October 15, 2025

The Cross-Border Trail of the Treasury Basis Trade

Daniel Barth, Daniel Beltran, Matthew Hoops, Jay Kahn, Emily Liu, and Maria Perozek

1. Introduction

Recent regulatory data collections on hedge funds indicate a massive increase in Cayman Islands hedge fund exposures to U.S. Treasury securities over the last two years, corresponding to a simultaneous surge in hedge funds' Treasury cash-futures basis trade positions (the "basis trade").1 While other data sources, including Coordinated Portfolio Investment Survey (CPIS) data, confirm this rise, statistics from official U.S. Treasury International Capital (TIC) data do not show a significant increase in Treasury securities held by Cayman Islands hedge funds.

This note examines the magnitude and implications of potential underreporting of U.S. Treasuries owned by Cayman-domiciled hedge funds in the TIC data, which are the primary source of cross-border securities and banking data in the U.S. By combining various data sources, we find that hedge fund basis trade positions are dominated by hedge funds domiciled in the Cayman Islands, and that this activity is not well captured by the TIC data. As a result, the TIC data appear to severely undercount Cayman-domiciled hedge funds' holdings of U.S. Treasuries by around $1.4 trillion as of the end of 2024, presenting a major impediment for researchers, policy makers, and other data users seeking to analyze cross-border flows and their effects on the U.S. economy and financial markets. The TIC data are also a key data source for the Financial Accounts of the United States – Z.1 (Financial Accounts), which provides a unique framework for studying both Treasury market dynamics and household balance sheet developments. Mismeasurement of Treasury exposures in the TIC data directly affects Financial Accounts measures of transactions and positions of Treasury market participants and indirectly affects measures of personal saving and household net worth.

2. The rise of the basis trade

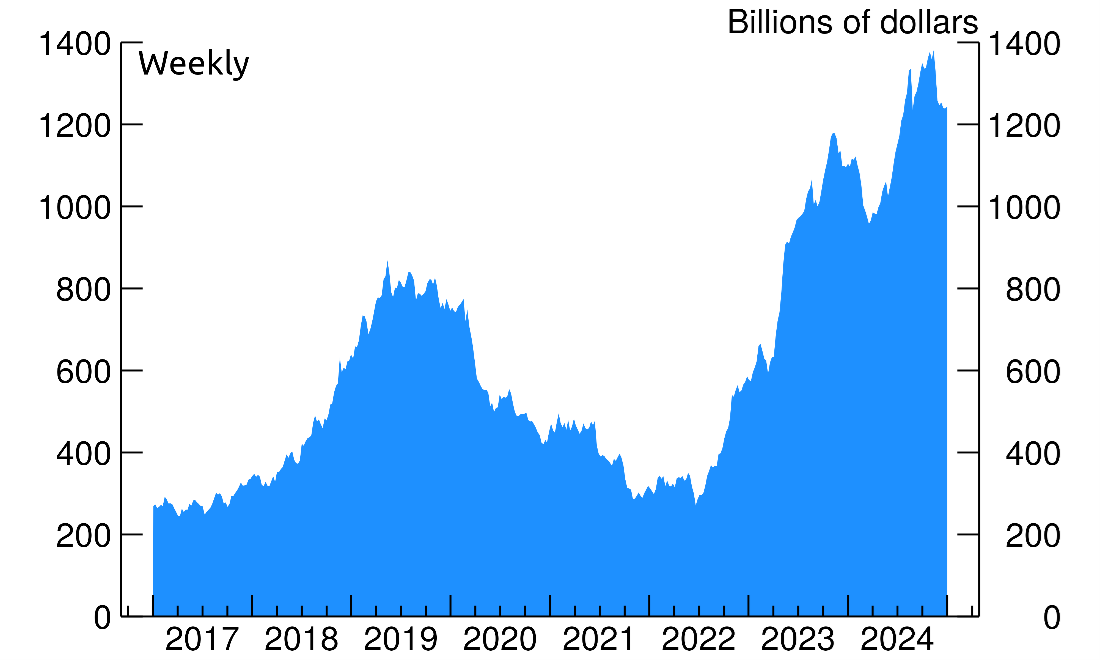

Beginning in 2018, leveraged funds' short positions in Treasury futures rose dramatically (Figure 1), consistent with a rise in basis trade activity, whereby hedge funds short Treasury futures and buy Treasury securities to take advantage of the difference in their prices.2 Hedge funds finance these trades by borrowing in the repo market and pledging the purchased Treasury securities as collateral, usually funded through bilateral repo, including the Fixed Income Clearing Corporation (FICC) sponsored repo market.3 The basis trade was partly unwound in March 2020 in response to significant strains in Treasury and repo markets, but has increased again in recent years, likely surpassing the highest levels seen in 2019 and 2020.4

