👋 Welcome to Climate Drift: your cheat-sheet to climate. Each edition breaks down real solutions, hard numbers, and career moves for operators, founders, and investors who want impact. For more: Community | Accelerator | Open Climate Firesides | Deep Dives

Hey there! 👋

Skander here.

You know that feeling when you’re waiting for the cable guy, and they said ‘between 8am and 6pm, and you waste your entire day, and they never show up?

Now imagine that, except the cable guy is ‘electricity,’ the day is ‘50 years,’ and you’re one of 600 million people. At some point, you stop waiting and figure it out yourself.

What’s happening across Sub-Saharan Africa right now is the most ambitious infrastructure project in human history, except it’s not being built by governments or utilities or World Bank consortiums. It’s being built by startups selling solar panels to farmers on payment plans. And it’s working.

Over 30 million solar products sold in 2024. 400,000 new solar installations every month across Africa. 50% market share captured by companies that didn’t exist 15 years ago. Carbon credits subsidizing the cost. IoT chips in every device. 90%+ repayment rates on loans to people earning $2/day.

And if you understand what’s happening in Africa, you understand the template for how infrastructure will get built everywhere else for the next 50 years.

Today we are looking into:

Why the grid will never come (and why that’s actually good news)

How it takes three converging miracles (cheap hardware, zero-cost payments, and pay-as-you-go)

2 case studies on how it works on the ground

Whether this template works beyond Africa (spoiler: it already is)

🌊 Let’s dive in

Here’s a stat that should make you angry: 600 million people in Sub-Saharan Africa lack reliable electricity. Not because the technology doesn’t exist. Not because they don’t want it. But because the unit economics of grid extension to rural areas are completely, utterly, irredeemably fucked.

The traditional development playbook goes something like this: Chapter 1, build centralized power generation. Chapter 2, string transmission lines across hundreds of kilometers. Chapter 3, distribute to millions of homes. Chapter 4, collect payments. Chapter 5, maintain the whole thing forever.

This worked great if you were electrifying America in the 1930s, when labor was cheap, materials were subsidized, and the government could strong-arm right-of-way access. It works less great when you’re trying to reach a farmer four hours from the nearest paved road who earns $600 per year.

Let me show you the math:

Cost to connect one rural household to the grid: $266 to $2,000

Average rural household electricity spending: ~$10-20/month

Payback period: 13-200 months (if you can even collect payments)

Collection rate in rural areas: complicated

So utilities do what any rational actor would do: they stop building where the math stops working. Which is exactly where the people are.

This has been the development sector’s dirty little secret for 50 years. “We’re working on grid extension!” Translation: we’re not working on grid extension because the economics are impossible, but we need to say we’re working on it so we keep getting donor money.

Meanwhile, 1.5 billion people spend up to 10% of their income on kerosene, diesel, and other dirty fuels. They walk hours to charge their phones. They can’t refrigerate medicine or food. Their kids can’t study after dark. Women inhale cooking smoke equivalent to two packs of cigarettes daily.

