Most traders believe that finding a trading edge means finding a system that wins more often than it loses. And while accuracy is essential, it's not the whole story. Chasing high accuracy while ignoring reward-to-risk dynamics can become a psychological trap, one that leads not just to financial losses but also to emotional instability and poor trading behavior.

This post examines how high-accuracy, low-reward strategies can backfire, why certain trader types are more susceptible, and why learning to accept losses might be the most underrated trading skill.

📈 The Allure of High Accuracy

High-accuracy systems are appealing because they generate frequent wins. A strategy that wins 80% of the time feels emotionally safe. You feel like you're "right." But the reward-to-risk ratio often tells a different story.

Consider a strategy that wins 8 out of 10 trades but only makes $1 when it wins and loses $3 when it fails. You can be right most of the time and still end up with a negative expectancy. Even if the statistics hold, a single loss can erase multiple wins.

And when the statistics don’t hold due to trader human behavior - It gets worse.

When evaluating reward-to-risk, it is essential to understand that trading is a negative-sum game. If you are using a reward-to-risk ratio of 1 reward to 1 risk, your actual reward-to-risk ratio could be something like 0.9 reward to 1 risk.1 - because of the charges involved. These charges can be particularly harsh if you are scalping quickly, and are less severe if you allow for significant price movement.

You may start with a 1 reward to 3 risk (including charges). Theoretically, a win rate of over 75% is all you need to stay profitable. You may have an 80% win rate. That is an edge. But in reality, when you see that the prices hit your SL and then move in the expected direction, you get frustrated, and you start changing the SL - because you are focused on winning - and you think, "Why not? The accuracy is 80%."

You may even win with that. But you slowly end up increasing the risk. You may have started with a small increase in SL, and then you end up increasing it slightly more and slightly more, and there, without noticing, you've reached a 1 reward to 5 risk.

Your edge is gone statistically, but it’s not intuitively visible. What you think is, "I know I’m going to win more often."

📉 Here’s a visual representation of that drift:

Imagine this progression:

- Trade 1: SL at $3 → reward-to-risk = 1 reward to 3 risk

- Trade 5: SL extended to $4.5 → reward-to-risk = 1 reward to 4.5 risk

- Trade 20: SL now $6 or $7 → reward-to-risk = 1 reward to 6 risk or 1 reward to 7 risk

You may not even register this change clearly, because each change is rationalized subconsciously. But across time, you’ve destroyed the statistical foundation of their system.

And then one trade causes a larger loss, not yet blown your account. But that loss, combined with a “winner expectation,” triggers a tilted behavior that is hard to recognize and control.

And then the tilt turns into an account blowup.

You might think that it was a discipline problem, but when you dive deeper, you’ll realize the problem is with "winning too often and not learning and practicing to take a loss".

Rookie tilts are easier to spot, but the other kinds are insidious. Learn more about it at Types of Trading Tilt – From Rookie Implosions to Professional Meltdowns

⚠️ The Real Risk: The Trader, Not the System

Let’s be clear - a high-accuracy system can be statistically viable. However, in practice, the problem lies with the human trader.

When you become accustomed to winning frequently, you develop a psychological attachment to being right. Each win feels like validation. Then comes the loss, and it hits harder than it should.

This is where behavior deviates from the plan:

- The trader adds to the losing position, hoping to average out.

- They move or remove the stoploss entirely.

- They take trades outside the system, desperate to get back on track.

These actions are usually not part of the original strategy. They emerge from emotional distress, especially in systems where the rare loss is disproportionately large.