Fund-level data also indicate a substantial increase in the basis trade. Since 2012, the Securities and Exchange Commission (SEC) has required private fund advisors to report information about their hedge funds on SEC Form PF. Data from Form PF show a significant increase in aggregate hedge fund Treasury positions beginning in 2018, a decline in those positions between 2020 and 2022, and another rapid increase thereafter.

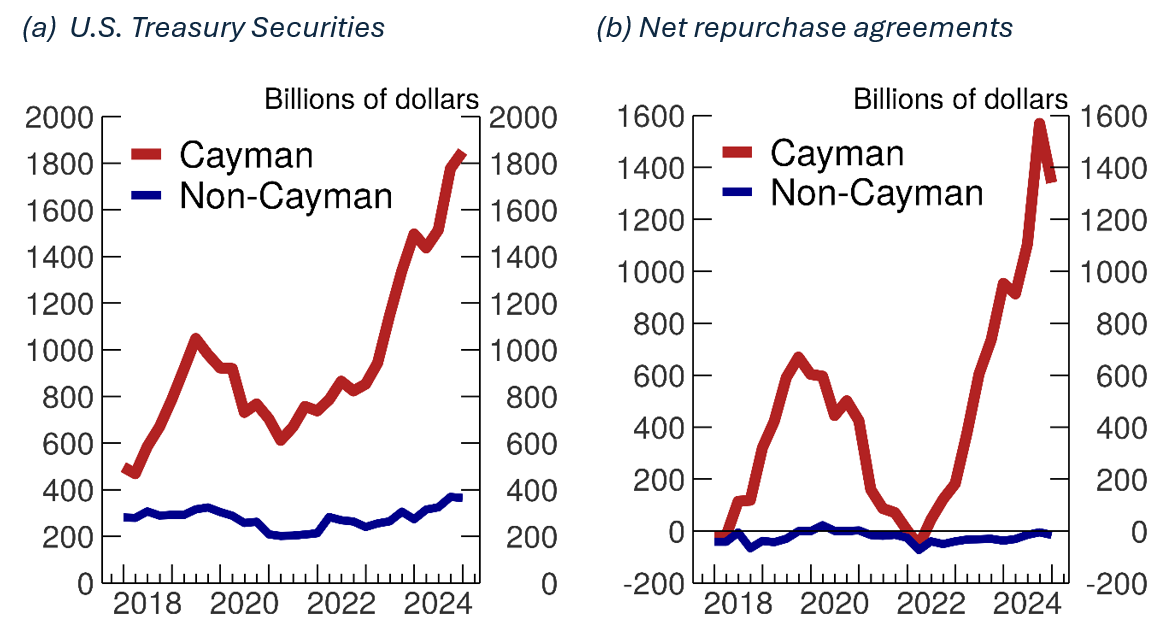

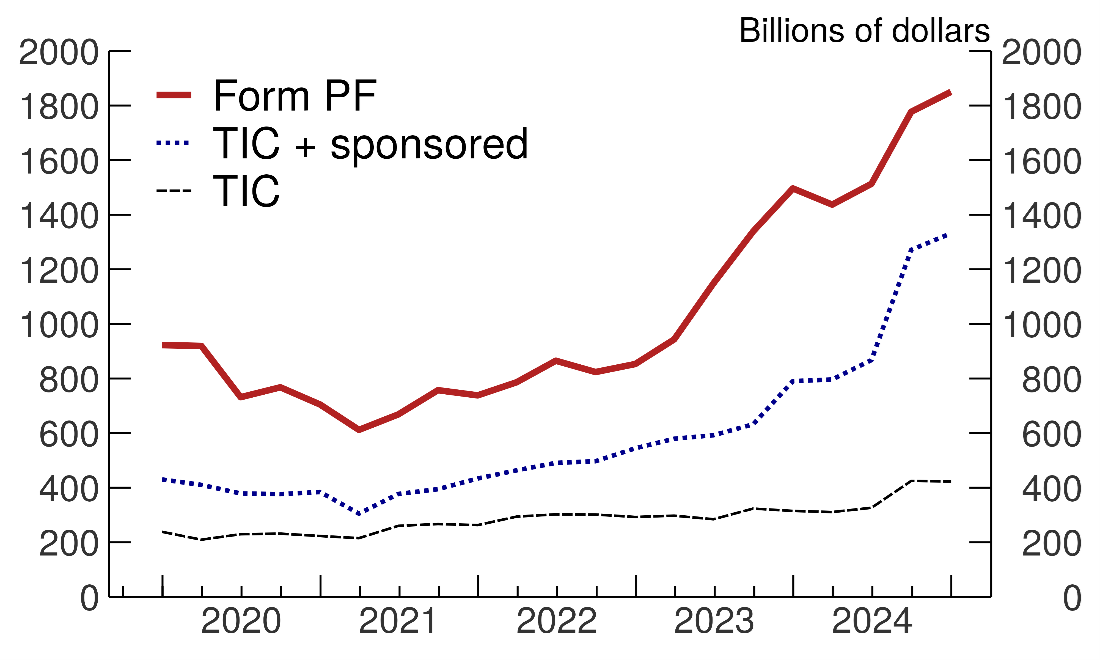

Importantly, the vast majority of these increases are driven by funds domiciled in the Cayman Islands (Figure 2a). Based on data from Form PF, we estimate that holdings of Treasury securities of Cayman-domiciled hedge funds have increased by $1 trillion since 2022, reaching $1.85 trillion by the end of 2024 (the red line).5

Another hallmark of the basis trade is the growth in net repo borrowing, defined as repo borrowing minus repo lending. The basis trade involves a repo borrowing leg but no offsetting repo lending leg, unlike cash-cash arbitrage trades, suggesting that net repo borrowing will rise during periods of high basis trade activity. Figure 2b plots net repo borrowing for Cayman and non-Cayman hedge funds. As in Figure 2a, nearly the entirety of the variation in net repo – which tracks closely the variation in short Treasury futures and aggregate Treasury exposures – is due to Cayman funds.

The cross-border nature of the hedge fund basis trade implies that we should see this activity in the Treasury International Capital data on cross-border flows and positions of U.S. Treasury securities. However, TIC data on Cayman Islands holdings of Treasuries do not appear to be picking up the Treasury transactions associated with the basis trade activity that we observe from hedge fund filings in Form PF.

3. Treasury reporting on the TIC Form SLT

An imperative goal of the TIC data program is to produce accurate and reliable data on cross-border holdings and transactions for all types of securities, including Treasury securities. TIC data are collected by the Federal Reserve System under the purview of the U.S. Treasury and inform the U.S. Balance of Payments produced by the Bureau of Economic Analysis (BEA) as well as the rest of world sector in the Financial Accounts of the United States – Z.1 produced by the Federal Reserve Board. The TIC data are used by policymakers, investors, and researchers interested in understanding the drivers and consequences of cross-border flows and asset allocations among different countries and investor types. Foreign holdings of U.S. Treasuries are a perennial topic of interest, as foreign investors play a large role in Treasury markets, holding roughly one-third of Treasuries outstanding.

U.S. resident custodians, end-investors, and issuers are required to submit a monthly report of their (or their customers') cross-border positions in securities on the TIC SLT Form.6 The TIC system is designed to capture all cross-border positions on a residency basis. For example, a U.S.-registered hedge fund that is legally incorporated in the Cayman Islands is considered a foreign entity in the TIC system, and any U.S. securities held by such a fund are reportable as cross-border U.S. liabilities to foreigners.7 Generally, such liabilities are reported by the U.S. custodian.

