A few days ago, Zohran Mamdani got elected to be the mayor of New York City. Along with new governors-elect Mikie Sherrill in New Jersey and Abigail Spanberger in Virginia, as well as elected officials across smatterings of other states, and new Georgia public services commissioners Peter Hubbard and Alicia Johnson, this crop is the latest group with a mandate to do something about the anger Americans feel towards their society. And whether moderate, left-wing, or in-between, most, led by Mamdani, are saying they will do something about it.

The challenges facing these leaders are profound, and they are not unique to this moment. In 2006, 2008, 2010, 2014, 2016, 2018, 2020, 2022, and 2024, voters threw the bums out, as the famous statement goes. They are likely to do so again in 2026, this time repudiating Donald Trump. And I think the reason is because most of our leaders are only looking at the public governments, not the private governments - aka commercial monopolies - that undergird them. To take a simple but powerful example, during Covid, it was Apple and Google, not governments, who set public health policy around contact tracing through their control of mobile privacy settings.

This shadow private governance model, controlled by financiers, is what Americans dislike. Obama and Trump saw this dynamic, and yet despite their anti-establishment political messaging, neither broke with the status quo on its alignment with Wall Street. Similarly, Nancy Pelosi in 2006 ran on Drain the Swamp, a message Trump re-used so effectively few remember Pelosi was there first. In fact, no one in the last 20 years has channeled the rage of voters with sufficient policy courage.

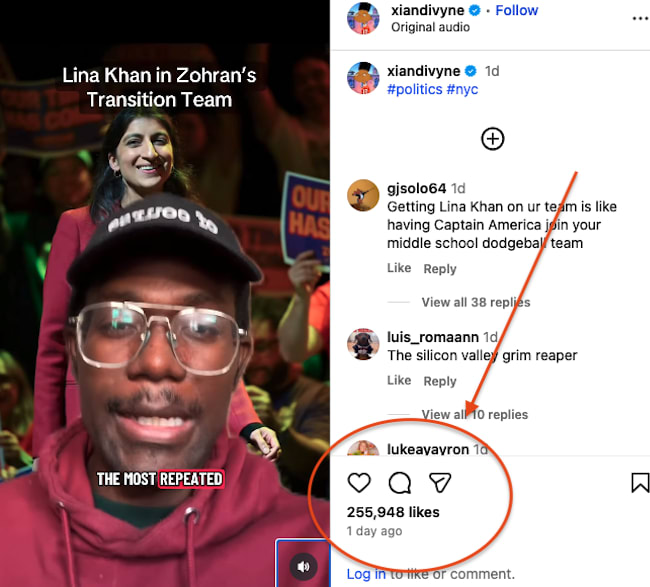

That’s why one of the more interesting dynamics at work in New York City is that Mamdani brought on anti-monopoly leader Lina Khan as one of his transition co-chairs. There are other signs. Mamdani is apparently going to maintain his political organizing machine, and has even launched a high-profile resume-gathering operation. (If you’re in NYC and are looking to do something interesting, you should consider applying…)

These dynamics lead to a question. Is there now a nascent unification of political populism with governing expertise? I don’t want to overstate the argument, since New York City governance is not something I know particularly well, and Mamdani has a whole lot of people giving him advice. We’ll know more when he starts hiring and making choices. But there is at the least the possibility of something here we haven’t seen before. And the viral videos about this choice show that at least some significant chunk of Mamdani’s base is aware of the economic policy conflicts at the heart of the election.

At any rate, rather than trying to lay out some sort of comprehensive plan for what Mamdani, or any of these new leaders should do, I’m just going to describe a bunch of economic termites, aka firms with market power, that drive up the cost of state and city government. More than just cost, they are the infrastructure on which governance operates, so the inflexibility of politicians is often a result of them being reliant on entities like these.

