of “conventionality.”

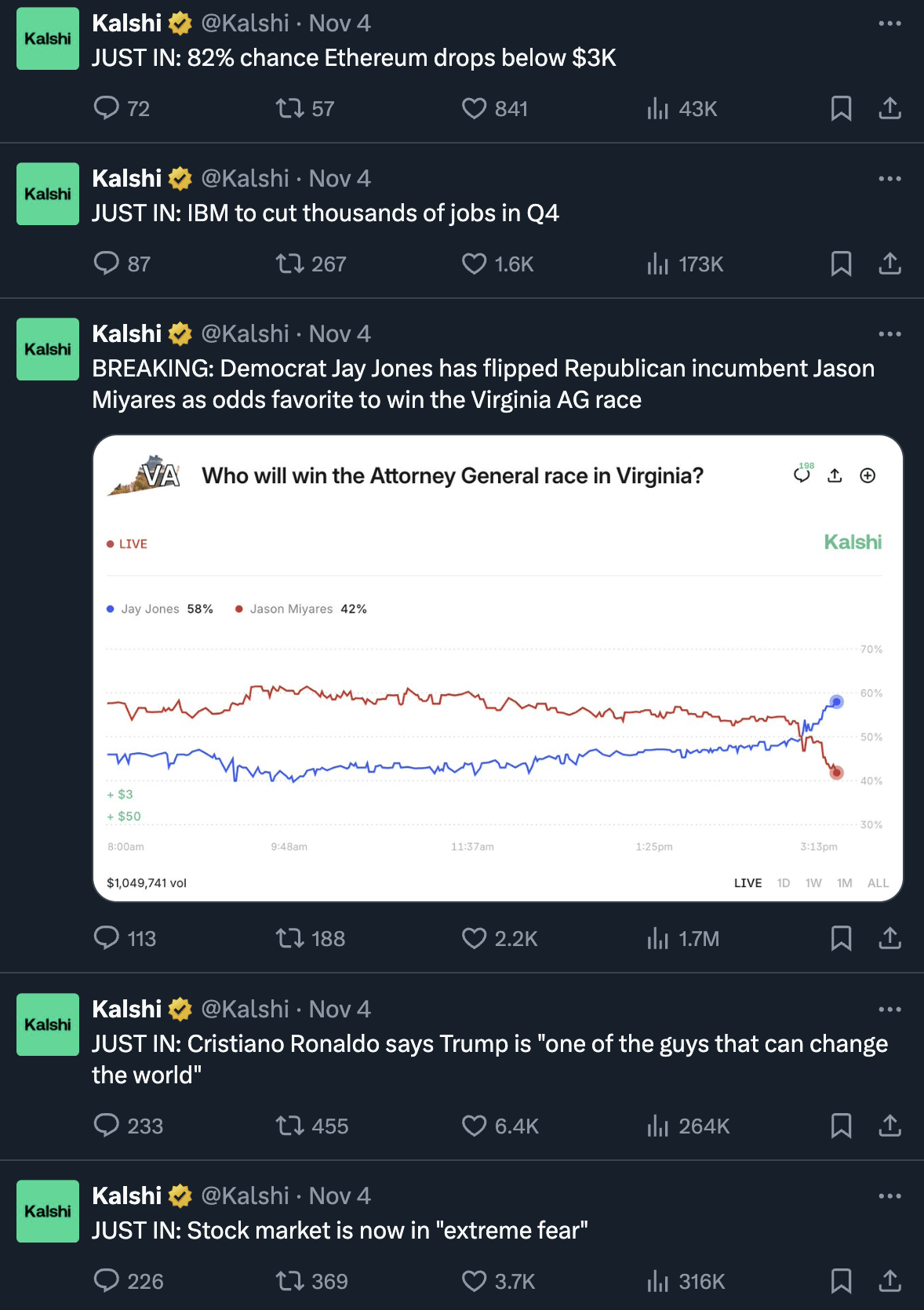

But the main thing to understand here is that these are sites where you bet on the outcome of elections (and, really, anything else), and because they are venues for gambling and speculation, they are heavily populated by young men with right-wing politics. I know this not because the markets over-rate conservative political outcomes (I’m not sure they do, in aggregate), nor because the comment sections on Kalshi are filled with boorish young reactionaries (though they absolutely are), but because “epistemically captured right-wing hobbyist gamblers and speculators” (which is to say, the average X.com user) is precisely who the markets have been targeting the past week, and for many weeks before that, on Twitter. Here is just a small flavor of the Kalshi account:

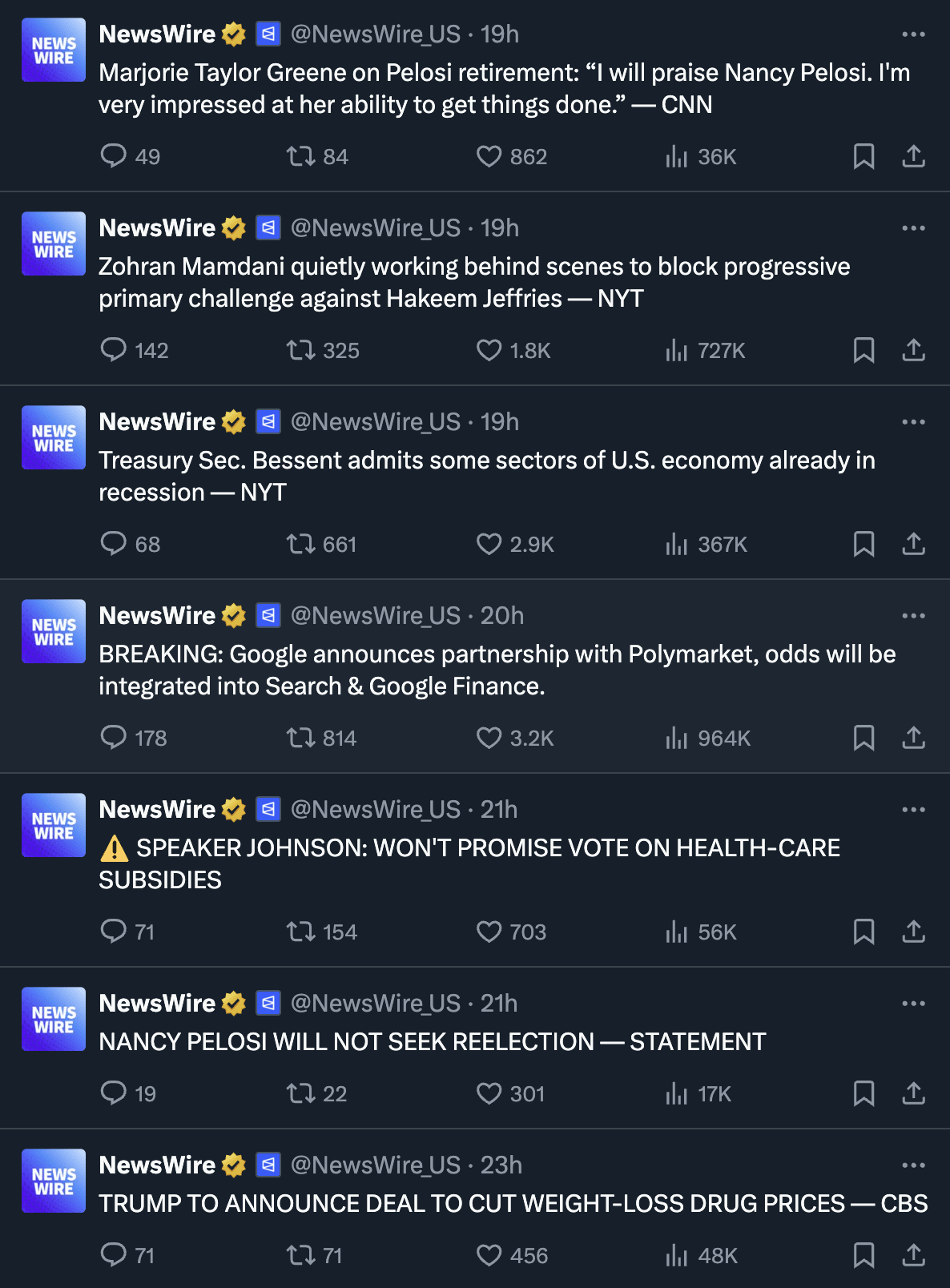

If you still spend time on X.com, you will recognize here precisely the same clipped, decontextualized, link-free, moronically breathless style of tweeting deployed by “financial news for low-trust illiterates” accounts like Unusual Whales or ZeroHedge (or, for that matter, in a slightly different arena, PopCrave). Polymarket even runs one of these accounts itself--an entirely separate, barely branded “News Wire” account consisting of extremely dubious headline summaries of news articles:

The main difference is that where Unusual Whales and its peers tweet wish-fulfillment and fear-mongering engagement-bait in exchange for payouts from X.com, Kalshi and Polymarket intersperse their “BREAKING: Trump Might Win Nobel Prize” posts with enticements to bet on the strange and volatile world depicted in the other tweets. The first-order goal of, say, posting an A.I. image of Zohran Mamdani crying with the text “BREAKING: Mamdani’s odds collapse in the NYC Mayoral Election” is not to pollute the information environment with fake news and propaganda; it’s to entice X.com users whose brains have already been fully liquified by news slop to put their dumb money where their dumb mouth is.

Which is not so say that there are no corrosive second-order effects to this kind of marketing. Nor, for that matter, that the marketing would be acceptable were its only purpose to mislead a bunch of dupes.

One way of thinking about Twitter, especially in the Elon Musk era, is as the latest and most sophisticated version of the mailing lists that have powered the conservative movement, and the various scams and cons and schemes that constitute it, since the 1960s--in other words, as a huge and immediately accessible collection of suckers, waiting to have their avidity and paranoia exploited for cash. The predictions markets here are happy to play the same role with heavy X.com users as crypto scams and meme-stock hustlers did on the same site a few years ago, or as cash-for-gold ads did with Fox News viewers a decade before that, or as direct-mail get-rich-quick schemes did with Goldwater voters deep in prehistory.

