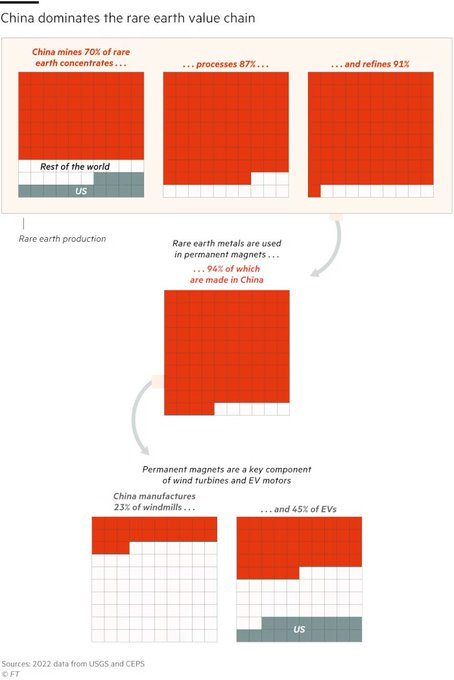

Recently, China’s dominance of Rare Earth magnets really came to the forefront. While many people have heard about China and Rare Earth, the following chart from 2022 provides a good overview of just how dominant China is. Now while 94% of RE metals used for permanent magnet are made in China, China’s dominance in the higher end heavy Rare Earth metals is in even higher (99%). Basically, China controls full supply chain at every step (with only mining below 80%). This is not surprising when you look at other metals where China also dominates in refining and processing as well as being the largest consumer. Of course, if this chart was done for today, China would be an even larger consumer for wind turbines and EVs.

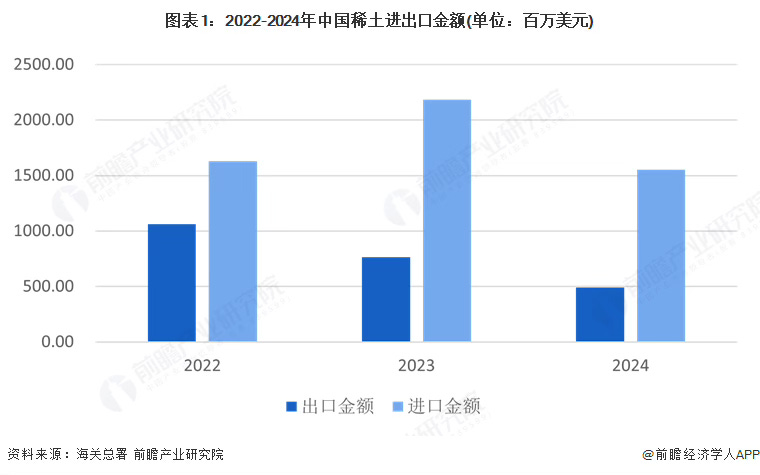

Now, we know that China has been imposing export restrictions on critical minerals since 2023 (after second round of Biden Tech war). It has gone up steadily as the tech/trade war picked up. It reached the maximum level in April as part of retaliation against Liberation Day tariffs. Interesting enough, China’s Rare earth exports have been falling even before this year, despite the fact that rare earth applications continue to increase. This points to China possibly just taking over more high end manufacturing or foreign companies reducing their RE inputs. Just as interestingly, China has almost stopped exports of RE metals & compounds. Most of its April exports were the higher value added magnets. That makes a lot of sense since China would want to squeeze out RE magnet producers that depend on Chinese Rare earth alloys. This is not good news for RE magnet producers out of China.

