Previously, I gave an overview of eleven justifications for why public science funding is way too low: (1) longevity—living longer, (2) defense—wars of the future, (3) returns —pays for itself, (4) prosperity—long-term driver of productivity growth, (5) innovation—better everday products, (6) resilience—insurance for future calamities, (7) jobs—creates some now, and then better jobs in the future, (8) frontier—sci-fi is cool, (9) sovereignty—reduce single points of failure in the economy, (10) environment—new tech needed for climate change and energy efficiency, and (11) power—maintaining reserve currency, among other things.

The returns justification—that science funding can literally pay for itself—may not seem like a critical rationale because it isn’t seemingly directly about science, but it’s the one that should end the debate. That’s because if many of the other justifications are valid, then paying for itself means that increasing science funding becomes a no-brainer, as it removes the downside (long-term cost). And crucially, research funding is the only policy with this pay-for-itself property that can scale to hundreds of billions in investment.

But, how exactly can a significant government expenditure actually pay for itself? That’s a bold claim that deserves a little unpacking.

It works by growing the economy so that, over time, the government collects more tax revenues than the initial expenditure. This is easier said than done, because the federal government currently collects only about 17% of GDP in federal revenue, so the growth must be substantial. Funding basic research, however, has been shown in many studies to achieve the growth rates necessary (more on that later).

Here’s roughly how it works: Let’s say we invest $500B more in federal science funding this year, which ultimately grows the economy by $1.5T (3 times the investment) each year, once discoveries are fully commercialized in the economy. Suppose the federal government takes in 17% of that increase in GDP, or about $250B a year in extra federal revenues. Then, after roughly 15 years in this toy example, these future increased federal revenues will more than pay for the initial $500B, even considering the time value of money (discount rate).

Of course, real-world models are more complicated, though those are roughly first-order accurate numbers for the U.S. In the previous post I referenced above, I had cited this IMF model (if you want to dig into it, search for innovation policy mix, with the underlying math in Online Annex 2.5). Here are their conclusions (note where it says pay for themselves near the end):

[T]he implied fiscal multiplier—the increase in output per dollar of fiscal cost—is 3 to 4 over the long term for the most effective tools (Online Annex 2.5). This implies that increasing fiscal support for R&D by 0.5 percentage point of GDP (or about 50 percent of the current level in OECD economies) through a combination of public research funding, grants to firms, and tax credits could raise GDP by up to 2 percent. The GDP impact reflects the complementarity between public and private research. The innovation policy mix also lowers the public-debt-to-GDP ratio by about 0.5 percentage point over an eight-year horizon, as the initial increase in debt from higher fiscal spending is gradually offset by higher GDP and revenue (Online Annex 2.5). However, while innovation policies can pay for themselves in the long term, countries with limited fiscal space may need to raise revenue or reprioritize other spending to finance the short-term costs of those policies (see Chapter 1).

In other words, increasing research funding at the margin today is expected to lower the national debt tomorrow by growing the economy, such that tax revenues eventually accumulate enough to start paying down debt. Of course, this assumes an advanced economy (like the U.S.) implementing a comprehensive and well-crafted policy mix (more on that in future posts).

No other government expenditure category is like this in that it can arguably be raised to the order of $500B and realistically be expected to pay for itself and start reducing the long-term public debt-to-GDP ratio within a couple of decades (acknowledging we’d hit diminishing returns at some point). For example, infrastructure spending doesn’t pay for itself; according to the Congressional Budget Office (CBO), it is expected to reduce net costs by more like one-third (under deficit-neutral financing) or one-fourth (under debt-financing), not return multiple times the expenditure. Universal early childhood education has strong societal returns, but from a fiscal perspective, it takes much longer to break even, if at all, because most of the fiscal benefits occur as people grow up and earn more in middle age, forty to fifty years down the line. Targeted preventive health measures, like childhood vaccines, are also found to pay for themselves, but they don’t cost much from the federal government’s perspective, so they can’t take that much extra investment.

In other words, increasing federal basic research funding is the highest return on investment (ROI) at-scale budgetary expenditure we have available.

No one entirely knows, of course, because the returns change based on the particular funding apparatus, and the marginal return is ultimately different from the average; that is, you get diminishing returns at some point.

In 2018, the CBO published this call for more research, noting “although extensive data exist on federal spending for nondefense R&D…[a] convincing synthesis of the results from the literature has proved elusive.” Since then, though, researchers have been heeding this call, including Karel Mertens at the Federal Reserve Bank of Dallas.