🎲 The Accuracy Trap in Monte Carlo Terms

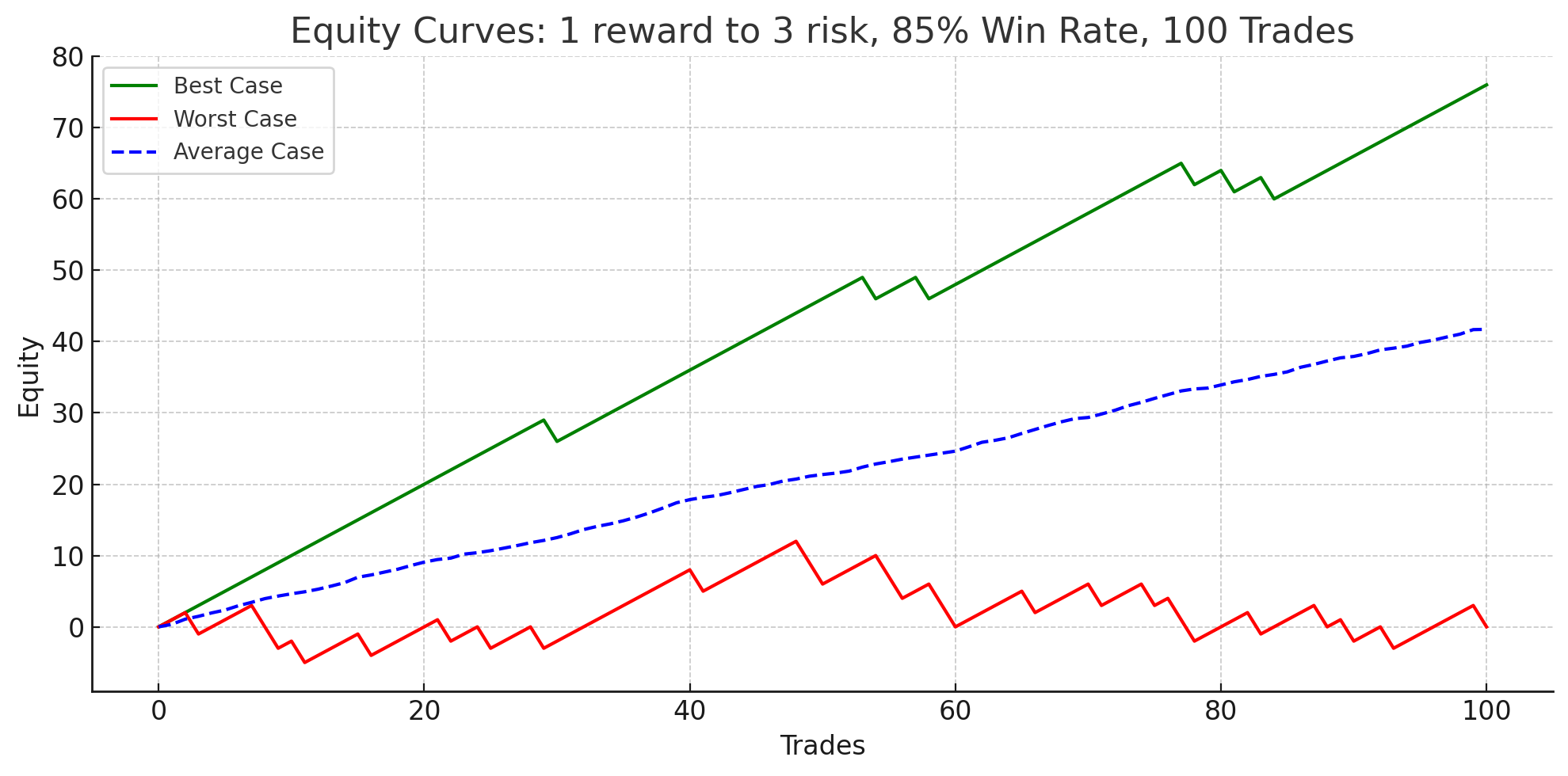

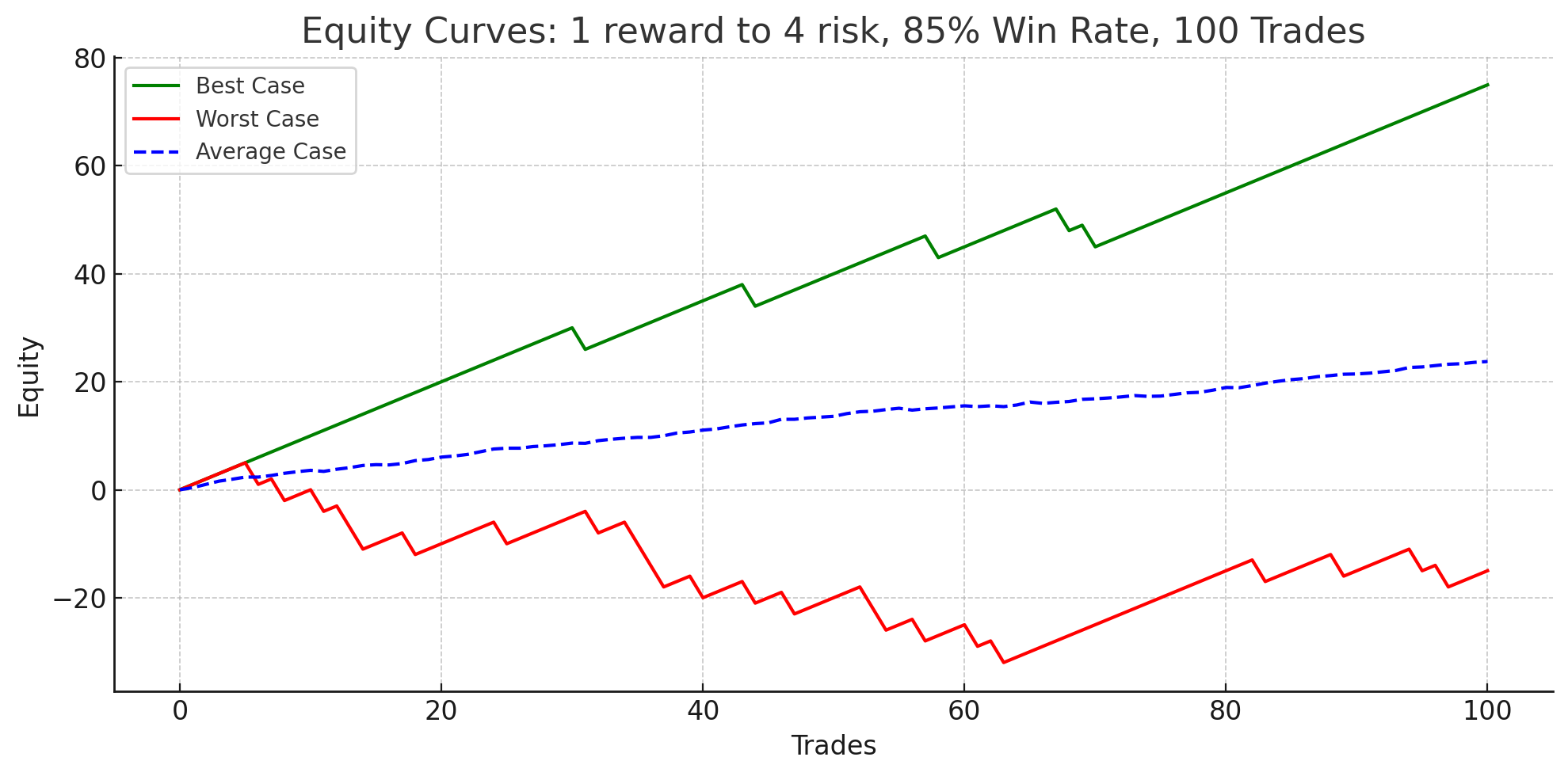

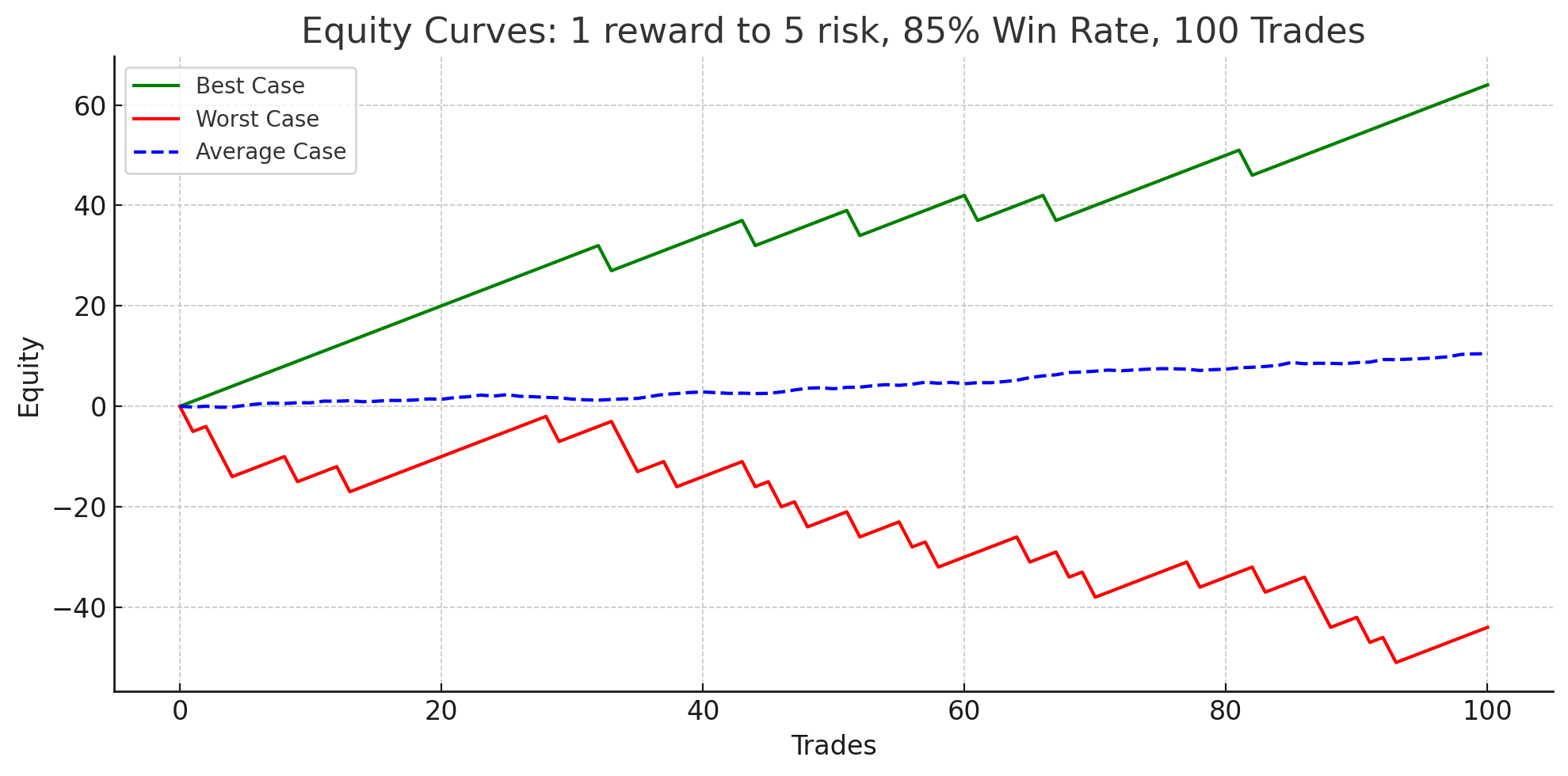

We simulated a system with an 85% win rate and different reward-to-risk settings. While this still shows slightly positive expectancy on paper, the simulation reveals just how fragile such a setup is. We compare the best-case simulations with the worst-case simulations.

1 Reward to 4 Risk. Requires a 75% win rate to stay profitable. The worst case is staying flat

1 Reward to 4 Risk. Requires a 75% win rate to stay profitable. The worst case is staying flatLet’s be real — it's unlikely you'll hit either extreme consistently. Most outcomes will fall somewhere in between. Still, it's smarter to plan for the worst and hope for the best.

1 Reward to 4 Risk. Requires an 80% win rate to stay profitable. The worst case is about flat

1 Reward to 4 Risk. Requires an 80% win rate to stay profitable. The worst case is about flat 1 Reward to 5 Risk. Requires ~84% win rate to stay profitable. The worst case is losing

1 Reward to 5 Risk. Requires ~84% win rate to stay profitable. The worst case is losingA 1 reward to 5 risk setup may show losses in the short term, but over a larger number of trades, it’s statistically likely to recover, assuming the edge holds.