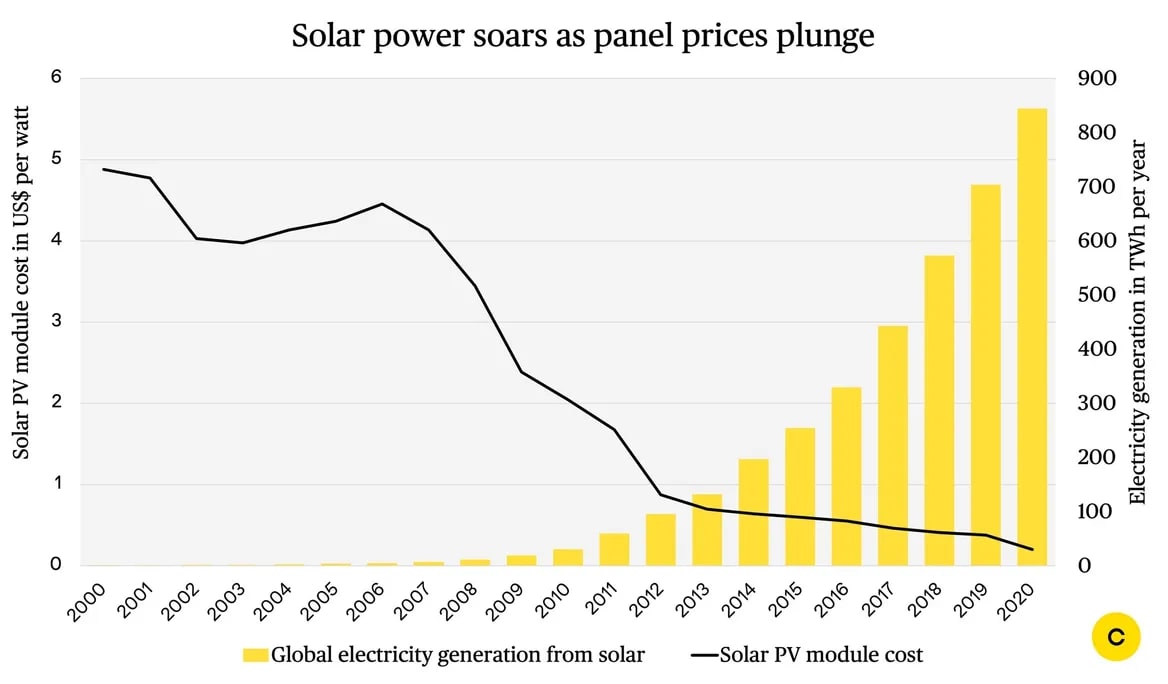

While everyone was arguing about feed-in tariffs and utility-scale solar, something wild happened to solar costs:

Solar Panel Price History:

1980: $40/watt

2000: $5/watt

2010: $1.50/watt

2020: $0.30/wlltt

2025: $0.20/watt

That’s a 99.5% decline in 45 years. Moore’s Law except for sunshine.

Want to learn how solar got cheap?

But here’s what’s even crazier: the price of complete solar home systems:

Solar Home System Evolution:

2008: $5,000 (affordable only for wealthy urban Kenyans)

2015: $800 (middle-class farmers)

2025: $120-$1,200 (true smallholders)

Battery costs also collapsed 90%. Inverters got cheap. LED bulbs got efficient. Manufacturing in China got insanely good. Logistics in Africa got insanely better.

All of these trends converged around 2018-2020, and suddenly the economics of off-grid solar just... flipped. The hardware became a solved problem.

But there was still a massive, seemingly insurmountable barrier: $120 upfront might as well be $1 million when you earn $2/day.

This is where the story gets interesting.

Quick history lesson: In 2007, Safaricom (Kenya’s telco) launched M-PESA, a mobile money platform that let people transfer cash via SMS.

Everyone thought it would fail. Why would anyone use their phone to send money?

By 2025: 70% of Kenyans use mobile money. Not in addition to banks. Instead of banks. Kenya processes more mobile money transactions per capita than any country on Earth.

It worked because it solved a real problem: Kenyans were already sending money through informal networks. M-PESA just made it cheaper and safer.

Here’s why this matters: M-PESA created a payment rail with near-zero transaction costs. Which means you can economically collect tiny payments. $0.21 per day payments.

This broke open a financing model that changes everything: Pay-As-You-Go.

This is the unlock. This is the thing that makes everything else possible.

Here’s the model:

A company (Sun King, SunCulture) installs a solar system in your home

You pay ~$100 down

Then $40-65/month over 24-30 months

The system has a GSM chip that calls home

No payment = remotely shut off

Keep paying = keep power

After 30 months = you own it, free power forever

The magic is this: You’re not buying a $1,200 solar system. You’re replacing $3-5/week kerosene spending with a $0.21/day solar subscription (so with $1.5 per week half the price of kerosene) that’s cheaper AND gives you better light, phone charging, radio, and no respiratory disease.

The default rate? 90%+ of customers repay on time.

Why? Because the asset actually works. It delivers value every single day. The alternative is going back to kerosene lamps in the dark. Nobody wants that.

This is the “innovation” that everyone missed. The hardware got cheap, but PAYG made it accessible. And mobile money made PAYG economically viable.

Now let’s talk about what happens when you combine these three things with 2 case studies.

23 million solar products sold in 2023, serving 40 million customers in 42 countries, and targeting 50 million units by 2026.

