I’ve noticed a strange and growing split on the right over property taxes that’s been largely invisible to my blue state friends.

We’ve all seen red state governors like Florida’s Ron DeSantis and Texas’ Greg Abbott promising to gut or even abolish property taxes entirely. Disastrous as this would be, it’s no surprise to hear this kind of rhetoric from state leaders of the party that loves to cut taxes.

What is surprising is seeing a robust defense of property taxes coming from young conservative Youtubers, producers of The Charlie Kirk Show, and prominent Republican legislators in red states. And if that wasn’t surprising enough, some of them are even going so far as to openly advocate for Land Value Tax (or Universal Building Exemption, if you prefer) as the sensible path forward to actually reforming property taxes.

Let’s go down the list.

Saagar Enjeti, right-populist host of Breaking Points, is perhaps the front-runner of this new movement, having made it something of a personal crusade. It began with the following clip:

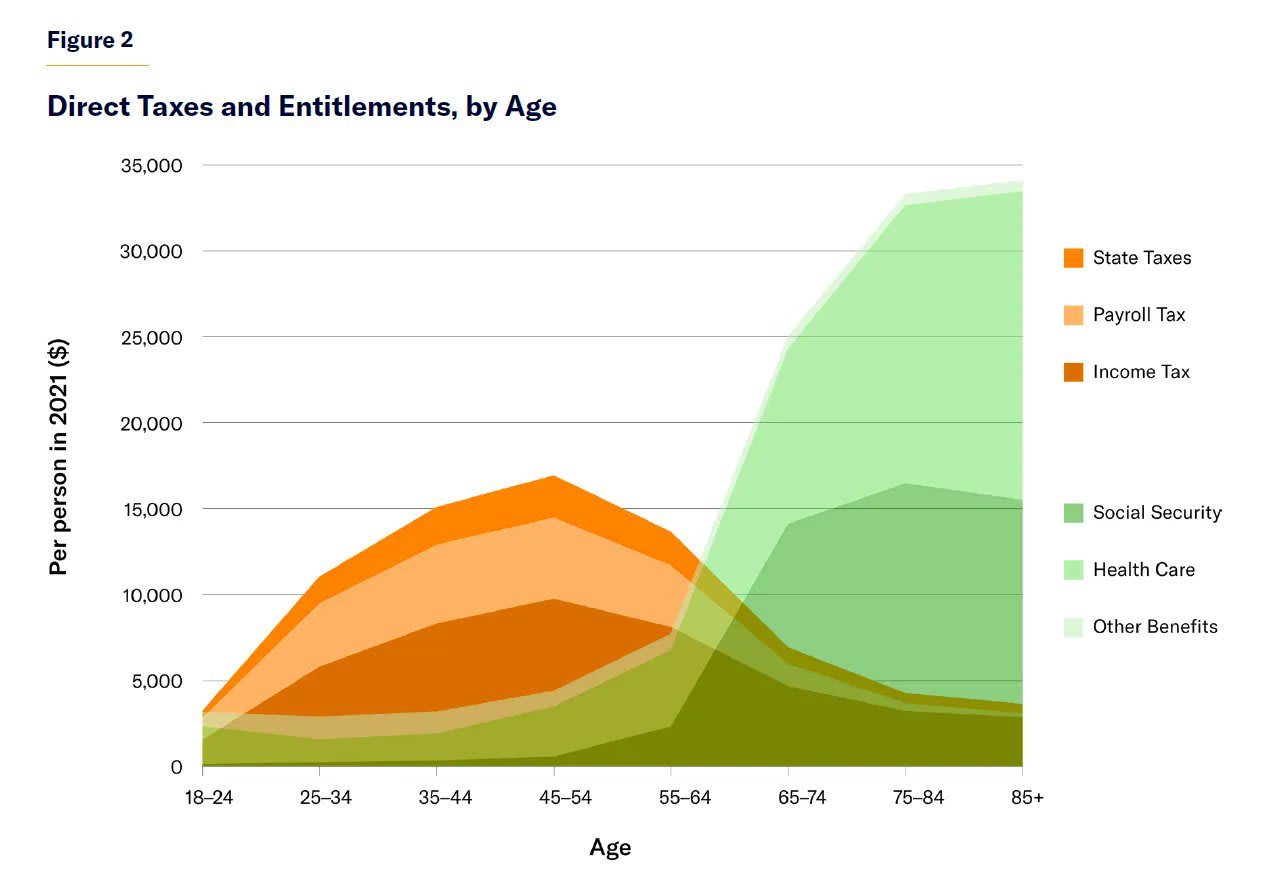

This is a massive giveaway to the old and it’s an inversion of how policy should be… The theory basically for property tax and the anti-property tax movement for a lot of old people is, hey, we’re older, our kids are grown, so why should we have to pay for schools? I think this is preposterous because I’m forced to pay Social Security and Medicare like everybody else with FICA. I could get hit by a bus on the day I turn 64 and 364 days old and get no social security. That doesn’t mean that I shouldn’t have to pay it for my entire life. Right? So their theory is that we have to pay for their retirement—which by the way is pegged to