A lot has been said about Tesla and Elon Musk recently, but I believe one aspect deserves more attention.

Tesla was at a crossroads in February 2024, with a tough decision ahead. They had to choose between producing the Model 2 (a low-budget EV) or investing in the Robotaxi (a groundbreaking self-driving cab service). Or maybe try to do both at the same time.

We all know the answer: Musk chose the Robotaxi.

But it wasn’t an easy decision. Musk had to overrule members of his key senior staff, and some of them left the company. And whether he made the right decision is yet to be seen.

What we can already do is analyse his decision-making process and find out if it made sense within the context and the expectations of customers and stakeholders.

Tesla’s Winning Trajectory

Tesla Motors has been one of the great innovation stories in America, bringing electric vehicles and automated driving to the forefront. It was founded on July 1, 2003, by Martin Eberhard and Marc Tarpenning, who envisioned a car company rooted in cutting-edge battery, software, and motor technology.

Ian Wright and J.B. Straubel joined shortly after, and in 2004, Elon Musk became the largest investor and chairman of the board after contributing US$6.5 million from his PayPal earnings. All five — Eberhard, Tarpenning, Wright, Musk, and Straubel — are officially recognized as Tesla co-founders. But only Elon Musk is still at the helm.

In 2006, Musk outlined his Master Plan, which included the following steps:

1. Create a low-volume car, which would necessarily be expensive.

2. Use that money to develop a medium-volume car at a lower price.

3. Use that money to create an affordable, high-volume car.

To make step 1 come true, Tesla launched the Roadster in 2008. Originally built in a bay, mostly manually and using parts, this model was sold for US$80,000.

Roadster was meant to showcase Tesla’s engineering prowess. It was the first highway-legal EV to use lithium-ion batteries, achieve over 200 miles of range and 0–60 mph in under 4s—groundbreaking at the time. Only 2,450 units were made between 2008 and 2012, turning its first generation into a collector’s item.

By 2012, Tesla moved into assembly line manufacturing at the NUMMI plant in California, which allowed them to increase the price of the Roadster to above US$100,000.

In the same year, they released the Model S, a full-size luxury sedan with a sleek, elongated profile, insane acceleration (0–60 mph around 2s) and yet cheaper than the Roadster (US$80-100,000).

I experienced Tesla’s uniqueness the first time I rode in a Model S in Shanghai. The driver had an EV because they could run daily, while gas cars could only operate every other day.

All was going great until the driver decided to speed up. He kept driving fast, then braked hard near a speed camera—every thousand feet or so. As I was in the back seat, I arrived at the airport feeling awful. But without a doubt about what a Tesla car could do.

The Model 3, a cheaper, high-volume car (US$35-45,000), was released in 2017. It made an EV car affordable for the first time, and Tesla stock took off. Musk made it his mission to spark worldwide interest in self-driving technology. Sales numbers were huge.

But then, Tesla found itself in what Musk called “production hell”—a term used to describe trying to do all these things simultaneously:

· Scale up to mass production.

· Keep the product affordable.

· Boost battery production and technology.

To solve this, Tesla built enormous factories (called Gigafactories for literal reasons), often housing car and battery production under the same roof. This decision sped up the manufacturing and protected Tesla from supply chain issues.

The Challenges

It seemed like Tesla was going to revolutionize the car industry. Until a string of challenges came their way:

Stale Models, Failed Launches

Model 3 had been out for seven years in 2024. The excitement was long gone. An upgraded model could have helped to turn this around, but nothing compared to the incredible buzz created by the launch of something truly innovative.

The Cybertruck and Semi models were both complete failures. Cybertruck’s unusual design and quality issues could have been ignored in the past, but they were obvious in comparison to the Ford F-150 Lightning, for instance. And the Semi EV Truck had a towing issue that alienated too many truck drivers.

Chinese Competition Heats Up

BYD and other Chinese carmakers were challenging Tesla with their affordable and reliable models. BYD alone produced over 3 million new energy vehicles in 2023, surpassing Tesla’s production for a second year.

China might have kept its firms out of the U.S. to avoid political conflict and retaliation, such as more tariffs. U.S. industrial policy also put up heavy barriers preventing Chinese firms from selling here—e.g. no tax credits.

Even so, Tesla’s international reach was at risk.

The Elon Musk Factor

Over the years, Tesla’s brand became intimately associated with Elon Musk’s public image. Customers were buying his dream as much as his cars. But as he became more vocal and involved in politics, customers started to question driving a vehicle built under his leadership.

Musk became heavily involved in Donald Trump’s re-election, which closely aligned the company with conservative politics. Something that some Tesla customers didn’t appreciate.

Three Paths Forward

Tesla was facing a lot of pressure by 2024. Which of the challenges above Elon Musk considered throughout his decision-making process, it’s impossible to say. But they were all happening. And he had to do something about it.

