This is the year the world came onchain.

When we launched our first State of Crypto report, the industry was still in its adolescence. The total crypto market was worth about half what it is today. Blockchains were much slower, more expensive, and less reliable.

In the last three years, crypto builders weathered a major market drawdown and political uncertainty — but continued to make significant infrastructure improvements and other advancements. Those efforts bring us to today, a moment when crypto is becoming a meaningful part of the modern economy.

The story of crypto in 2025 is one of industry maturation. In short, crypto grew up:

- Traditional financial incumbents, like Visa, BlackRock, Fidelity, and JPMorgan Chase — and tech-native challengers like PayPal, Stripe, and Robinhood — are offering or launching crypto products.

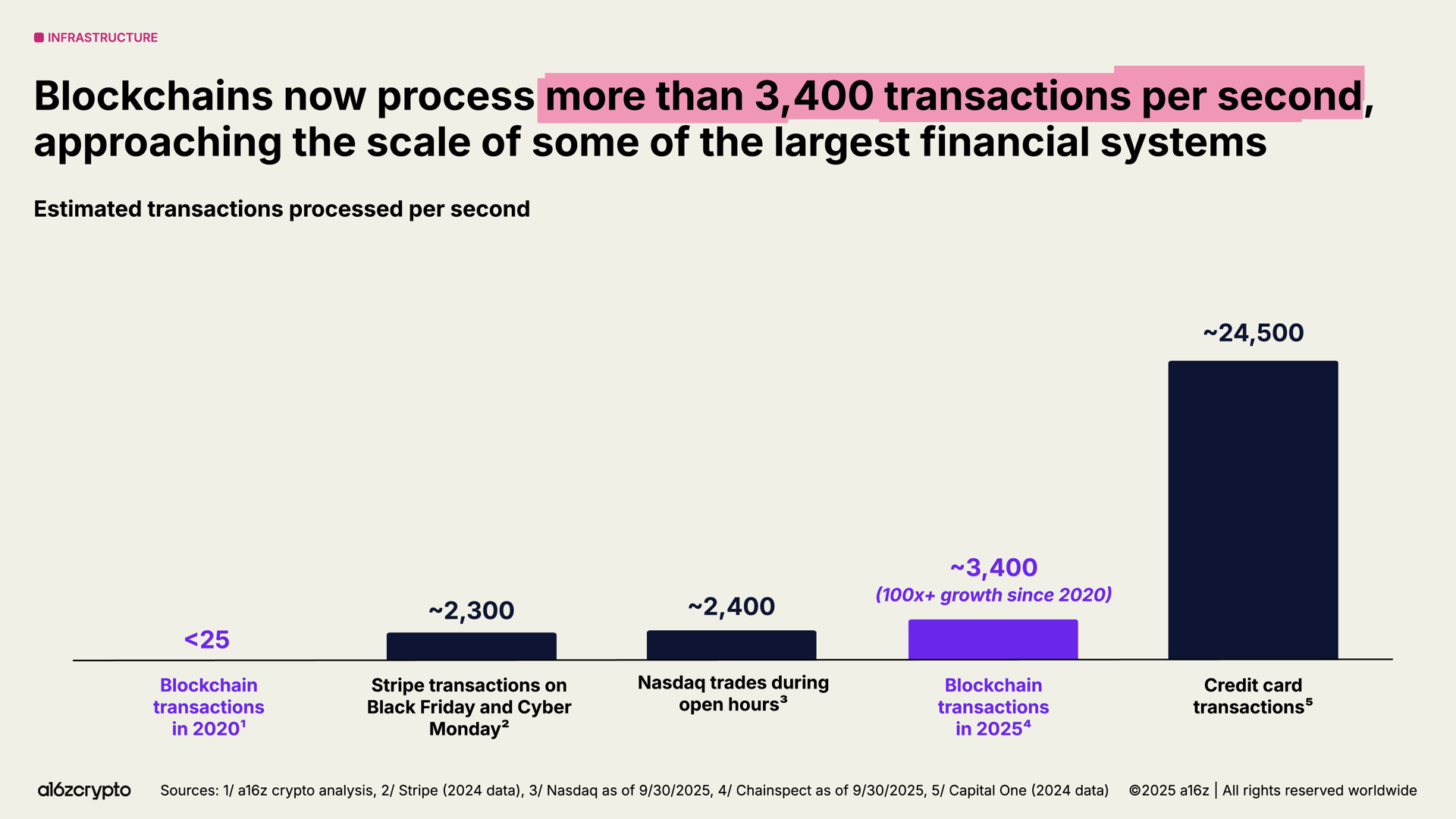

- Blockchains now process over 3,400 transactions per second (100x+ growth in the last five years).

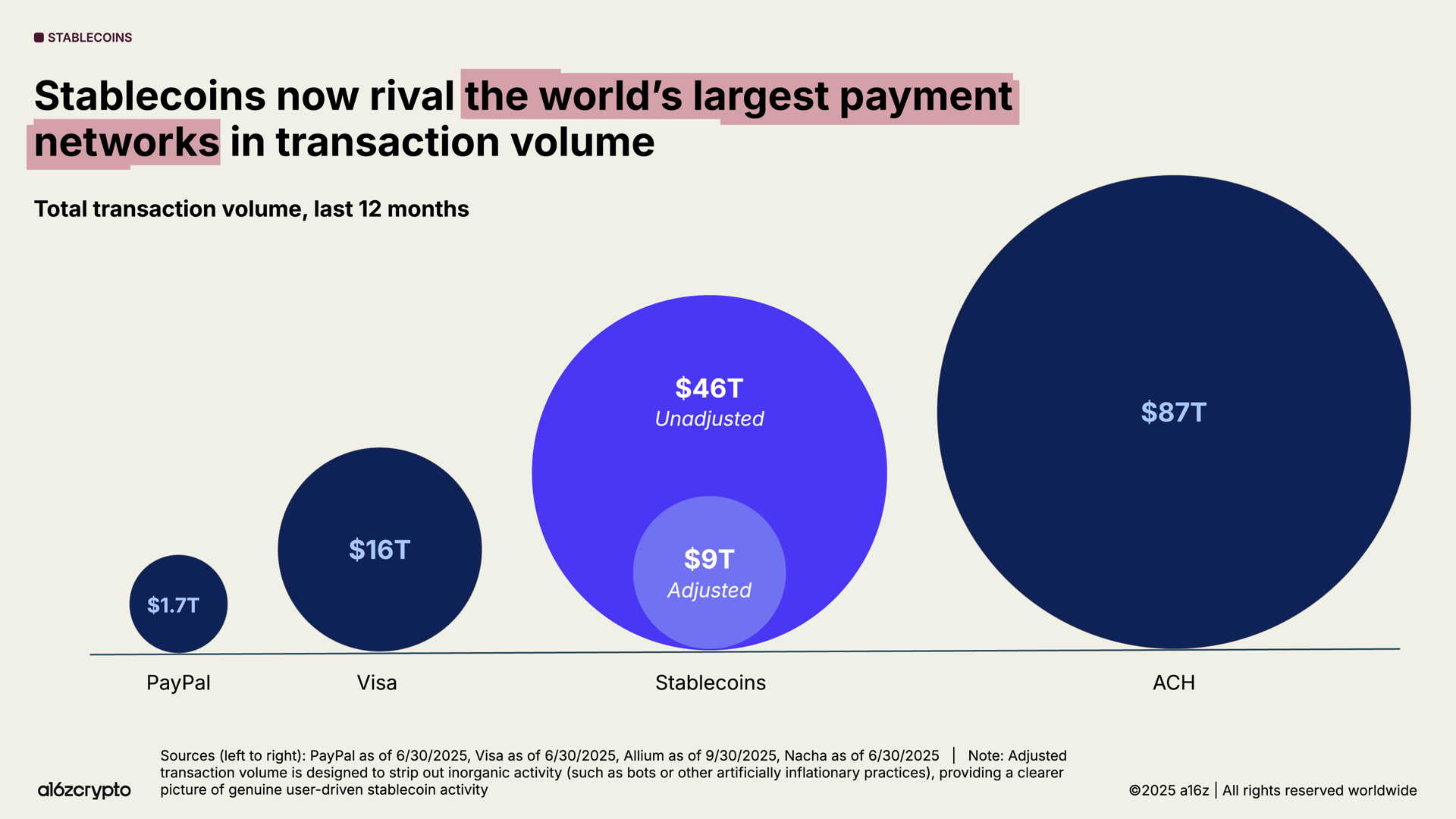

- Stablecoins power $46 trillion ($9 trillion adjusted) in annual transactions, rivaling Visa and PayPal.

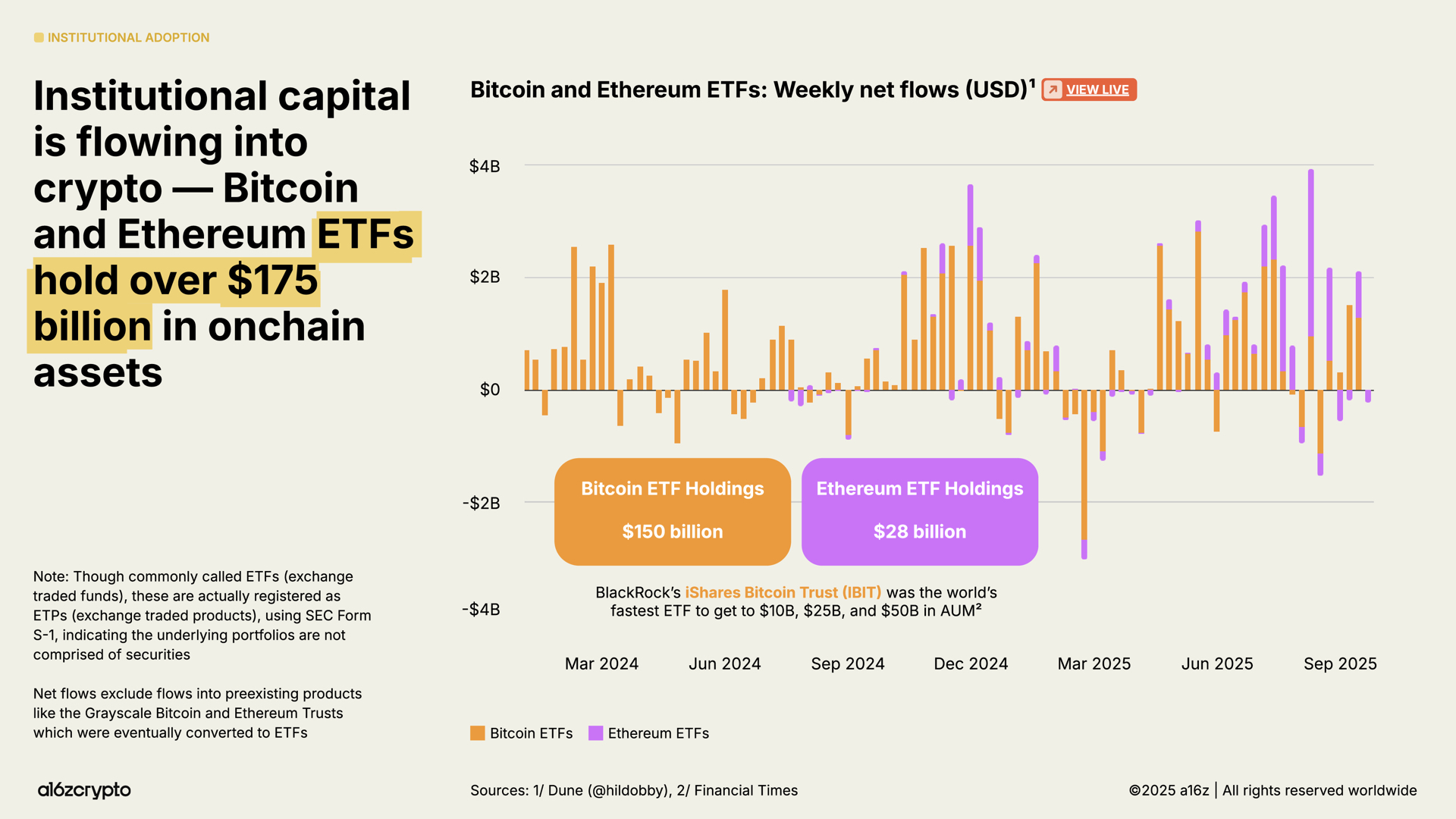

- Over $175 billion sits in Bitcoin and Ethereum exchange-traded products.

Our latest State of Crypto report explores this industry transformation, from institutional adoption and the rise of stablecoins to the convergence of crypto and AI. And for the first time, we’re introducing a new way to explore the data and track the industry’s evolution by the metrics that matter: the State of Crypto dashboard.

Now for the findings…

Key takeaways

- The crypto market is big, global, and growing

- Financial institutions have embraced crypto

- Stablecoins went mainstream

- Crypto is stronger than ever in the United States

- The world is coming onchain

- Blockchain infrastructure is (almost) ready for prime time

- Crypto and AI are converging

The market is big, global, and growing

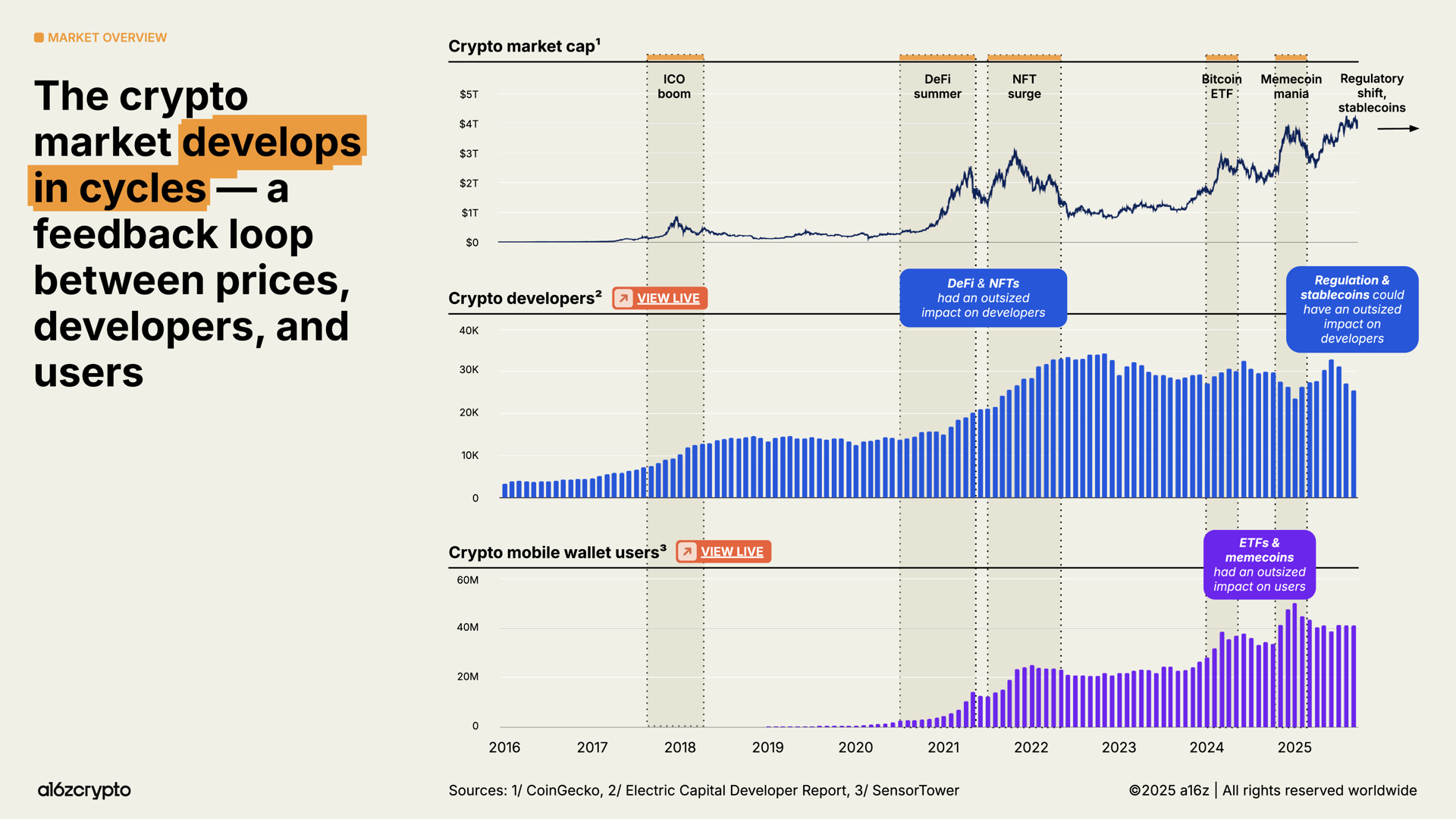

In 2025, the total crypto market cap crossed the $4 trillion threshold for the first time, marking the industry’s broad progress. The number of crypto mobile wallet users also reached all-time highs, up 20% from last year.

The shift from a hostile regulatory environment to a much more supportive one, alongside accelerating adoption of these technologies — from stablecoins to the tokenization of traditional financial assets to other emerging use cases — will define the next cycle.