Their product range spans from handheld solar lamps to multi-room home solar kits and clean LPG stoves

Products:

Handheld solar lamps ($50-120)

Multi-room home systems ($200-500)

LPG clean cookstoves (acquired PayGo Energy)

Phone charging, battery backup, lighting

Want to dive deeper? I got a casestudy for you

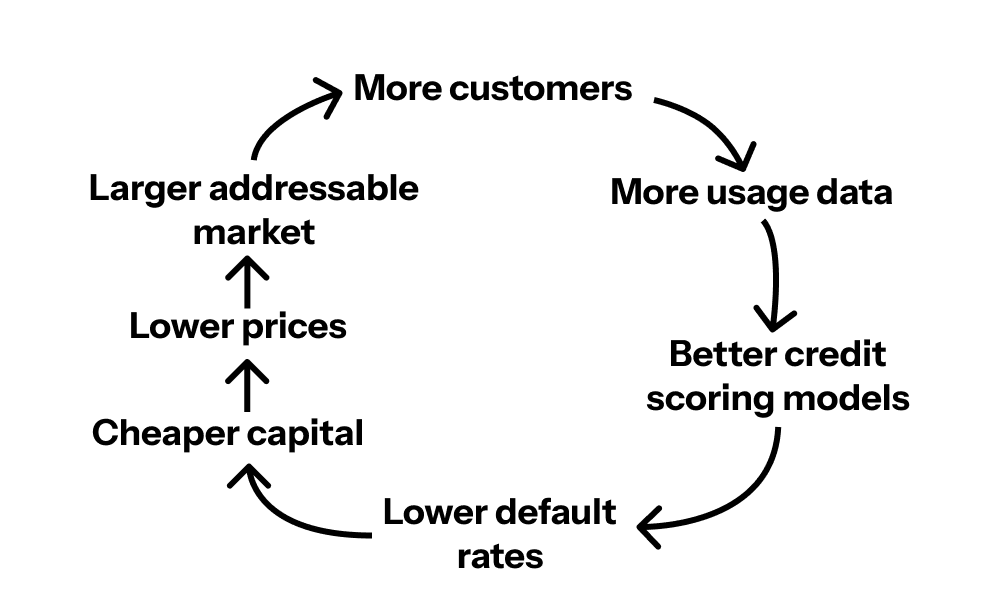

Each turn of the wheel makes the next turn easier. This is a compounding moat.

And here’s what nobody outside Africa understands: Sun King has 50%+ market share in their category. They’re not scrappy startup. They’re a dominant infrastructure provider.

This would be like if one startup owned 50% of U.S. home solar. Except the impact and the TAM is bigger because there’s no incumbent grid to compete with.

If Sun King is the lighting/household electrification play, SunCulture is the agriculture productivity play. And the numbers are even more insane.

The Problem:

95% of Sub-Saharan Africa’s cropland is rain-dependent

Farmers spend $2B annually on diesel pumps

The SunCulture Solution:

Solar-powered irrigation pumps

IoT-enabled remote monitoring

PAYG financing ($100 down, $40-65/month)

Free installation, 10-year warranty

Drip irrigation included

The Results:

Crop yields increase 3-5×

Farmers go from $600/acre to $14,000/acre revenue

Zero marginal cost after payoff (no diesel!)

Year-round irrigation instead of seasonal

17 hours/week saved from manual water hauling

The Scale:

47,000+ systems deployed

40,000+ farmers served

50%+ market share in smallholder segment

6 countries (Kenya, Uganda, Ethiopia, Ivory Coast, Zambia, Togo)

That’s not a charity. That’s a fucking rocketship.

Okay, this is where it gets really spicy.

Remember that SunCulture solar pump displacing diesel? That’s 2.9 tons of CO2 avoided per year. Per pump.

Multiply by 47,000 pumps = 136,000 tons CO2/year. Over seven years = 3+ million tons cumulative.

Want to dive deeper? I got another casestudy for you

Now here’s the hack: Someone will pay for that.

Enter carbon credits. SunCulture is the first African solar irrigation company with Verra-registered carbon credits. Each ton of avoided CO2 can be sold for $15-30 (high-quality agricultural credits, not sketchy forest offsets).

