Retail didn’t buy Bitcoin.

They bought volatility arbitrage shells.

And they lost $17 billion doing it.

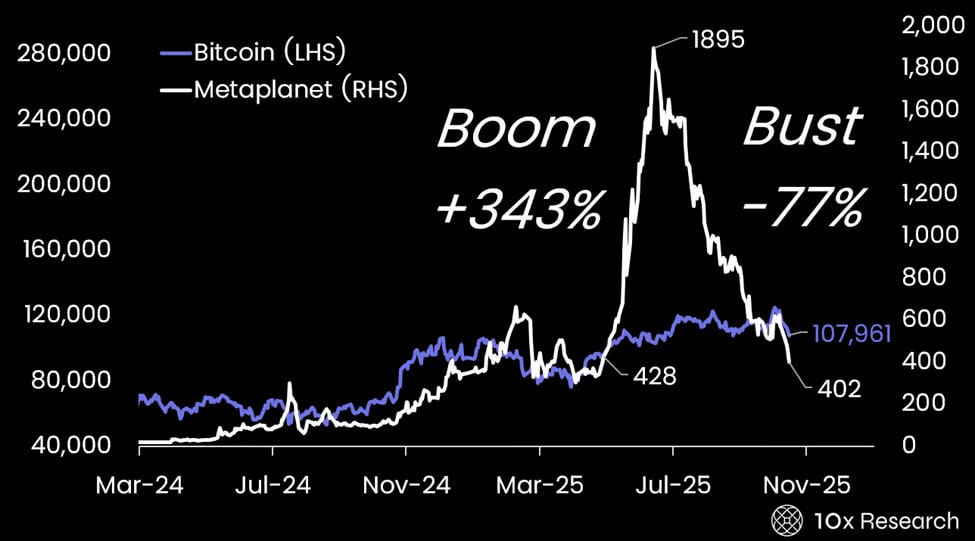

Bitcoin is up +15% YTD

But retail who bought Strategy or Metaplanet are losing money.

Why?

They didn’t buy BTC.

They bought shares of Digital Asset Treasuries (DATs) designed for convertible hedge funds.

Markus Thielen explained it

“Retail investors have lost an estimated $17 billion trying to gain Bitcoin exposure through digital asset treasury firms.”

These were not Bitcoin proxies.

They were volatility-selling machines.

Here’s how the trade worked:

- DAT issues convertibles, or fixed/moving-strike warrants

- Hedge funds buy them at premium terms

- Hedge funds short the stock to delta hedge

- High realized volatility = huge profits for funds

- DAT uses proceeds to buy Bitcoin

- Retail buys the stock… thinking it’s just “leveraged BTC”

But when volatility compresses?

- Hedge funds stop playing

- Issuance dries up

- Coin accumulation halts

- mNAV collapses

- Retail bags the losses

Market Net Asset Value (mNAV) was the illusion.

👉 Paid subs get market analysis with actionable trades, regulatory playbooks, and execution frameworks founders use to avoid $50k+ mistakes.

When mNAV > 1, DATs raised cash above asset value.

When mNAV < 1, new share sales destroy value.

Metaplanet went from $8B market cap to $3.1B.

It still holds $3.3B of BTC.

Translation: Retail got crushed. Hedge funds got paid.

As Markus Thielen, said it best:

“DATs need to evolve into structured asset managers. The age of financial magic is over.”

He’s right.

DATs must stop pretending they’re “Bitcoin treasuries.”

They are volatility factories - and must operate as such.

I’ve been warning about this for months.

These structures work only when mNAV is accretive.

When issuance arbitrage breaks, the whole loop unravels.

If you’re still holding these stocks thinking it’s just “BTC with leverage” - you’re playing a game you don’t understand.

Want Bitcoin exposure?

Buy Bitcoin.

Not someone else’s convertible-funded treasury shell.

Investors. Analysts. Builders:

DAT illusion is breaking.

Next wave of Bitcoin-native public companies must be engineered for transparency, reflexivity, and true shareholder alignment.

Not just volatility recycling.

Agree? Disagree?

👇

👉 9,000 read for free. 100s of founders, executives and funds, pay for actionable strategy memos, market analysis, and UAE/MiCA playbooks that shape trades, raises, and listings.

.png)