inflation—but they get property tax, school tax frozen, and now they want to eliminate it entirely, which are pay for city services; which again—who’s calling 911 for an ambulance all the time? It’s old people. Okay? And these people want to opt out of that and shift the tax burden to the consumption or sales tax, which would actually be a massive giveaway to them.

As well as this one:

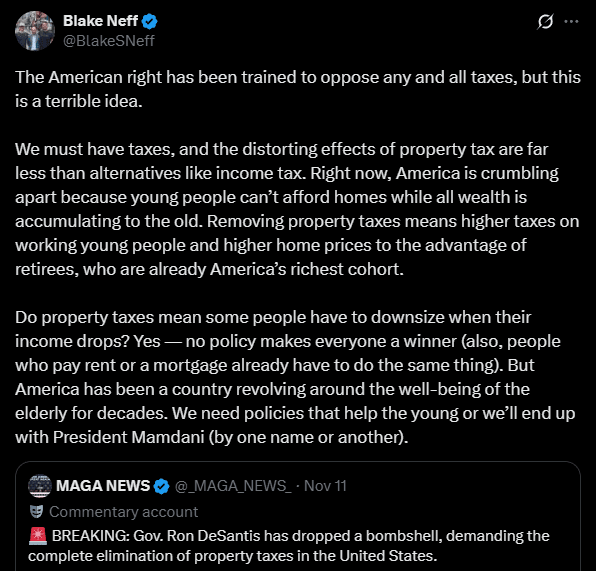

Over on Twitter/X, Saagar was joined by Blake Neff, producer of The Charlie Kirk show:

Blake recently invited Saagar onto the latest episode of the radio show/podcast, where Saagar laid out his argument (starts at the 18:37 mark):

Here’s Saagar (emphasis mine):

SAAGAR: Something that I’m very passionate about is defending the very idea of property tax very specifically, while also being able to critique individual school districts, because I believe that it’s very important to preserve the local connection of the taxpayer to their community. And one of my more recent objections right now specifically, is that [abolishing property taxes] actually centralizes control of education, of police, public services, and others at the state and the federal level.

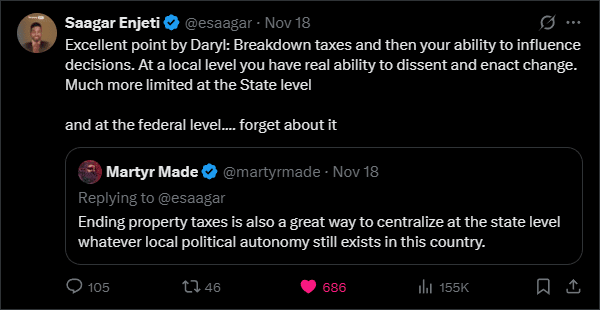

This point was first brought up by Daryl Cooper of Martyr Made, a recent guest on both Joe Rogan and Tucker Carlson’s shows, and a prolific podcaster in his own right:

SAAGAR: And if you really think back to the founding of our republic, property taxes were in many the most American tax that exists. Fourteen out of the fifteen colonies had a property tax by 1796, Thomas Jefferson actually believed that property tax was the “most righteous tax that could exist” here in the United States.

