Hi, it’s Colin! Welcome to the 85 new subscribers who have joined Take Rate since the last Marketplace Memo. I am excited to have you join the 3,600+ marketplace founders, operators, and investors who subscribe. Join the fun! 👇

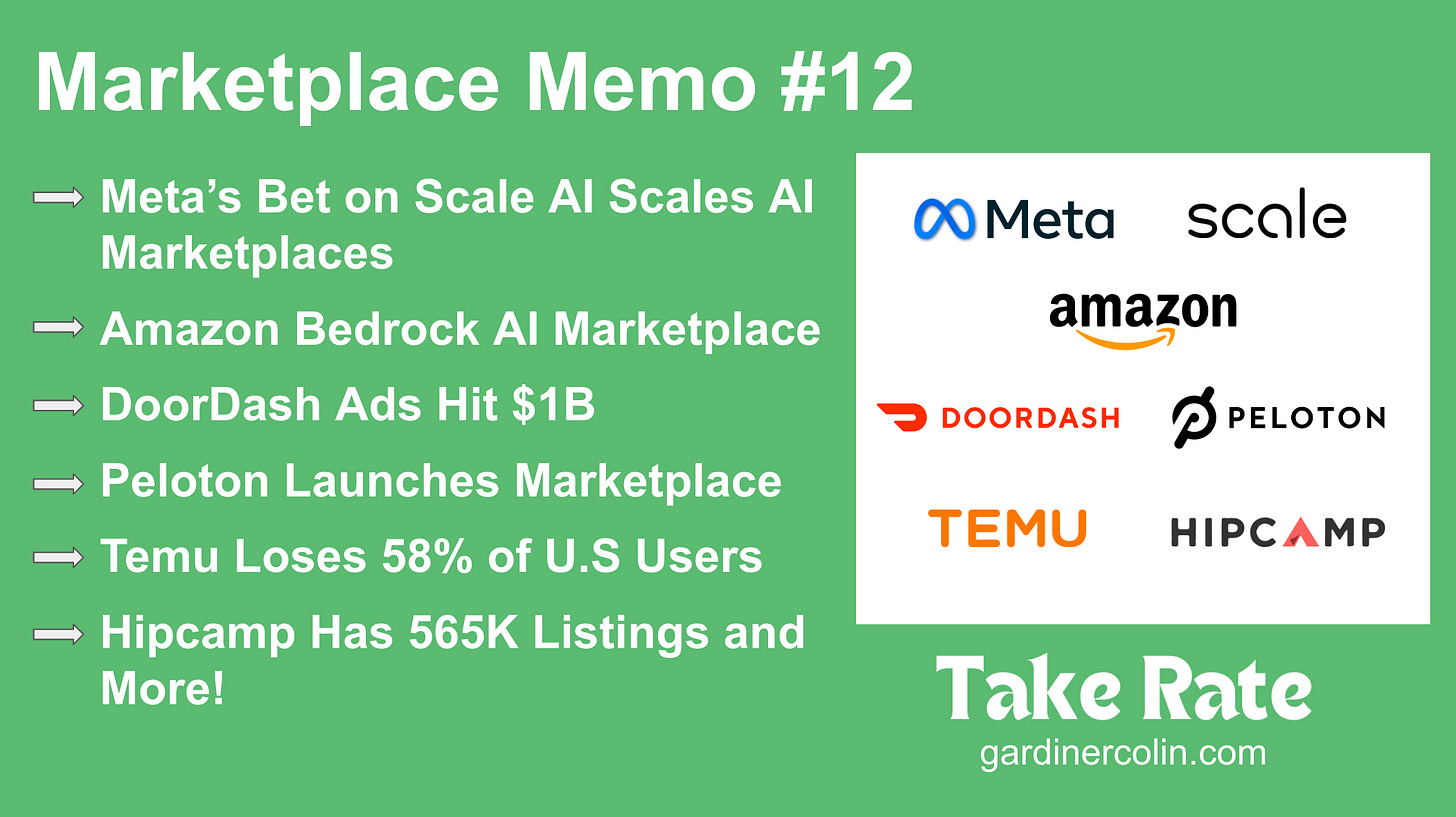

👋 Welcome to the 12th edition of the Marketplace Memo. My goal is to share curated news, content, and stories related to marketplaces, along with a splash of my own color. Please enjoy and share with others!

