The SEC's commissioners are reviewing Grayscale's uplisting of a large cap fund, a letter from the agency said.

Updated Jul 2, 2025, 7:51 p.m. Published Jul 2, 2025, 7:50 p.m.

The U.S. Securities and Exchange Commission's leaders are reviewing the agency's recent approval of a Grayscale effort to convert a fund into an exchange-traded fund (ETF), a letter dated July 1 said.

The SEC allowed Grayscale to uplist the Digital Large Cap Fund (GDLC), which holds $755 million in bitcoin

, Ethereum

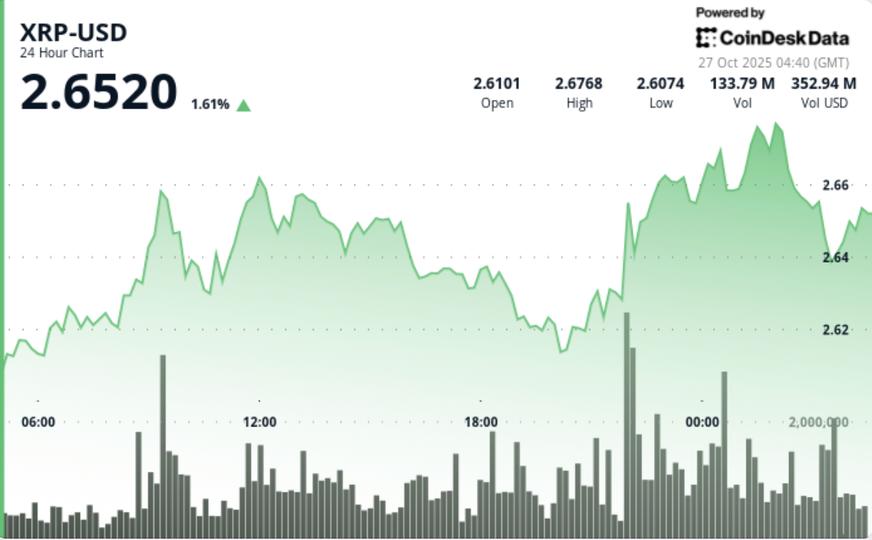

, XRP

, Solana

and Cardano

, into an ETF through delegated authority — meaning the SEC's commissioners did not vote to approve the conversion, but rather agency staff gave the sign-off.

"This letter is to notify you that, pursuant to Rule 431 of the Commission’s Rules of Practice, 17 CFR 201.431, the Commission will review the delegated action," the letter said. "In accordance with Rule 431(e), the July 1, 2025 order is stayed until the Commission orders otherwise."

Any commissioner can ask that an SEC action be reviewed. In the past, commissioners have asked to review ETF disapprovals, for example.

GDLC is benchmarked to CoinDesk's CoinDesk 5 Index.

Nikhilesh De

Nikhilesh De is CoinDesk's managing editor for global policy and regulation, covering regulators, lawmakers and institutions. He owns < $50 in BTC and < $20 in ETH. He won a Gerald Loeb award in the beat reporting category as part of CoinDesk's blockbuster FTX coverage in 2023, and was named the Association of Cryptocurrency Journalists and Researchers' Journalist of the Year in 2020.

.png)

3 months ago

49

3 months ago

49