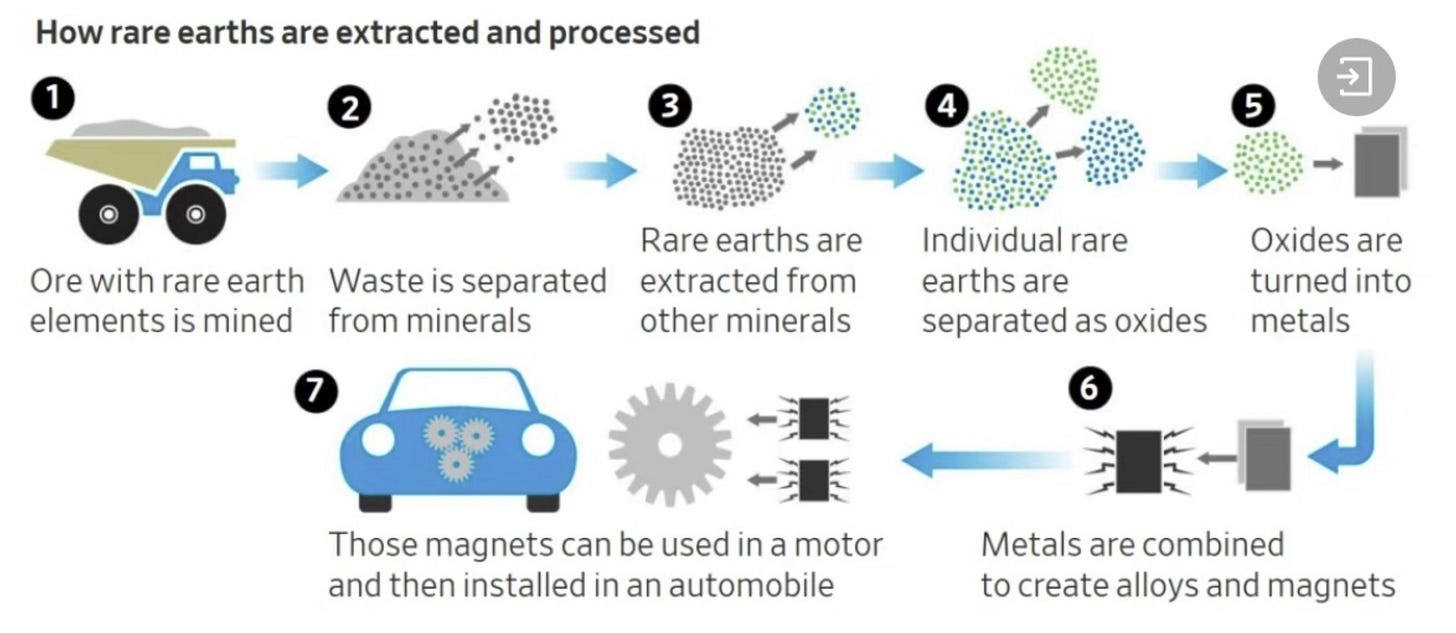

The one thing that I have repeatedly pointed out to people is the misconception of Rare Earth as just something you dig out of the ground. It is grouped together with other critical minerals. While Rare Earth is dug out, separated, extracted, processed and refined, these are not simple processes. In fact, China now has all the R&D and patents on Rare Earth supply chain. It has many university grads trained on it, while Western countries have lost that expertise. However, it goes beyond even the refined metal or the alloy. The RE magnets themselves are not all created equal and higher end magnets are needed for more demanding applications like a lot of military stuff as recently pointed out by New York Times article on Samarium.

I often like sharing this table. These are different RE magnet products offered by JL Mag. Its NEV product can maintain coercivity at operating temperature of 200 deg C while maintaining highest energy density.

The heavy rare earth stuff are not only harder to refine and turn into alloy, but also to create high end magnets.

That is why China is actually importing more Rare Earth than it exports. What it exports is mainly not the raw rare earth or even refined rare earth, but the magnets as you can see above. Here is the import vs export figures from 2022 to 2024

Notice that it export $1B in 2022 (while importing $1.6B) and this $600m trade gap has increased in 2024 to $1B with $500m export and $1.5B import. So in many way, this has mirrored China’s dominant position in Titanium where it is the largest producer and importer by far. All that raw Ti allowed it to dominate production of downstream Ti products like Titanium sponge and alloy.