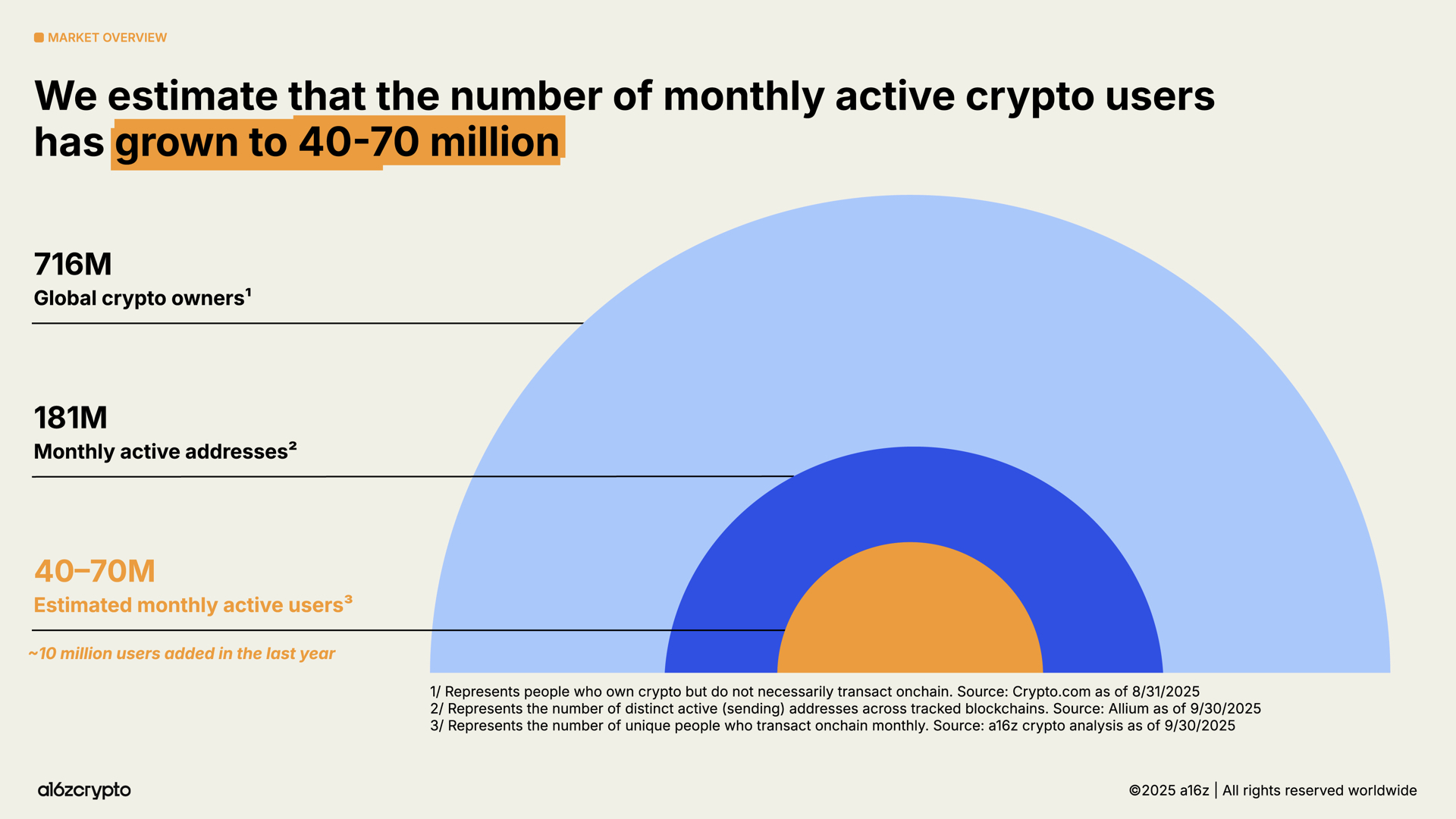

We estimate that there are roughly 40-70 million active crypto users, an increase of about 10 million over the last year, per our own analysis based on an update to this methodology.

This is a fraction of the estimated 716 million people who own crypto, up 16% from last year. It’s also a fraction of the approximately 181 million monthly active addresses onchain, down 18% from last year.

The gap between passive crypto holders (people who own crypto but don’t transact onchain) and active users (people who transact onchain regularly) represents an opportunity for crypto builders to reach more potential users who already own crypto.

So where are these crypto users, and what are they doing?

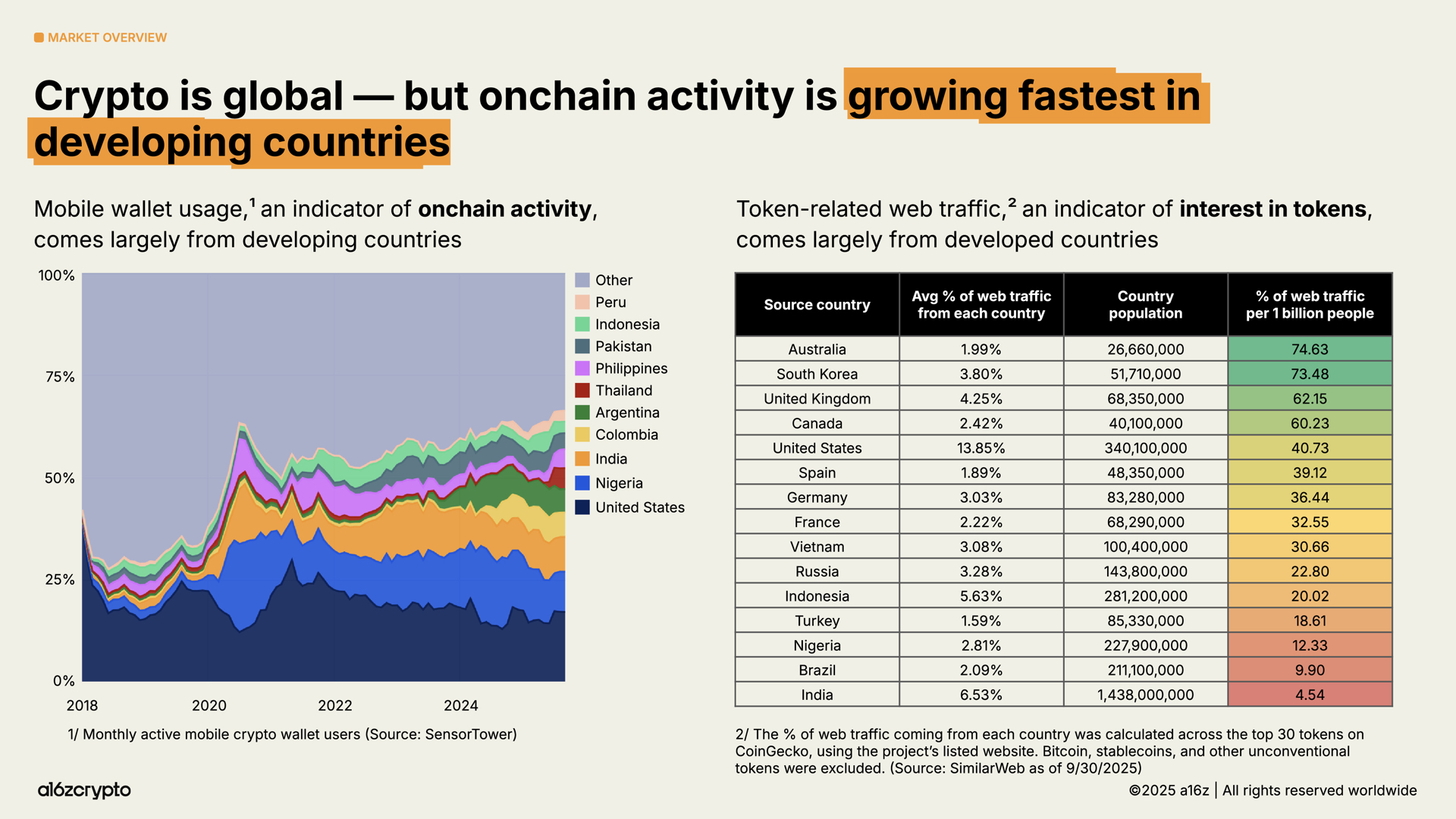

Crypto is global, but different parts of the world appear to use it in different ways. Mobile wallet usage, an indicator of onchain activity, is growing fastest in emerging markets like Argentina, Colombia, India, and Nigeria. (In particular, Argentina has seen a 16x increase in crypto mobile wallet usage over the last three years, amid an escalating currency crisis.)

Meanwhile, indicators of interest in tokens skew more toward developed nations, as our analysis of the geographic sources of token-related web traffic shows. Activity in these countries — particularly Australia and South Korea — may be more focused on trading and speculating compared to user behaviors in developing countries.

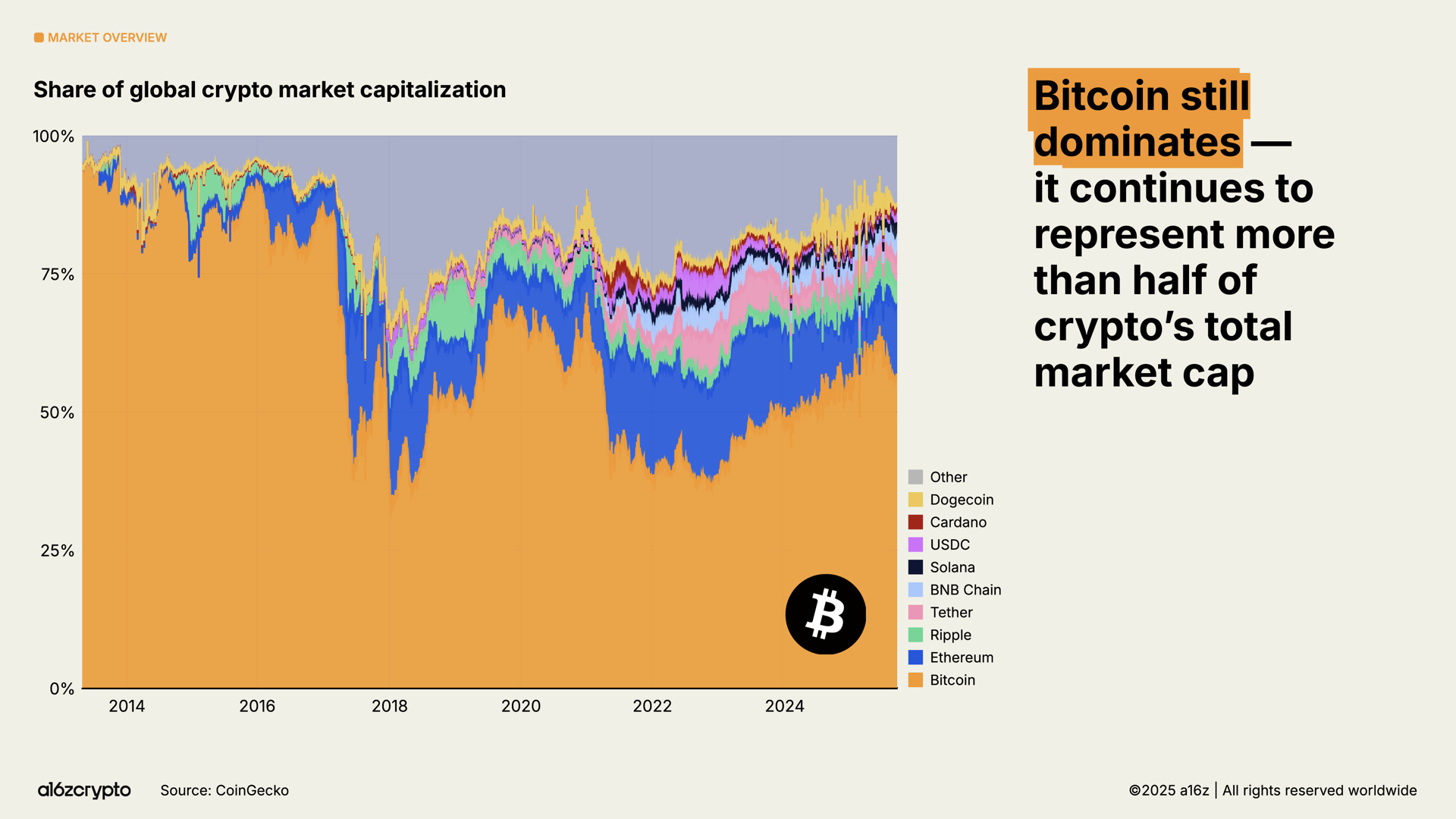

Bitcoin, which still represents more than half of crypto’s total market cap, hit an all-time high above $126,000 as it gained traction among investors as a store of value. Meanwhile, Ethereum and Solana recovered much of their post-2022 drawdowns.

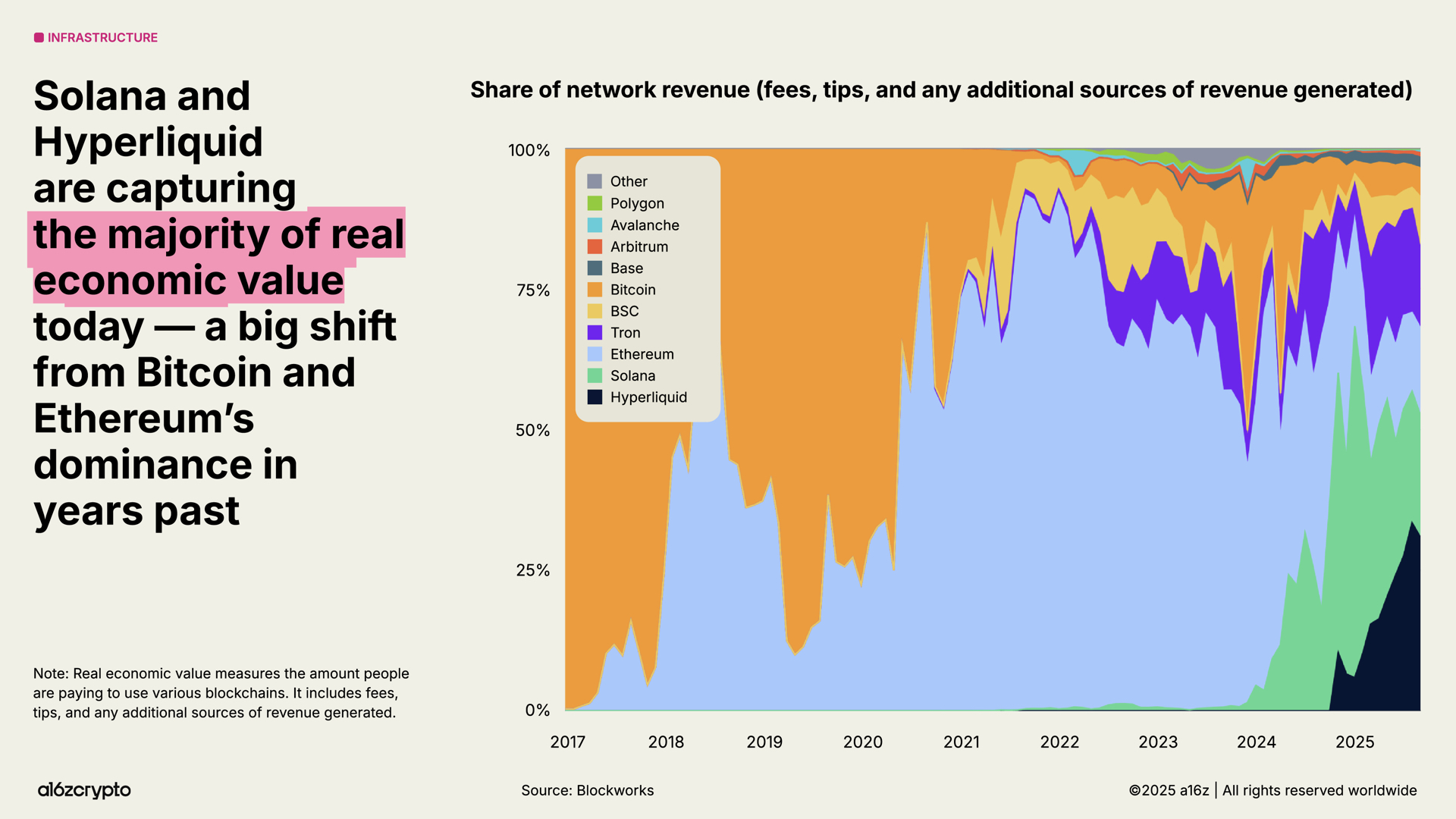

As blockchains continue to scale, as fee markets mature, and as new applications emerge, certain metrics are becoming more important; one of these is “real economic value” — a measure of how much people are actually paying to use blockchains. Hyperliquid and Solana account for 53% of revenue-generating economic activity today, a significant departure from the dominance of Bitcoin and Ethereum in previous years.