Public Safety Equipment: Police and Fire Apparatus

Back in January, Basel Musharbash showed that the Los Angeles governance failure during the major wildfires may have been a result of monopoly. A few corporations, REV Group and Oshkosh, have made it extremely hard to repair fire trucks. Prices have gone over the last fifteen years, delivery times are such that it’s impossible to get a truck in a reasonable time frame. Some of these same companies might have market power over ambulances as well. The Senate held a hearing a few months ago and did an investigation, and now the Federal Trade Commission is investigating. Who buys fire trucks? Cities!

But that’s not all. There’s also police equipment, like body cameras, tasers, and squad surveillance equipment. Here’s Forbes:

Baltimore, Maryland; Augusta, Maine; and Howell, New Jersey have sued Axon, alleging that the company has committed antitrust violations, abused its market power, and forced cities to pay exorbitant fees for a basic, but crucial piece of law enforcement tech.

Filed in federal court in New Jersey, the suit claims that the Arizona-based company formerly known as Taser International bought VieVu, one of its key competitors, to secure four major contracts that had eluded it: New York City, Oakland, Miami-Dade and Phoenix. Then, under its new Axon brand, it aggressively raised prices for clients that had few other options. Within a year, Axon’s body cam prices had risen 50 percent. By 2022, those prices had nearly tripled, reaching $490 per camera.

And a BIG reader involved with city government noted:

One big change in our public safety budget - Computer software increased from $175,000 in 2025 to $715,000 for 2026!

Our sheriff explained Axon, the company that initial made tasers, now does squad cameras, body cameras. You no longer purchase and own, you “subscribe” with a fee and it is $500,000 a year. He actually called it a “monopoly.”

The tactics by firms like these - bundling, monopolization, and long-term contracts - are standard. It would be useful for New York City to take the lead on either bringing antitrust suits here in coordination with other cities, or investing directly in startups or potential rivals who could make similar cheaper products. Often there’s a prestige factor at work, where there are competitive suppliers, but government and corporate purchasers are too scared to try someone different. New York City could be that first buyer to break open markets to new entrants.

Emergency Radios

The New York Times did an important story on the summer’s deadly flash floods in Texas, noting that one cause of the accidents was a $7 million contract for emergency radios, provided by monopolist Motorola Solutions. “The grueling job was made more difficult because the radio system they needed to coordinate the response was not up to the task,” wrote the Times.

Prices have increased dramatically over the last few years, “six-channel Motorola radio site could be put on the air seven years ago for $300,000, but now costs about $500,000.” Motorola has 70-80% of the market, and “expanded its offerings for emergency responders to include body-worn cameras, police drones and 911 call-center software.” The company’s stock has quadrupled since 2021.

This one too is a prestige buying situation, along with long-term contracts. Local buyers are afraid to try out someone untested with such vital infrastructure, even though Motorola was such a failure.

Transit Buses

As with fire trucks, so too with buses. The median price of an electric bus in the U.S. is $1.1 million, vs $330,000 in Singapore or $350,000 in South Korea. Diesel buses have largely remained the same price over the past forty years, which is inconsistent with the broader trend of lower automotive prices.

What happened? Well, there are some regulatory issues, but as with fire trucks, a wave of mergers over the last decade, combined with bankruptcies, has turned commuter bus production into a duopoly of two firms, Gillig and New Flyer. New Flyer bought Motor Coach Industries International and North American Bus Industries. Earlier this year, Nova Buses ended bus production in New York state. Rivaz has a small presence in the market after they bought a bus producer from REVGroup.

There are also likely similar dynamics we see in the fire apparatus market, like difficulties in replacing spare parts and high service costs.

Court and City Management Software

Tyler Technologies provides software that manages municipal functions, everything from “permitting, police dispatching, jail booking, property appraising, campground reservations, restaurant inspecting, cannabis licensing and school bus tracking. Customers range from the US’s second-largest state parks system (California’s) to its third-largest prison network (Florida’s).” And it’s widely disliked software that is also deeply entrenched.