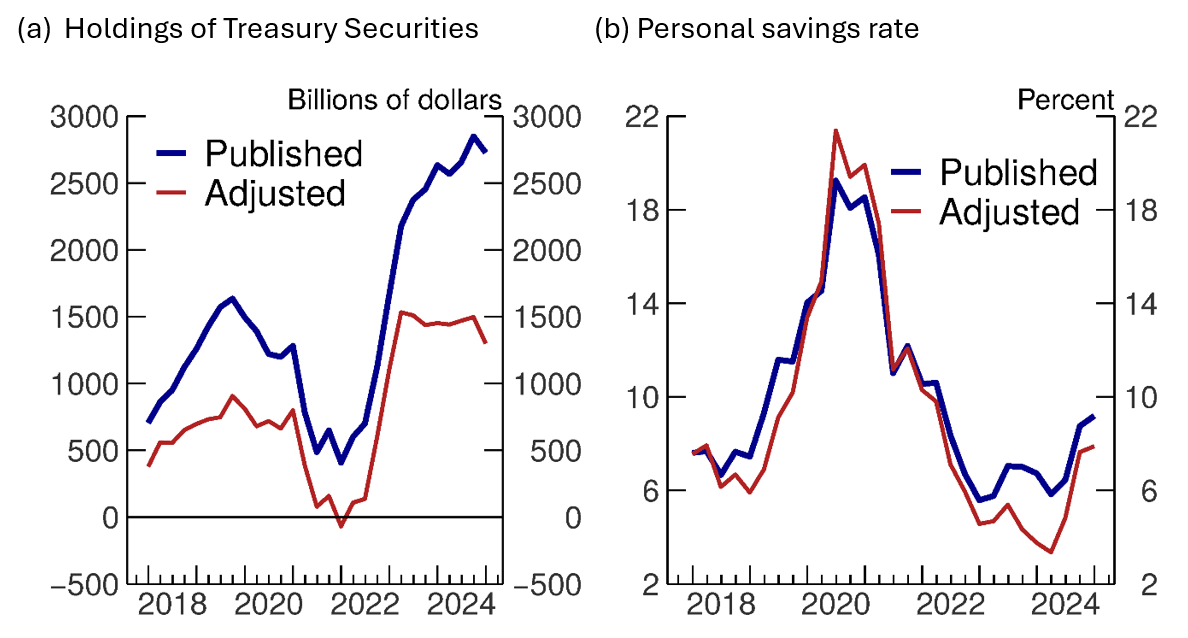

However, the large increases in Treasury exposure for Cayman Islands hedge funds that appear on the Form PF data and other sources are not evident in the TIC data.8 As shown in Figure 3, the gap between Cayman Islands' holdings of U.S. Treasuries in the TIC measure (black line) and those estimated from Form PF (red line) has notably ballooned with the reemergence of the basis trade since 2022, and has widened to nearly $1.4 trillion as of the end of 2024, pointing to a severe undercounting of Cayman-held Treasuries in the TIC. Importantly, this $1.4 trillion gap is not solely attributable to the basis trade. Hedge funds hold Treasuries for various reasons, including other arbitrage trades that are also supported by repo borrowing and would similarly contribute to the gap between Form PF and TIC Treasury values.

Figure 3. Adjusted TIC data for Estimated Holdings of Treasury Securities by Cayman-Domiciled Investors

While the gap has fluctuated in recent years, it has notably expanded during periods in which the basis trade is popular, including the recent runup since 2022. Indeed, it may be the case that assets and liabilities involved in the basis trade are not appearing in the TIC data. Notably, the TIC holdings data show neither an increase in holdings during periods linked to the basis trade, nor a decline during the March 2020 stress period, when hedge funds involved in the basis trade sold large amounts of Treasuries, further indicating that Treasuries reported on the TIC are simply not reflective of aggregate hedge fund holdings at all.9 Why are these Cayman-held Treasury securities not showing up in the TIC data?

The underreporting of Cayman Islands Treasury holdings in TIC is likely a result of collateral transfers from the repurchase agreements (repos) used to finance the basis trade. The TIC SLT instructions state that "securities sold under repurchase agreements or lent under securities lending arrangements, or collateral provided, should be reported by the original owner of the securities as if the securities were continuously held; that is, as if the repurchase agreement did not exist" (emphasis ours). It may be difficult, however, to track ownership of securities after they are exchanged as collateral for a repo or securities lending transaction, which involve the transfer of the security to another party or custodian. From the custodian's perspective, the securities may look as if they have been sold, even though the Treasuries may in fact still be "owned" by the hedge fund for the purposes of TIC. In such cases, the custodian does not report the unseen securities, resulting in an underreporting of hedge funds' holdings in the TIC SLT.