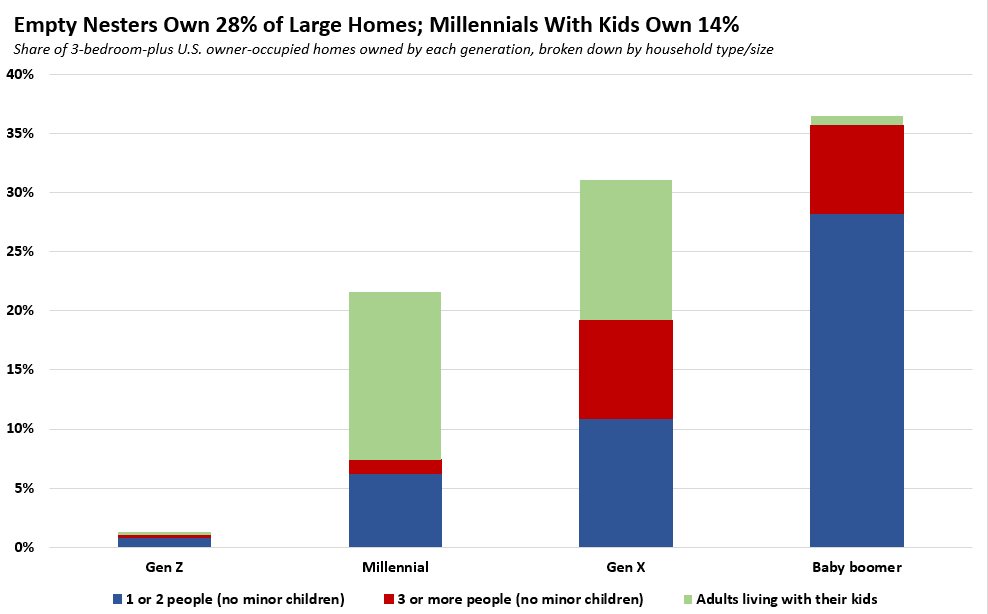

And so I’m concerned more specifically at a very high level that this is largely a give-away to the wealthy landowner class, which yes, also disproportionately happens to be much older, and that it is not one that prioritizes younger families, turnover, and other healthy elements of a housing market which remains, as you guys know, as Charlie knew as well, one of the central pain points for the burgeoning American family. If we care about families, if we care about housing, housing policy, school district funding is something that we all need to think about very deeply about and I think this just goes in the wrong direction.

The two co-hosts, Andrew Kolvet and Blake Neff, had previously discussed the same issue in a previous episode, which apparently flooded their inbox with angry reactions. In that episode, Kolvet brought up the issue that some safeguards need to be put in place for old people to ensure their security. Blake responded that this is all well and good, but no such provision exists for young people. In fact, in conservative culture, young people who can’t afford their rent are explicitly told to just suck it up:

Let’s be frank, old people love to point this out with younger people, if they live beyond their means and then they feel entitled to things…the way that we respond to that in plenty of other situations is “you can downsize”…I feel like it’s special pleading for objectively, the generation of Americans who have the most resources.

Interestingly enough, in that episode Kolvet briefly brings up the subject of Land Value Taxes as a potential way to resolve the property tax question. Blake agrees that LVT would be better as well, though this is only briefly mentioned.

Moving back to the most recent episode, Blake goes on to make these points:

BLAKE: Charlie talked about this all the time. The people who are in the most dire situation in America are the young. They feel like they no path forward to what their parents and grandparents had access to, and as a result they’re becoming very radical, on both on the right in many cases. And so, I think it would be disastrous to pursue a tax policy of just abolishing property when it almost certain this will mean raising the tax burden that is paid by young working families, because the offset to this is almost inevitably going to be higher income taxes, or higher sales taxes. It’s like a balloon-you squeeze the balloon somewhere, and it will expand elsewhere. So we have to think, where is that balloon going to expand?

Saagar and the two hosts go back and forth, with Kolvet sympathetic to both Saagar and Blake, but pointing out that some sort of provision needs to be made for securing the tenure of seniors. (Comptroller’s Form 50-126, guys! At least in Texas! Seniors can defer their property taxes until death, stay in their homes, and won’t have to pay another penny for as long as they live—all without distorting the tax base! This is a solved problem!)

Blake ultimately ended the interview with this point:

BLAKE: I want to emphasize because it’s created such a passionate reaction. We are not pursuing generational warfare. We’re not attacking anyone who owns a home, anyone who’s retired. We’re reminding people we are all in a country and—we have people with the biggest problems, which are young people, and this would ignite generational warfare, to pursue this. And I think we shouldn’t do that, and Charlie would tell us not to do that.

SAAGAR: Well said, Blake.