Now imagine a scenario where the trader starts modifying the stoploss during losing trades - something that often happens when the strategy "usually works" and the trader can’t accept being wrong.

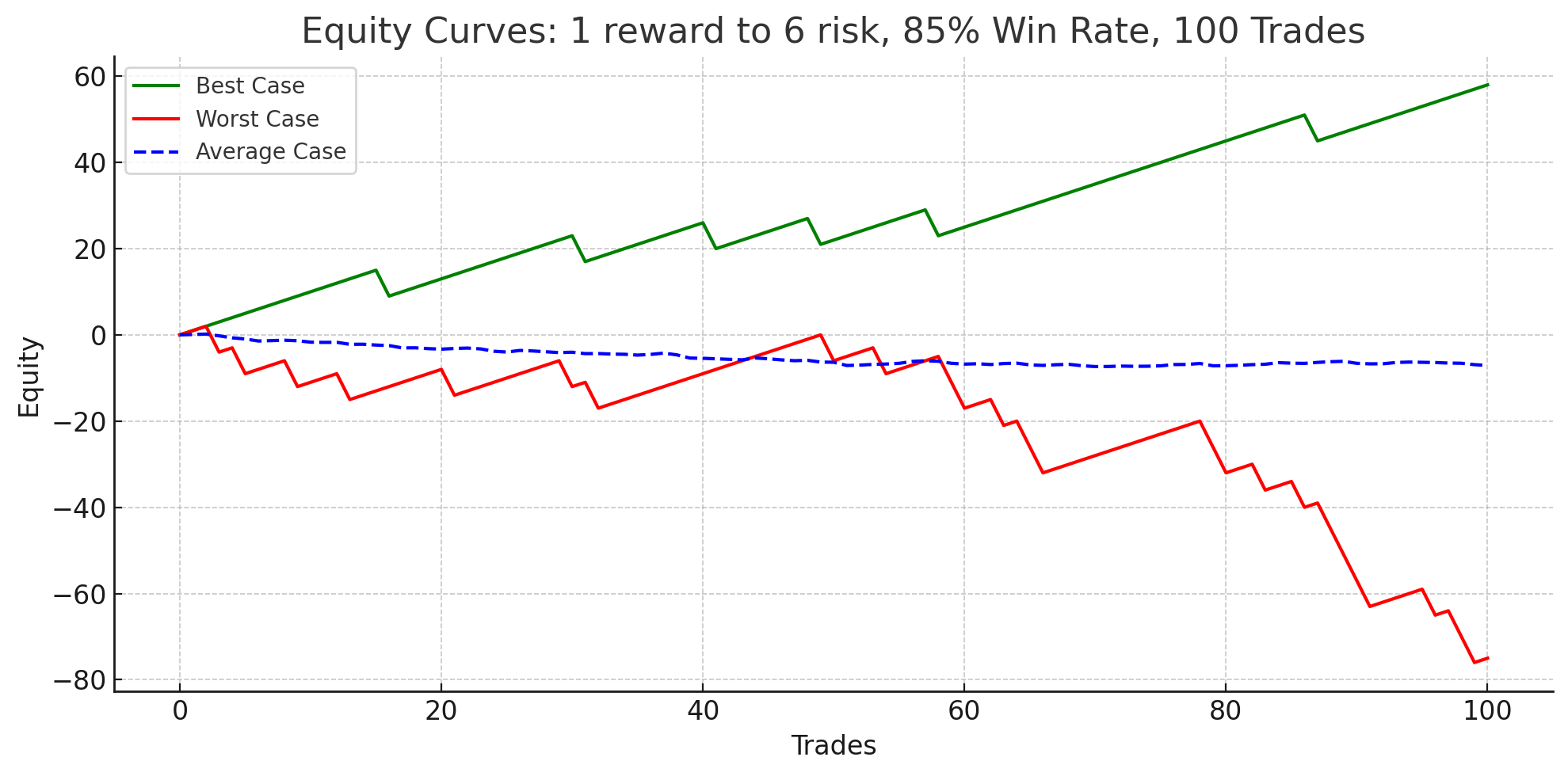

In the second simulation, we adjusted the loss to $6 while keeping everything else the same. This turns the system into a clearly negative expectancy setup:

- Win rate: 85%

- Reward: $1 per win

- Loss: $6 per loss

Expected Value:

EV = 0.85 × 1 - 0.15 × 6 = 0.85 - 0.90 = -0.05

1 Reward to 6 Risk

1 Reward to 6 RiskThis shows how emotional decision-making, especially adjusting stoplosses to "give trades more room," can ruin a system - even one that looks solid on paper.