4. Repo financing of the Treasury basis trade

Since Treasury holdings associated with the basis trade may be missing in the TIC data due to their use as repo collateral, one way to reconstruct the size of these holdings is to track repo claims on hedge funds in the Cayman Islands. Repo lending of U.S. banks to Cayman Island residents should be reported on the TIC Report of U.S. Dollar Claims of Financial Institutions on Foreign Residents (the TIC BC).10 We can add this series to the TIC SLT holdings to "recapture" some of the missing Treasury exposure. While this series cannot be disclosed due to confidentiality concerns, this adjusted measure follows our Form PF-based estimate of Cayman Treasury holdings more closely. However, a substantial gap still appears in periods when the basis trade is at its height. This gap suggests the TIC BC data may not be capturing the totality of repo lending to Cayman hedge funds involved in the basis trade. We believe this undercounting of repo lending in recent years may be due to the increasing use of sponsored repo in lending to hedge funds.

Using data on the Fixed Income Clearing Corporation's (FICC) Sponsored Delivery-Versus-Payment (DVP) we show that the volume of repo borrowed in this segment fills a large portion of the gap between TIC Treasury holdings and our PF series. While not all borrowing in sponsored repo is by hedge funds domiciled in the Cayman Islands, the vast majority is.11 Moreover, there is reason to believe that this activity in FICC DVP repo may not be captured in TIC BC. When dealers lend to hedge funds through sponsored DVP, their trades are novated to FICC, which is a U.S.-resident entity. From a legal and accounting standpoint, after the trade is novated FICC becomes the (domestic) counterparty to both the U.S. lender providing the funds and the foreign hedge fund borrowing the funds. Meanwhile, on FICC's annual reports these transactions are reported as guarantees of repo trades rather than direct transactions. Therefore, FICC may not accurately report these transactions to TIC BC.

An adjusted measure of Cayman Treasury holdings that adds FICC sponsored borrowing to the TIC measure results in the dark blue dotted line in Figure 3. This adjusted Treasury estimate follows our Form PF based estimate much more closely.12 The remaining gap nearly closes with the addition of the TIC BC data. All told, we believe some of the cross-border repo lending for financing the hedge fund basis trade out of the Cayman Islands is reported in the TIC BC, but the TIC BC data alone are undercounting repo lending in recent years because of the increasing use of sponsored repo in lending to hedge funds.

5. Implications for the Financial Accounts of the United States – Z.1 measures of Household Net Worth and Personal Saving

Mismeasurement of Cayman Islands Treasury holdings in the TIC data affects multiple measures in the Financial Accounts of the United States, a quarterly statistical release which is an important component of our national economic accounting system.13 The Financial Accounts provide an integrated set of balance sheets that allows users to trace credit flows in the economy, track the behavior of participants in various financial markets—including the Treasury market—and analyze important measures of household financial conditions, such as personal saving and household net worth.14

The TIC data are used to construct the balance sheet of the rest of the world (ROW) sector in the Financial Accounts. Because the Financial Accounts are an integrated set of balance sheets, errors in the TIC data are not confined to the ROW balance sheet. Estimates of household portfolio holdings are particularly affected because household sector transactions for Treasury securities are calculated residually—that is, by subtracting the net purchases of Treasury securities for all other sectors identified in the Financial Accounts from the net issuance of Treasuries by the federal government in each period. In turn, Treasury securities held by households at the end of each quarter are estimated by adding the net purchases obtained from the residual calculation to the previous quarter-end level adjusted for market price changes. As a result, any error in net purchases of Treasury securities by the ROW in the TIC data will flow through to Financial Accounts' estimates of both transactions and levels of Treasury security holdings on the household balance sheet, and will, in turn, affect Financial Accounts' measures of personal saving and household net worth.

We can get a sense of the magnitude of these effects by reducing published measures of households' Treasury holdings and transactions by the amount of the difference between the Form PF and the TIC measures of Treasury security holdings and transactions of Cayman Islands hedge funds. Starting with the level of Treasury holdings, Figure 4a shows that the published measure of direct holdings of Treasury securities on the household balance sheet (the blue line) is significantly higher than the adjusted measure (the red line), particularly during the most recent episode of heightened Treasury basis trade activity, where the difference between the two measures widened from just under $500 billion at the end of 2021 to $1.4 trillion at the end of 2024.15 These two series convey very different messages about the household sector's role in Treasury markets over the past few years.

Household net worth is calculated as the total amount of nonfinancial and financial assets held minus total liabilities owed. Therefore, if households' Treasury holdings are indeed significantly lower than the published measure, then household net worth will also be lower by the same amount. However, given that household net worth is estimated to be around $169 trillion in 2024:Q4, the revision to Treasury holdings would be relatively small, accounting for less than 1 percent of net worth.