This post could have been vibe coded with…

Lovable – Create apps and websites by chatting with AI

Effortless product development, from idea to deployment. Lovable writes, debugs, and refactors code with you in real time. Build as fast as you can type.

Remember when building a marketplace required a whole engineering team, months of development, and a small fortune to get an MVP off the ground? First came the no-code revolution with platforms like Sharetribe, Bubble, and Webflow, making it possible for non-technical founders to spin up marketplaces in days. Now we're witnessing the AI-powered development era, where tools like Lovable, Replit, and Cursor are turning natural language into functional code faster than I can explain why GMV is sometimes a vanity metric. I've watched founders go from idea to working prototype in hours if not minutes.

The barriers to entry have never been lower, and we're seeing an explosion of niche marketplaces testing hypotheses that would have been too expensive to validate just a few years ago (as well as existing marketplaces adding features at a breakneck pace). But here's the thing that hasn't changed and never will: product-market fit still requires real people making real transactions. You can build the most beautiful marketplace interface in the world using the latest AI tools, but none of that matters if you can't get buyers and sellers to have a value exchange on your platform.

This democratization of building tools means that the real competitive moats are no longer in the technology itself. They're in understanding your market, building trust between strangers, and creating that magical moment when supply meets demand. The hard part was never the code; it was figuring out how to make strangers trust each other enough to transact. And that, my friends, is still the same complex problem it's always been, just with much better tools to help you solve it.

