Investors are piling into assets such as gold, bitcoin and shares amid worries about government debt, central bank independence, and the weakness of major currencies such as the dollar. The trade has even been given a moniker: the “debasement trade”. But what does it mean?

What is the debasement trade?

Debasement is the act of reducing the quality or value of something. Henry VIII was behind one of the most notorious examples in history: the “great debasement” saw the amount of gold and silver in coins substituted with cheaper base metals such as copper to fund his lavish lifestyle as well as wars with France and Scotland. It earned him the nickname Old Coppernose when silver started to wear off the coins featuring his face.

The modern debasement trade involves investors moving away from fiat currencies, such as the dollar, in favour of “harder” assets that provide safety from the risk of rampant inflation.

The trade – a hot topic in the markets this month – is being driven by anxiety that governments will not, or cannot, rein in their borrowing by cutting spending and raising taxes. The concern is that politicians may take control of their central banks, allowing them to run persistently high deficits and prioritise debt financing over price stability.

Why is the debasement trade in vogue?

Concerns about fiat currencies – which are issued by governments without the backing of a hard asset such as gold – have been rising for years. But interest in the debasement issue has gathered pace as a result of the Trump administration’s trade and fiscal policies, which have threatened to drive the already huge US national debt even higher than its current $37tn.

Enthusiasm for the trade has risen as investors have observed central banks cutting interest rates even though inflation remains over target: Trump has noisily demanded hefty cuts to US borrowing costs.

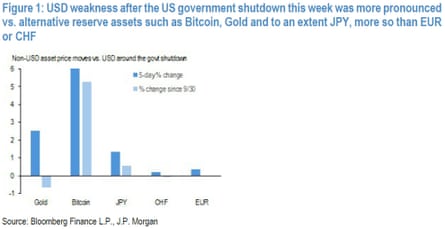

The US government shutdown, France’s inability to agree a budget, and the fact Japan’s next prime minister supports aggressive public spending, have added to concerns about debt sustainability in large economies.

Fears about money printing have been swirling since central bankers began their stimulus packages during the financial crisis. But broader confidence in the global financial system appears to be weakening further, in a world of weaker growth and rising debts.

How are investors playing the debasement trade?

They are spending more of their fiat currency reserves on assets that cannot be printed, such as precious metals and bitcoin.

It’s “the familiar pattern of dollar debasement against alternative reserve assets amid Washington dysfunction”, according to JP Morgan analysts this week.

Inflows into gold exchange-traded funds hit a record high in the last quarter, according to data from the World Gold Council, amid macroeconomic and geopolitical uncertainty.

What impact is it having?

Some asset prices are hitting the roof. Gold has had more highs than a 1970s rock star this year, hitting $4,000 an ounce for the first time on Wednesday. It has surged by 50% during 2025.

Gold prices are now up a stunning 18% since the Fed's dovish pivot at Jackson Hole on August 22. The Dollar is stable. This should be giving governments around the world serious pause. Markets fear global debasement in the face of post-COVID debt overhangs. This is all fiscal... pic.twitter.com/4vI7RywswA

— Robin Brooks (@robin_j_brooks) October 6, 2025Bitcoin is also having a rollicking year, up more than 20% since January, hitting the $125,000 mark for the first time on Monday.

But the dollar, which underpins the global financial system, has dropped by about 9% since the start of the year against a basket of other currencies, as its status as the global reserve currency has come under strain.

Ken Griffin, the founder and chief executive of the hedge fund Citadel, said this week that investors were looking for ways to “effectively de-dollarise and de-risk their portfolios vis-a-vis US sovereign risk”.

“Inflation is substantially above target and substantially above target in all forecasts for next year. And it’s part of the reason the dollar’s depreciated by about 10% in the first half of this year. It’s the single biggest decline in the US dollar in six months, in 50 years,” Griffin told the Citadel Securities future of global markets conference.

Government long-term borrowing costs have also risen, as investors have shunned long-dated bonds out of fear that inflation will eat away their value. This is the worst decade on record for government bonds, according to recent Deutsche Bank data.

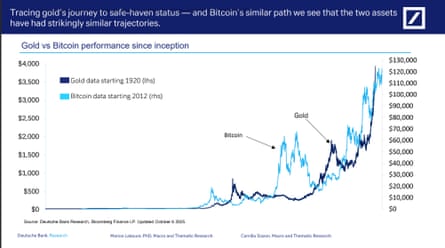

The weakness of the US dollar, and the rise in alternative assets, raises speculation that bitcoin could serve as a credible reserve asset alongside gold.

“A strategic bitcoin allocation could emerge as a modern cornerstone of financial security, echoing gold’s role in the 20th century,” suggested Deutsche Bank’s Marion Laboure and Camilla Siazon this week, who predicted both assets were likely to feature on central bank balance sheets by 2030.

Can it last, or will it end in tears?

Goldman Sachs has predicted that gold will keep rising over the next year or so – it has raised its price forecast for the end of 2026 to $4,900 an ounce.

There are plenty of sage heads warning that asset prices have risen too high this year, pumped up by enthusiasm over artificial intelligence. Comparisons with the dotcom boom of the late 1990s are rampant. But what goes up has a habit of keeping going up, before it all turns sour.

The billionaire hedge fund manager Paul Tudor Jones suggested this week we could see a surge in stock prices before the bull market tops out. He told CNBC:

My guess is that I think all the ingredients are in place for some kind of a blow-off.

History rhymes a lot, so I would think some version of it is going to happen again. If anything, now is so much more potentially explosive than 1999.

Gold is also acting as a haven from concerns that the artificial intelligence stock boom may collapse, as big AI players announce a wave of interconnected, or “circular”, deals.

Shares in those companies have soared this year, pushing the wider stock markets to fresh highs, in the Fomo (fear of missing out) trade, as investors try to catch a piece of the AI boom.

.png)