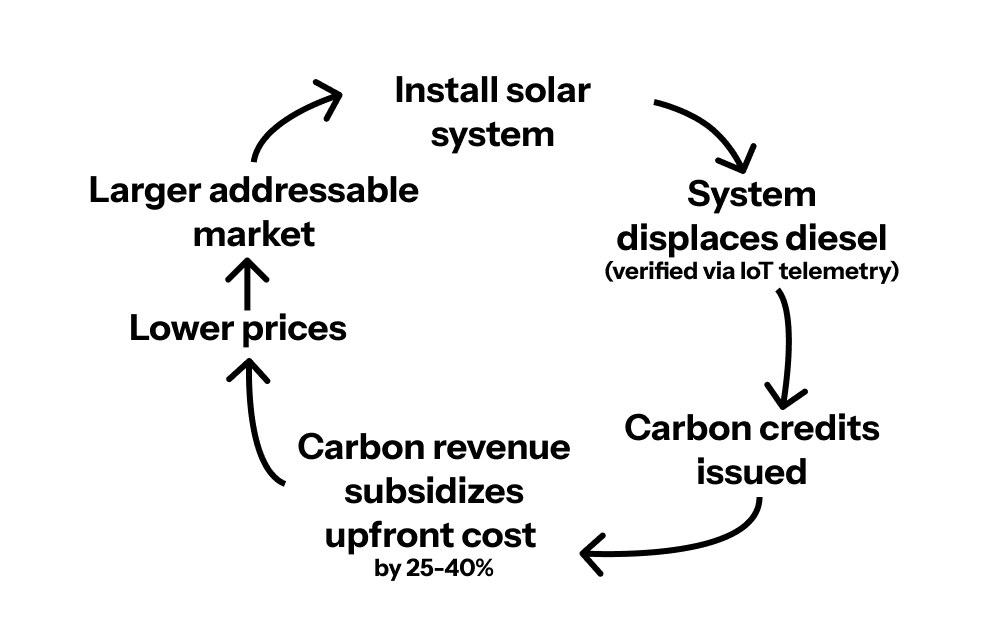

Let’s do the flywheel again, but this time turbocharged with carbon credits.

Install solar system

System displaces diesel (verified via IoT telemetry)

Displacement = carbon credits issued

Sell credits to companies needing offsets

Carbon revenue subsidizes upfront cost by 25-40%

Lower cost = 4-5× larger addressable market

More systems deployed = more carbon credits

Repeat

It gets even better: there are people who will pay for credits beforehand.

British International Investment (UK’s DFI) pioneered this with SunCulture: they provided $6.6M in “carbon-backed equipment financing.” They bear the carbon price risk, SunCulture gets upfront capital, farmers get 25-40% cheaper pumps.

This is how it should be: The climate impact that was an externality is now a revenue stream. The global North’s carbon problem subsidizes the global South’s energy access.

A quick note on MRV

Okay, so you might know I have… issues with the carbon credit world, especially MRV(monitoring, reporting, verification). Here monitoring is IoT-based, the MRV costs are near-zero. No expensive field audits. The telemetry data proves the pump is running = proves diesel is displaced = proves carbon is avoided.

The carbon credit mechanism turns climate infrastructure into an asset class. Which means you can finance it at scale.

Btw this is how the largest forest of the US is now being financed:

Chestnut Carbon buys degraded farmland across the Southeast, replants biodiverse native forests, verifies long-term carbon removal, and signs long-dated offtake deals with blue-chip buyers like Microsoft. The company has acquired more than 35,000 acres, planted over 17 million trees, and aims to restore 100,000+ acres by 2030 with an expected 100 million tons of CO2 removed over 50 years.

Learn more here:

So: what now?

Why is the market concentrated? Because the full-stack is really fucking hard.

You need:

Hardware manufacturing expertise

Supply chain across fragmented markets

Last-mile distribution (29,500 agents for Sun King)

Mobile money integration

Credit scoring models for the unbanked

IoT/telemetry systems

Customer service in 10+ languages

Financing (equity, debt, securitization)

Carbon market relationships

Regulatory navigation across 40+ countries

Most companies can do 2-3 of these. The winners do all 10.

This creates massive barriers to entry and long-term moats. New entrants can’t just show up with cheaper panels. The moat is the full-stack execution.

Let’s do the math on how big this can get.

600M people without reliable power in Sub-Saharan Africa

570M smallholder farming households in Africa

900M people in Africa use traditional cookstoves

And that’s just Africa. Add Asia (1 billion without electricity) and you’re north of $300B-$500B.

But here’s the thing: this massively understates the opportunity.

The solar system is the Trojan horse. The real business is the financial relationship with 40 million customers.

Because what you’re really doing is creating a digital infrastructure layer that enables:

Consumer lending (smartphones, motorcycles, appliances)

Livestock/agriculture financing

Insurance products

Healthcare delivery

Education services

Payment processing

So the actual TAM? It’s whatever the total consumer spending is for 600M people rising into the middle class.

Okay, let’s zoom out. What happens when 100M+ people get electrified through this model?

Kids study at night → higher test scores → better jobs

Adults work after dark → higher income

Farmers irrigate year-round → 3-5x yields → food security

Phone charging → mobile money access → financial inclusion

Refrigeration → vaccine storage → disease prevention

Refrigeration → Keep milk/meat eatable → reduced food waste No kerosene smoke → respiratory disease drops

Clean cookstoves → 600,000 fewer deaths/year from indoor pollution

Diesel displacement = cleaner air quality

But here’s the meta-point: This is the template for building infrastructure in the 21st century.