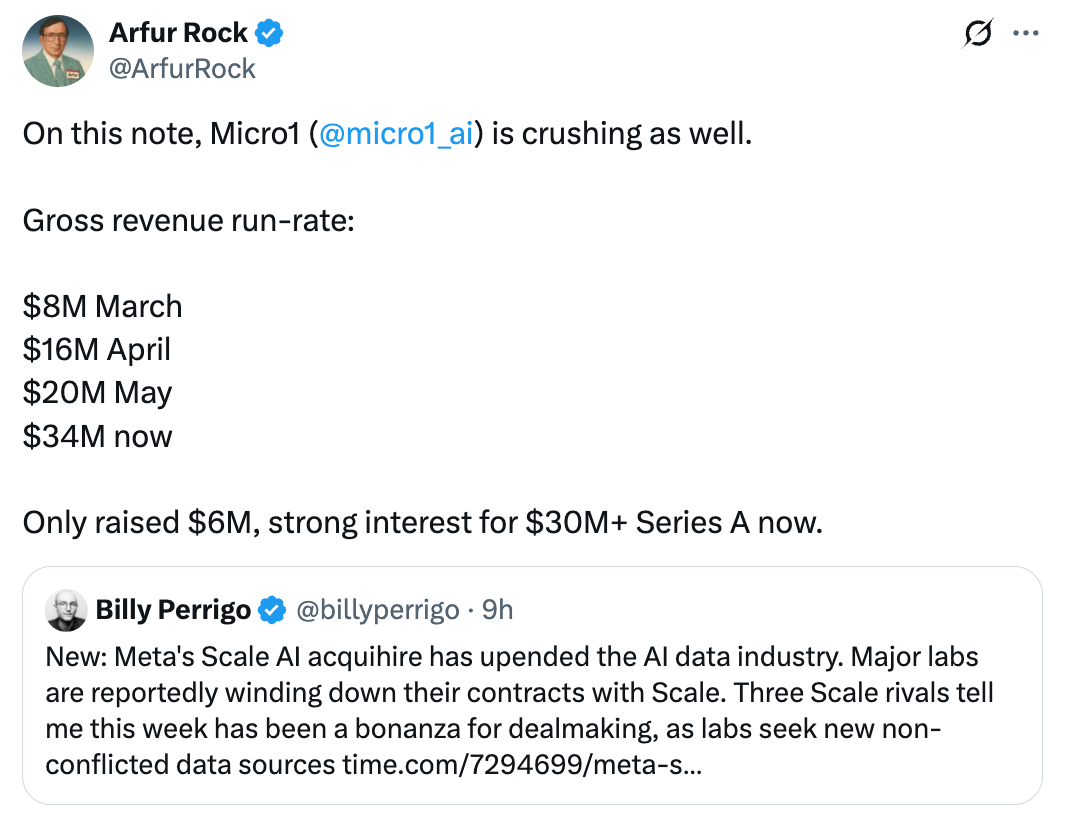

Meta's $14.3 billion acquisition of a 49% stake in Scale AI has triggered a massive market disruption, forcing major AI labs to rapidly diversify their data suppliers and creating unprecedented opportunities for AI talent marketplaces. As Google and others plan to cut ties with Scale AI and reduce their planned $200 million annual spend, competitors are experiencing explosive demand growth.

The market reshuffling is creating immediate winners across the AI talent ecosystem:

Handshake CEO Garrett Lord reports demand for his company's services "tripled overnight" following the Meta deal

Handshake launched Handshake AI, leveraging its network of 500,000 PhDs to provide expert model validation services

Turing CEO Jonathan Siddharth added $50 million in potential contracts in two weeks, as "frontier labs recognize that advancing AGI requires truly neutral partners."

Micro1 has scaled to $40 million ARR, representing 400% growth since March

The Scale AI situation highlights how vertical integration in AI can lead to unintended market fragmentation. As Appen CEO Ryan Kolln described it: "This is the equivalent of an oil pipeline exploding between Russia and Europe," with customers "really quickly evaluating: how do they get alternative supply?" This forced diversification is driving major AI labs directly to specialized talent marketplaces, such as Handshake AI, Micro1, Mercor, and Turing, as they scramble to replace Scale's services with neutral partners. For these emerging platforms, this represents a rare opportunity to inherit validated enterprise demand, transforming lengthy customer acquisition cycles into immediate revenue acceleration at unprecedented scale.

"Amazon wants to become a global marketplace for AI" - AWS is positioning itself as the infrastructure layer for the AI economy through Bedrock, offering customers a choice among 100+ models rather than betting on a single winner, while competitors align closely with specific providers. It is the fastest-growing segment for AWS, accounting for 18% of revenue. Yahoo Finance

"Peloton explores placing its equipment in gyms, launching marketplace for used gear" - Peloton is testing gym partnerships through its Precor subsidiary and launched "Repowered," a peer-to-peer marketplace for used equipment, as the fitness company seeks new revenue streams beyond direct-to-consumer sales. TechCrunch

"Breaking: DoorDash Buys Symbiosys as Ad Network Hits $1B Run Rate" - DoorDash acquired NYC-based ad tech company Symbiosys for $175 million while announcing its advertising network reached a $1 billion run rate, showcasing how delivery platforms are monetizing through high-margin ads. Modern Delivery

"Report: Temu Loses 58% of US Daily Users Due to Tariffs" - Temu lost 58% of its U.S. daily users in May after the end of the de minimis exemption, highlighting the vulnerability of cross-border marketplace models to trade policy changes. PYMNTS.com

"Why retailers like Amazon and Walmart are looking into stablecoins" - Major retailers are exploring stablecoin offerings to cut billions in interchange fees and payment processing delays, with stablecoins potentially settling in seconds versus days for traditional card transactions. For marketplace operators, this signals a potential disintermediation of conventional payment rails and the emergence of new competitive dynamics surrounding transaction costs. Stripe is also already making moves around stablecoins. Axios

