1. China’s Consumer AI Trails in Global ARR

2. Chinese AI Apps Dominate on Reach

3. Most Chinese AI Startups Serve Home Users, But Revenue Flows Overseas

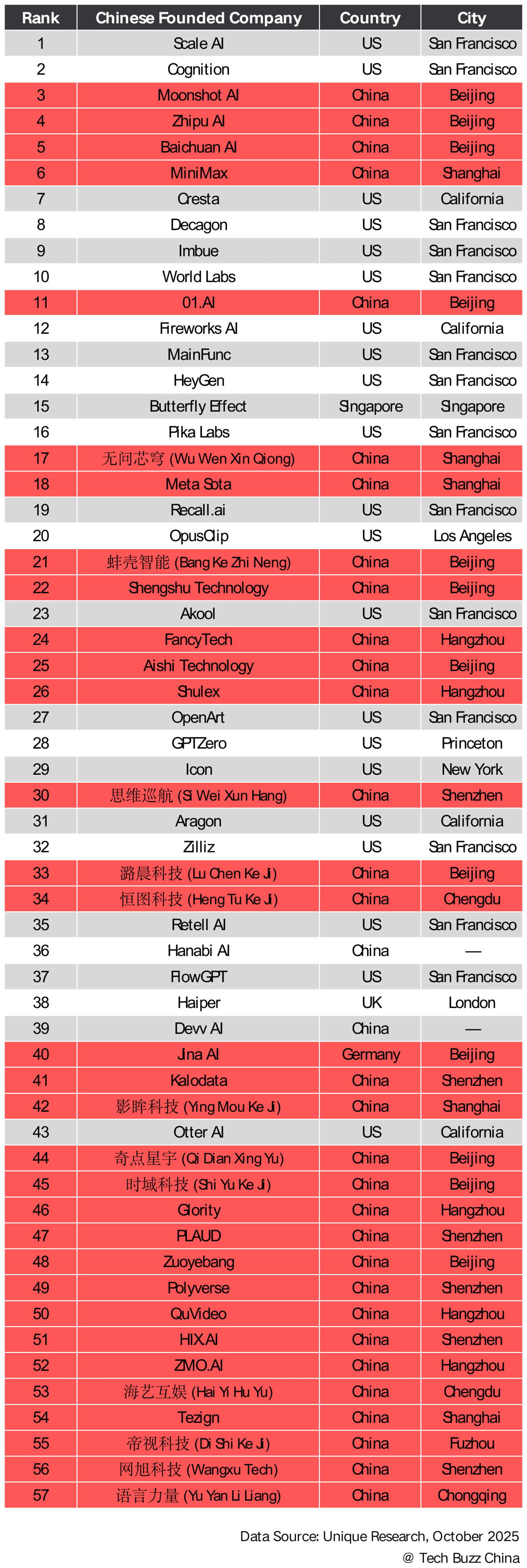

4. China Specializes in Content; Global AI is More Diverse

5. Chinese Listed Giants Set the Pace

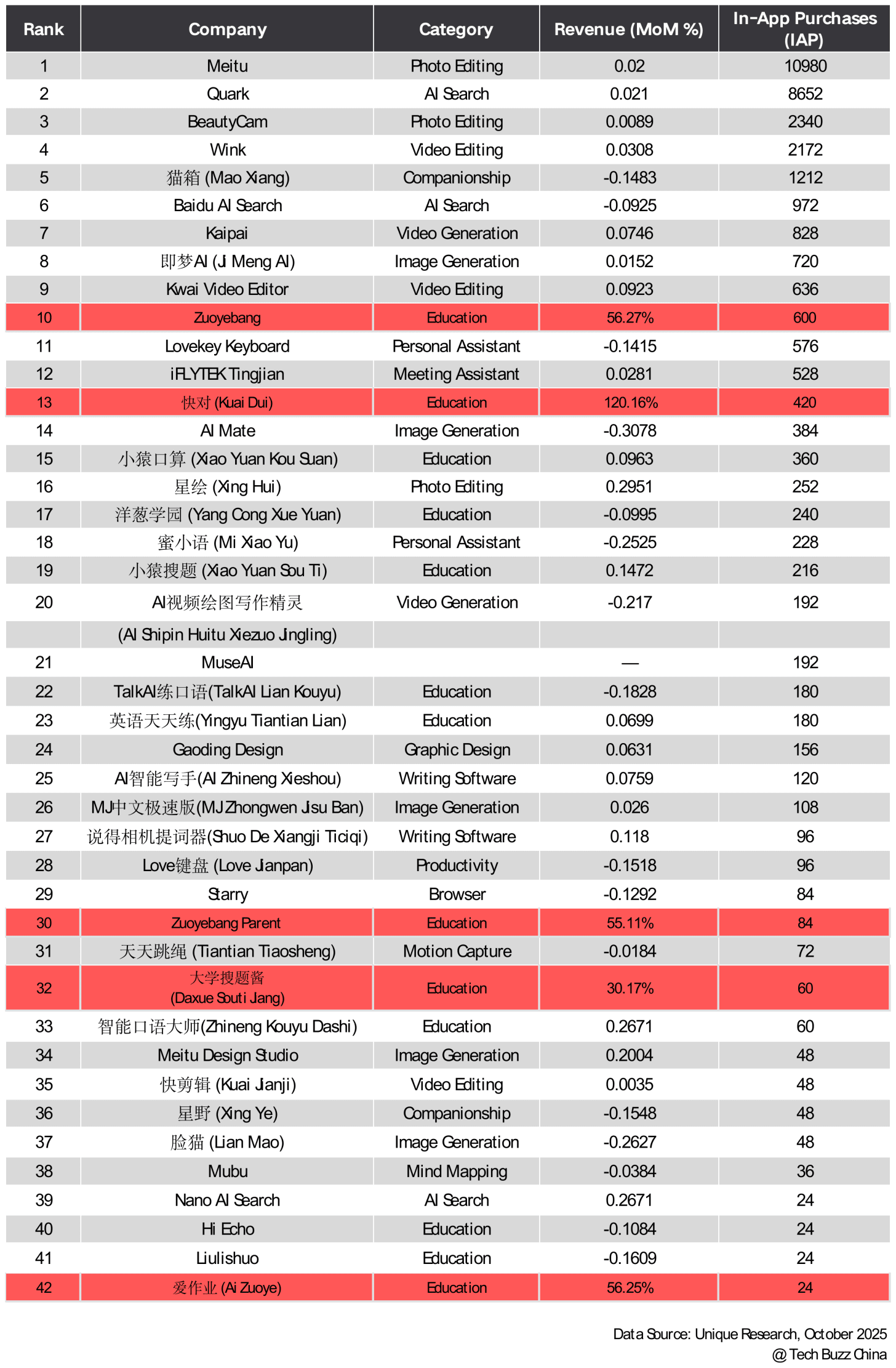

6. Education Drives China’s In-App Revenue Surge

7. Four Clusters Drive Most Chinese AI Activity

Conclusion: China’s AI App Economy Enters Its Scale Phase

Profiles of Major Chinese AI Players

In 2025, China’s AI applications expanded with remarkable speed and range. Multimodal generation became easier to use, and learning and workplace tools started working straight out of the box. Meanwhile, major platforms quietly integrated AI into everyday touchpoints—search, photo galleries, short video, and documents. The spotlight shifted from eye-catching demos to fundamentals: reliability, latency, inference cost, and content governance. AI is now less of a spectacle and more of an operational capability that must endure and scale.

Three themes stand out. First, user reach and revenue growth no longer rise together; real advantage comes from embedding AI into the workflow itself, not from showcasing isolated features. Second, the profit engine has moved to the middle layer: data governance, model routing, and automation determine margins, retention, and reuse across products and devices. Third, categories are settling into different rhythms. Creative tools still draw attention, but the pragmatic, “get-the-job-done” utilities are proving more consistent in both usage and cash flow.

This report is co-published by Tech Buzz China and Unique Research, an independent AI research organization committed to open-source principles, neutrality, and reproducibility. Unique Research conducts data-driven studies, publishes AI application rankings and trend reports, and provides ongoing monitoring and localized analysis to guide companies and investors. It also bridges industry and academia through research partnerships and events.

This report offers a practical framework for comparing AI products and strategies. It provides a consistent lens on how reach, retention, and monetization interact; a way to pinpoint the engineering and distribution levers that drive margin; and guidance on what capabilities can be reused versus where new investment is needed. The goal is to help teams build shared baselines for roadmaps, partnerships, and resource planning in the next stage of AI product development.

As always, Tech Buzz China aims to deliver forward-looking, insightful advisory and analysis. Enjoy!

Rita Luan

Tech Buzz China

Wei Wu

Unique Research

We define a Chinese AI application company by its operating base, registration, and primary team location. Firms that moved their headquarters, such as HeyGen, are not counted as Chinese AI companies, though they are marked in the Unique Research database as founded by ethnic Chinese. Some, like Butterfly Effect (Manus), are included in the Profiles section due to their origins and relevance, even if they are now classified as Singapore-based.