Let’s now analyze each of his options:

1. Release the Model 2

They could have released the Model 2, a budget car with a price point of around US$25-28,000. By doing so, Tesla would continue to follow their Master Plan, producing increasingly cheaper cars. It’d also have pleased many of his key senior staff, as I’ll comment later.

But this choice would create a branding issue, with the Model 2 moving the company away from luxury, speedy, high-tech cars. It wouldn’t fit into their product brand image or customer demographics.

They could have solved this challenge by creating a separate brand for the budget models, like other manufacturers do—something like Tesla and Tesla Jr. But there is no indication that the company considered this alternative.

And there was a competition issue, as the EV space was already flooded with budget Chinese cars. It wouldn’t be easy for Tesla to navigate this environment.

One could also argue that producing the Model 2 would take Tesla into another production hell. I’ve seen some speculation that Musk doesn’t want to go through that scaling effort again, but it’s hard to guess if Tesla would really need to expand that much for a Model 2.

2. Invest in the Robotaxi

Robotaxi is Musk’s baby. It’s the realization of his vision of a future where people don’t necessarily own a car. Or, as a friend of mine suggested to me recently, a future with one family car, despite scheduling conflicts.

The plan was to make Robotaxis available in huge fleets of Tesla cars—or cars from other manufacturers using the Tesla Autopilot system—, allowing them to take charge of everything, from vehicles to technology.

The doubt here is how Tesla can overpower the large and strongly established EV network formed by carmakers, Waymo, Uber, and Lyft, among other companies. With so many rivals in alliance, it’d be hard for a single firm to eliminate all the competition.

We should add to the pot Elon Musk’s personality. He often chooses to do the big, splashy thing. He invests in space programs, watches rockets blow up, tries to revolutionize industries (even the government), regardless of the consequences. It’s not a surprise that he was more likely to be interested in captaining the self-driving industry than in manufacturing budget electric cars.

3. Attempt Both

The third option is to do both at the same time: launch the Model 2 and the Robotaxi. But this isn’t a great option. Taking two massive bets at the same time is very dangerous to any company. They’d need to split resources, funding, talent, engineering, and focus.

I’ll take this third option off the table entirely, just based on how difficult it would be to accomplish this.

The Real Reason Behind Musk’s Decision

In that February 2024 meeting, Musk overruled his senior staff and decided to move forward with the Robotaxi. And the question here is why. And the answer lies with a vital element we haven’t talked about, which is valuation.

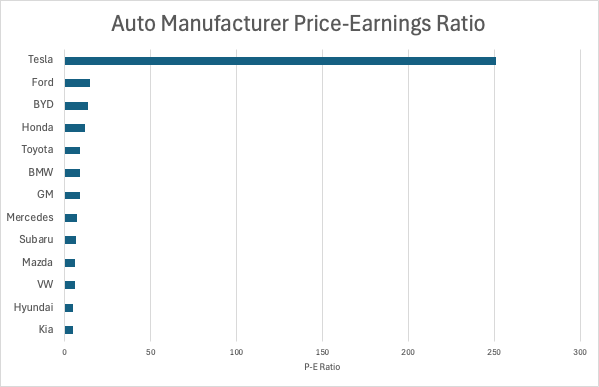

Each public company has a price-to-earnings ratio (P/E), whose multiplier (stock price divided by earnings per share) gives you a good idea of their prospects.

· Most car manufacturers, such as GM, Honda and BMW, have a P/E ratio of around 6 to 7.

· BYD, probably due to their success, are valued at a multiple of 13.

· Ford, for reasons too complex to explain here, has a multiplier of 14-15.

· And then, we have Tesla, with a mind-boggling P/E ratio of over 250

The market believes that if Tesla pulls off their promise to wipe the board with the Robotaxi, they are going to eat up the value of Lyft, Uber, some car manufacturers and, potentially, Waymo. Tesla would then hold a vertical monopoly, which would mean outsized profits for Tesla—and their investors and other stockholders.

This scenario is unlikely, but it’s possible. And that’s why we end up with Tesla’s massive multiplier. But this multiplier is very dependent on making progress. And progress right now means Robotaxi. And in this understanding lies the key to why they’re not going to launch the Model 2, a product with no comparable impact.

Tesla’s stock price was falling, going from US$273.23 in 2023 to around US$199.95 by February 2024. If they had gone for the Model 2 and eschewed the Robotaxi, their multiplier would likely decrease to somewhere around BYD’s at 13 or 14. That would reduce their stock price to US$21.84 from US$199.95 (Feb/2024), and their market capitalization (shares * price) from 643 billion to 70 billion. An unimaginable drop with impossible consequences.