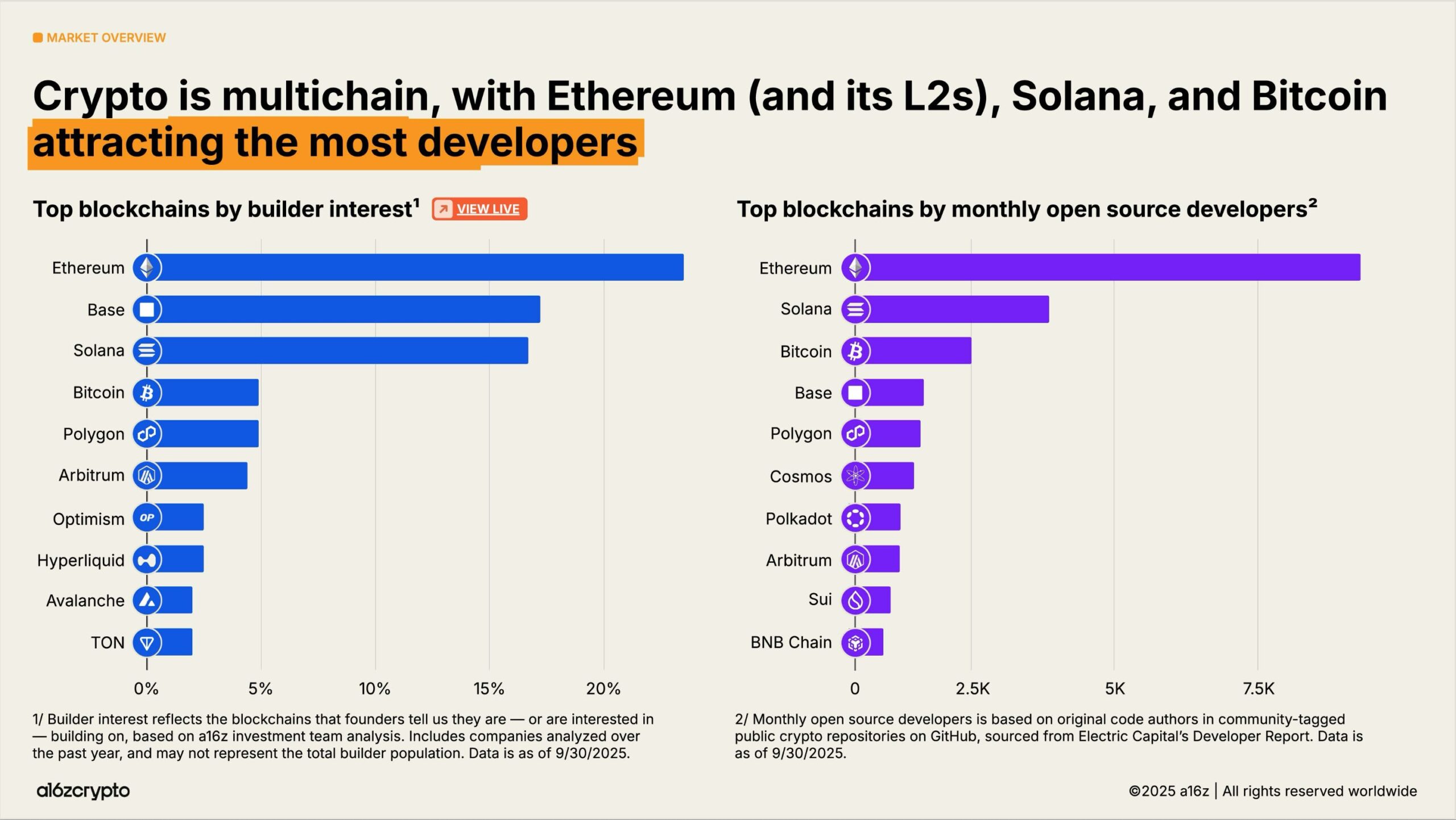

On the builder side, crypto remains multichain, with Bitcoin, Ethereum (and its L2s), and Solana attracting the most developers. Ethereum, combined with its L2s, was the top destination for new developers in 2025. Meanwhile, Solana is one of the fastest-growing ecosystems, with builder interest increasing by 78% in the last two years; this is a reflection of the number of founders who tell us which ecosystem they are building on — or are interested in building on — based on a16z crypto investment team analysis. (You can take a closer look at these and other trends in our State of Crypto dashboard.)

Financial institutions have embraced crypto

2025 is the year of institutional adoption. Just five days after stating that stablecoins had found product-market fit in last year’s State of Crypto report, Stripe announced its intent to acquire stablecoin infrastructure platform Bridge. The race was on: Traditional finance companies were ready to make public stablecoin moves, too.

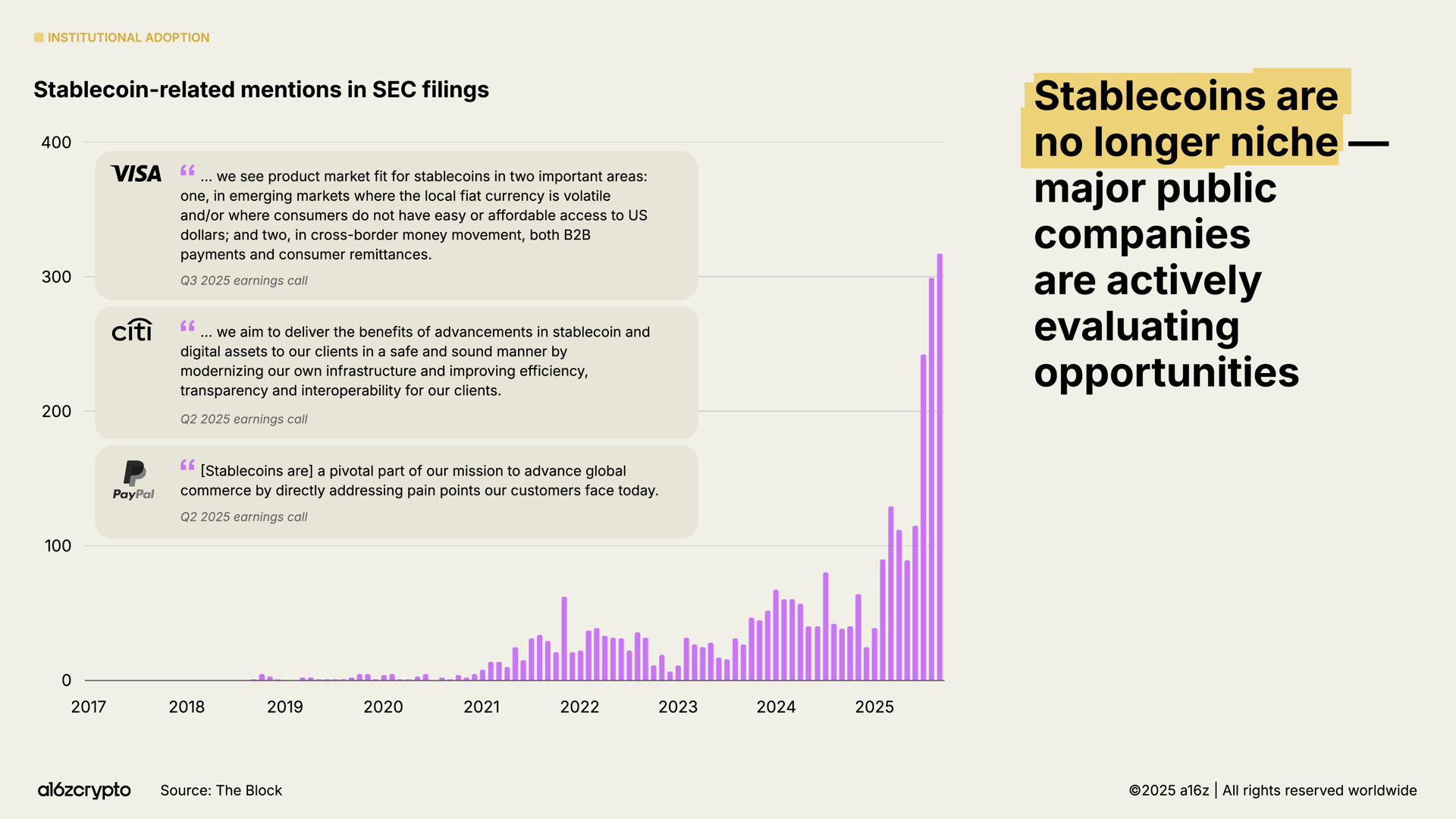

A few months later, Circle’s billion-dollar IPO marked the arrival of stablecoin issuers as mainstream financial institutions. And in July, the bipartisan GENIUS Act passed into law, providing builders and institutions with the clarity they needed to move forward. In the months since, mentions of stablecoins in SEC filings have grown 64%, and a flurry of announcements have continued to follow from major financial institutions.

Institutional adoption has ramped up quickly. Traditional institutions — including Citigroup, Fidelity, JPMorgan, Mastercard, Morgan Stanley, and Visa — are now offering (or planning to offer) crypto products directly to consumers, allowing them to buy, sell, and hold digital assets, alongside equities, exchange-traded products, and other traditional instruments. Platforms like PayPal and Shopify, meanwhile, are doubling down on payments and building infrastructure for daily transactions between merchants and customers.

Beyond direct offerings, major fintechs — including Circle, Robinhood, and Stripe — are actively developing, or have announced plans to develop, new blockchains, focusing on payments, real-world assets, and stablecoins. These initiatives could bring more payment flows onchain, encourage enterprise adoption, and ultimately create a bigger, faster, and more global financial system.

These companies have massive distribution. If development continues, crypto could become deeply integrated into the financial services we use every day.

Exchange-traded products are another key driver of institutional investment, with over $175 billion in onchain crypto holdings today, up 169% from $65 billion a year ago.

BlackRock’s iShares Bitcoin Trust (IBIT) has been cited as the most traded Bitcoin exchange-traded product launch of all time, and the follow-on Ethereum exchange-traded products have seen notable inflows in recent months. (Note: Although commonly called exchange-traded funds, or ETFs, these are actually registered as ETPs, or exchange-traded products, using SEC Form S-1, indicating that the underlying portfolios do not consist of securities.)

These products make crypto more accessible, unlocking a significant amount of institutional capital that has historically been on the sidelines of the industry.

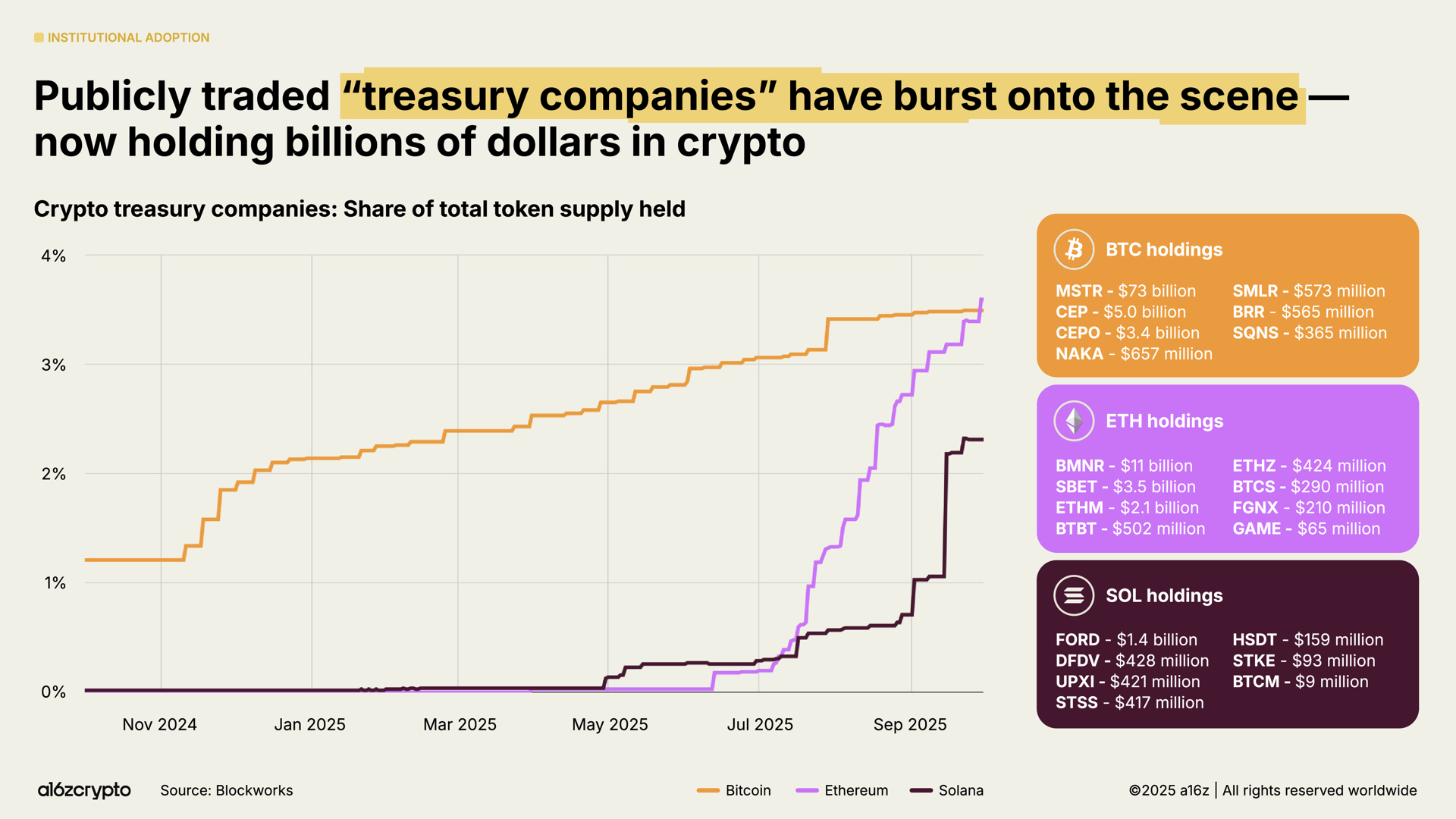

Publicly traded “digital asset treasury” (DAT) companies — entities that hold crypto on their balance sheets, much like corporate treasuries hold cash — now collectively hold about 4% of the total Bitcoin and Ethereum in circulation. These DATs, combined with exchange-traded products, now hold around 10% of both Bitcoin’s and Ethereum’s token supplies.

Stablecoins went mainstream

Nothing signals crypto’s maturity in 2025 more than the rise of stablecoins. In years past, stablecoins were used mostly to settle speculative crypto trades; as of the last couple years, they have become the fastest, cheapest, and most global way to send a dollar — in less than one second for less than one cent, almost anywhere in the world.

And this year, they became the backbone of the onchain economy.

Stablecoins have done $46 trillion in total transaction volume in the last year, up 106% from the year before. And, while not an apples-to-apples comparison since this figure mostly represents financial flows (versus retail payments for card networks), this is nearly three times that of Visa and approaching that of the ACH network, which plumbs the entire U.S. banking system.

On an adjusted basis — a better measure of organic activity that attempts to filter out bots and other artificially inflationary activity — stablecoins have done $9 trillion in the last 12 months, up 87% from a year ago. This is more than five times PayPal’s throughput, and more than half of Visa’s.

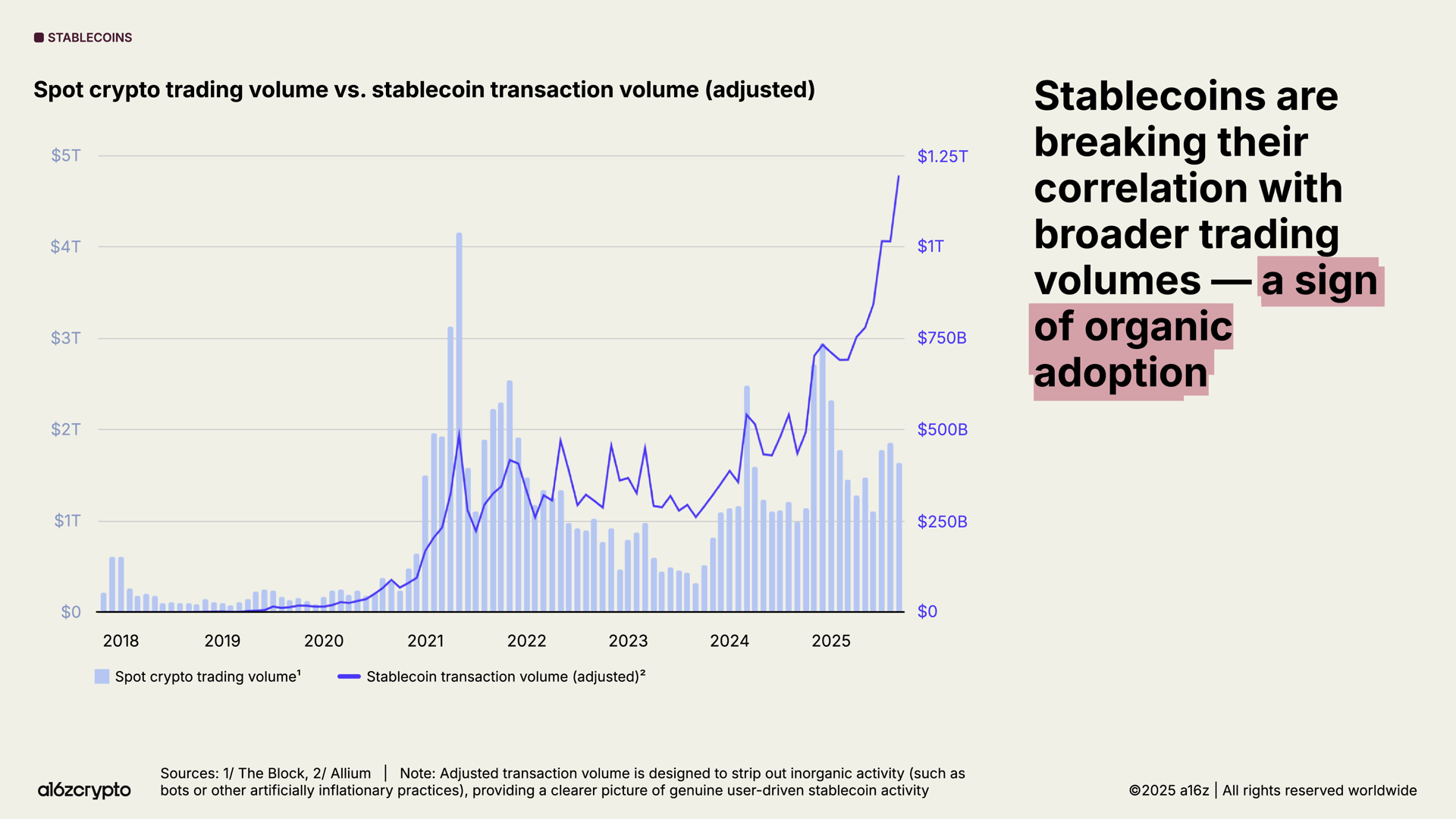

Adoption is accelerating. Monthly adjusted stablecoin transaction volume has exploded to new all-time highs, approaching $1.25 trillion in September 2025, alone.