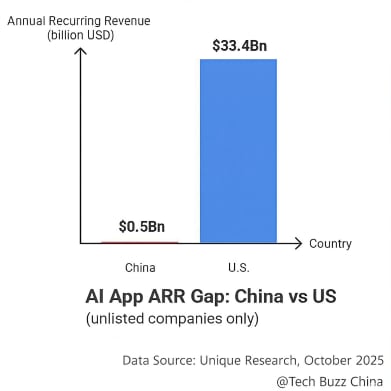

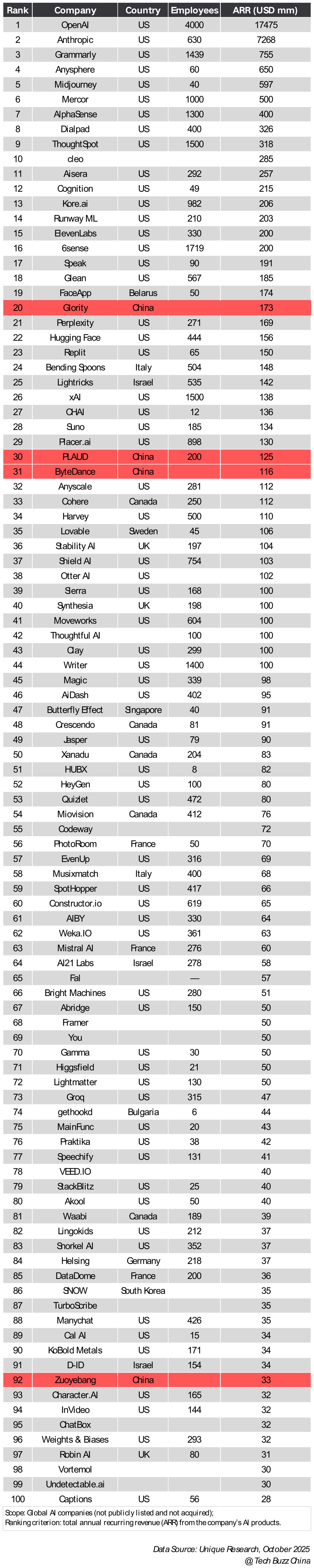

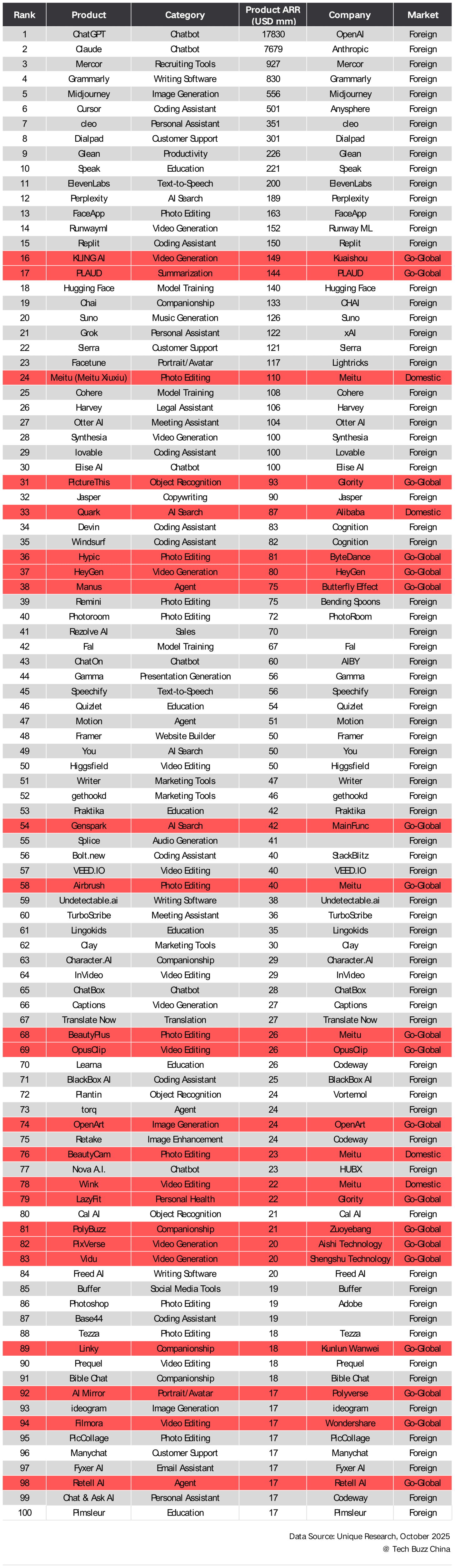

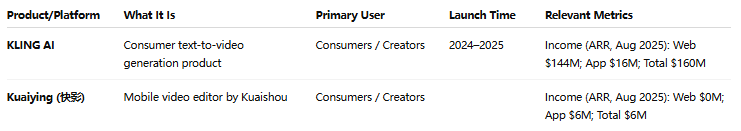

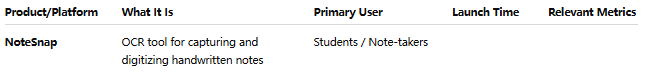

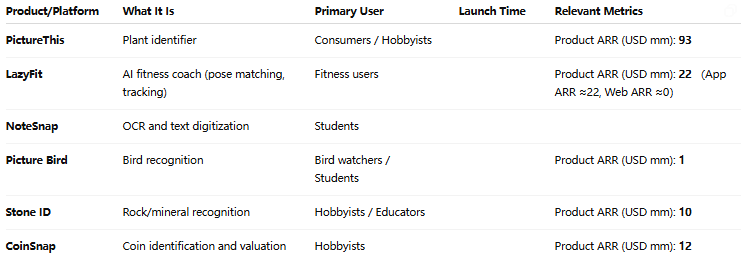

Despite China’s heavy national investment in AI, its consumer-facing startups capture only a small share of global recurring revenue. In Unique Research’s ranking of the top 100 private AI companies by annual recurring revenue (ARR), only four are Chinese—Glority ($173 million, No. 20), PLAUD ($125 million, No. 30), ByteDance ($116 million, No. 31), and Zuoyebang ($33 million, No. 92). Together, they generate $447 million in ARR, just 1.23% of the list’s $36.4 billion total, while U.S. companies account for $33.4 billion. The gap underscores how limited China’s consumer AI scale remains in global terms.

Hangzhou-based Glority, creator of the PictureThis plant-identification app, is the largest of the group. Founded in 2009, it has built a suite of computer-vision tools used in education, healthcare, and document processing—illustrating how Chinese AI success stories often blend consumer appeal with enterprise utility.

Several structural factors help explain the imbalance. Most Chinese AI companies focus on infrastructure, enterprise software, or public-sector projects that depend on custom contracts rather than subscriptions. At the consumer layer, competitive pricing, limited willingness to pay, and a culture of free services constrain recurring-revenue models. As a result, China produces fewer large-scale consumer AI products with stable ARR compared with the United States.