IT expert Brendan Keeper describes systems like Tyler’s in other areas as “identity of record” software systems, which are usually bad quality and very difficult to move off of. In certain areas, it isn’t possible. “Where court-record software is concerned,” noted BusinessWeek, “research analyst Josh Reilly of Needham & Co. says that Tyler has a near-monopoly and that it’s hard to even find a website for one of its rivals.” NeoGov is another one that sells human resources systems for governments, specifically.

The way to address this problem is to use legal tools and bargaining power to open up this software to third party developers, and foster the interoperability of data. We’ve seen a bit of this in Federal health care law.

Health Care Middlemen

Health care is probably the most significant area of direct power for cities and states, most of which manage large portions of our health bureaucracies. On a basic level, states and cities have large workforces which buy health care. New York City, for instance, just had an odd switch in benefits, where UnitedHealth Care somehow got a contract to provide insurance to city workers. That buying power is meaningful, and can be used in creative ways. (In Florida, one hotel chain simply contracts with providers for its employees, saving massive $$$. Why couldn’t a city?)

Beyond having workforces who buy health care, every state has a Medicaid program, meaning that each state has direct authority over a large health insurance and pharmaceutical benefit for its poor and lower middle class residents. As I noted, Ohio, Kentucky, and New York have replaced their corporate pharmacy middlemen with public systems, saving money and helping patients and pharmacists. Oregon recently banned corporate ownership of medical practices, and Arkansas passed a law to break up insurers. California even contracted with a nonprofit manufacturer to produce its own $11 insulin pen.

That trend is likely to continue; incoming Virginia governor Abigail Spanberger will implement a single state-run PBM, which will save the state billions of dollars, and she pledged pricing transparency in hospitals. Similarly, New Jersey governor-elect Mikie Sherrill made a video about the threat of pharmacy benefit managers.

In New York City, the situation is slightly different. The mayor has influence over the biggest municipal health system in America, which includes 11 hospitals, 5 long-term care centers, and 30 community-based clinics. That gives Mamdani power over the system’s purchases of drugs and medical supplies - including opioids - through consolidated wholesalers, as well as the use of middlemen called Group Purchasing Organizations, which “manage an estimated $300 billion of hospital purchasing for 5000 health systems (as well as nursing home facilities and other providers), or 90% of hospital supplies in the United States.”

Through this hospital system, New York City also has access to a Federal drug discount program called 340b, which could theoretically be opened up for cheap drugs to the uninsured or underinsured. Pharmacists don’t make money on the drugs that get the biggest 340b discounts, so it wouldn’t be bad for the pharmacists in the city. New York City could also seek to contract with California for cheap insulin.

That said, there are obviously very entrenched interests here. The board of directors of New York’s hospital system, which the mayor appoints, includes a Goldman Sachs managing director and a UnitedHealth Care advisor. Not exactly a hotbed of populism.

Credit Cards, Google, and Economy-Wide Monopolies

Some corporations with market power, like credit card systems Visa, Mastercard, and American Express, cost every business in the economy money by taking a cut of every transaction, as well as redistributing wealth from merchants and the poor to the rich via reward programs. States and cities are big payment processors and use these gatekeepers. In 2017, states lost on procedural grounds in going after the credit card oligopoly for antitrust violations, it’s about time for another go, since more data has come out that overcomes those legal hurdles.

There are other levers. New York City might be able file an amicus brief in the Federal antitrust suit against Visa. Additionally, the Federal Reserve has a payment system called FedNow that it could open up to compete with credit cards; it would be fun to see Mamdani do an event outside the New York Federal Reserve in downtown asking for the Fed and Trump’s help lowering costs on businesses and consumers.

Similarly, Google’s advertising technology just was declared an illegal monopolist, and no doubt New York City is an ad buyers who could demand damages. Across the board, there are many dominant commercial services used by cities and states, some of which have antitrust claims or liability.

Other Services: Prison Phone, Construction, Industrial Gasses

Just in terms of delivering city services, I asked BIG readers for help coming up with additional examples that drive up governance costs and make the city less flexible, they suggested looking into waste disposal and recycling monopolies, food purchasing, construction contracts, the prison phone industry, Chromebooks for schools, school security and architecture, ankle monitors, software for tracking/paying parking citations, software for publishing city council meetings and agendas, procuring industrial gasses such as carbon dioxide for municipal water treatment, and a bunch of others.

