content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Solana Foundation executive Vibhu Norby ignited a fresh round of cross-ecosystem debate this weekend, challenging XRP supporters to ground their bullish narratives in verifiable network metrics rather than aspiration. In a series of posts on X, Norby said he “want[s] Ripple and XRP to succeed at an insane degree,” but argued that “the community does not argue with facts, even though the data is readily available.” He added: “as a longtime engineer and truth seeker, that bothers me.”

Norby Says XRP Growth Stalled

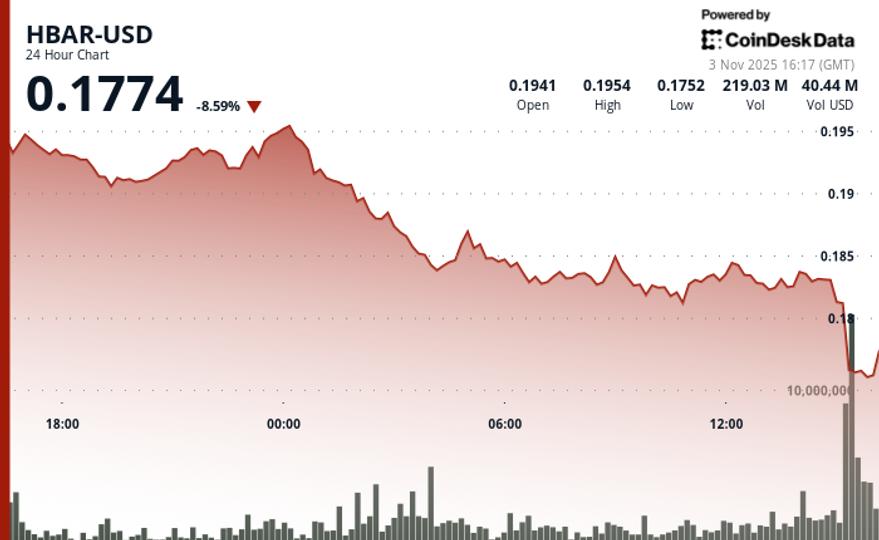

The core claim is that—measured by on-chain activity—the XRP Ledger’s growth has been “extremely mediocre” relative to faster-growing chains, most notably Solana. Citing XRPScan, he said the “active daily accounts shows no 3-year improvement, hovering around 25,000 daily active accounts,” while “this year, Solana is averaging over 2.5 million daily active accounts. That’s 100x.” Short of debating sentiment or distant roadmaps, he framed the discussion as empirical: “The fiction is very far ahead of the facts.”

Number of active accounts | Source: X @vibhu

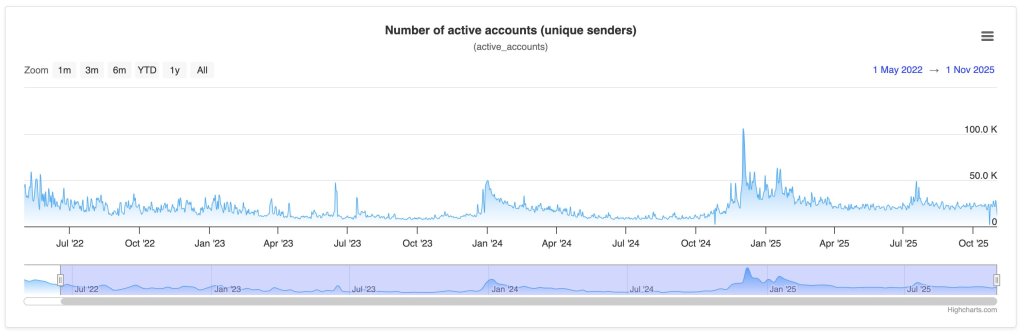

Number of active accounts | Source: X @vibhuThe activity gap was a through-line in Norby’s posts. On throughput, he pointed to XRP’s roughly 1–1.5 million daily transactions and contrasted that with Solana’s order-of-magnitude higher traffic: “the total daily transactions, around 1.5 million per day, is outclassed by Solana which is handling about 100 million per day.”

Successful payments | Source: X @vibhu

Successful payments | Source: X @vibhuWhile exact daily figures vary with market conditions and data providers, independent dashboards corroborate the broad picture: XRP’s transactions typically sit in the low-single-digit millions per day, while Solana’s effective user-facing throughput has been documented near the ~1,000 TPS range with peaks far higher under stress; counting all transaction types, Solana’s raw transaction count regularly dwarfs legacy chains. “Currently, XRPL is handling about 17 TPS, according to XRPScan. Solana executes 1000 non-vote TPS on mainnet, and often more,” Norby said.

Norby also trained attention on value transfer rather than just message count. “XRP’s transfer volume today is about $50–60 billion per month. However, Solana’s October stablecoin transfer volume alone, which is a small subset of all network assets, was almost $2 trillion,” he wrote.

Anticipating the most common rejoinder—“oh it’s all fake, bots, etc.”—Norby argued that the Solana-side data excludes wash behavior in the stablecoin tallies he referenced and that fee structures are not a sufficient explanation for alleged bot asymmetry. “Given both XRPL and Solana have similarly low transaction fees, there’s no reason why Solana would uniquely attract bots that XRPL wouldn’t,” he wrote, adding that the on-chain payments edge in Solana remains “a huge measurable margin” even after obvious noise filters.

The exchange quickly broadened beyond raw counters to product-market fit. One defender asserted that “XRP isn’t for retail and memecoins. Financial institutions are heavily regulated and slow to adopt.” Norby rebutted that premise bluntly: “They haven’t been slow to adopt – lol. They’re just adopting stablecoins, not XRP.”

In a separate reply to a question about what’s driving Solana’s relative outperformance, Norby’s answer was a one-word thesis: “Technology.” He later summarized the posture of the XRP army he believes the data supports with a pointed quip: “Solana is a bridge currency.”

Norby also dismissed the idea that RippleNet’s progress should be conflated with on-chain traction: “One cannot have a view on RippleNet because it appears to be simply a private business. Therefore it’s hard to argue it has any bearing on XRP.”

That distinction echoes long-standing commentary that RippleNet, as an enterprise messaging and settlement network, can operate independently of XRP unless specific corridors use On-Demand Liquidity mechanisms. “Offchain connections are entirely commoditized,” Norby added, casting political or banking relationships as insufficient substitutes for measurable on-chain usage.

As the thread grew, community pushback coalesced around two counterclaims: that XRP’s design goal is institutional settlement rather than retail-heavy app ecosystems, and that a “HODL-heavy” holder base naturally depresses daily active address counts. Norby responded that Solana, too, is held by large numbers of passive investors—“Believe it or not, many people also just buy SOL and hold”—but “the difference is that people also actually use Solana.”

He concluded with a challenge: “Open offer to any community member or Ripple executive: let’s do a livestream debate right here on X. You bring facts, I bring facts. Facts are important. Let the internet decide who wins.” He also hosted a public X Space to continue the discussion.

— vibhu (@vibhu) November 2, 2025

None of the above makes Ripple’s endgame impossible. Norby repeatedly allows that “it is very possible that XRPL wins,” framing his argument as a present-tense snapshot rather than a terminal verdict. But his counsel to investors is unsparing: “If you hold XRP as an investment, you need to seriously consider how much longer it’s worth waiting around.”

At press time, XRP traded at $2.40.

XRP falls below the 0.5 Fib, 1-day chart | Source: XRPUSDT on TradingView.com

XRP falls below the 0.5 Fib, 1-day chart | Source: XRPUSDT on TradingView.comFeatured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

.png)