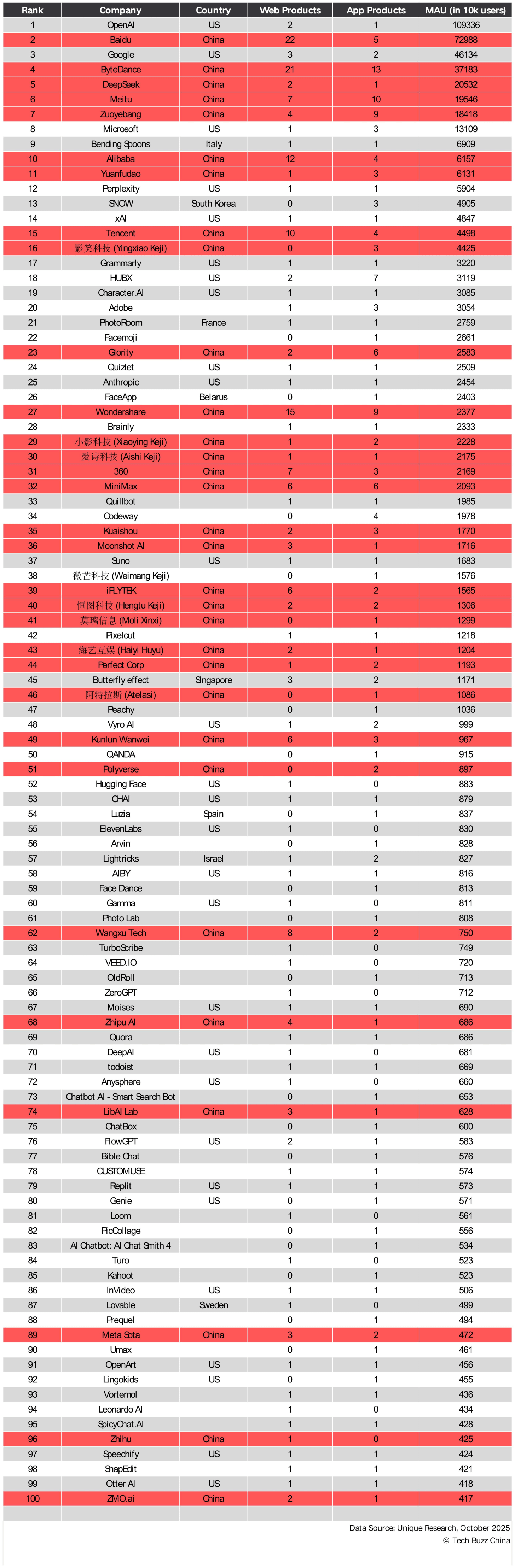

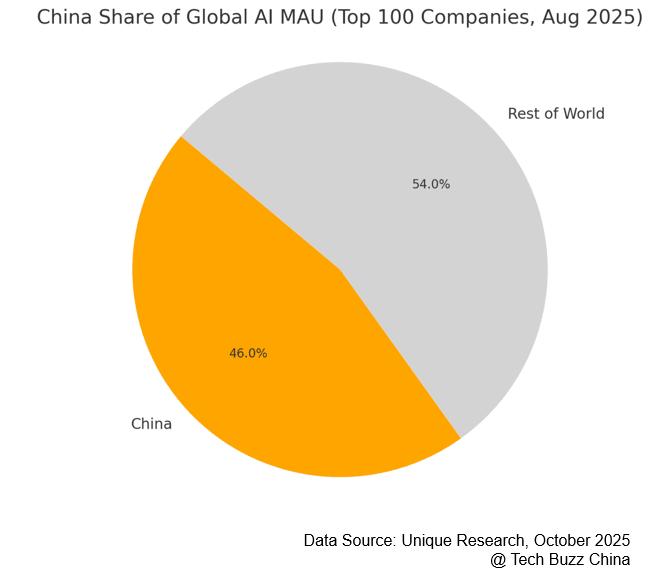

As of August 2025, the top 100 AI companies in our sample reached an estimated 4.78 billion monthly active users across web and mobile. China accounts for roughly 46 percent (about 2.2 billion MAUs), and six of the ten largest by scale are China-based—Baidu, ByteDance, DeepSeek, Meitu, Zuoyebang, and Alibaba. Baidu alone serves around 730 million monthly users, showing how features embedded in dominant platforms—often offered for free—can accelerate adoption at unmatched speed. (Figures represent platform-level MAUs and are not deduplicated across apps.)

This reach reflects the breadth of each company’s product network. Baidu operates about 22 web products and 5 apps; ByteDance 21 and 13; Meitu 7 and 10; Zuoyebang 4 and 9; and Alibaba 12 and 4. By embedding new AI capabilities into frequently used services and pushing them through large portfolios, these firms turn distribution scale into a core competitive asset.

Pricing strategy reinforces that advantage. Broad free or low-cost access builds ubiquity first and monetization later, concentrating users on platforms that fold AI tools into daily habits: Baidu ~730 million, ByteDance ~372 million, DeepSeek ~205 million, Meitu ~195 million, and Zuoyebang ~184 million. The pattern underscores China’s strength in user reach—even as monetization remains constrained by pricing norms and platform design.