These adjustments to Treasury holdings could be somewhat more important for estimates of the distribution of wealth from the Board's Distributional Financial Accounts, which are produced by combining aggregate data from the Financial Accounts with microdata on household portfolio shares from the Board's Survey of Consumer Finances. These data indicate that about 80 percent of directly held Treasury securities are owned by households in the top decile of the wealth distribution; as a result, reducing these Treasury holdings could alter our measures of wealth inequality, though the effect is still likely to be minor.

Personal saving in the Financial Accounts is calculated analogously to household net worth, using net transactions of assets and liabilities instead of amounts outstanding.16 A similar exercise that adjusts Treasury security transactions suggests that published measures of personal saving are likely overstated when Cayman Islands hedge funds are purchasing large amounts of Treasury securities to conduct the basis trade and understated during periods in which hedge funds are selling Treasury securities to unwind the basis trade. As shown in Figure 4b, the four-quarter moving average of the published measure of personal saving in the Financial Accounts tends to be greater than the adjusted measure during periods characterized by a high level of basis trade activity. In fact, the average published personal saving rate was higher than the adjusted measure by about 1.1 percentage point during the 2018-2019 period and by 2.1 percentage points during the 2023-2024 period. This adjustment implies a relatively large effect on measured personal saving rates, particularly during the more recent period (2023-2024) when published saving rates averaged 8 percent.