Notably, this activity was largely uncorrelated with broader crypto trading volume — indicating the non-speculative use of stablecoins and, more to the point, their product-market fit.

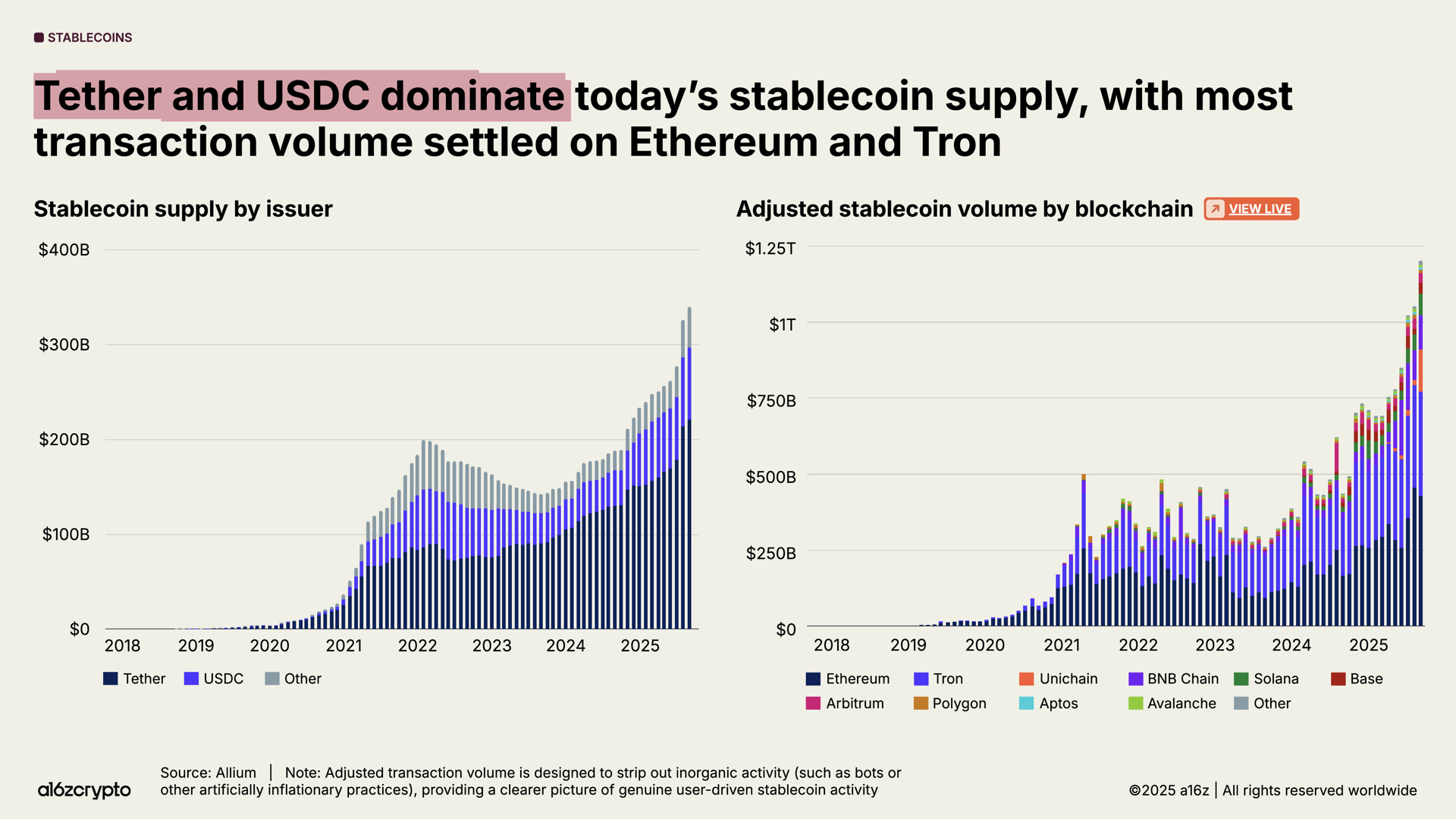

The total stablecoin supply is also at record highs, now over $300 billion.

The market’s largest stablecoins dominate: Tether and USDC account for 87% of the total supply. $772 billion in stablecoin transactions (adjusted) were settled on Ethereum and Tron blockchains in September 2025, 64% of all transaction volume. While these two issuers and chains account for the majority of stablecoin activity, growth among new chains and issuers is also gaining steam.

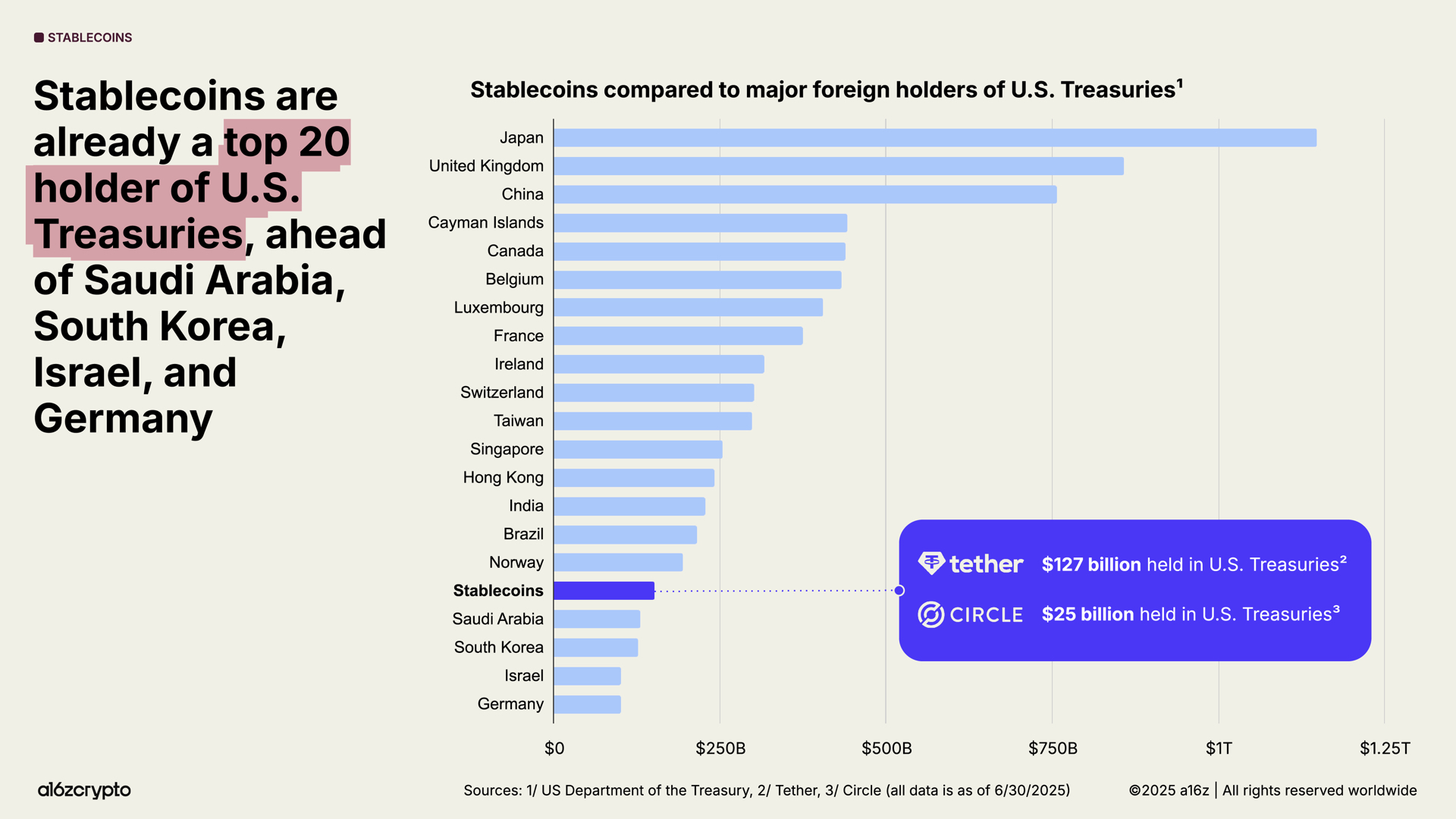

Stablecoins are now a global macroeconomic force: More than 1% of all U.S. dollars now exist as tokenized stablecoins on public blockchains, and stablecoins are now the #17 holder of U.S. Treasuries, up from #20 last year. Altogether, stablecoins hold over $150 billion in U.S. Treasuries — more than many sovereign nations.

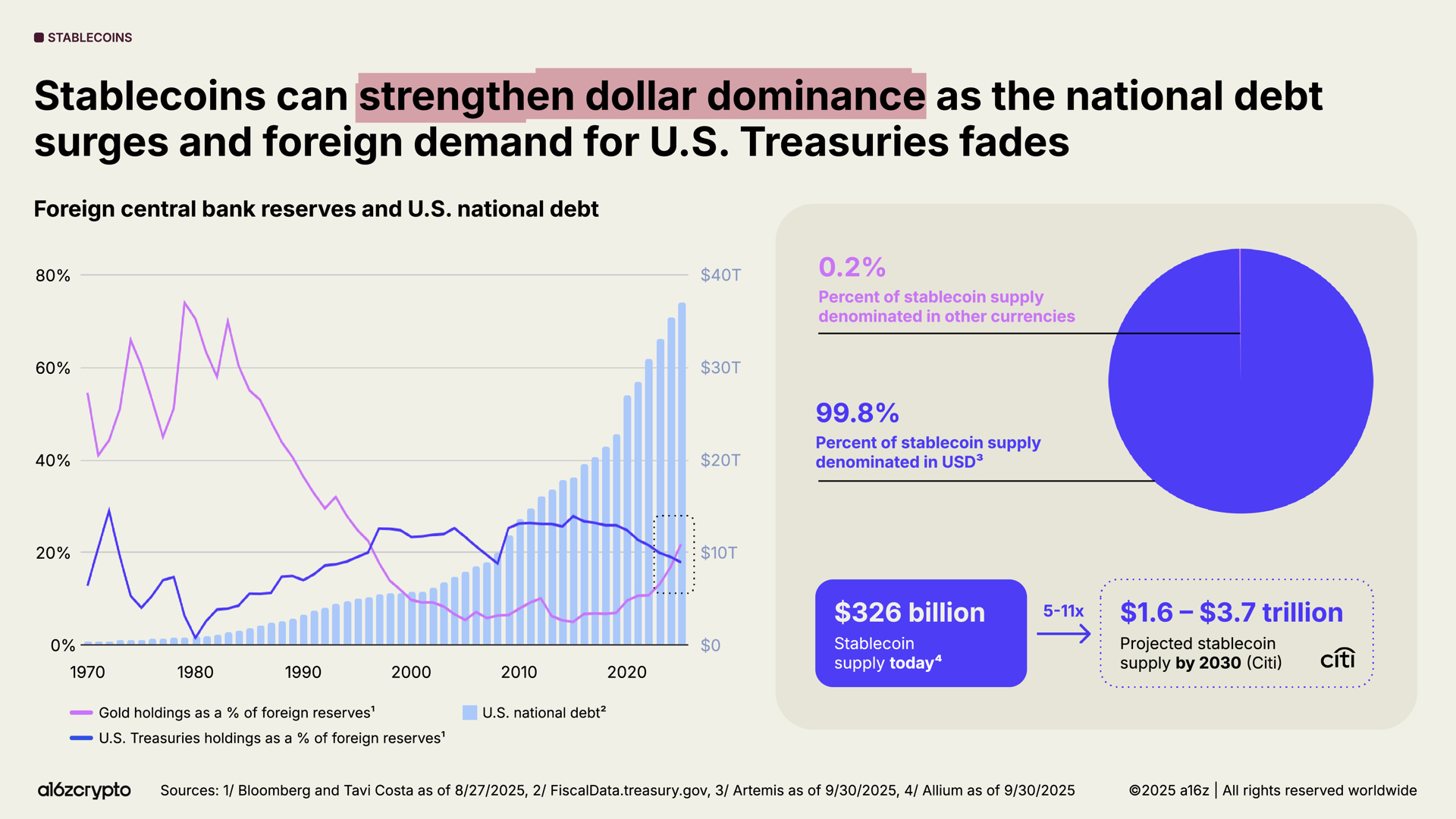

Meanwhile, the U.S. national debt is surging even as global demand for that debt wanes. For the first time in 30 years, foreign central banks hold more reserves in gold than U.S. Treasuries.

But stablecoins are bucking the trend: Over 99% of stablecoins are denominated in USD, and they are projected to grow 10x to more than $3 trillion by 2030, presenting a potentially strong and sustainable source of demand for U.S. debt in the years ahead.

Even as foreign central banks reduce their Treasury holdings, stablecoins are strengthening dollar dominance.

Crypto is stronger than ever in the United States

The U.S. has reversed its formerly antagonistic stance toward crypto, reviving builder confidence.

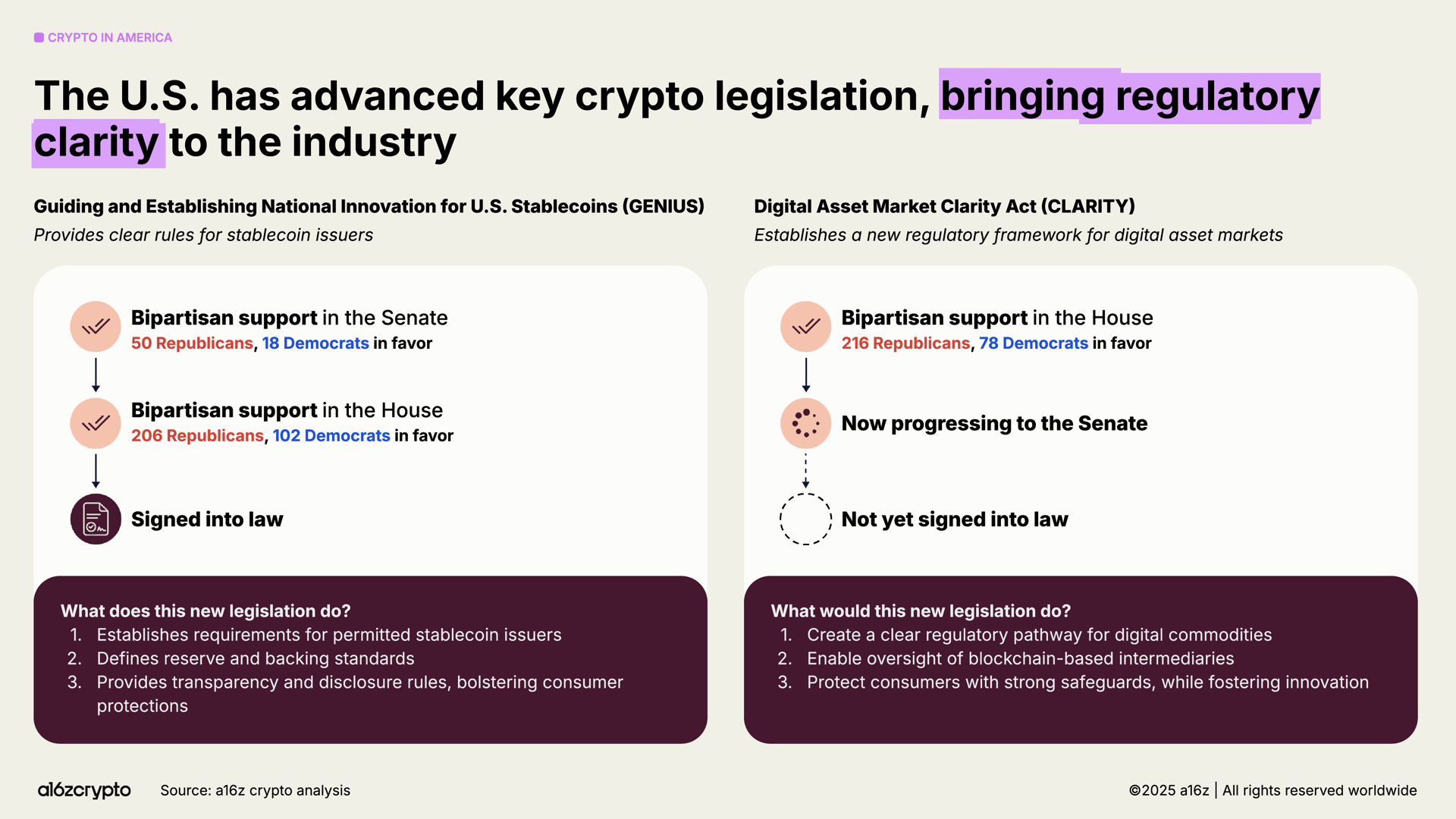

The passage of the GENIUS Act and the House approval of the CLARITY Act this year signal a bipartisan consensus that crypto is both here to stay and ready to thrive in the U.S. Together, these bills establish a framework for stablecoins, market structure, and digital asset oversight that balances innovation with investor protection. The legislation was complemented by Executive Order 14178, which reversed earlier anti-crypto directives and created a cross-agency task force to modernize federal digital-asset policy.

