I co-founded Flying Founders with Michal Truban almost one year ago, with a simple thesis in mind:

Back founders who want to build profitably growing SaaS businesses.

Our core value is that the best businesses should be funded by customers, not investors.

If you need to raise capital, it should be just once - enough to reach product-market fit, then aim to turn profitable growth within 12-18 months.

I see way too many founders raise money thinking it’s a milestone. But in reality, it often is a dependency.

When you reach profitability early - even modest profitability - you shift the power dynamic and buy yourself options to:

Grow on your own terms

Say no to bad term sheets

Take your time, instead of rushing into the next round

Keep control, protect your cap table, and build something that lasts

You’re no longer dependent on fundraising to survive.

You can choose if, when, and why to raise again.

We kept bouncing this thesis off of early-stage startups.

And, we saw the same pattern over and over.

Most founders thought they had only two options:

Bootstrapping - slower, riskier, often lonely

Venture capital - fast growth, but high dilution and pressure to keep raising

Not many have heard of or considered the “raise once, then turn profitable” approach.

We didn’t even have a name for it at first - just a working model we kept talking about with founders.

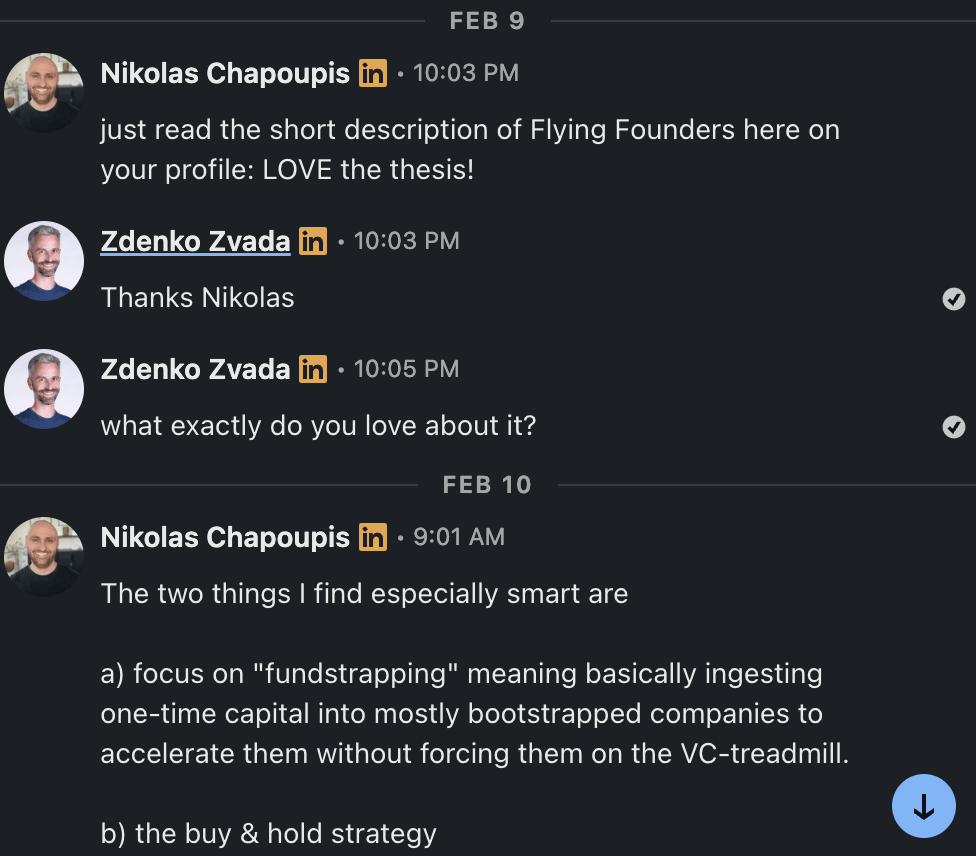

Then one day, I received this LinkedIn message from Nikolas:

I had never heard about fundstrapping before. But it immediately clicked.

Since then, I’ve seen it come up more and more. Sometimes as fundstrapping, or more often referred to as seedstrapping.

Some say it’s just a buzzword for something that’s been around forever.

We think it marks an important shift in how founders and investors think about building and funding businesses - and not many people are talking about it (yet).

It’s raising a sensible amount of funding to build a real business - not just chase a funding narrative.

It’s not anti-VC.

And, it is not bootstrapping at all costs.

Though there is no blueprint on how seedstrapping should work (yet) - here’s how one could look like:

Make money before you start building (eg. consult, pre-sell, service)

Use the money to automate part of your service and unlock more €

Get to an early traction - €50k, €100k, €200k ARR or more

Raise €200k - €1m, from angels or smaller funds

Invest that capital in gtm, product and team

Keep building like no other round is coming

Reach profitability in 12-18 months

After that, you can still scale.

You can still raise more.

But you don’t depend on it.

This approach is more relevant than ever in 2025:

VCs are more selective - fewer deals, more demands

Profitability matters again - capital efficiency is no longer optional

Tools are cheaper, GTM faster - with AI real traction is within reach earlier

Founders are getting smarter - and know that raising doesn’t equal winning

Some of the best founders we meet are quietly building cash-generating, well-run businesses - without chasing the spotlight or the next round.

In the coming weeks, I’d like go deeper into:

Building a profitable GTM motion early

What kinds of startups (and investors) fit this model

How much to raise in a seedstrapped round

Real founder stories

+ more

If you’re building something real, and want to stay in the driver’s seat, subscribe to this newsletter, it might resonate.

Until next week,

Zdenko

Thanks for reading Seedstrapped! If you liked this post, feel free to share it with your friends.

PS: I’d love to hear from others building this way. If you’re exploring seedstrapping (or tried a version of it) let me know in the comments or DM.

.png)