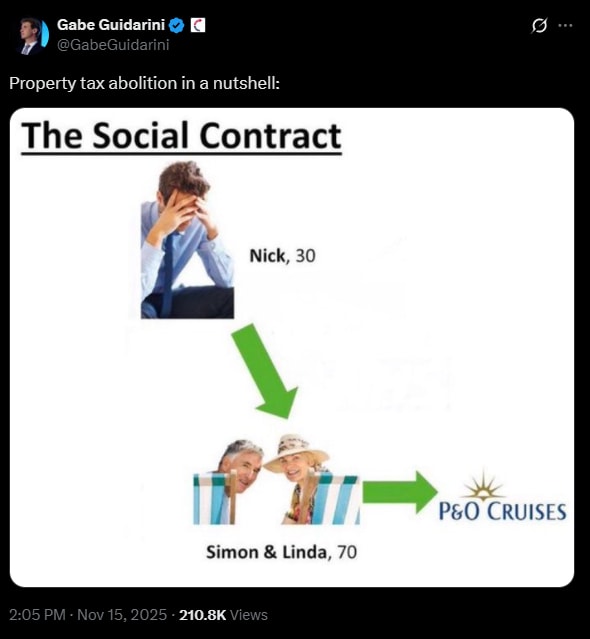

Gabe Guidarini, of Ohio Turning Point action, College Republicans, and former senate campaign staffer for JD Vance, was far less polite:

@MoreBirths, a conservative-leaning pro-natalist account, instead of directly bashing the older generation, gently appealed to facts and graphs, exhorting readers to think of the children:

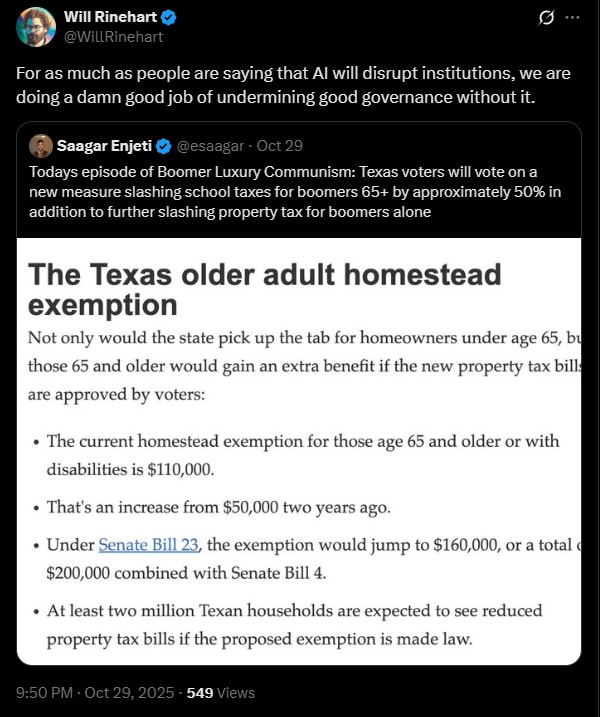

Will Rinehart, Senior Fellow at the American Enterprise Institute, had this to say:

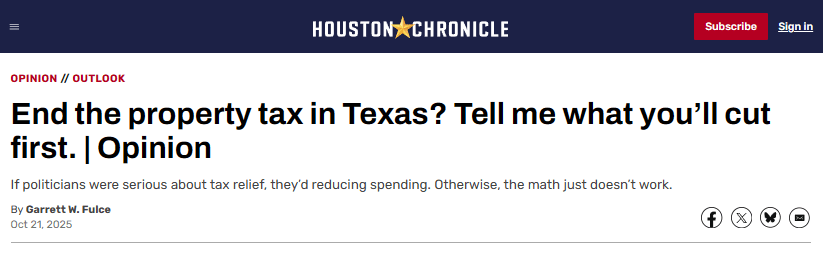

Garret W. Fulce, a Republican political strategist and host of his own political podcast Seeing Red, criticized so-called “conservatives” who are happy to vote for tax cuts without reducing any spending.

Here’s Garret:

Candidates love to promise to “eliminate” property tax on the campaign trail because that fires up their base. But even the dimmest politician knows the ultimate sacrament in Austin is spending someone else’s money — and the taxes the state politicians thunder about cutting don’t go to the state of Texas, but to local governments.