In a 2024 paper entitled “The Returns to Government R&D: Evidence from U.S.,” Mertens and Andrew Fieldhouse take a novel approach by examining the aftereffects of historical “shocks” in R&D funding across five federal agencies. They conclude:

[T]he implied rates of return to nondefense R&D are high. The reliable estimates range from around 140 percent to 210 percent…

Our estimates also suggest that federal investments in nondefense R&D are self-financing from the perspective of the federal budget, at least in the long run. Assuming a return of 171 percent, a $1 long-run increase in government R&D capital would improve the budget as long as the additional tax revenue raised per dollar of additional GDP is at least 9 cents (δ/ρ = 0.16/1.71 = 0.09), which is substantially below the historical ratio of federal tax revenues to GDP.

Note that 171% means $1 in yields $2.71 out, which is close to the IMF assumption above. They also have this summary blog post about their paper that gives a bit more color on the methodology and conclusions:

We find that shocks to nondefense R&D appropriations lead to significant increases in various measures of productivity and scientific innovation, but only with a delay—consistent with implementation lags and a gradual diffusion of new knowledge…

After about eight years, productivity starts to significantly and steadily increase. It continues rising and remains persistently elevated for at least 15 years after the increase in R&D appropriations. Put differently, greater nondefense government R&D appears to spur gains in long-term productivity, thus increasing living standards.

The implications align with my thesis that science funding was already way too low before we started recently going further in the wrong direction. Mertens and Fieldhouse agree:

In terms of policy implications, our finding of large returns to government R&D implies substantial underinvestment of public funds in nondefense R&D…

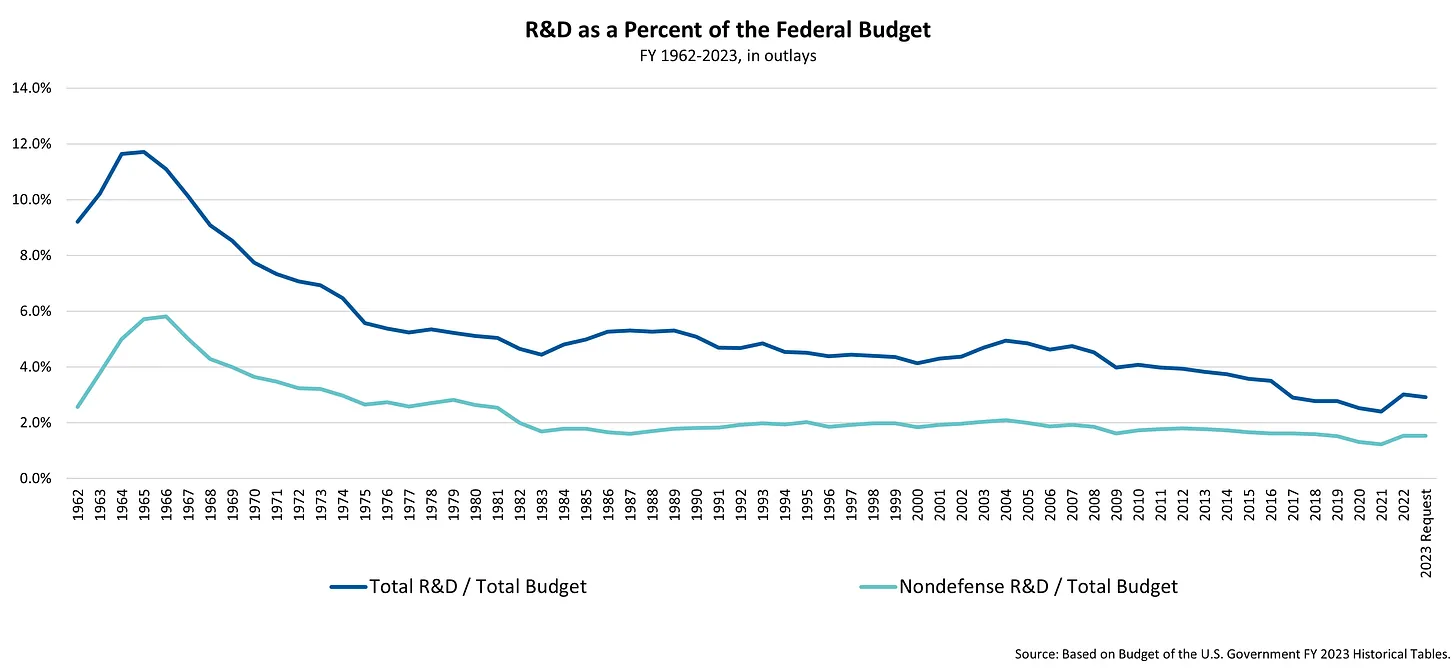

I want to start developing a “prosperity platform” for a set of policies that will collectively maximize our future prosperity. I currently believe that dramatically increasing nondefense federal funding in basic research is #1 on that list. We need to reverse the trend and greatly increase this investment in our future:

.png)