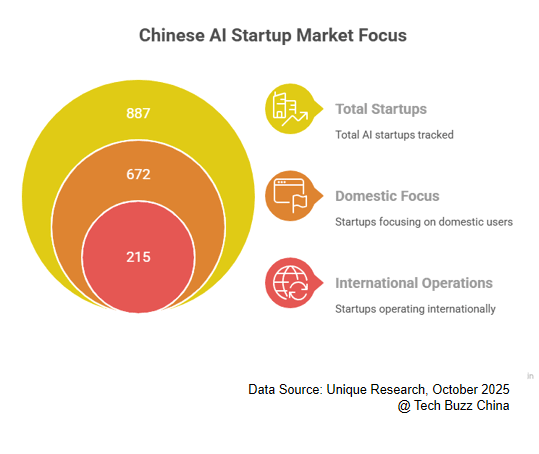

Despite China’s global tech presence, most of its AI startups still focus on the domestic market. Of 887 companies tracked by Unique Research, 672 serve primarily local users, while 215 operate across both domestic and international markets. That tilt reflects structural advantages at home: a vast internet population, a sophisticated mobile ecosystem, lighter compliance barriers for local rollout, and early commercialization channels through government procurement, enterprise contracts, and partnerships with major domestic platforms. These conditions make China a fertile ground for launching and testing new products.

Revenue data, however, tell a different story. In the ranking of the 100 largest AI products worldwide by annual recurring revenue (ARR), 23 came from Chinese developers—and 19 of those generate most of their revenue overseas. Only four focus mainly on domestic users.

Taken together, company focus skews local while top-earning products lean global. The local market continues to offer scale and institutional demand that make it attractive for initial deployment, but international markets currently present more favorable conditions for recurring revenue, which is where many of the most successful Chinese AI products are finding traction.