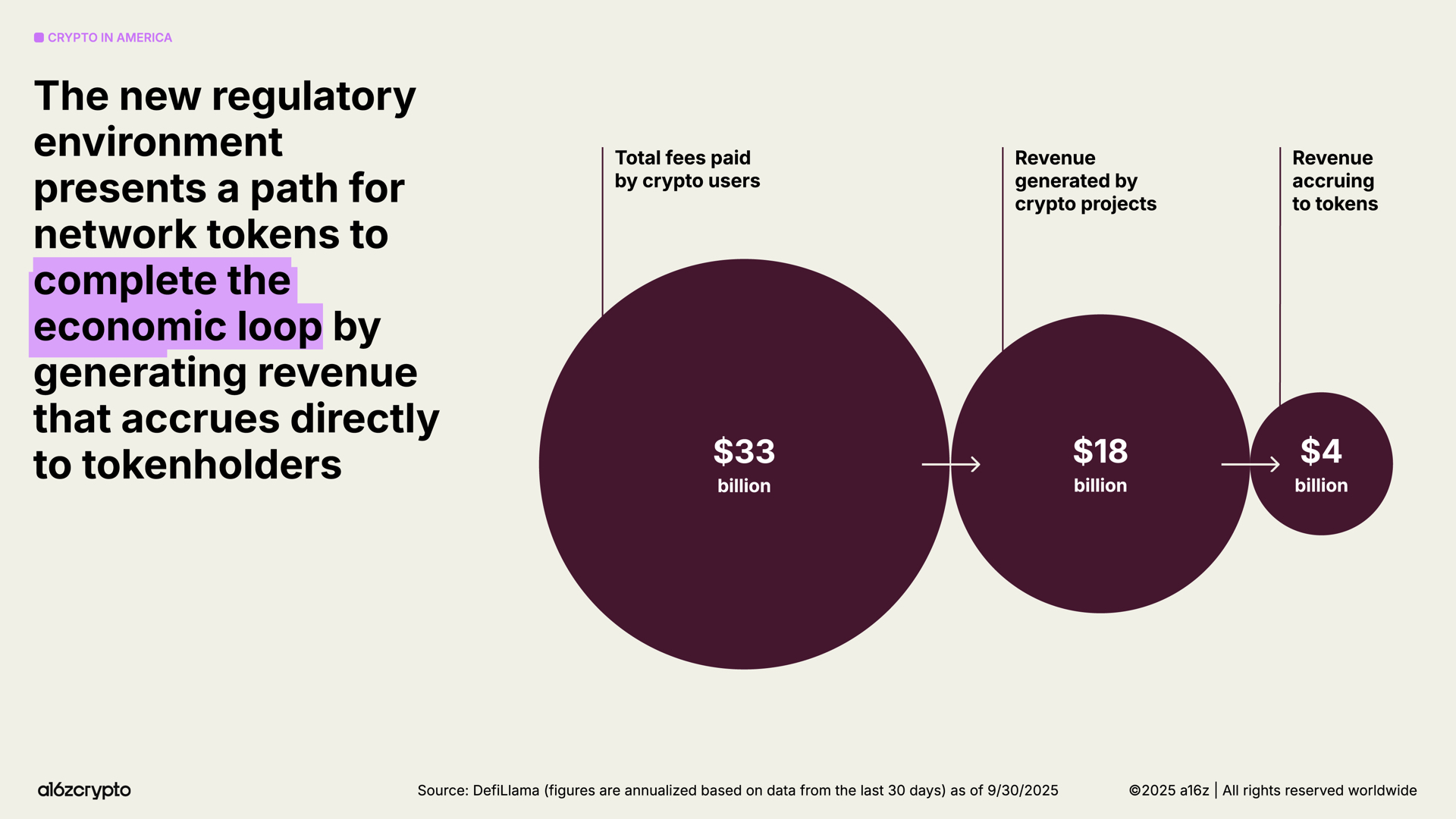

The regulatory environment is clearing a path for builders to realize the potential of tokens as a new digital primitive, akin to what websites were for previous generations of the internet. With regulatory clarity, more network tokens will be able to complete their economic loop by generating revenue that accrues to tokenholders — creating a new economic engine for the internet that is self-sustaining and that gives more users a stake in the system.

The world is coming onchain

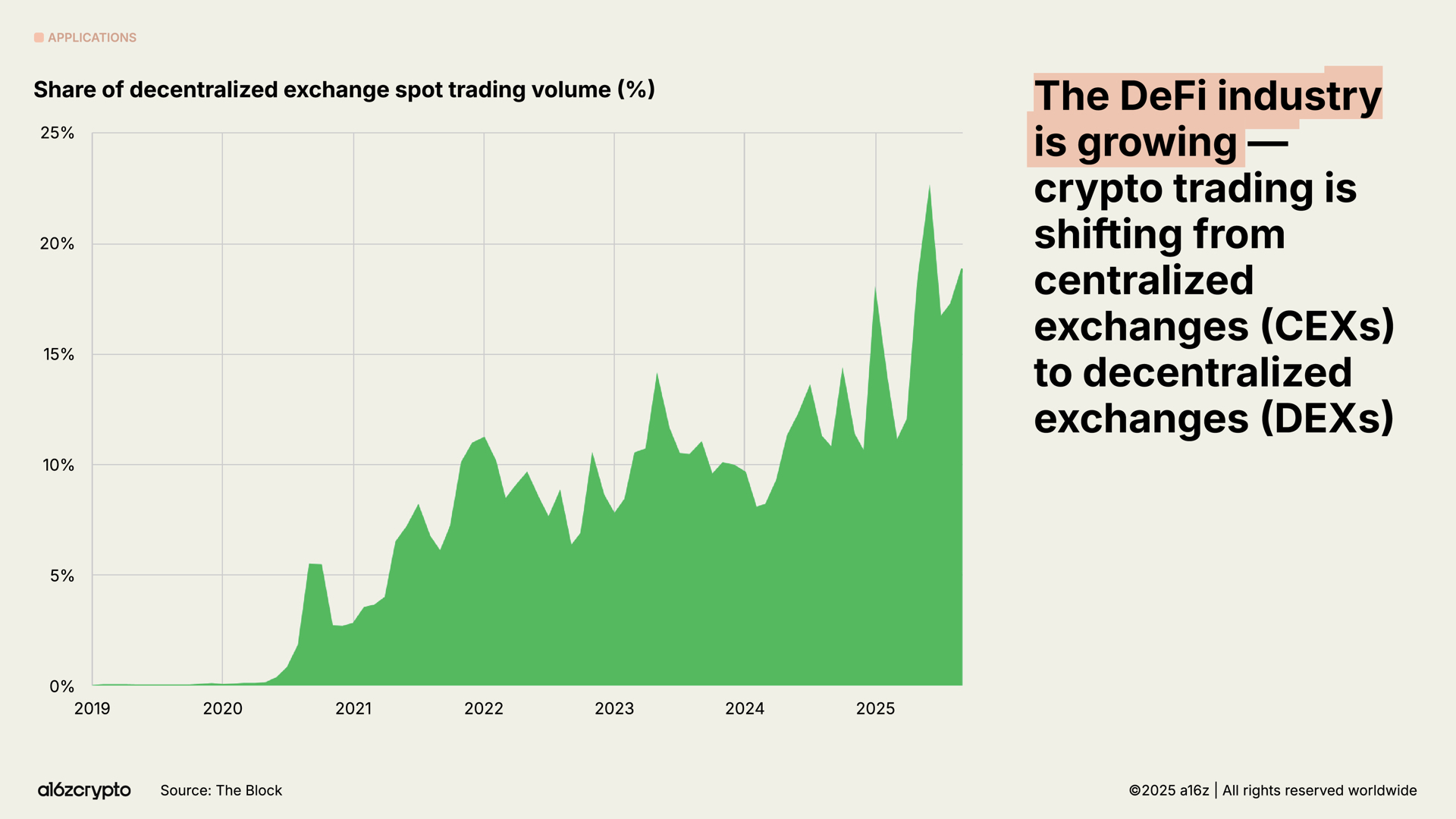

The onchain economy — once a niche playground for early adopters — has evolved into a multi-sector marketplace with tens of millions of monthly participants. Nearly one-fifth of all spot trading volume now happens on decentralized exchanges.

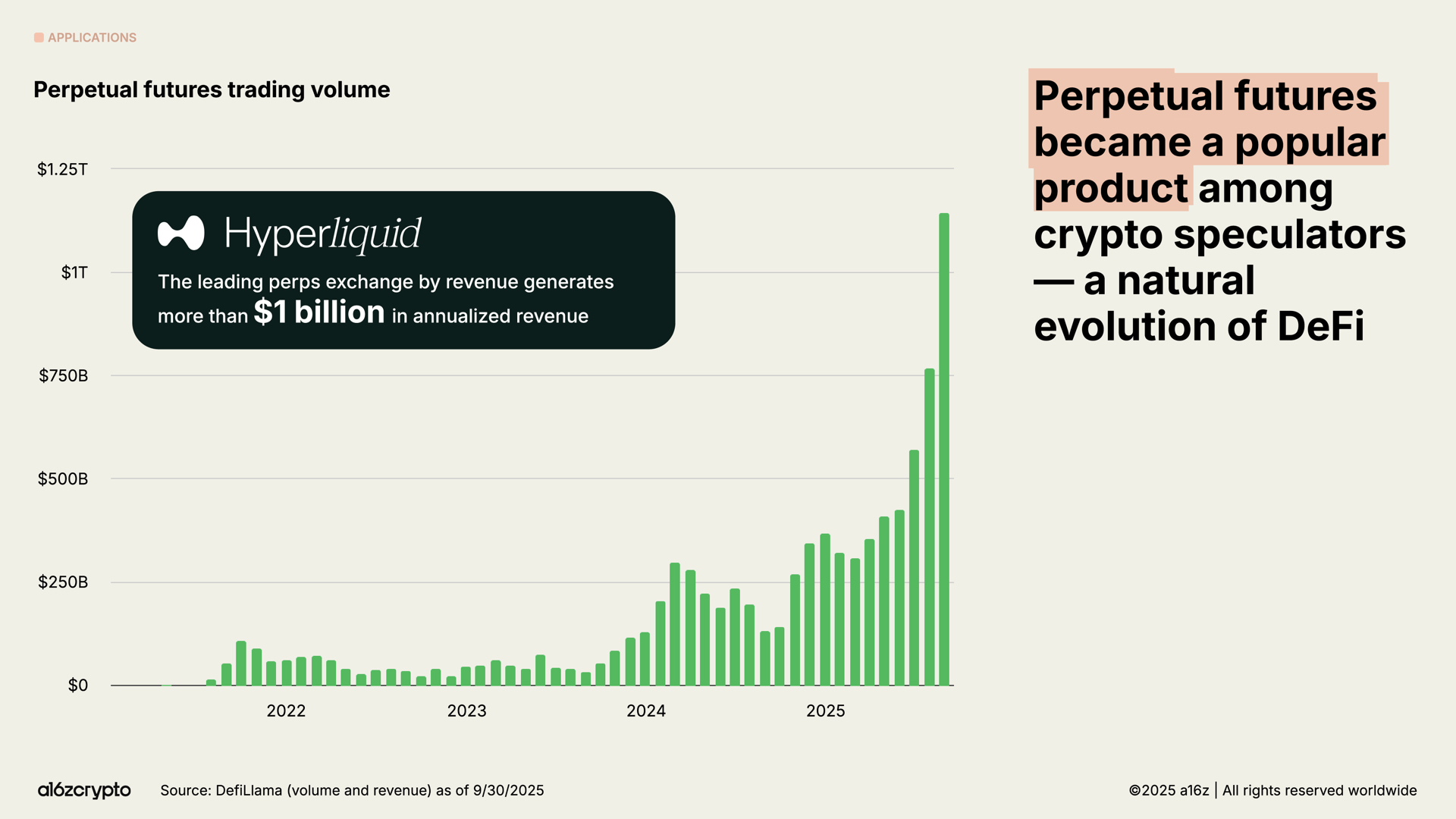

With volumes up nearly 8x in the last year, perpetual futures have exploded among crypto speculators. Decentralized perps exchanges like Hyperliquid have processed trillions of dollars in trades, and generated more than $1 billion in annualized revenue this year — numbers that rival some centralized exchanges.

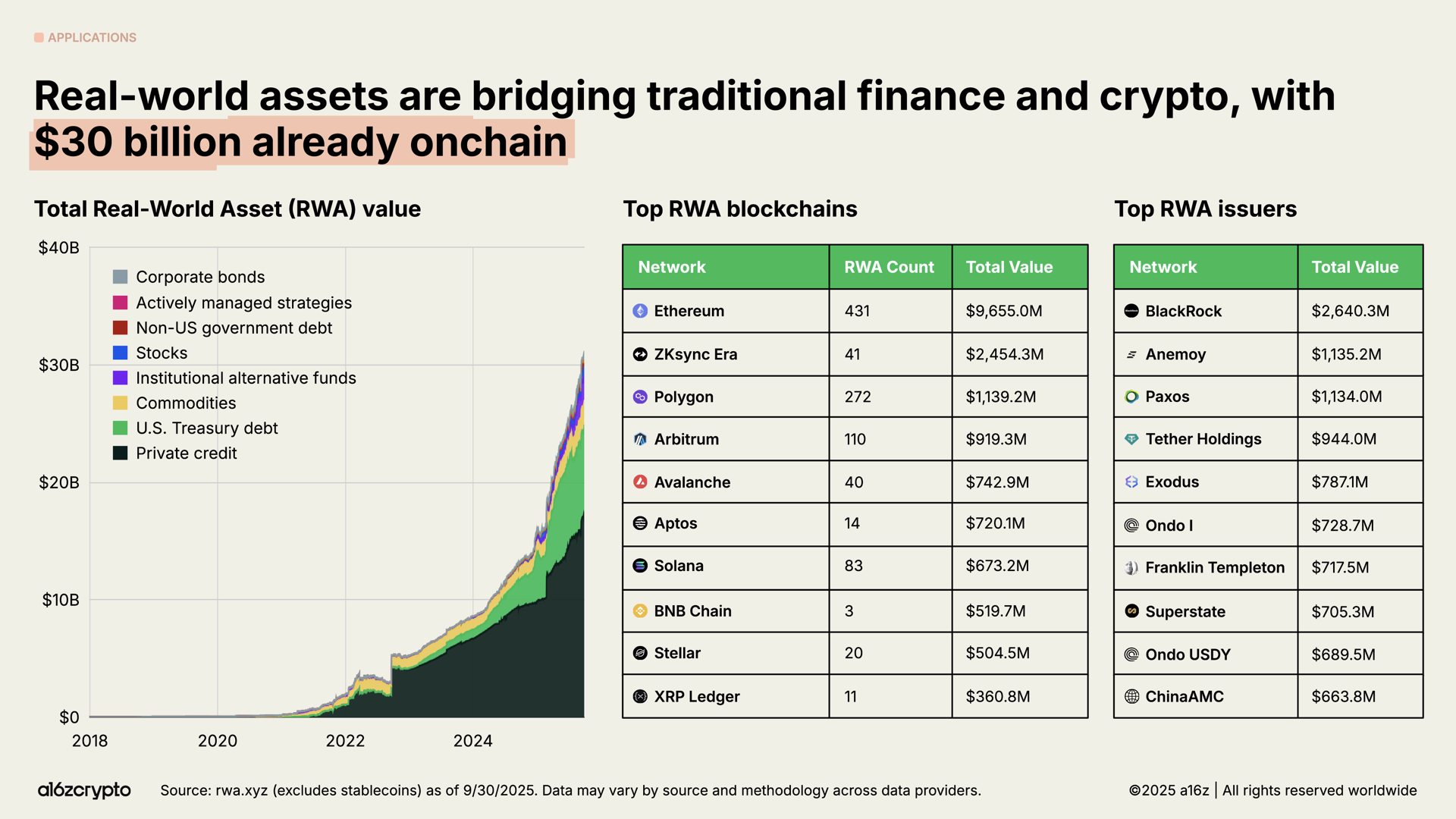

Real-world assets (RWAs) — traditional assets such as U.S. Treasuries, money-market funds, private credit, and real estate that are represented onchain (“tokenized”) — bridge crypto and traditional finance. The total market for tokenized RWAs sits at $30 billion, up nearly 4x in the last two years.

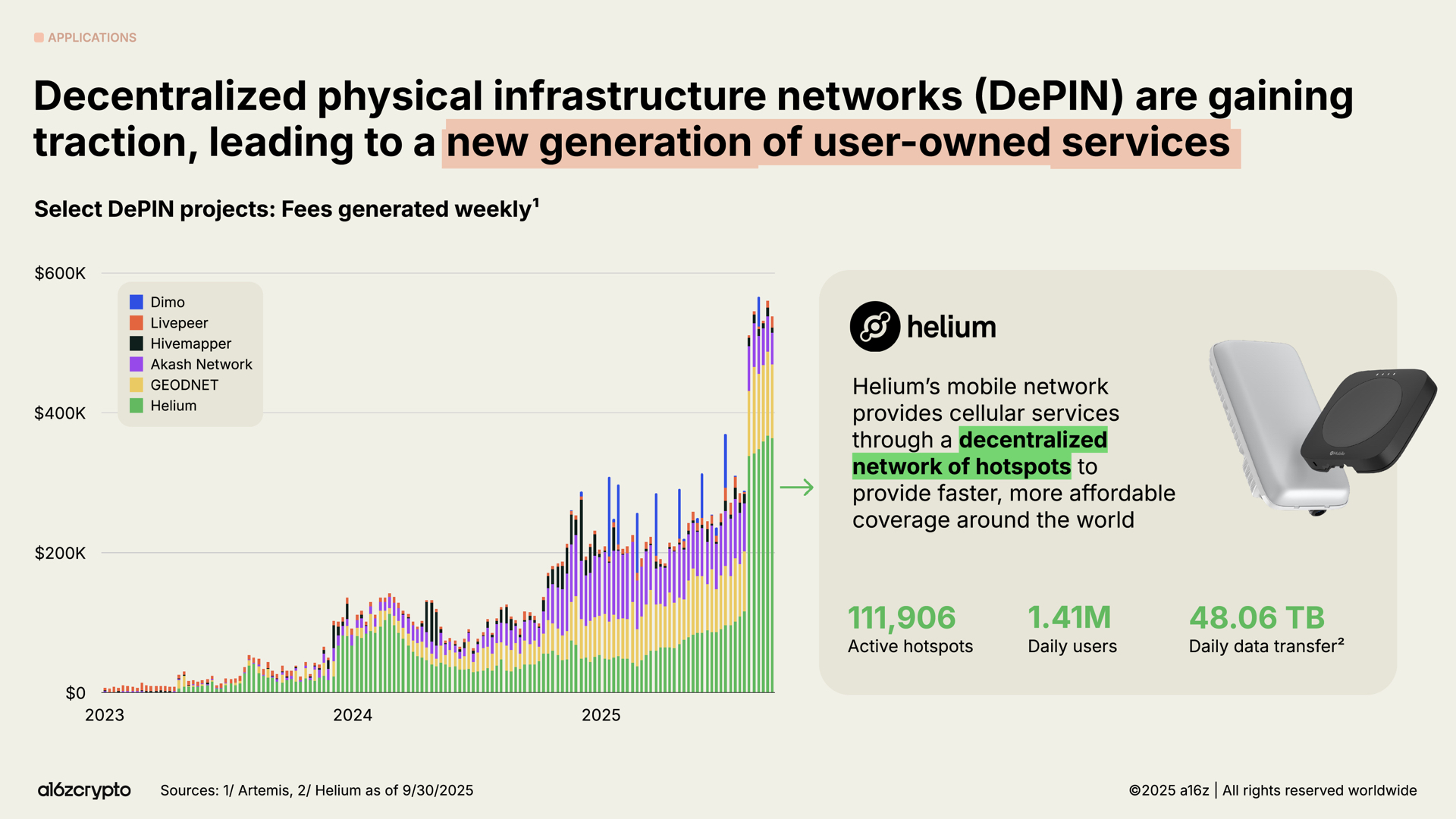

Beyond finance, one of the most ambitious frontiers for blockchains in 2025 is DePIN, or decentralized physical infrastructure networks.