Garret finishes his piece by offering a practical, sensible reform that will actually deliver meaningful property tax relief without destroying the budget—Land Value Tax!

Until politicians are brave enough to make cuts we can at least limit the damage and move the burden off of homeowners.

We can do that by ending the taxation of buildings and improvements and just taxing the land underneath for everybody. Developers who sit on property should pay the same as the family that lives nearby. Businesses should pay the same as their customers. No more sweetheart deals.

This allows people to improve their homes without fear of long-term tax implications, while also incentivizing landowners and landlords to develop or offload underutilized properties. Land in desirable areas will inevitably be worth more, regardless of the structure on it, and necessary churn and land optimization can still occur.

Conservative icon and economist Milton Friedman called the land-value property tax the “least bad” tax. He was right. Maybe Austin can finally do the least bad thing and fix the broken system it created.

Will Upton, a former Public Affairs Specialist at the Treasury Department under the last Trump administration, straight-up pushed for LVT:

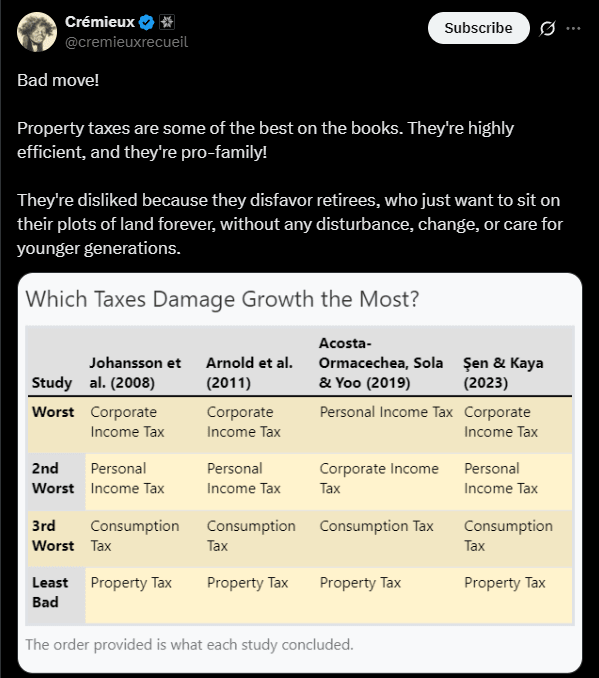

Cremieux, a prominent right wing anon account with over 279,000 followers, vigorously defended the property tax. He has also previously advocated for LVT.

Last but not least, asking “Grok is this true?” results in a vote of assent from Elon’s edgy right-wing AI bot:

Okay, so a lot of people are mad online. But how about actual Republicans in actual elected office who have the actual power to do things? How do they feel about this issue?

Property tax abolition has failed not once but twice in Texas, despite being a deep red, Republican state where governor Greg Abbott has been demanding sweeping property tax cuts for years. One clue may be that the Texas governorship is a surprisingly weak office, while the lieutenant governorship commands significant power. This is because the Texas governor must endure significant state constitutional checks on his power, while the lieutenant governor presides over the state senate and therefore enjoys significant control of the legislative agenda.

Case in point—momentum to abolish property taxes stalled when a report came out that showed that total abolishment would require replacing $81.5 billion dollars in revenue each year. The man who ordered that report was none other than Republican Lieutenant governor Dan Patrick, a perpetual thorn in the side of property tax abolitionists:

Patrick has called the goal a “fantasy” and, according to the Quorum Report, said it would push sales taxes as high as 20% to offset lost revenue, since a state income tax will never happen in Texas. “If you’re going to eliminate all property taxes, you have no money left to do anything,” Patrick told reporters in early June. “There would be no funding for education, no funding for health care, no funding for law enforcement.”

Patrick isn’t the only one who feels this way:

“This is not something that you can find $81 billion on a per-year basis and not have a major impact on the remaining sales tax rates, because that is a huge amount of money to be able to replicate,” said state Sen. Paul Bettencourt, a Houston Republican and Patrick’s chief lieutenant on property taxes.

Can I interest you in a Universal Building Exemption, Mr. Patrick?