"Uber Promotes Company Veteran to COO as CEO Says He's Not Going 'Anywhere'" - Uber named Andrew Macdonald as its first COO since 2019, consolidating oversight of both mobility and delivery under one executive as longtime delivery chief Pierre-Dimitri Gore-Coty departs after 13 years. Bloomberg

"Wholesale marketplace Faire's Lauren Cooks Levitan moves from president to board—her next step is launching a startup." - Faire's president, Lauren Cooks Levitan, is stepping down to join the board and launch her startup called Root, after helping build the wholesale marketplace from initial CFO to president over six years. Fortune and LinkedIn

"Rebecca Van Dyck joins as Chief Marketing Officer, Hiroki Asai named Chief Experience Officer" - Airbnb hired Meta and Apple veteran Rebecca Van Dyck as CMO while promoting Hiroki Asai to a new Chief Experience Officer role as the company expands beyond accommodations into services and experiences. Airbnb Newsroom

"Looking for a Campsite? Hipcamp Now Has Half a Million to Choose From." - Hipcamp doubled its campsite inventory to 565,000 locations by adding private campgrounds and RV parks, positioning itself as the comprehensive platform for outdoor accommodation discovery. Outside Online

"A New Way to Discover Poshmark Listings—Now on Facebook Marketplace" - Poshmark is testing a partnership that surfaces its secondhand fashion listings directly on Facebook Marketplace, giving sellers increased visibility with zero additional effort. Poshmark

"Pre-IPO Marketplace Hiive Eyes Funding as Competition Rises" - Vancouver-based pre-IPO trading platform Hiive is seeking up to $100 million in Series B funding as competition intensifies in the secondary market for private company shares. Bloomberg

"Cargado expands freight marketplace into Canada, launches market rates tool" - Cross-border freight marketplace Cargado expanded into Canada after success in Mexico-U.S. routes, while launching a market rates tool providing instant pricing data based on 35,000+ historical bids from 200+ brokers. FreightWaves

Akido raises $60M in Series B led by Oak HC/FT - Akido operates an AI-powered healthcare network of 240 providers across 26 specialties, using its ScopeAI system to increase clinical capacity and improve patient access to care. Business Wire

Piston raises $7.5M Seed led by Spark Capital - Piston operates a cardless payments platform connecting commercial fleets and gas stations through QR code transactions, serving over 120 fleets across 800 stations with $20M+ in annualized volume. FinSMEs and LinkedIn