Where DeFi reimagined finance, DePIN is reimagining physical infrastructure, including telecom and transportation networks, energy grids, and more. The opportunity is huge: The World Economic Forum projects the DePIN category will grow to $3.5 trillion by 2028.

The Helium network is the best-known example. The grassroots wireless network now provides 5G cellular coverage to 1.4 million daily active users across more than 111,000 user-operated hotspots.

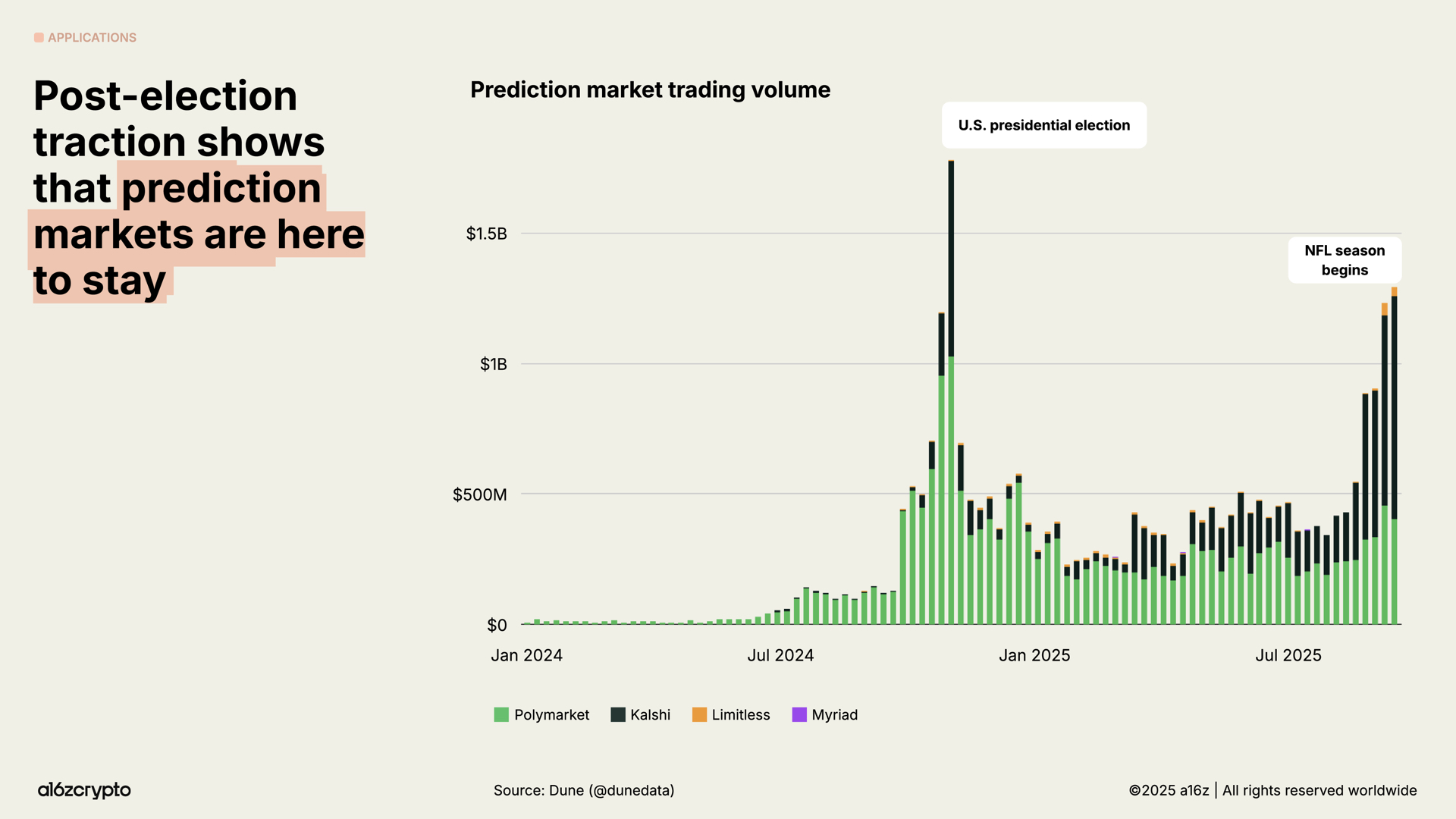

Prediction markets broke into the mainstream during the 2024 U.S. presidential election cycle with the most popular platforms, Polymarket and Kalshi, seeing billions in combined monthly trading volume. Despite facing skepticism over whether they could sustain engagement outside election years, these platforms have seen trading volume increase nearly 5x since the start of 2025, nearing previous highs.

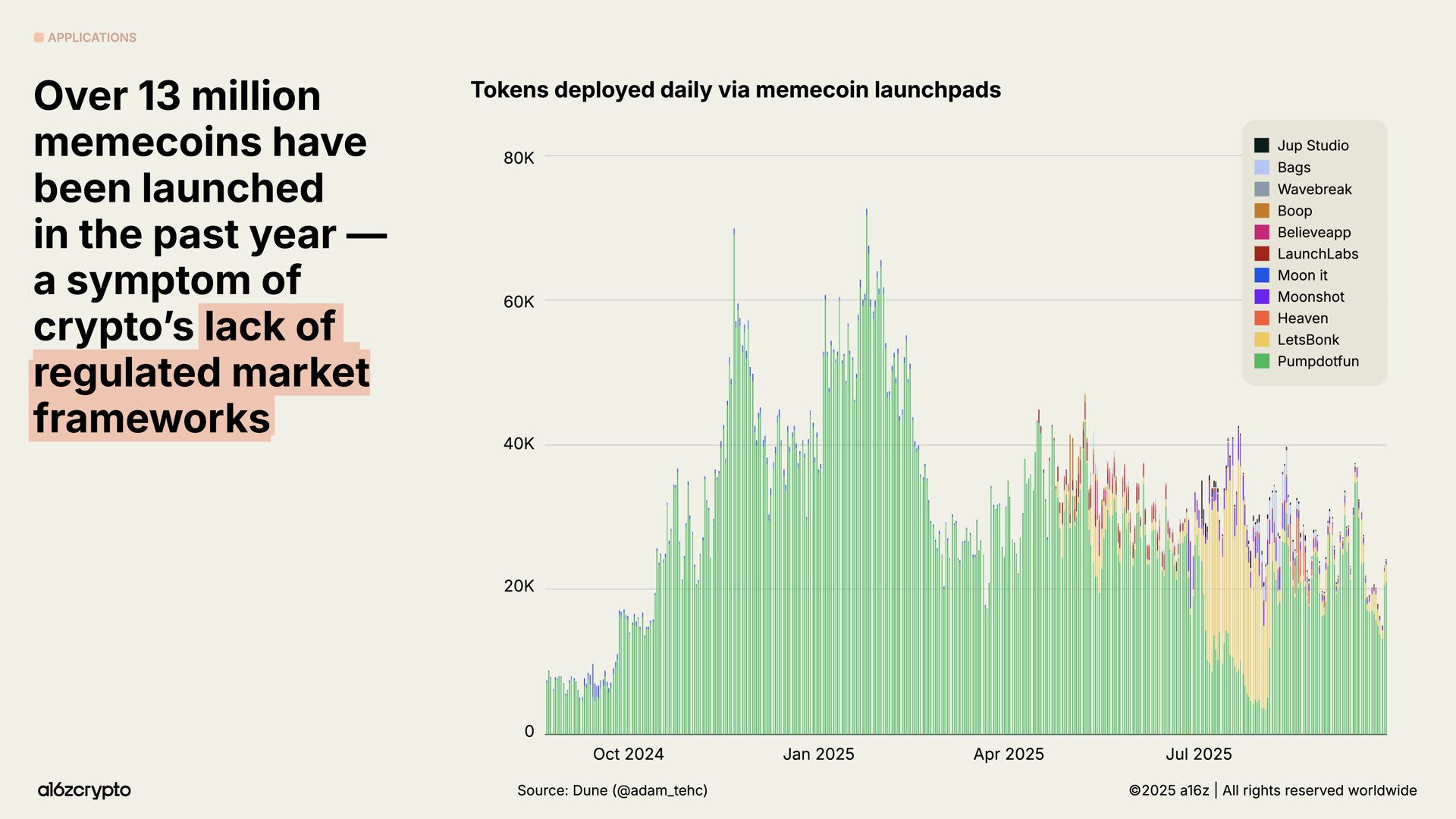

In the absence of regulatory clarity, memecoins flourished. Over 13 million memecoins launched in the last year. This trend appears to be cooling down in recent months — there were 56% fewer launches in September than in January — as sound policy and bipartisan legislation clears the way for more productive blockchain use cases.

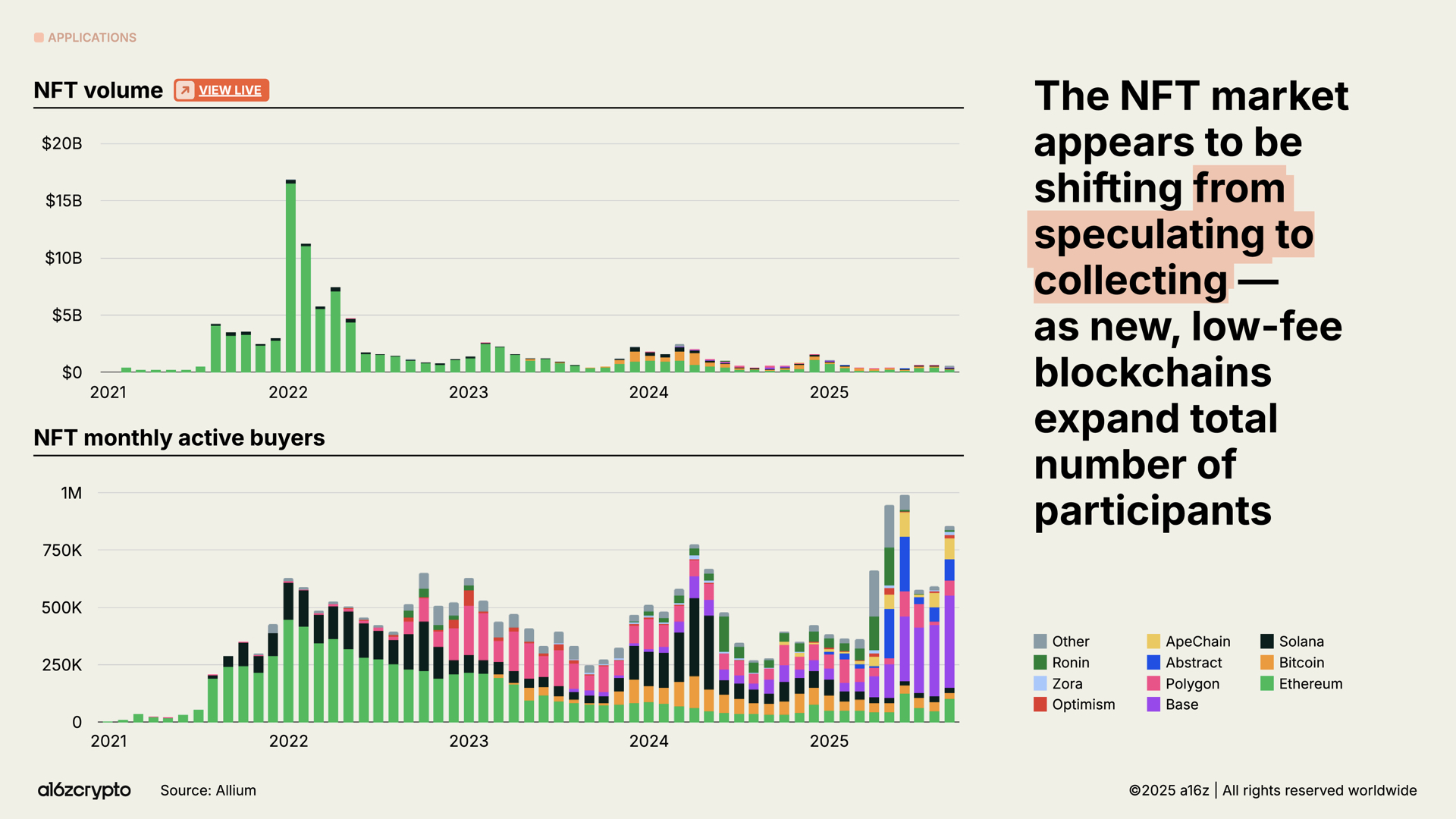

NFT market volume is nowhere near its peak in 2022, but the number of monthly active buyers has been growing. These trends appear to signal a shift in consumer behavior from speculating to collecting, one enabled by the advent of cheaper blockspace across chains like Solana and Base. (For more on the intersection of crypto and creator economy, see our Voices Onchain program.)

Blockchain infrastructure is (almost) ready for prime time

All of this activity wouldn’t be possible without major advances in blockchain infrastructure.

In just five years, aggregate transaction throughput across major blockchain networks has increased more than 100x. Then, blockchains processed fewer than 25 transactions per second. Now they process 3,400 transactions per second, on par with completed trades on the Nasdaq or Stripe’s global throughput on Black Friday — and at a fraction of the historical cost.

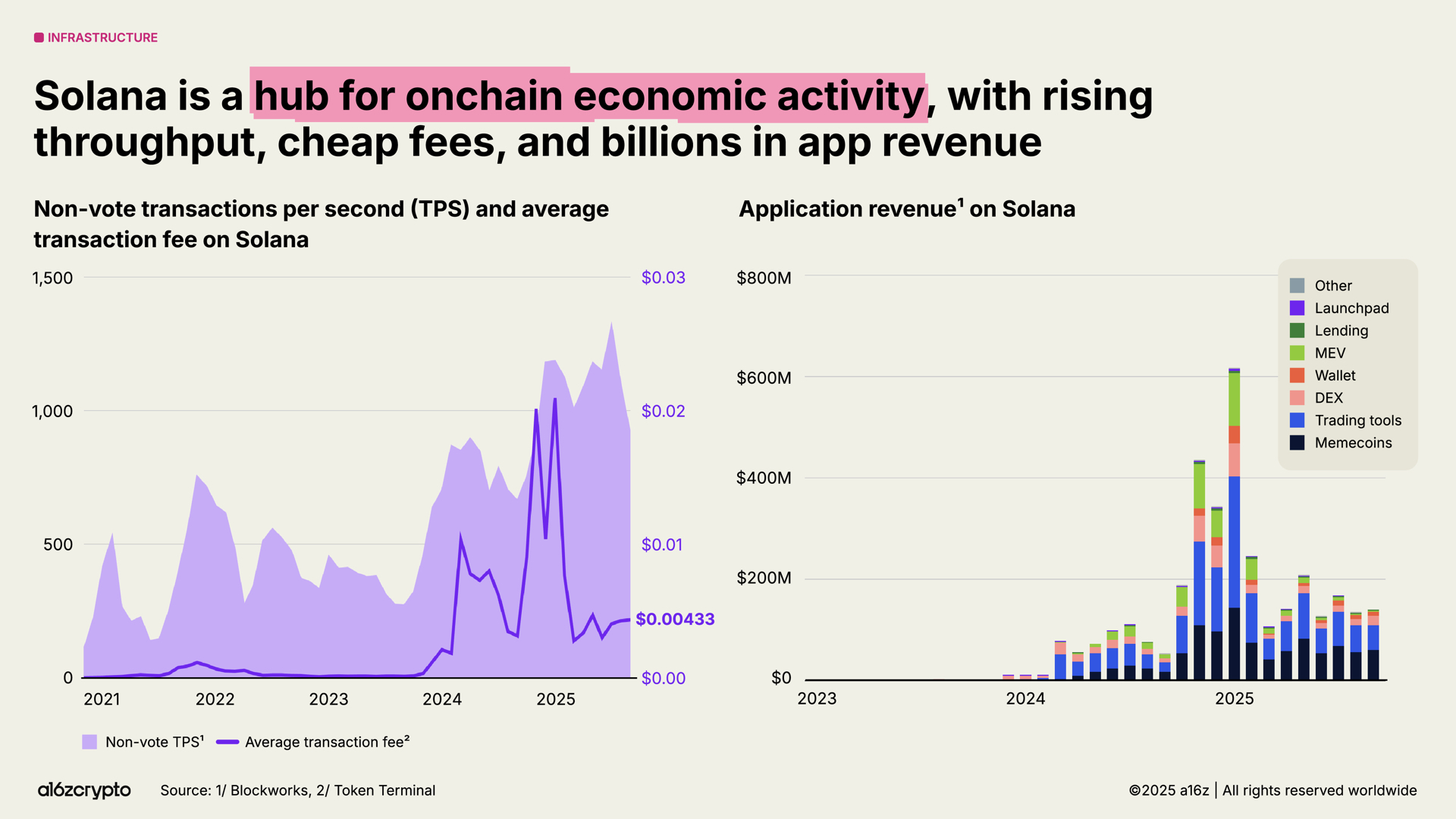

Among blockchain ecosystems, Solana has emerged as one of the most prominent. Its high-performance, low-fee architecture now underpins everything from DePIN projects to NFT marketplaces, with its native applications generating $3 billion in revenue in the past year. Planned upgrades are expected to double the network’s capacity by year-end.