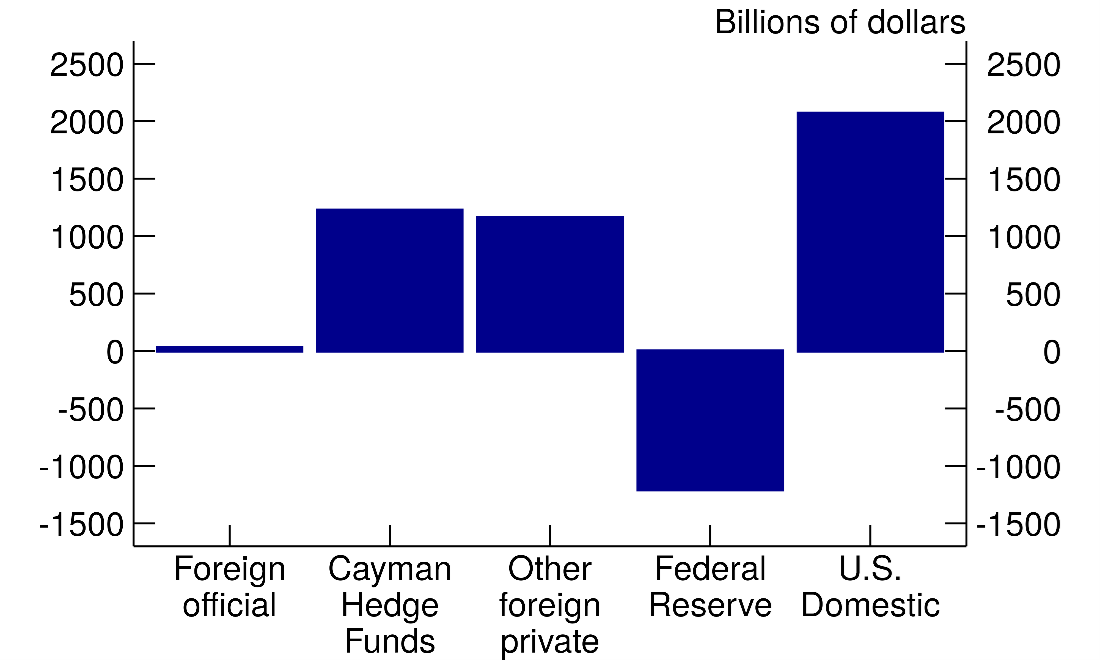

The mismeasurement of cross-border Cayman Islands hedge fund repo financing related to FICC's sponsored DVP service also appears to be widening the discrepancy between borrowers and lenders in the U.S. domestic federal funds and security repurchase agreements market (table L.207) reported in the Financial Accounts.17 This widening discrepancy aligns with basis trade periods, and makes sense given that the Financial Accounts capture accurate repo lending by money market funds as reported on SEC Form N-MFP, the key lender of cash via repos in the basis trade, while some borrowing by Cayman Islands hedge funds appears to be missing from TIC as mentioned in section 4. Currently, the Financial Accounts show that the security brokers and dealers sector has the largest repo liability position in recent years. However, adding the suspected missing sponsored repo borrowing by foreign hedge funds per the dotted blue line shown in Figure 3 to the rest of the world liability position would increase the amount by about $475 billion in 2023:Q4, putting the rest of the world liability nearly equal to security brokers and dealers at $2.1 trillion. In 2024:Q4, adding the missing sponsored repo liabilities of about $908 billion would make the rest of the world the largest borrower in U.S. repo markets at about $2.5 trillion, about $195 billion more than security brokers and dealers. This mismeasurement distorts our understanding of cross-border activity and masks the magnitude of cross-border repo exposures and vulnerabilities, which are important for understanding the role of foreign investors in short term funding markets.

6. Concluding remarks: Implications for understanding the role of foreign investors in Treasury markets

The residency basis of the TIC data grants us an important window into the rise of broader trends, including the use of shadow banking channels. Many nonbank financial institutions (NBFIs) are incorporated offshore, which means that cross-border flows related to collateralized loan obligations (CLOs), asset-backed securities, and other forms of non-bank lending can be tracked in the TIC data. In the years ahead of the global financial crisis, for example, it was possible to see the rise in popularity of mortgage-backed securities (MBS) in the TIC survey data.18 More recently, the growth in CLOs has been observed in the TIC survey and banking reports.19 Thus, the undercounting of cross-border assets and liabilities in the official statistics also compromises the ability to track the growth of foreign-domiciled NBFIs that have an active footprint in U.S. securities and funding markets. The undercounting also hampers the BEA and other data users in accurately measuring cross-border flows. The undercounting in the TIC data also likely affects estimates of the sensitivity of Treasury demand by different types of investors to changes in asset prices and market conditions.20

Our findings suggest that Cayman Islands hedge funds are, increasingly, the marginal foreign buyers of U.S. Treasury notes and bonds. As shown in Figure 5, between January 2022 and December 2024, a time when the Federal Reserve was reducing the size of its balance sheet by allowing maturing Treasuries to roll off from its portfolio, Cayman Islands hedge funds purchased, on net, $1.2 trillion of Treasury securities. Under the assumption that these purchases are comprised entirely of Treasury notes and bonds, they absorbed 37% of net issuance of notes and bonds, nearly the same amount as all other foreign investors combined.21 Furthermore, after adjusting Cayman-owned Treasuries in TIC for the estimated undercount of roughly $1.4 trillion, the Cayman Islands is in fact the largest foreign holder of U.S. Treasury securities—holding significantly more than China, Japan, and the United Kingdom, the largest 3 holders currently displayed in Treasury's "Major Foreign Holders" table.22

The puzzling disconnect between the TIC and Form PF data on Cayman Islands' holdings of U.S. Treasuries is under active investigation, the results of which should improve data quality in the future. In the meantime, data users should be aware that this major gap exists.

References

Ayelen Banegas, Phillip J. Monin and Lubomir Petrasek, (2021). "Sizing hedge funds' Treasury market activities and holdings," FEDS Notes 2021-10-06-3, Board of Governors of the Federal Reserve System (U.S.).

Daniel Barth and R. Jay Kahn, (2025). "Hedge Funds and the Treasury Cash-Futures Basis Trade," Journal of Monetary Economics, 154.

Daniel Barth, R. Jay Kahn, and Robert Mann (2023). "Recent Developments in Hedge Funds' Treasury Futures and Repo Positions: is the Basis Trade "Back?," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, August 30, 2023.

Daniel O. Beltran, Laurie Pounder DeMarco and Charles P. Thomas (2008). "Foreign Exposure to Asset-Backed Securities of U.S. Origin," International Finance Discussion Papers 939, Board of Governors of the Federal Reserve System.

Carol C. Bertaut and Ruth A. Judson. (2023). "Measuring U.S. Cross-border Securities Flows: New Data and a Guide for Researchers," FEDS Notes. Washington: Board of Governors of the Federal Reserve System.

Adam Copeland and R. Jay Kahn (2024), "Repo Intermediation and Central Clearing: An Analysis of Sponsored Repo," Staff Reports 1140, Federal Reserve Bank of New York.