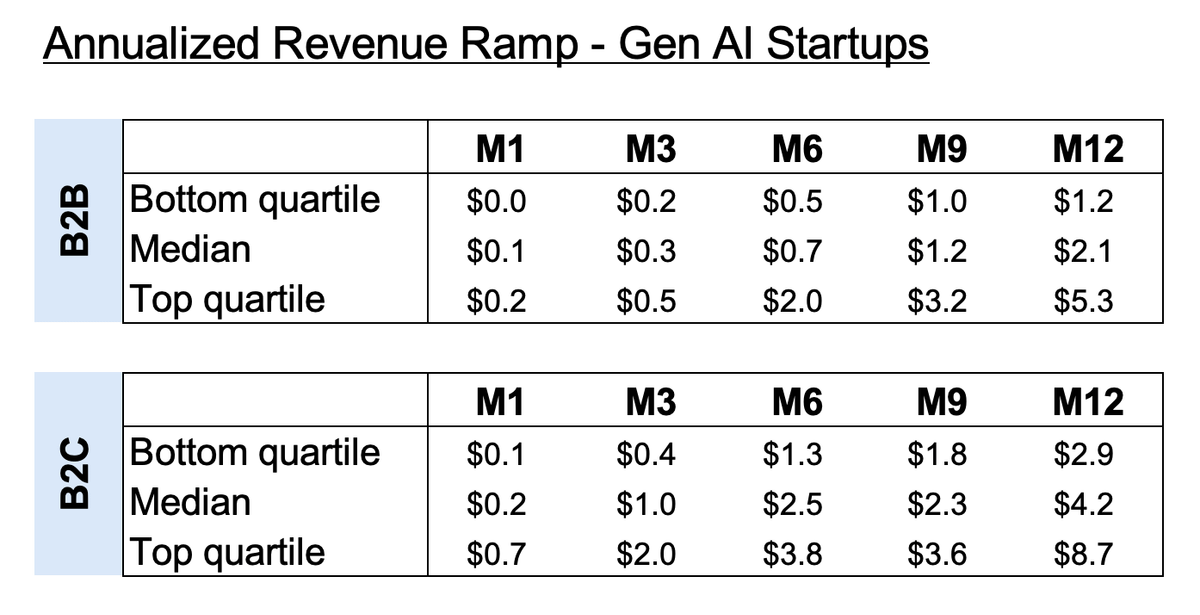

"What 'Working' Means in the Era of AI Apps" - a16z's revenue benchmarks for AI companies reveal median enterprise startups now hit $2M ARR in year one (vs. the old $1M benchmark), while consumer AI companies reach $4.2M ARR. Marketplace builders should note the shifted metrics and accelerated growth timelines, particularly as AI-powered features become a standard for platform businesses. Andreessen Horowitz and Twitter

"Taskrabbit CEO Ania Smith on AI automation and the future of work" - The head of the Ikea-owned gig work platform discusses how AI can enhance rather than replace human labor, while navigating economic uncertainty and the rise of agentic AI systems that could book services directly. Smart insights on the resilience of platforms requiring immediate, hyperlocal supply versus those focused purely on aggregation. The Verge

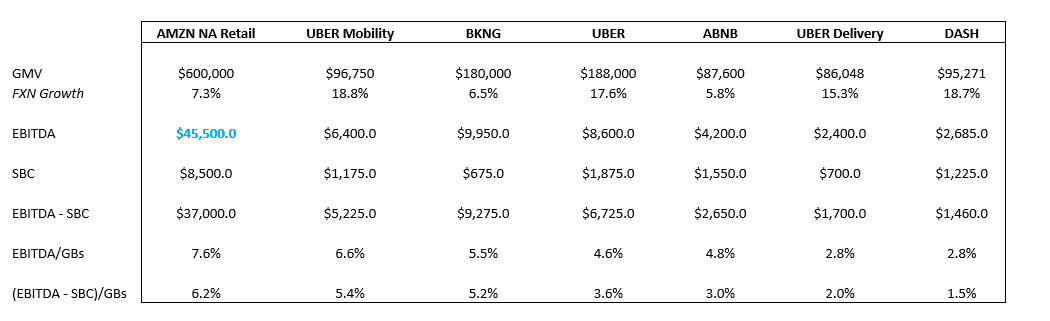

Marketplace Financial Benchmarks Analysis - Comparative data across major platforms shows Amazon North America Retail dominating GMV ($600B) and EBITDA ($45.5B), while Uber Mobility and DoorDash lead growth rates (18.8% and 18.7%). Notably, Booking maintains strong profitability margins (5.5% EBITDA/GBs) despite lower growth, while Uber Delivery and DoorDash’s compressed margins (2.8%) reflect food delivery's challenging unit economics. Twitter