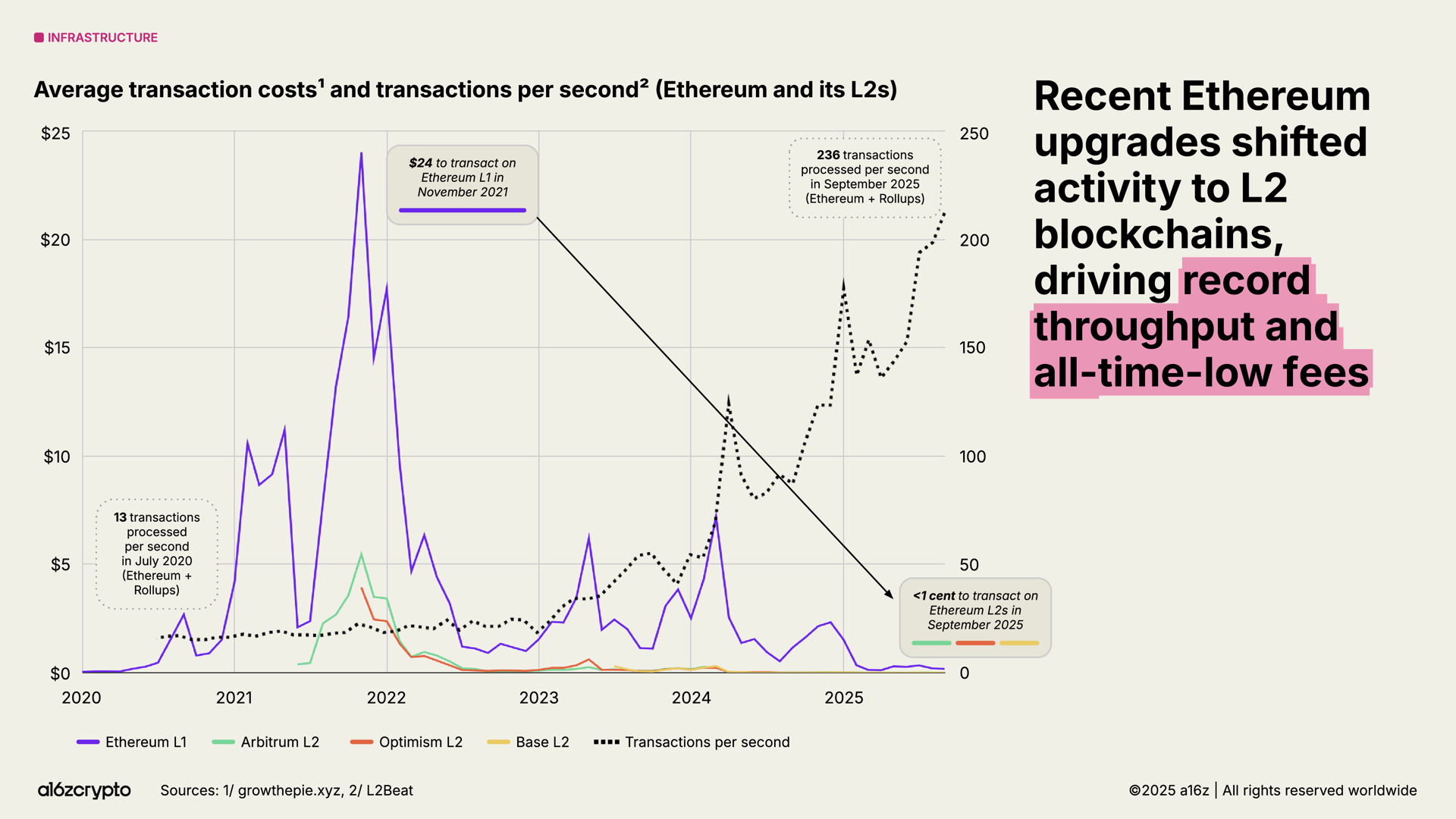

Ethereum continues to execute on its scaling roadmap, with most of its economic activity migrating to L2s such as Arbitrum, Base, and Optimism. Average transaction costs on L2s have dropped from around $24 in 2021 to less than one cent today, making Ethereum-linked blockspace cheap and abundant.

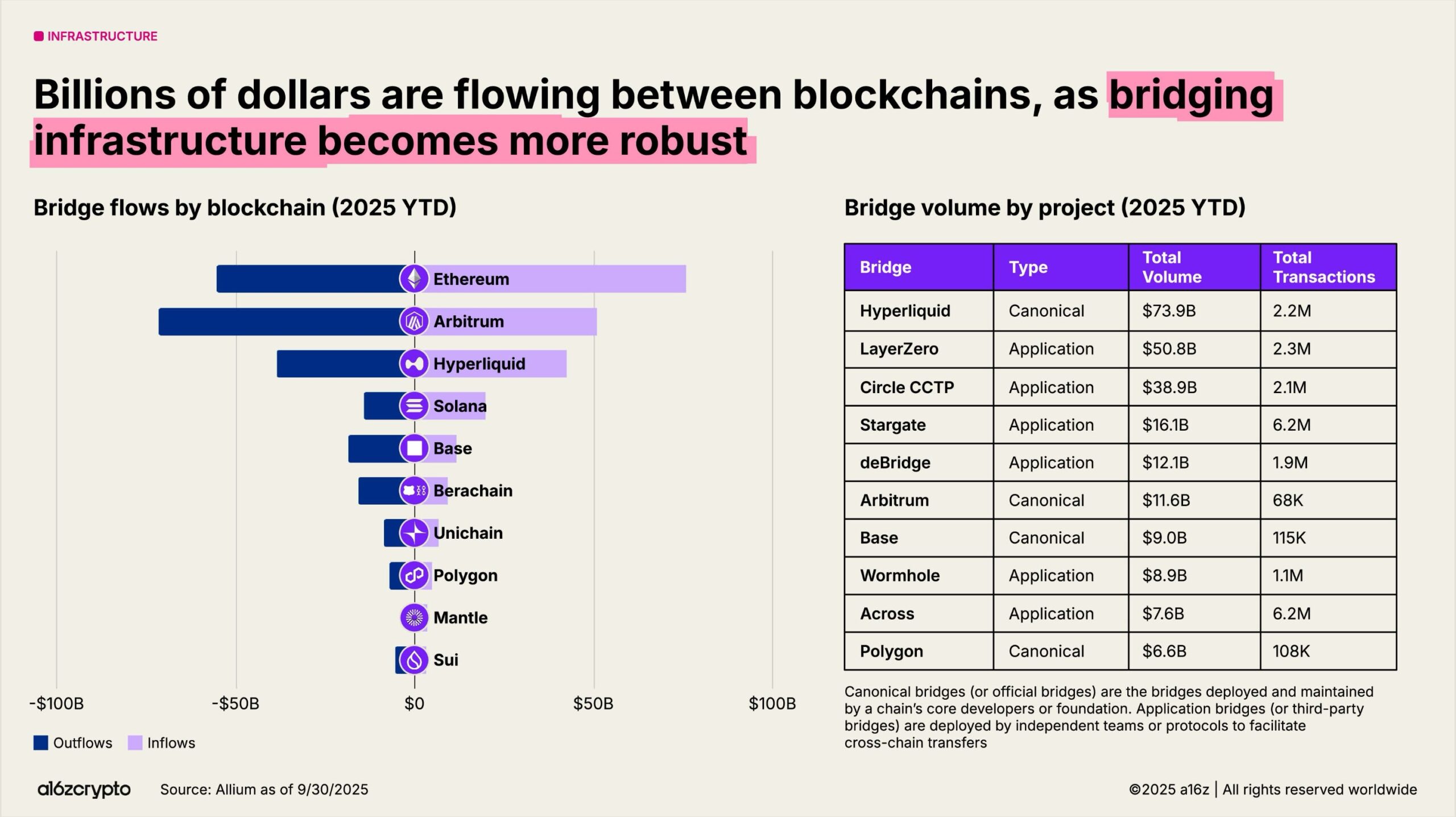

Bridges are allowing blockchains to interoperate. Protocols like LayerZero and Circle’s Cross-Chain Transfer Protocol allow users to move assets across a multichain system. Hyperliquid’s canonical bridge also reached $74 billion in volume year to date.

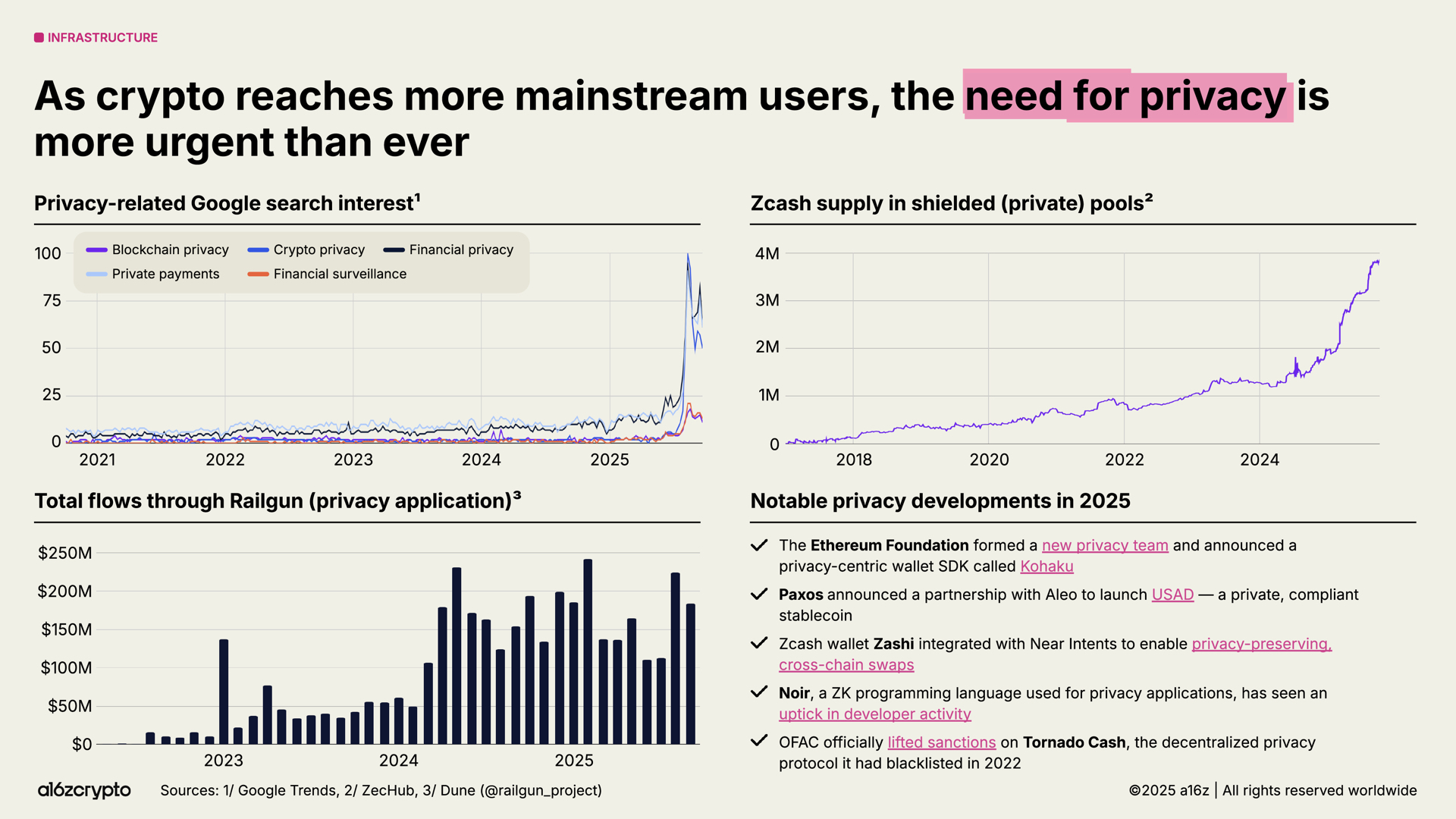

Privacy is returning to the foreground and could be a prerequisite for wider adoption. Indicators of growing interest: Google searches related to crypto privacy surged in 2025; Zcash’s shielded pool supply grew to nearly 4 million ZEC; and Railgun’s transaction flows surpassed $200 million monthly.

More signs of momentum: The Ethereum Foundation formed a new privacy team; Paxos partnered with Aleo on a private, compliant stablecoin (USAD); and the Office of Foreign Assets Control lifted sanctions on decentralized privacy protocol Tornado Cash. We expect this trend to gain even more momentum in the years ahead as crypto continues to go mainstream.

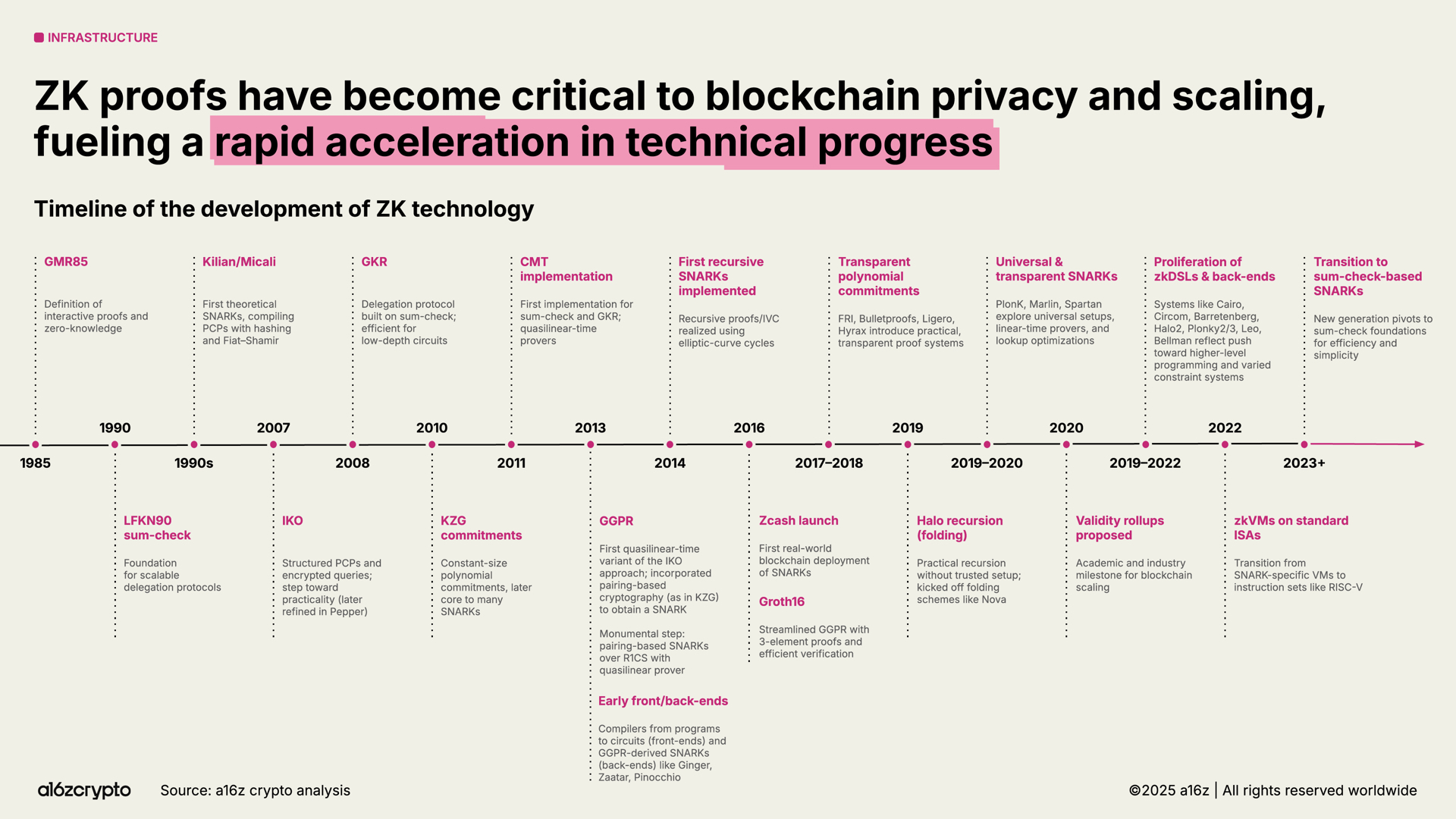

Likewise, zero-knowledge (ZK) and succinct proof systems are rapidly evolving from decades-old academic research into critical infrastructure. Zero-knowledge systems are now integrated across rollups, compliance tools, and even mainstream web services — Google’s new ZK identity system being one example.