Since the value of having the Robotaxi so far outstrips the value of the Model 2 in stock price, it becomes imperative not to take resources away from the Robotaxi. That shelves the option of doing both products at the same time.

Another unique thing to consider is that Elon Musk, as an individual, owns many businesses, such as SpaceX, X.ai, and X (formerly Twitter). And his Tesla stock is collateral for the funding he uses to invest in these other firms.

If Musk had chosen not to go forward with the Robotaxi, and Tesla’s stock price collapsed, we could have watched not only Tesla going down but also his other businesses.

Why Tesla’s Leaders Walked Away

The immediate consequence of Musk’s decision was a number of key senior employees quitting Tesla. And they might have had good reasons for doing so:

1. They were likely to be car people through and through. They didn’t want to stay at Tesla when the commitment to building vehicles was gone.

2. I suspect strongly that these employees may have found Musk’s actions at odds with Tesla’s original purpose to use EVs to have a positive impact in the world.

3. They staked their careers when they went to Musk to express their opinion. But they got overruled by the boss, which gave them no choice but to leave the company with bruised egos.

4. Musk isn’t known for his social skills. I imagine he wasn’t particularly diplomatic during the meeting when he presented his choice.

It’s been suggested that Musk shut down an internal Tesla executive analysis stating that the Robotaxi wouldn’t be a success.

Regardless of its factuality, their analysis relied on many assumptions. The weakest one was that a poor regulatory environment will slow the rollout of the Robotaxi. Uber is a clear counterexample here: they expanded internationally despite a lack of a regulatory framework, and the legislation followed later.

But I agree with them that Musk’s promise seems too good to be true.

Lessons for Managers

Tesla’s choice to prioritize Robotaxi over Model 2 can affect many businesses, but how well Robotaxi does will determine the nature of these consequences.

Here is what you should be watching for if you work for some of these companies—or others in the same industry:

1. Tesla

It’s going to be a bumpy ride as Tesla makes a massive push to catch up to Waymo, outbuild Toyota, and compete with Uber/Lyft. One year later, Elon Musk’s public image remains controversial, and the Robotaxi is yet to be seen on the streets. Anything can happen next, and you should be prepared for uncertainty and changes.

2. Waymo

Waymo is ahead of Tesla, but they must work to maintain this lead. As a manager, you should carefully consider your alliances and ecosystem, ensuring car companies, Uber, and Lyft provide excellent experiences to their customers, preventing Tesla from entering the rideshare market. You’ll also be busy with Waymo’s expansion into NYC, Seattle and Denver—it’ll be the first time that autonomous taxis operate in snow.

3. Uber/Lyft

The strategy for Uber and Lyft is tricky. You want to stay in business, yet you wish to avoid Waymo’s control of the technology. Having a monopoly as an upstream supplier means that Waymo will get all the outsized profits and leave nothing for Uber or Lyft.

As a side note, Uber sold their self-driving research to Aurora, but Aurora is far behind and only focused on trucks. That may be a play that hurts Uber in the long term.

If Tesla does what they say they will, Robotaxi takes you out of the sector entirely. Your challenge is to figure out how to hurt Tesla enough that it stops trying to replace you, but not so badly that its technology falls out of the industry.

4. BYD

BYD is probably relieved that Tesla won’t launch Model 2. You, as a manager, will probably be asked to focus on affordable EVs, consolidating your position in the market by reducing competition and expanding internationally. But BYD is also making rapid strides in self-driving. You might be assigned to a related project so that you can become a major contender in the future.

Where Tesla Stands in 2025

Now we are in 2025, still waiting for the Robotaxi. Musk tried to launch it, but what we saw was a lackluster product unveiling, to say the least. Reuters published an article saying that Tesla still hasn’t filed the required paperwork, among other concerns.

Musk has been in and out of the Department of Government Efficiency (DOGE), where he wasn’t particularly successful and became a lightning rod for criticism. To the point that setting fire to or exploding Cybertrucks became political statements.

Things are changing, though.

Elon Musk’s exit from DOGE led to a 9% rise in Tesla’s stock price. As investors see him as key to the future of Robotaxi, Tesla’s value was boosted as he made it a priority.

The price of Tesla stock increased—from US$348 per share on 9/10/25 to US$422 on 9/16/25—after Musk revealed his intention to buy back more Tesla stock.

It’s a positive signal when a company’s owners buy their stock back, as they have superior insight into their investments. Musk bought 2.57 million shares for a total of US$1.035 billion, a substantial and impactful amount.

Still, we should consider Musk’s intentions. The assumption is that he did it to push the stock valuation up because Tesla had made actual progress. But he might have done this to artificially prop the price up to help his portfolio.

Whether Musk will be right in his choice not to follow his senior staff’s advice is an interesting question. If he were primarily trying to save his own wealth, that’s another interesting question. But it’s already clear that it was the right move for the stock market.

.png)