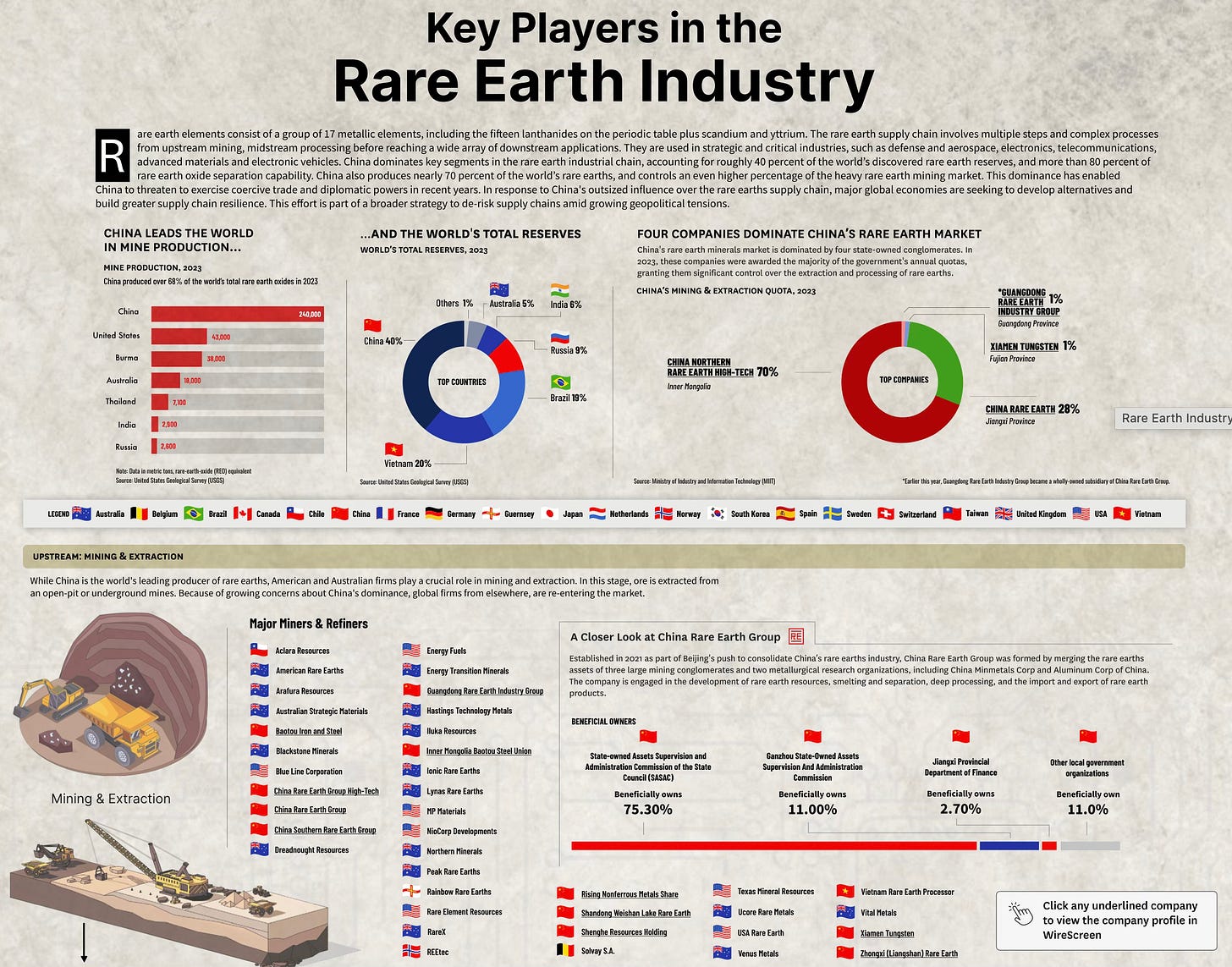

Remember that America’s great Rare Earth hope MP Materials is actually a huge exporter of rare earth to China. This is why China continues to allow export of end product, but not the intermediate process techniques. See below for just how the intermediary process is dominated by Chinese firms. No foreign companies on this supply list.

Whereas if you are looking at the upstream processes, China actually does not fully control the mining and extraction. Many other countries do have Rare Earth reserves. There is in fact many American and Australian companies in this list:

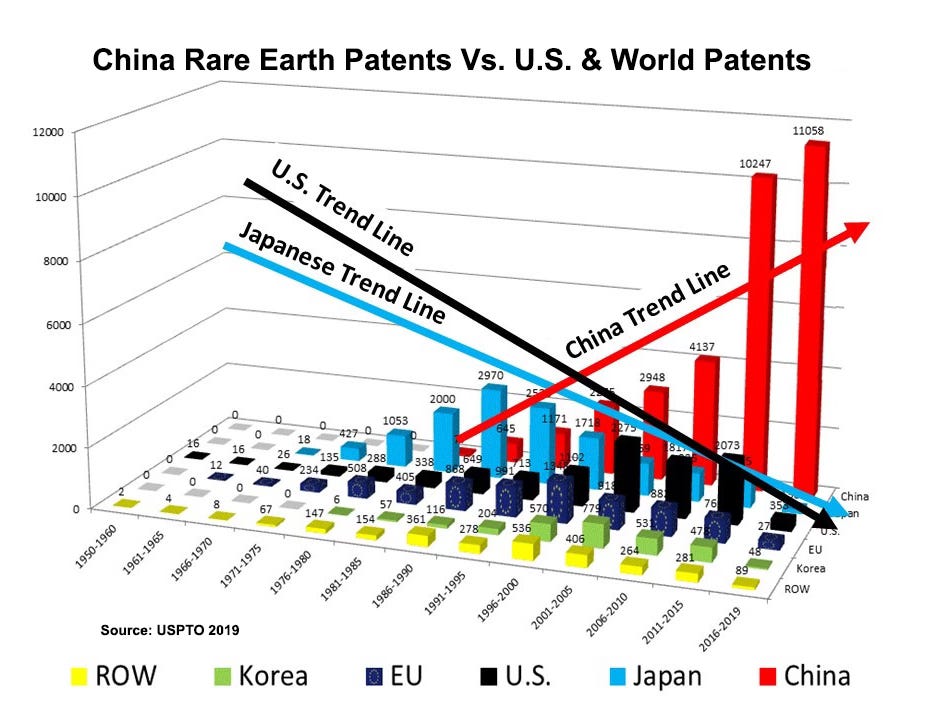

So contrary to popular belief, China does not just do digging and separation. It has built its leading position through hard research into all the intermediary steps and in turning them into those precious magnets. This graph below shows just how much more patents are generated in China vs rest of the world. All of the research and expertise now reside in China. This is a process that kept moving forward even after China restricted Rare Earth access to Japan in early 2010s. Japan’s RE research actually went down after that.

There are many research paper posted by Chinese researchers on improving recovery rate of rare earth from ores and doing so with lower cost and reduced environmental footprint.

Beyond that, it probably has achieved higher purity alloy which allows for more higher end magnets to be produced. Remember that the ability to use Heavy rare earth magnets is really important.

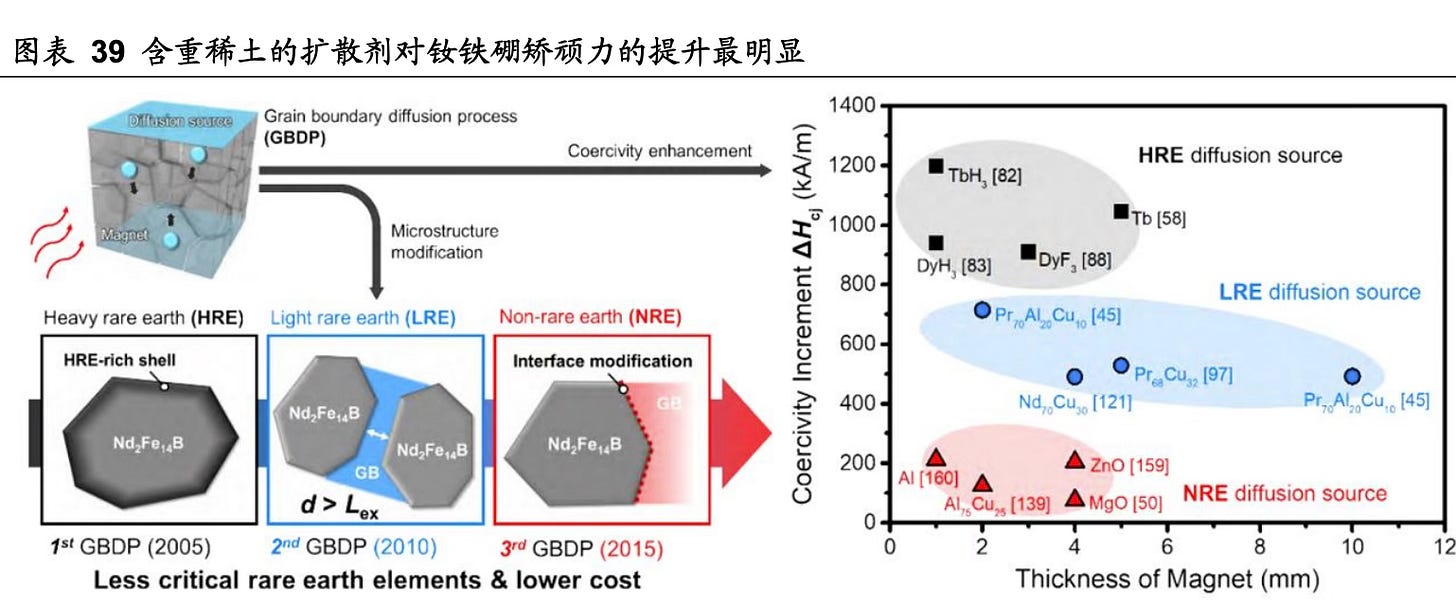

See above for HRE vs LRE vs NRE magnets. HRE clearly has higher coercivity than other types of magnets, even when they are relatively thin.