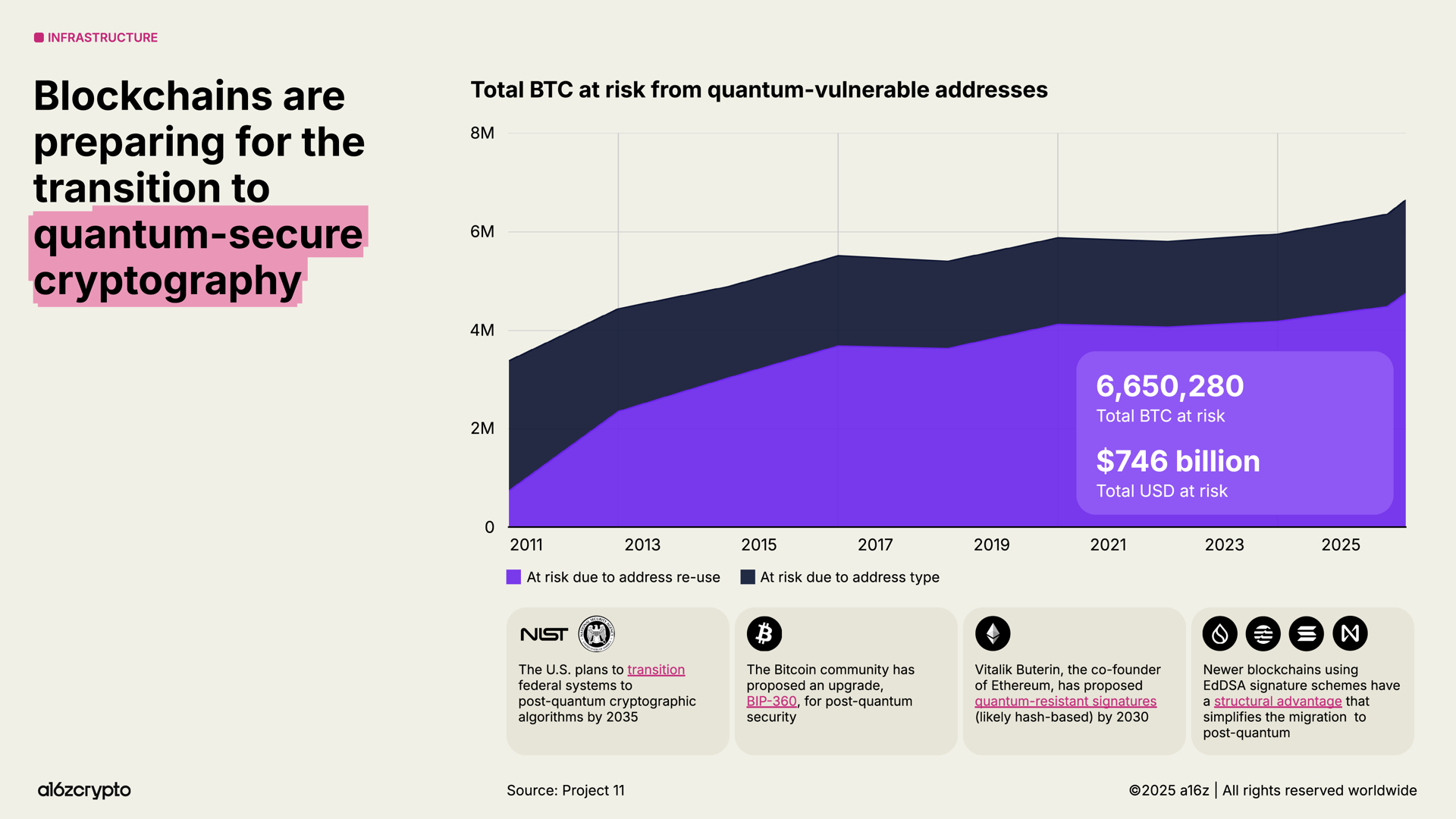

At the same time, blockchains are accelerating post-quantum roadmaps. Roughly $750 billion in bitcoin sits in addresses vulnerable to future quantum attacks. The U.S. government plans to transition federal systems to post-quantum cryptographic algorithms by 2035.

AI and crypto are converging

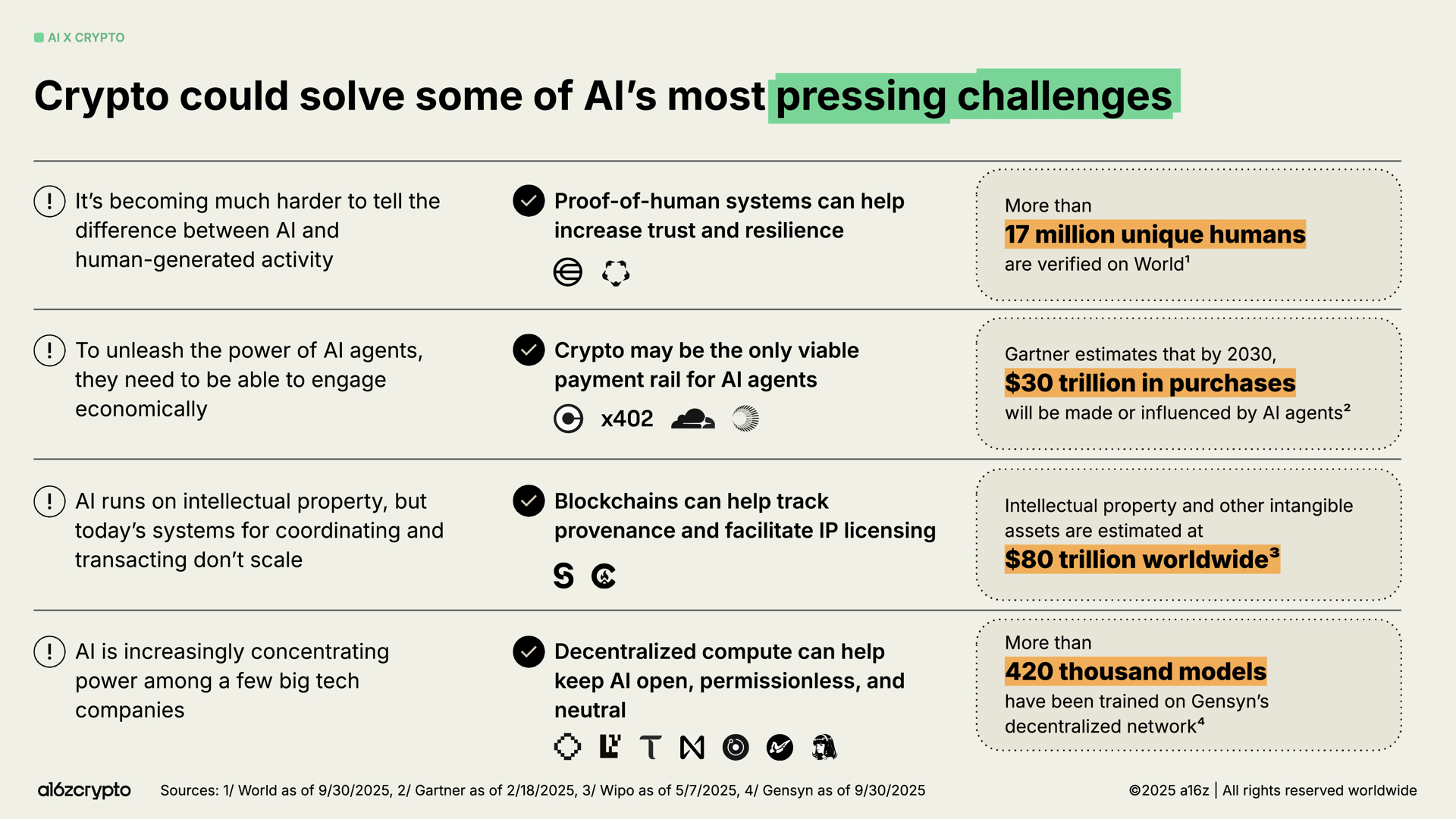

Among other advancements, the launch of ChatGPT in 2022 brought AI to the forefront of public attention — with clear opportunities for crypto. From tracking provenance and IP licensing to providing payment rails for agents, crypto may be the solution for some of AI’s most pressing challenges.

Decentralized identity systems like World, which has verified more than 17 million people, can provide “proof of human” and help differentiate people from bots.

Protocol standards such as x402 are emerging as a potential financial backbone for autonomous AI agents, helping them make micro-transactions, access APIs, and settle payments without intermediaries — an economy that Gartner estimates could reach $30 trillion by 2030.

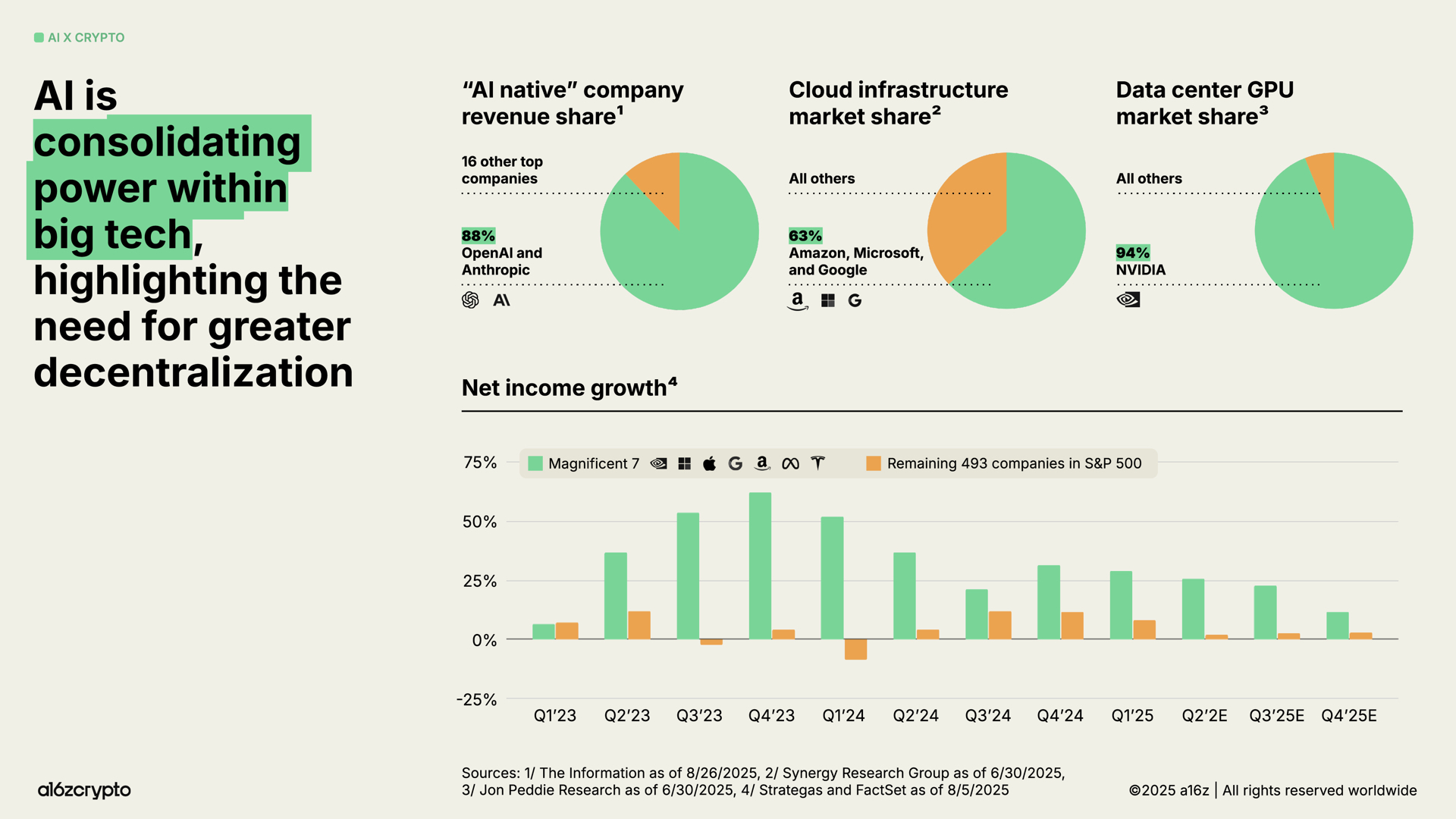

Meanwhile, AI’s compute layer is consolidating around a handful of tech giants, raising concerns about centralization and censorship. Just two companies, OpenAI and Anthropic, control 88% of “AI-native” company revenue. Amazon, Microsoft, and Google control 63% of the cloud infrastructure market, while NVIDIA holds 94% of the data center GPU market. These imbalances have fueled double-digit quarterly net income growth for the “Magnificent 7” companies over the last few years, while earnings growth of the remaining S&P 493 in aggregate have failed to outpace inflation.

Blockchains offer a counterbalance to the apparent centralizing forces of AI systems.

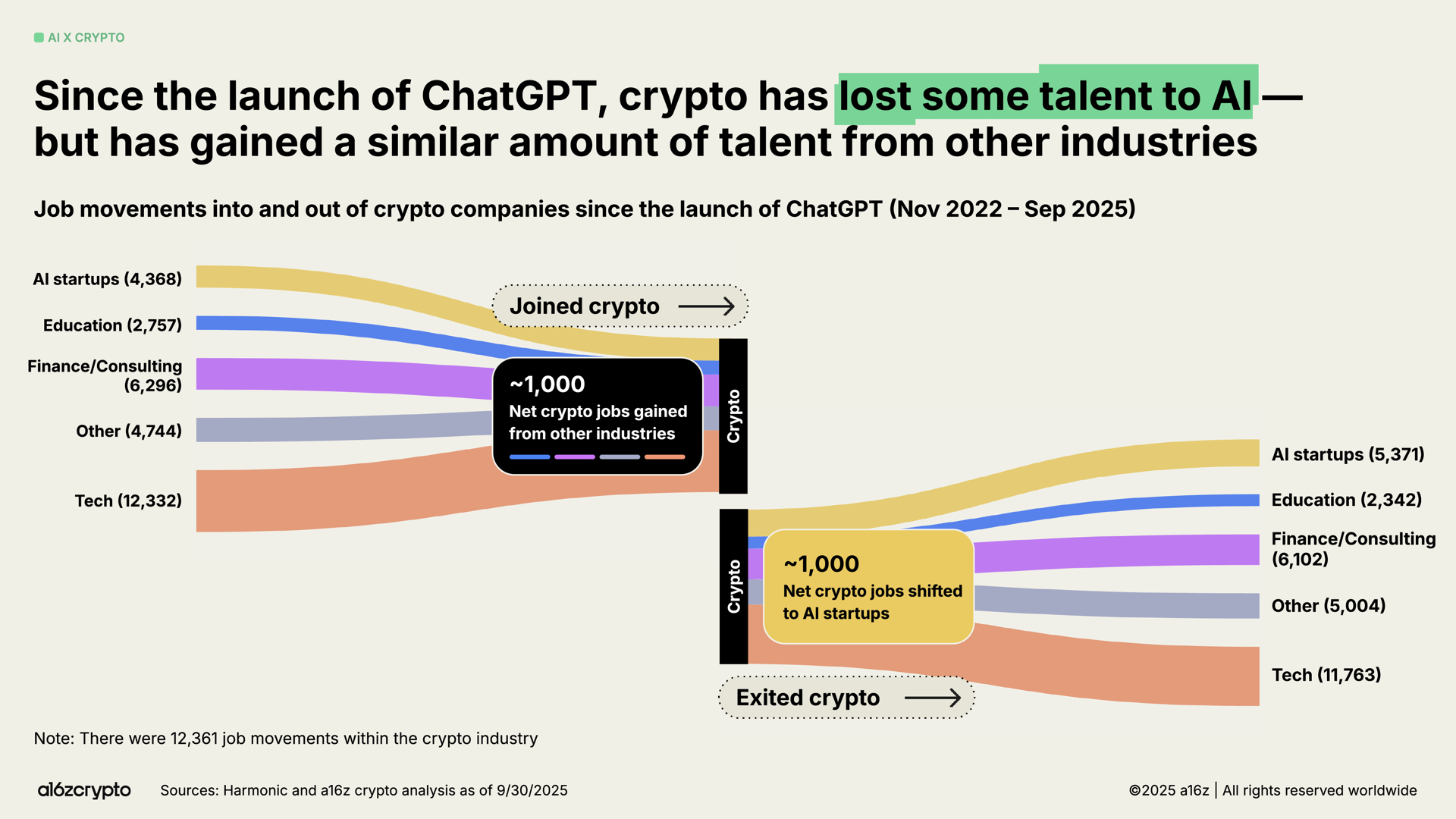

Amid the AI excitement, some builders have pivoted away from crypto. Our analysis suggests that about 1,000 jobs shifted from crypto to AI since the launch of ChatGPT. But this number has been offset by an equivalent number of builders joining crypto from other areas, like traditional finance and tech.

What’s next

Where does that leave us? With greater regulatory clarity on the horizon, a path is clearing for tokens to generate real revenue via fees. TradFi and fintech adoption of crypto will continue to accelerate; stablecoins will upgrade legacy systems and democratize financial access globally; and new consumer products will bring the next wave of crypto users onchain.

We have the infrastructure, the distribution, and hopefully soon, the regulatory clarity to take this technology mainstream. It’s time to upgrade the financial system, rebuild global payment rails, and create the internet that the world deserves.

Seventeen years in, crypto is leaving its adolescence and entering adulthood.

***

Sign up for our newsletter here for more industry reports, trend updates, news analysis, builder guides, and other resources. And for more regular data updates, see our State of Crypto dashboard, an interactive tool that tracks key industry metrics.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.

.png)