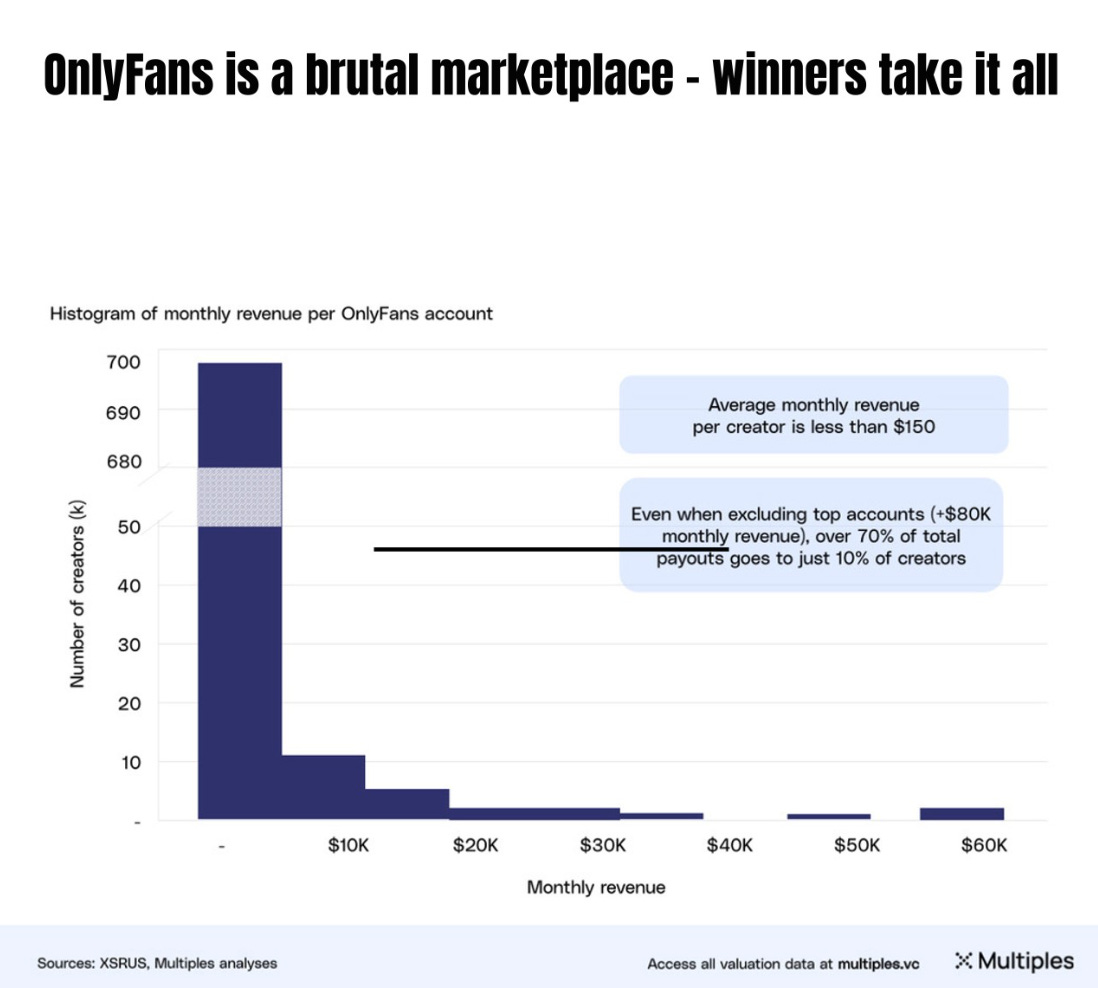

OnlyFans Revenue Distribution: The Pareto Principle on Steroids - Data reveals the brutal economics of creator marketplaces: over 70% of total payouts go to just 10% of creators, with average monthly revenue under $150 for most participants. This concentration (beyond the typical 80/20 rule) illustrates how network effects and algorithmic discovery create winner-take-all dynamics in creator economy platforms. LinkedIn

"How Upwork Optimizes LTV to CAC" - A primer on marketplace economics showing how Upwork predicts customer lifetime value within 24 hours of acquisition and dynamically adjusts CAC targets based on economic conditions. For marketplace operators, this is an excellent read on optimizing unit economics. Mostly Metrics