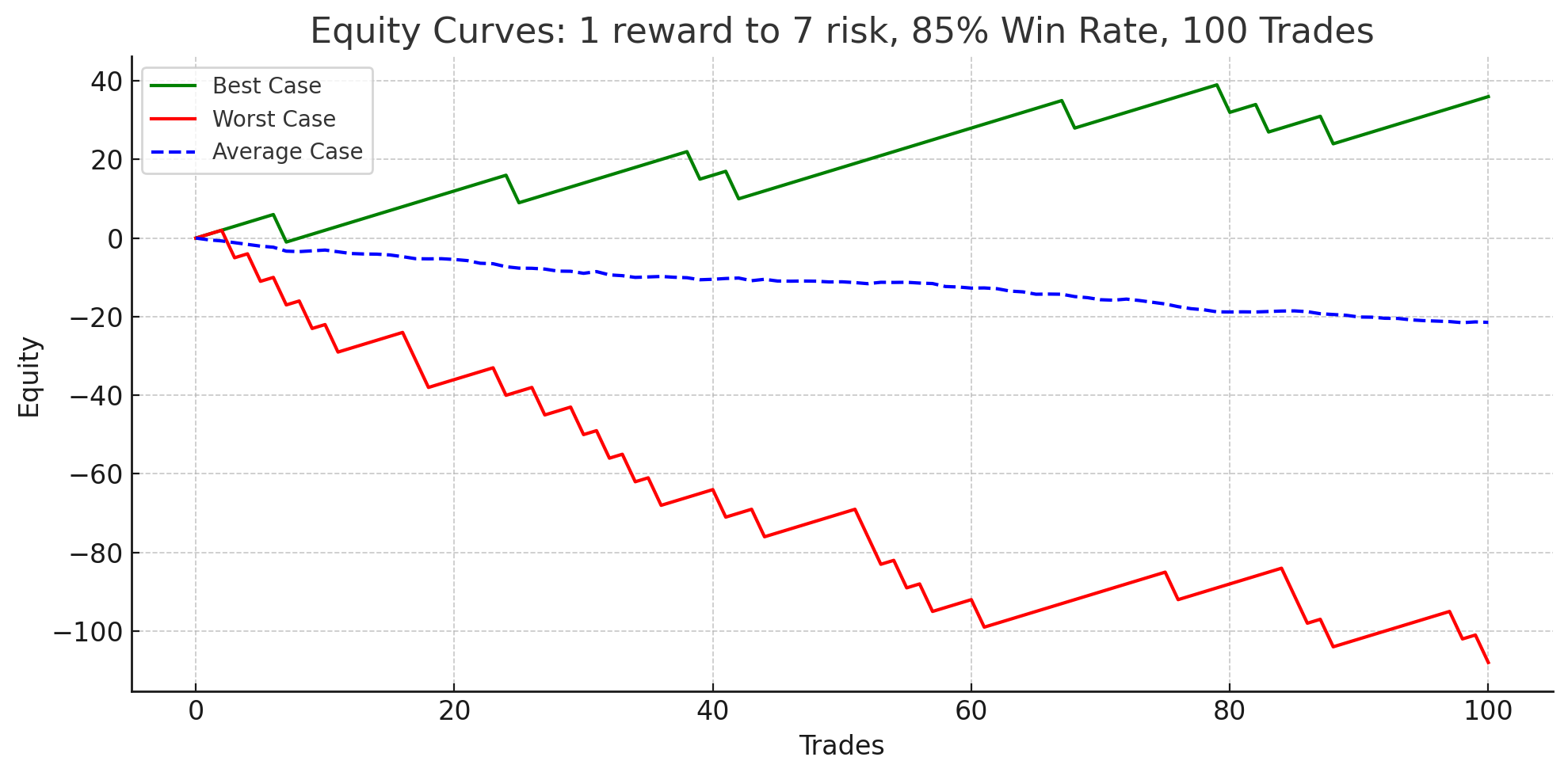

1 reward to 7 risk - catastrophic equity collapse in worst-case

1 reward to 7 risk - catastrophic equity collapse in worst-caseWe extended this idea further with simulations from 1 reward to 3 risk to 1 reward to 7 risk reward-to-risk ratios, and plotted both the best and worst case equity curves. The results showed:

- At 1 reward to 3 risk, even worst-case outcomes may be tolerable with the 85% w.

- At 1 reward to 6 risk and 1 reward to 7 risk, the system becomes extremely vulnerable. One or two bad runs can cause huge drawdowns.

These Monte Carlo charts make the point clear: emotional variance—how the trader can be deadlier than statistical variance.

🧠 Trader Types Most Vulnerable

Some traders are more likely to fall into this trap:

- New Scalpers: They rely on frequent small wins and often operate in a low-reward-to-risk environment, slowly tilting out of their edge.

- Perfectionists: They equate winning with success and have a deep fear of being wrong.

- Overcontrollers: They feel the need to manage every trade outcome, often interfering with stop-losses and exits.

- Revenge Traders: After a loss, they immediately try to recover, breaking rules in the process.

These personalities find it harder to accept losses as part of the process, making them more likely to sabotage even a statistically sound system.