Not government-led. Not centralized. Not requiring 30-year megaprojects.

Instead: modular, distributed, digitally-metered, remotely-monitored, PAYG-financed, carbon-subsidized infrastructure deployed by private companies in competitive markets.

The 20th century infrastructure model was:

Centralized generation

Government-led

Megaproject financing

30-year timelines

Monopolistic utilities

The 21st century infrastructure model is:

Distributed/modular

Private sector-led

PAYG financing

Deploy in days/weeks

Competitive markets

This is how things will get built going forward.

So what could go wrong?

Let’s start by making clear this is not a one size fits all solution:

PAYG solar works for households and smallholders. Doesn’t work for factories or heavy industry. This isn’t a complete grid replacement.

1. FX Risk Companies raise dollars, buy hardware in dollars, collect revenue in Naira/Shillings. Currency crashes can blow up unit economics overnight.

2. Political/Regulatory Risk

Governments could impose lending restrictions, tariffs on solar imports, or subsidize grid/diesel to protect state utilities.

3. Default Risk

10% default rate is good but fragile. Economic shocks, droughts, or political instability could spike defaults.

4. Maintenance Complexity

Panels last 25 years, batteries 5 years, pumps break. Building service networks across rural Africa is expensive.

5. Carbon Price Volatility

Carbon credits crashed from $30/ton to $5/ton in 2024. If 25-40% of affordability comes from carbon revenue, price swings hurt.

6. Competition from Grid

What if governments actually build the grid? (Unlikely given economics, but possible with enough subsidy)

7. Supply Chain Bottlenecks

Port congestion, customs delays, tariff swings, China export controls, and last-mile logistics can delay installs, raise COGS, and tie up working capital.

Fun fact: Sun King is now producing their devices in Africa, cutting $300 Million in imports over the next years.

Okay, the bear case is important. But let’s talk about the scenarios where this doesn’t just work: it goes 🏒.

Solar panels dropped 99.5% in 45 years. What if we’re only halfway through?

Current situation:

China has 600+ GW of solar manufacturing capacity

Current global demand: ~400 GW/year

Overcapacity = price collapse incoming

What happens next:

Solar: $0.20/watt → $0.10/watt by 2030

Batteries: Another 50% drop as sodium-ion scales

Complete solar home systems: $120-1,200 → $60-600

A $60 entry-level system puts the addressable market at 2 billion people instead of 600 million. You’re not just electrifying rural Africa. You’re electrifying rural India, Bangladesh, Pakistan, Southeast Asia, Latin America.

Right now, these companies finance at 12-18% interest rates. What if Development Finance Institutions (DFIs) actually do their job?

The scenario:

World Bank, IFC, British International Investment create dedicated facilities

“De-risk” lending to proven operators like Sun King/SunCulture

Cost of capital drops from 15% → 5-7%

What this unlocks:

Monthly payments drop 30-40%

Addressable market expands by 200M+ people

Payback periods shrink from 30 months → 18-24 months

Companies can deploy 3-5x faster with better unit economics

This is literally what happened with microfinance when Grameen Bank proved the model. Billions in cheap capital followed.

Here’s what nobody’s pricing in: social proof at scale.

The flywheel:

Village A: 3 households get solar

Neighbors see: kids studying at night, no kerosene smell, phone always charged

Village A: 30 households get solar within 12 months

Next village over hears about it → sales agent swamped

Company expands distribution network to meet demand

What the data shows:

Sun King’s customer acquisition cost has dropped 60% since 2018

Why? Word of mouth. Referrals. “My cousin has one.”

In mature markets (Kenya), 40%+ of sales come from referrals

When 20-30% of a region has solar, it becomes the default. You’re not an early adopter, you’re behind. This is how mobile phones scaled in Africa. The tipping point creates exponential adoption curves.

The grid that never came turned out to be a blessing. While development experts spent 50 years debating how to extend 20th-century infrastructure to rural Africa, something more interesting happened: Africa built the 21st-century version instead.

Modular. Distributed. Digital. Financed by the people using it, subsidized by the carbon it avoids.

The solarpunk future isn’t speculative fiction. It’s 23 million solar systems, 40 million people, and a template for how infrastructure gets built when you’re not stuck defending the past.

Thanks to Jarek Dmowski for first spotlighting the companies in our monthly Follow the Money and for his perspectives, and to Aaron Kruse for the conversations that shaped this essay.

.png)