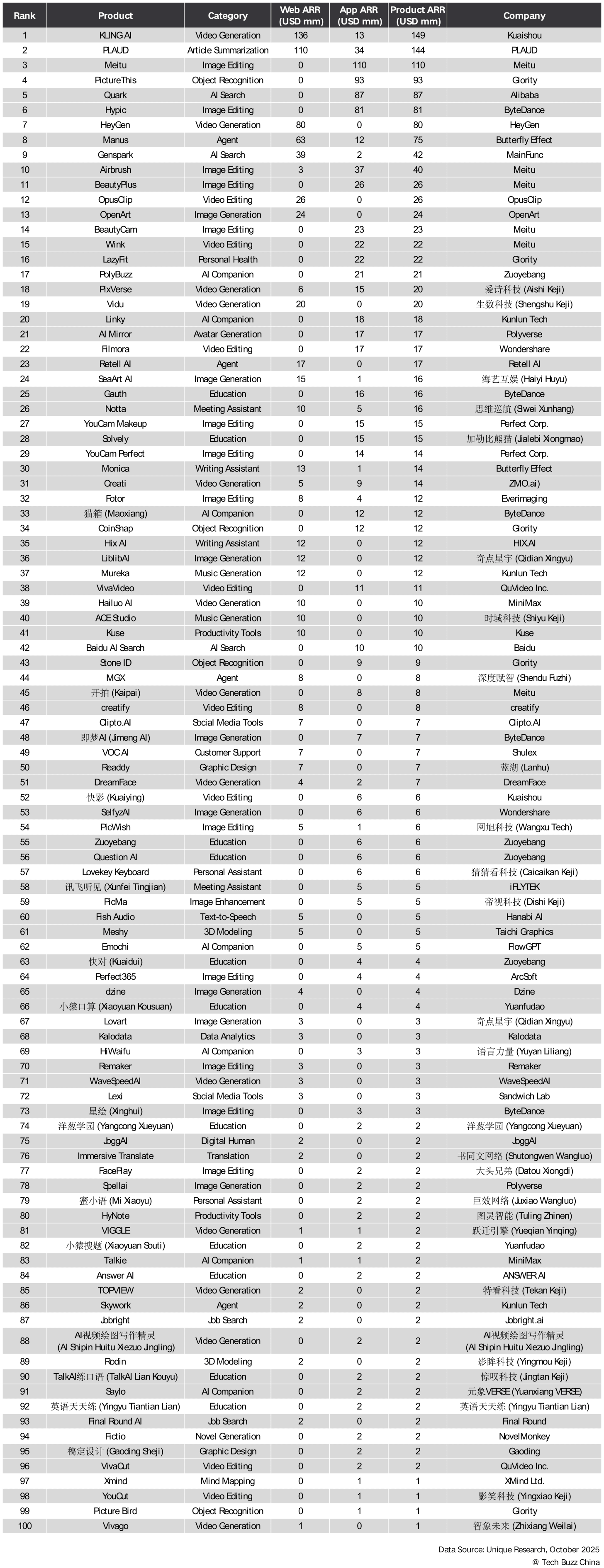

Nearly half of China’s top 100 AI products center on media creation and refinement, with 47 focused on video (23) or image (24) generation and editing—about 47 percent of the total. This heavy concentration reflects an ecosystem optimized for making and polishing visual content. Notable examples include KLING AI, HeyGen, Vidu, and PixVerse on the video side, and Meitu, Hypic, BeautyPlus, BeautyCam, OpenArt, and 即梦AI on the image side. Other categories such as search, writing, and chat exist but remain smaller, and few products are built deeply into enterprise workflows.

The global landscape looks very different. International products extend beyond media into categories that support repeatable, higher-value contracts and diversified monetization models—customer support, developer tools, model infrastructure, and productivity. Examples include Intercom and Dialpad for support, Cursor and Replit for development, Hugging Face and Cohere for infrastructure, and Grammarly and Glean for productivity. This breadth enables both multi-seat SaaS licenses and usage-based APIs alongside consumer subscriptions.

The same pattern appears across adjacent verticals. Beyond media, the global list spans audio generation, 3D modeling, and smart search—with firms such as ElevenLabs, Suno, Speechify, Perplexity, and You.com—showing a wider spread of use cases and buyer segments. China, by contrast, remains narrowly specialized around text, image, and especially video pipelines.

These structural differences shape how companies make money. Global vendors benefit from broader enterprise adoption and more diversified revenue streams. Chinese applications, concentrated in content creation, depend more on creator and consumer markets where product cycles move faster and pricing power is weaker.

China’s content-heavy consumer mix shapes where the money goes. Scale, cross-promotion, and model reuse matter more than niche innovation, so recurring revenue concentrates among large platforms rather than stand-alone apps. Meitu leads the field, turning visual demand into a steady, multi-app business spanning capture, beautify, edit, and design. Kuaishou and Alibaba extend reach by embedding model upgrades into video and office products, while Kunlun Tech, Perfect Corp., Wondershare, and Baidu round out the ecosystem with tools from digital cosmetics to editing and chat.