But the demand for dumb money created by the increasing annexation of our everyday social and cultural lives into casino-market hybrids like predictions markets (or, arguably, social media itself) isn’t going to be satisfied solely by a pre-existing population of Birchite suckers. We talk a lot about the “male loneliness crisis” but in my estimation we don’t talk enough about the “male suckerfication crisis”: The process by which young men are continuously cultivated--by politicians, influencers, podcasters, sportscasters, and the very structure of social networks--as dupes and suckers, both for the enrichment and empowerment of Trumpist politicians and movements but also in service of the profits of an ever-expanding roster of gambling and gambling-adjacent industries, among them app-enabled retail day-trading, crypto speculation, predictions markets, and of course, actual sports betting.

“Young right-wing men who gamble” is not a hugely sympathetic group of people, granted, and lord knows their continuing existence allows anyone with fairly basic reading comprehension skills to earn some easy money. (Full disclosure: I’ll walk away from Tuesday’s elections about $500 up.) Some of them even make enough money to crash Lamborghinis in Miami while live-streaming. But the larger population isn’t wising up on their own, and, as we more tightly integrate predictions markets into the media ecosystem, we seem intent on producing more of them. In the same way that sports media has almost entirely been given over to gambling, news organizations are increasingly using prediction-markets odds to forecast events, and this week, Google announced a partnership with Kalshi and Polymarket to include their pricing in some search results:

Google said Thursday that the deal with allow its users to “harness the wisdom of the crowds.” As an example, it said that a user asking about future GDP growth will be offered the odds reflected on the exchanges.

I don’t mean to say this isn’t or can’t be useful. But is it worth the sociocultural infrastructure necessary to make prediction markets usefully “predictive”--a nation of gamblers, effectively, scrolling through lying slop touts on Twitter?

.png)