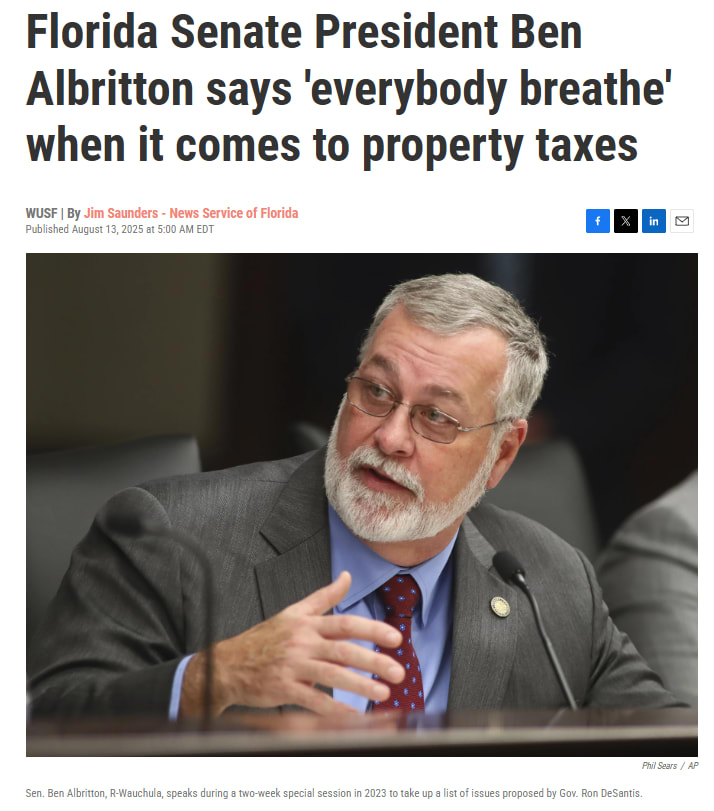

While governor Ron DeSantis pushes for widespread cuts, he’s also getting resistance from prominent members of his own party. State Senator Ben Albritton, president of the Florida Senate, has been doing his best to lower the temperature and assure local governments that nothing radical will be rammed through:

“When it comes to property taxes, everybody breathe. Everybody breathe. Nobody’s going to do anything crazy,” Albritton said Monday during a Hardee County legislative delegation meeting. “We’re going to take a measured approach. Measure three times, cut once. We’re going to take a measured approach to this and try to figure out what it is we can do.”

In a diplomatically worded March 2025 memo, Albritton “aplauds” Governor DeSantis for “pursuing an innovative concept”, but quickly pivots to insisting that, “a final tax cut package of this size be predominantly nonrecurring, while permanent tax cuts are explored during the interim.”

Unsatisfied with picking a fight with the leader of just one of the legislative chambers, DeSantis also crossed swords with Daniel Perez, the speaker of the Florida House as well. When the house proposed several property tax reforms, DeSantis rejected them all:

DeSantis, who in June vetoed the Legislature’s attempt to study property taxes, has scorned the House proposals as wimpy and “an insult.”

“They’re all milquetoast” while Floridians want a “bold” proposal, he said at the University of South Florida Oct. 29. “There’s not one proposal that would get people excited about,” he said. “They’re total half measures.”

Perez was nonplussed:

Responding to DeSantis, House Speaker Daniel Perez said DeSantis was being “small and petty.”

If DeSantis considers the House proposals “milquetoast,” Perez said, the governor must want to abolish all homestead taxes including those for schools (the House proposals exempt school taxes).

“I look forward to seeing the Governor’s proposed budget where he makes up for the $21 billion for schools that he plans to cut,” Perez said Oct. 29.

Florida and Texas aren’t the only states considering deep cuts to property taxes. Vivek Ramaswamy, as part of his run for governor, has also pledged deep cuts:

Unfortunately for Vivek, he isn’t governor yet. The actual governor of Ohio, Mike DeWine, will be in office until 2026, after which he is term-limited. DeWine had the following to say about eliminating property taxes:

“I don’t know how you abolish property taxes completely without raising other taxes,” DeWine said. “I mean, this is a significant way that we fund our schools.”

The main group pushing for this, the Committee to Abolish Property Taxes, doesn’t seem to have much of an actual plan:

Brian Massie leads the Committee to Abolish Property Taxes, and said his group is no longer interested in talks with lawmakers or waiting to see what they approve.

“It’s irrelevant to us because now, after talking to so many people throughout the state, they’re saying they do not have a voice in this government. No one is worried about them,” Massie said in an interview for “The State of Ohio”. “We’re going to get the signatures and we’re going to let the citizens vote.”