This dominance rests on three strengths: massive user funnels built through brand and distribution, enough capital to absorb training and inference costs while recycling R&D, and compliance and sales teams that speed updates through app stores and enterprise channels. For startups, that means higher entry barriers unless they plug into these networks or focus on narrow, high-value niches. For investors, near-term AI revenue remains platform-led, with growth tied to how incumbents package, price, and promote AI across their portfolios.

The strongest in-app revenue growth in China is coming from the education sector. Month over month, the top domestic gainers are homework and language apps: 快对 (Kuaidu) (+120.16%), which scans homework questions and returns step-by-step K–12 solutions; Zuoyebang (+56.27%) and Zuoyebang Parent (+55.11%), which let parents track and guide study progress; 大学搜题酱 (Daxue Souti Jiang) (+30.17%), a photo-search tool for college problem sets; and 智能口语大师 (Zhineng Kouyu Dashi) (+26.71%), an AI speaking coach offering real-time feedback. Together, they put education at the center of China’s near-term monetization story.

Overseas, growth is more spread out across categories such as companions, creative tools, and model portals. Leading examples include PolyBuzz, SeaArt AI, and Qwen, with education apps like Gauth appearing occasionally. In contrast to China—where education leads AI revenue—no single category dominates abroad.

The reason is structural. In China, education apps monetize frequent, outcome-oriented tasks—solving problems, practicing speech, and reinforcing learning—ideal for small, repeatable payments. Abroad, growth spreads across multiple categories where innovation cycles and user traffic, rather than a single vertical, drive performance. The result: education is China’s most consistent near-term revenue engine, while global growth remains broad but less concentrated.

China’s AI industry is clustering, not spreading evenly. Four city hubs drive most of the country’s momentum—each with a distinct engine and trade-off.

Beijing – Research to Enterprise

Beijing connects national labs and top universities with enterprise demand. Foundation-model teams sell into banks, telecoms, and state-owned firms. Its edge is deep research talent, pilot customers with complex workflows, and policy channels that support large-scale rollouts. The trade-off is slower sales and heavier compliance.

Shenzhen – Hardware Acceleration

Shenzhen’s dense electronics supply chain lets startups pair models with robots, vision systems, and wearables on rapid iteration cycles. Its strength is speed and engineering talent fluent in both firmware and inference. Margins are thin and export rules tight, so defensibility depends on integration and distribution rather than model breakthroughs.

Shanghai – Commercial Integration

Shanghai’s proximity to advertisers, retailers, and multinationals makes it strong in go-to-market execution. Teams build analytics, ad-tech, and urban service platforms that plug into transport, utilities, and public systems. The advantage is product-market fit and upgrades sold into existing budgets, though revenue rises and falls with brand and municipal spending cycles.

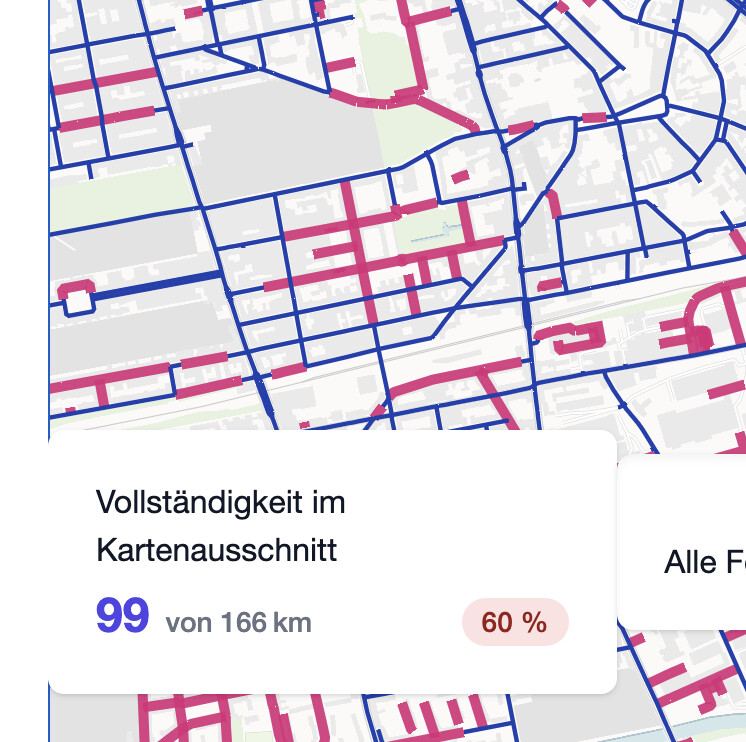

Hangzhou – Operational Intelligence

Hangzhou draws on e-commerce and fintech roots to specialize in data governance, traffic prediction, and service automation—high-volume, rules-based work. Monetization comes through subscriptions and workflow seats, embedding AI into enterprise and city tools already in use. Retention is strong, and defensibility rests on integrations and proprietary data rather than model size.