Jonathan Glicoes, Benjamin Iorio, Phillip Monin, and Lubomir Petrasek (2024). "Quantifying Treasury Cash-Futures Basis Trades," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, March, 08, 2024.

Liu, Emily and Tim Schmidt-Eisenlohr (2019). "Who Owns U.S. CLO Securities?," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, July 19, 2019.

Alexandra M. Tabova and Francis E. Warnock, 2022, "Preferred Habitats and Timing in the World's Safe Asset," NBER Working Papers 30722, National Bureau of Economic Research, Inc.

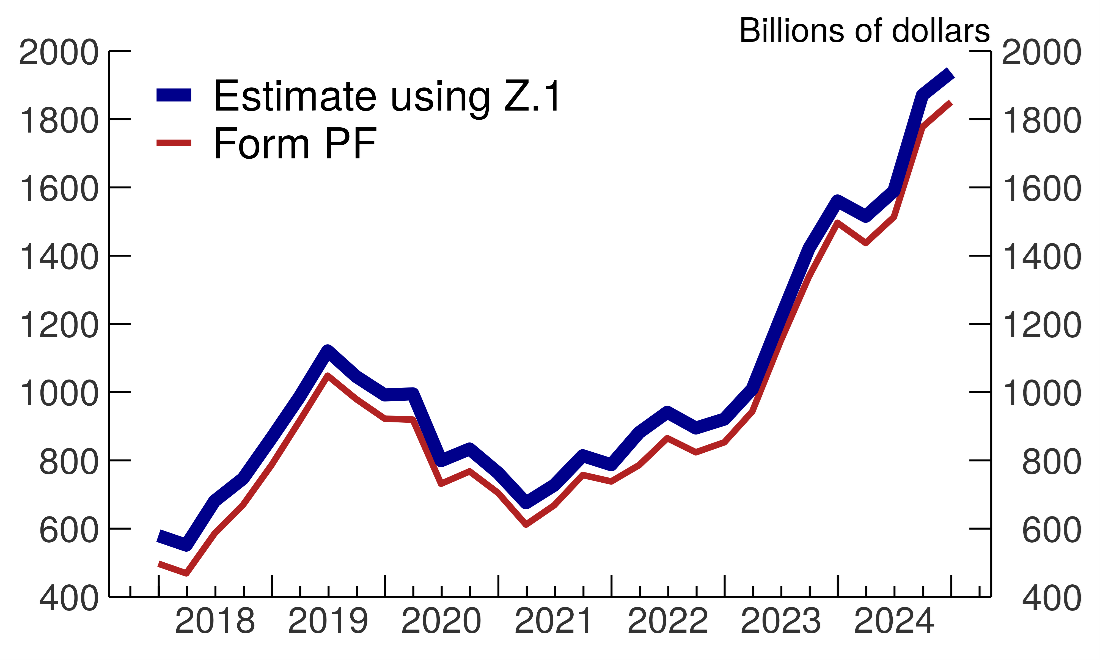

Appendix A - Estimating Cayman Islands' Holdings of Treasury Securities Using Publicly Available Data

The Form-PF based estimates of Cayman Islands hedge funds' holdings of U.S. Treasuries reported in Figures 2 and 3 are based on confidential fund-level data from Form PF, which is not publicly available. Using publicly available data from the Financial Accounts, and the Enhanced Financial accounts, it's easy to construct a reliable proxy for these holdings. This Financial Accounts based estimate of Cayman Islands hedge funds' Treasury holdings is computed by subtracting U.S. domiciled hedge fund holdings in the Financial Accounts, from holdings of all hedge funds reported in the Enhanced Financial Accounts, with the assumption that most foreign hedge funds are domiciled in the Cayman Islands. As can be seen in Figure A1, estimated holdings using the public data (dark blue line) closely tracks and is only slightly higher than the more accurate estimate using confidential Form PF data (in red).

Figure A1. Estimating Cayman Islands Hedge Funds' Holdings of US Treasuries using the Enhanced Financial Accounts

Please cite this note as:

Barth, Daniel, Daniel Beltran, Matthew Hoops, Jay Kahn, Emily Liu, and Maria Perozek (2025). "The Cross-Border Trail of the Treasury Basis Trade," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, October 15, 2025, https://doi.org/10.17016/2380-7172.3939.

Last Update: October 15, 2025

.png)