New York City is often considered ungovernable because of the thicket of expensive and difficult to manage entrenched interests. That’s increasingly true all over the country. But why? One answer is because the city is a complex $120 billion a year organization with immense legal authority and responsibilities. The city government, or associated entities, is a massive asset owner, managing ferries, airports, public housing, parks, universities, schools, highways, libraries, and sewers. But another answer is because the actual mechanisms of governance and the necessities of life, from rent to food to electricity, are controlled by financiers.

The cost of commercial rent in New York City, for instance, is inflated by the widespread use of non-disclosure agreements by landlords, as well as by bank loans whose covenants make it very hard to drop list rent prices, and privilege chain stores. That’s why there are so many retail vacancies, it makes more sense to keep an empty property than take a tenant who would rent it for a bit less money. Tax law can partly address this driver of higher costs.

Food prices, similarly, are organized by large buyers who get volume discounts, which undermines local farmers and raises the costs of food sold by local grocers and bodegas. There’s been a lot of anger over Mamdani’s proposal to have five municipal grocery stores, but if he were to use municipal presence in retailing to lead litigation against these volume discounts on behalf of the many grocers and bodegas in the city, that might be powerful. Another result is that food could be healthier and more local. One result of price discrimination, for instance, is that upstate New York’s great dairy capacity, which used to provide milk to New York City, is gone. It could come back.

On a policy level, there are a lot of things that you can do about each of these problems. Cities could band together and build a municipally-focused antitrust league, serving as joint plaintiffs to defray legal costs when litigating against common vendors. They could jointly invest in companies that build capacity to supply what they need, as California has done for insulin. There are aspects of bargaining over data standards that could be done in common. To be clear, not every idea I’ve described will work, and many ideas I haven’t considered would likely be more effective. But in general, the the predicate to fixing entrenched systems is to have leaders explaining why governance isn’t delivering, and how to fix it.

And fortunately, that’s now possible. As a political candidate, Mamdani is understood as someone who was “good at social media,” as if he were releasing buzzy fun cat videos. But what he actually did was to make videos that were either listening by portraying the voice of New Yorkers, or explaining by making videos showing how governance worked. His first viral video was one from the post-2024 election, in which he asked residents whey they voted for Trump or why they didn’t vote at all, drawing out a mix of opinions about the high cost of living under Biden combined with spending money on Israel. That was listening. His second viral video, Halalflation, was one in which he explained why street vendors had high prices, tracing it to a corrupt city licensing regime. That was explaining.

We need the law, and we need the courts, and we need better policy. But we also need better politics. Only with sustained public exposure, and discussion, will Americans be able to regain control of our governing levers. Anyway, if you’re in government or around it, add your thoughts in the comments, or other examples of market power problems for governments that I’ve missed.

Thanks for reading! Your tips make this newsletter what it is, so please send me tips on weird monopolies, stories I’ve missed, or other thoughts. And if you liked this issue of BIG, you can sign up here for more issues, a newsletter on how to restore fair commerce, innovation, and democracy. Consider becoming a paying subscriber to support this work, or if you are a paying subscriber, giving a gift subscription to a friend, colleague, or family member. If you really liked it, read my book, Goliath: The 100-Year War Between Monopoly Power and Democracy.

cheers,

Matt Stoller

P.S. I got a note from a reader after publishing a piece on economic termites in health care, specifically a merger of two survey firms, Qualtrics and Press Gainey.

I noticed your latest Substack mentioned Press Gainey. I do not know much about their business except that when our medical practice was purchased by a private equity company, they subjected us to the Press Gainey patient satisfaction scores system. A consultant was brought in to instruct us on how to improve our scores. The algorithm was proprietary and the scoring was overly complicated. It seemed that the take home lesson was to learn to give the patients a perception of receiving good care rather than actually providing it.

Sounds accurate.

.png)