💡 Learning to take a loss: A Core Skill

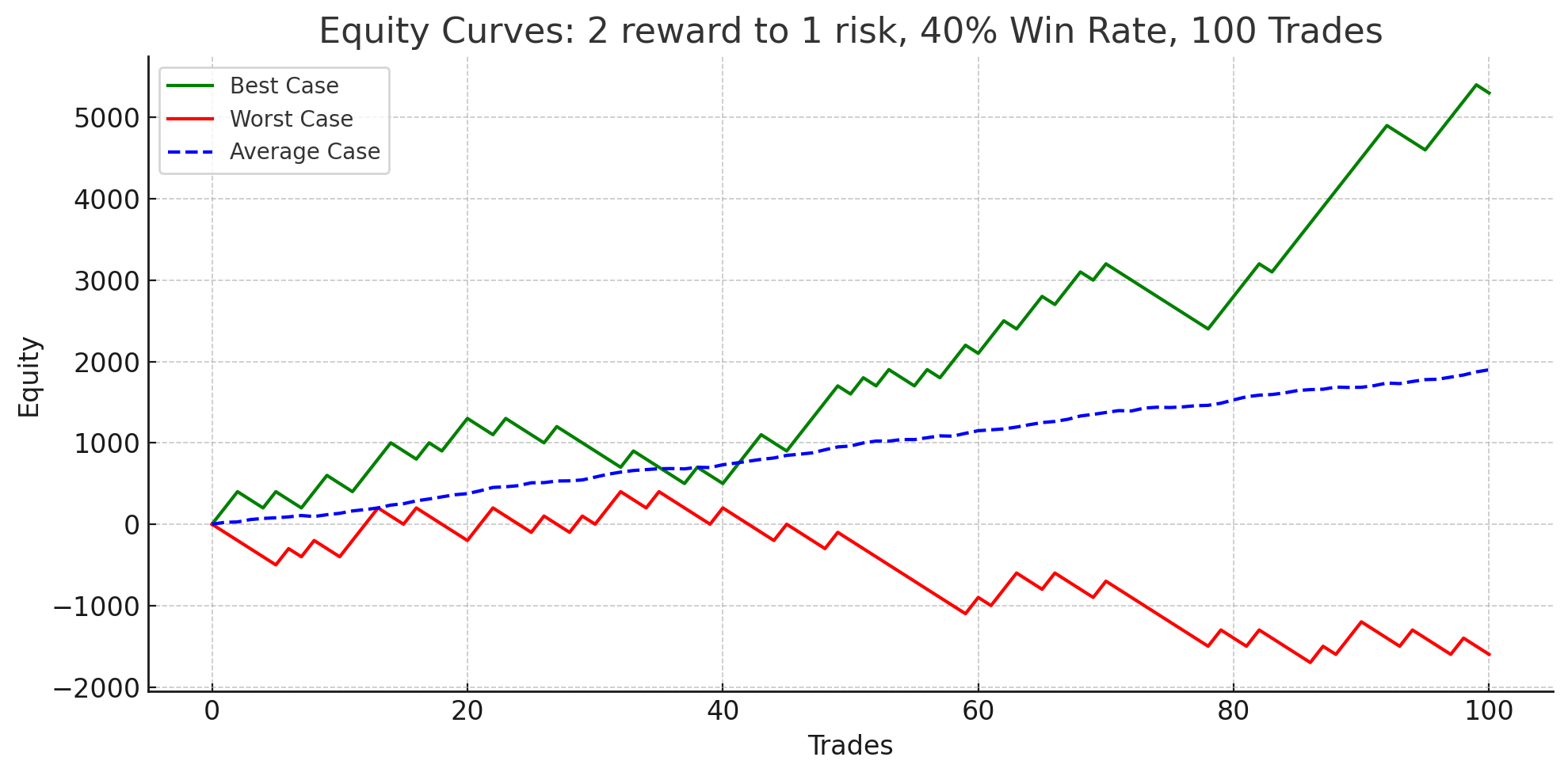

You might ask then - Is it possible to have a better reward-to-risk like 2 reward to 1 risk or 3 reward to 1 risk and still have good accuracy?

Yes. Let’s take a quick example to see how a strategy with only a 40% win rate can still be highly profitable if the reward-to-risk ratio is favorable.

That is losing 6 trades in every 10 trades. The question is - are you comfortable taking the loss? It is one thing in theory, and another in practice.

Assume the following:

- Win rate = 40%

- Reward = $200 per win (after accounting for charges)

- Risk = $100 per loss (including slippage, spread, etc.)

- So, reward-to-risk = 2 reward to 1 risk

Out of 100 trades:

- Wins = 40 trades → $200 × 40 = $8,000

- Losses = 60 trades → $100 × 60 = $6,000

Net Profit = $8,000 - $6,000 = $2,000

With 2 reward to 1 risk, even though you lose more trades than you win, the average result is still solidly profitable.

Simulations for 2 reward to 1 risk

Simulations for 2 reward to 1 riskDespite losing more often than winning, the strategy is profitable due to the favorable payoff per win. Now, imagine scaling this over 1,000 trades—the edge compounds significantly.

You also need to have an edge that aligns with the expected win rate. Simply taking random trades with a favorable reward-to-risk ratio won't work. Your entries and setups must consistently produce an edge; only then does the reward-to-risk structure help you compound profits over time.And it takes practice to take a loss. Next time you do this, see the magic for yourself. Do 8-10 trades with a better reward-to-risk ratio. Stay patient in those trades. Once you see it working, it will be easier for you to internalize it.

Every good trader eventually learns: losing is not the opposite of winning - it is a part of winning. Systems that win only 40% of the time can still be wildly profitable if the reward is two to three times the risk. However, to operate such a system, a trader must be comfortable with the prospect of losing more than they win.

This requires emotional detachment, discipline, and above all, trust in the system over short-term results.

🪞 Final Thoughts

Trading humbles you. The more profound truth is: markets are not just testing your edge - they're testing your identity. It's not about proving you're right more often than others. It's about lasting longer, thinking clearly, and knowing when to step away.

If your strategy feels easy to execute emotionally, it’s likely built for your temperament. If not, your edge might exist only on paper.

The system isn’t the only thing being backtested—you are.A system that looks great on a spreadsheet can crumble in the hands of a trader who can't take a loss. High-accuracy, low-reward strategies may seem safer, but they come with hidden emotional risks. The real edge comes not from just being right, but from being resilient.

Design systems you can emotionally withstand. Train yourself to lose well. Because in trading, the ability to lose gracefully might be your greatest long-term asset.

.png)