"The DoorDash Operating System, part 0." - Steve Kenning adds to his series on DoorDash's operating system by exploring how the company weaponized discomfort to drive execution in a brutal marketplace business. His thesis, that comfortable teams build mediocre products, resonates deeply, especially his point about how bureaucracy, groupthink, and empire-building hinder marketplace velocity. Missing & Incorrect

"Fighting Disintermediation: Can AI Today and Agentic Commerce Tomorrow Help Marketplaces Survive?" - Matt Bendett, the co-founder of Peerspace, explores how AI tools can help platforms combat circumvention today while preparing for the agentic commerce future where intelligent agents may bypass traditional marketplaces entirely. No Fixed Path

"Price and prejudice: Gender discrimination in online marketplaces" - Academic research examining gender discrimination in Facebook Marketplaces through experimental buyer profiles, revealing how bias persists even in digital commerce environments. Essential findings for marketplace operators focused on trust and safety. ScienceDirect

"Trivago watched its revenue forecast plummet from $1 billion to nearly zero—so the company tapped a set of former interns to turn it around" - Trivago's CEO, CFO, and CMO were all once interns at the company and are now leading its recovery efforts after the metasearch platform faced near-extinction during the pandemic. Fortune

"DOGE Days" - Sahil Lavingia, the founder of Gumroad, shares a candid account of his 55-day stint as a software engineer with the Department of Government Efficiency. Sahil Lavingia

"Mercor CEO: Evals Will Replace Knowledge Work, AI x Hiring Today & the Future of Data Labeling" - Brendan Foody explains how Mercor is revolutionizing hiring by creating infrastructure that helps AI labs label data, evaluate candidates, and make performance-driven decisions. With $100M in fresh funding and partnerships with top AI players, they're shifting recruiting from intuition to measurable prediction—a glimpse into the future of talent marketplaces. YouTube

"Why Uber's CPO delivers food on weekends" - Behind Uber's extreme dogfooding and "ship, ship, ship" culture with CPO Sachin Kansal, who personally completes nearly 1,000 Uber driving and delivery trips to sharpen product insight and user empathy. A masterclass in building product culture through firsthand experience and rapid iteration. Lenny's Newsletter

"Episode 49: Dan Park and the Incredible Comeback Story of Clutch" - Fabrice Grinda of FJ Labs interviews Dan Park, CEO of Clutch (the "Carvana of Canada"), about surviving a near-death experience in 2023 and engineering a remarkable turnaround. The transparency around their journey from burning $5M per month to profitability offers invaluable lessons for any marketplace founder navigating challenging times. Fabrice Grinda

"Tech Scenes with Brian McMahon" - Jeff James Martin talks with Pickle's CEO about pivoting from a social polling app to building a peer-to-peer rental marketplace. Brian's emphasis on getting in front of customers and building tight feedback loops is an excellent lesson in marketplace fundamentals. Spotify

“Michael Farb, CEO of Boatsetter, on leading the go to platform for boating experiences worldwide!” - Michael shares how Boatsetter has become the go-to platform for boat rentals, offering everything from self-captained adventures to fully crewed experiences. The discussion covers the marketplace's foundations, impressive customer retention through stellar reviews, and insights into operating a two-sided market in the marine space.

Would you like to see your job listed here? Email [email protected] with the subject line “Job Posting” to be included or get your job featured!

That is a wrap for the week! As always, please email me at [email protected] with any missed feedback or news. Hot tips are always welcome. Please don’t forget to subscribe and follow me on X and LinkedIn for other great marketplace content. If you want to book a call, you can find me on Intro.

About Me:

Colin is a marketplace geek and the General Partner of Yonder, a pre-seed marketplace fund that invests in marketplaces that create new economies. He has also been a longtime advisor to marketplaces, helping them with product growth, monetization, liquidity optimization, and strategy. Previously, he served as the CPO/CRO at Outdoorsy and has worked at Tripping.com, Ancestry.com, JustAnswer, and the Federal Reserve.

.png)