Given that eliminating property taxes in Ohio would leave a $23 billion dollar hole, Bill Seitz, a former Republican lawmaker and chair of the property tax laws working group, demands an actual plan:

“When you ask the proponents of this amendment, ‘what would you replace that revenue with?’, they’re kind of elusive in their answer,” Seitz said in an interview, also on “The State of Ohio”. “I’ve heard them suggest increased income taxes. I don’t really see any appetite to do that after the legislature has spent a quarter of a century reducing income taxes. Then they talk about increasing sales taxes. But you would need a statewide sales tax rate of something approximating 20% to make up for that revenue.”

And Seitz added that some local entities that get funding from property taxes don’t have the power to levy sales taxes.

“Townships don’t, libraries don’t, mental health don’t, parks do not,” Seitz said. “So suggesting that we raise the sales tax when those entities, many of them, don’t even have authority to do a sales tax is not the smartest thing in the world to me to do.”

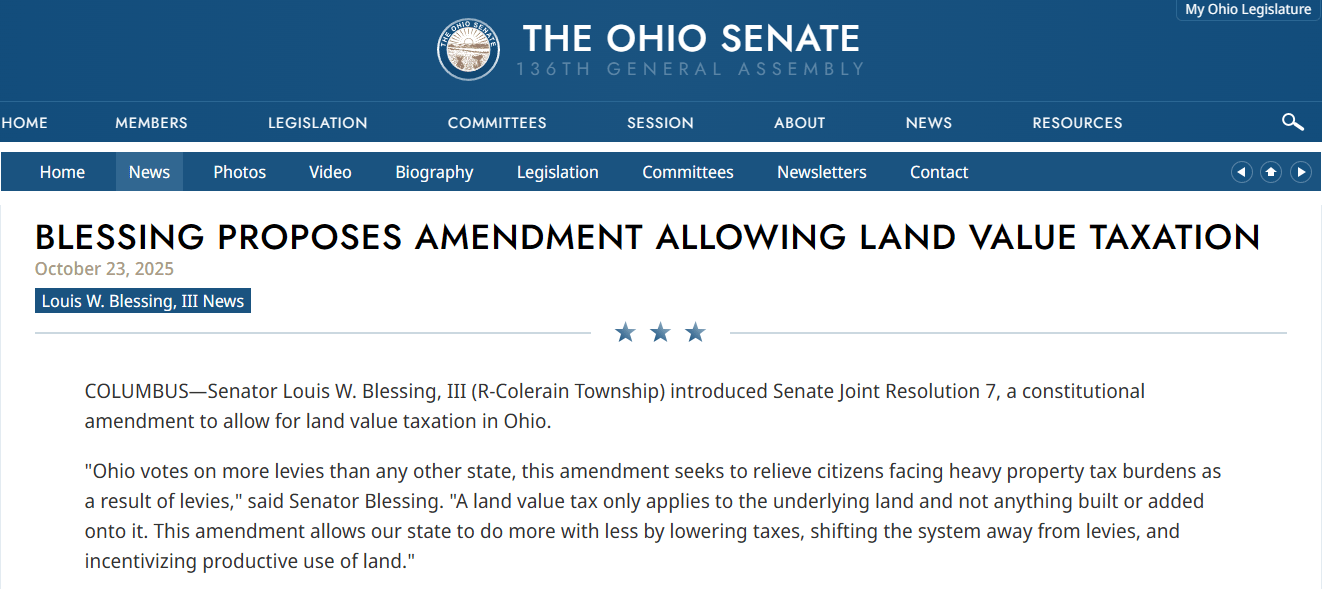

There is at least one person in Ohio who has an actual plan to reform property taxes in a way that works for everybody. That would be state senator Louis Blessing, chair of the ways and means committee, who just endorsed a state constitutional amendment to enable Land Value Tax:

LVT is perfectly in line with conservative principles. It empowers local government over distant, centralized state and federal governments, it doesn’t punish investment and hard work the way taxes on buildings, incomes, and sales transactions do, and it punishes idle speculation. As for those who say that the only taxes citizens should pay are those that are “fees for services rendered,” this is essentially what an LVT is in practice—the value of land comes from the activity of the community that surrounds it.