Keep in mind that China also dominates Rare Earth magnet production because it is far and away the largest consumer due to the huge clean energy industry.

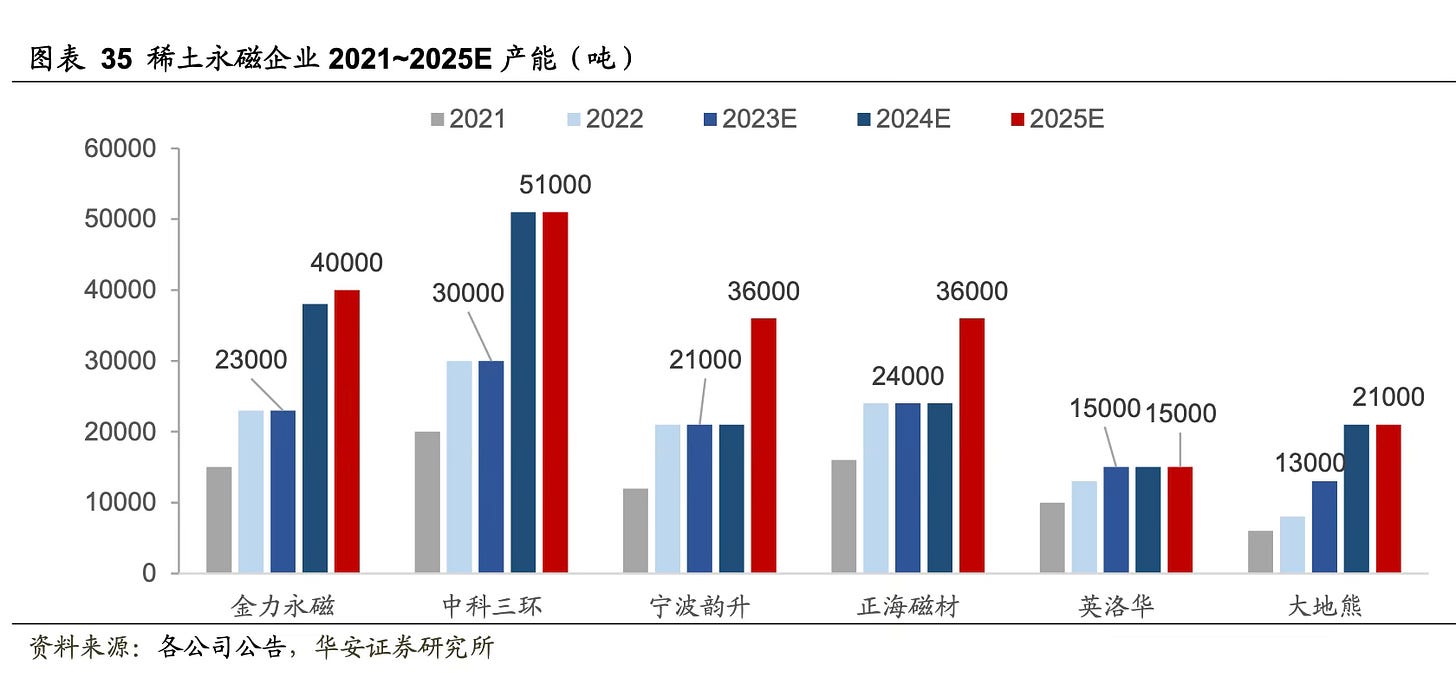

See above for all the production capacity increases from China’s major RE magnet players. Without this massive increase, China simply would not be able to increase EV production this quickly while also lowering its cost. Chinese industry really worked with upstream suppliers to scale up production.

As we move forward, the rest of the world also needs more RE magnets as we transition more toward new industries like EVs, renewable energy, AI data centers and humanoid robots. In the past, the world relied on Chinese producers to scale up production to meet the demand. Due to the new licensing requirements, this may scare away new industries like AI and humanoid robots from expanding quickly. Since US is China’s main competitor in these industries, the new export restrictions is an AI play as well as a national security play. China will likely grant export license to auto, aerospace and other existing users. But it can make plenty of national security excuses about granting licenses to military users or new users (which are typically AI focused). This is likely something that will hit US harder than other advanced economies.

It will be very interesting to see how the new RE magnet schemes affect America’s MIC production and AI development. China is likely to grant enough licenses to satisfy existing large consumers and dissuade other countries from making large investment into building their own RE supply chain. But also deny enough licenses to make lives harder for development of new emerging industries like AI in other countries.

.png)