When your house is in a nice school district, the land value goes up. When your neighborhood is well policed, the land value goes up. When your roads are maintained and emergency services are prompt, the land value goes up. A tax on the land, and not on any of the buildings, transforms the property tax into a much fairer tax that is directly tied to the value of the local services you receive.

As Saagar has pointed out, our own founders favored property taxes over burdensome income taxes and regressive sales taxes. Founding father Thomas Paine went even further in explicitly preferring a tax on land with no tax on improvements, as did Capitalism’s chief founder, the one and only Adam Smith.

In the twentieth century LVT was championed by famed British conservative Winston Churchill, as well as by the architect of the 20th century American conservative movement, William F. Buckley.

As for the libertarian wing, Albert J. Nock was a key supporter, the man who literally coined the term “Libertarian.” He would be joined by David Nolan, who founded the American Libertarian party, not to mention famed libertarian economist Milton Friedman.

And if that’s not enough, the philosophy behind LVT comes with the robust anti-endorsement of one Karl Marx, founder of communism, who called it “Capitalism’s last ditch.”

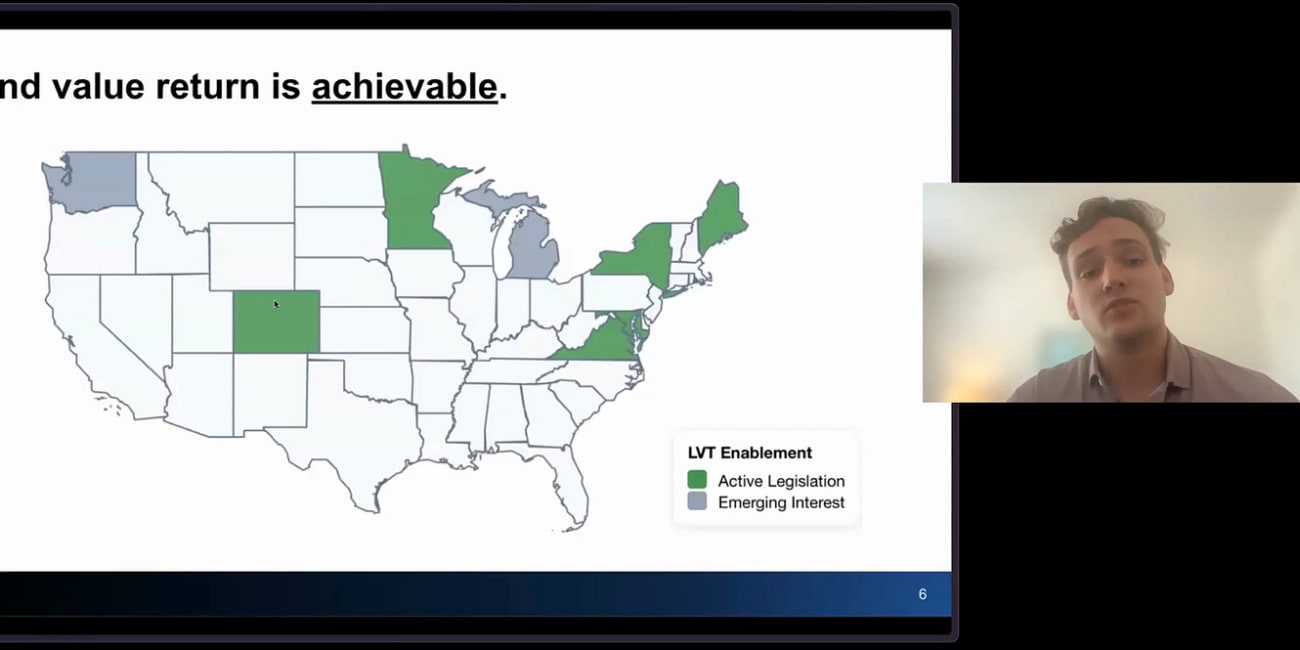

While property tax abolitionists continue to slam into brick walls, LVT is steadily building momentum throughout the country, among conservatives and liberals alike.

Land value return is needed, pragmatic, and achievable

On September 26th, 2025, the Progress & Poverty Institute and the Center for Land Economics joined forces for our first of many “LVT Landscape LIVE” events where we update the community on what’s been happening nationwide in the world of LVT and related policies, including input from local officials actively running on this issue. Many people weren’t ab…

.png)