System Dynamics

Two factors support these hubs. A steady flow of engineers, product managers, and researchers keeps local talent networks active, while government programs such as compute subsidies, industrial parks, and pilot initiatives help move projects from testing to deployment. For founders and investors, location is a practical choice. The key is to choose the hub that fits a company’s core needs and understand the trade-offs each environment brings.

Chinese AI app makers are going where the money is—overseas. “Chuhai” is no longer a hedge; it has become the starting premise. Teams now design from day one for dollar subscribers, transparent billing rules, and global distribution. Company rosters show this shift across productivity, creator tools, and developer platforms. This is not a side bet but the new default go-to-market.

At home, distribution is consolidating. Platforms with reach to hundreds of millions of users—Baidu, ByteDance, and Meitu among them are turning scale into defensibility. They operate large, fast-iterating portfolios of AI web and mobile products, not just portals. Their reach drives lower acquisition costs and faster release cycles than independent rivals can typically match.

Revenue is following that gravity. Among Chinese companies with meaningful top lines, consumer-facing video and photo suites and utility houses still lead, but they now compete alongside global leaders and well-funded U.S. startups. Firms such as Wondershare, XiaoYing, and Glority post strong ARR, yet they play in a global league table dominated by frontier model vendors and emerging vertical specialists. There is ample room to grow, but the bar for breakout scale is higher than it was a year ago.

The product mix is shifting from novelty to utility. Photo and video remain sticky, but the fastest growth is in “get-work-done” categories: productivity suites, digital employee helpers, and developer tools. The middle layer of the stack is filling in with toolchains that help developers ship faster, accelerating how quickly Chinese teams can launch export-ready apps.

Looking to next year, more teams will go global. The playbook is proven, ad rails and subscription infrastructure are in place, and many teams now price in dollars first. But a single breakout app is unlikely to dominate the field. The economics of distribution, model access, and cross-sell still favor the large platforms. Glority-style utility winners can continue to mint hits, but they are unlikely to command categories when platforms can fast-follow and bundle features into massive traffic bases.

China’s AI app economy is now entering its scale phase. Incumbents with reach will keep compounding. The most ambitious startups will build both for export and for the stack, plugging into platforms or supplying the picks and shovels. The competitive edge is no longer clever models alone—it lies in distribution, bundling, and the ability to move up or down the stack fast enough to stay outside someone else’s moat.

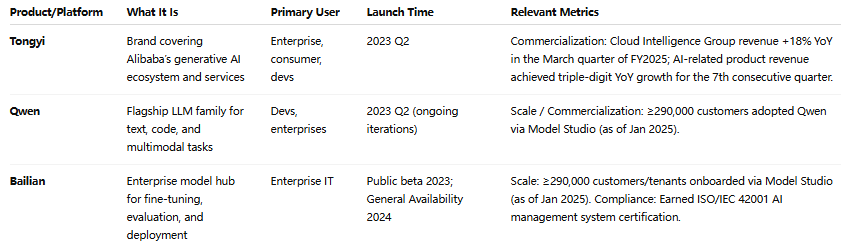

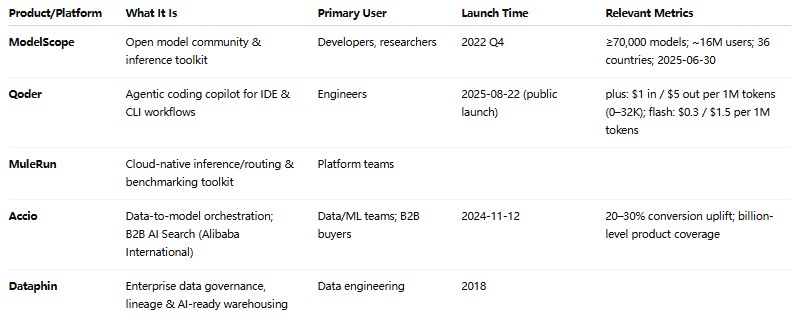

Alibaba Group, one of China’s largest technology conglomerates, has developed a broad AI ecosystem that spans foundational models, developer infrastructure, enterprise productivity tools, marketing and creative platforms, and consumer applications. The portfolio is anchored by the Tongyi (通义) family of models, which includes the Qwen series of large language models, and is closely integrated with Alibaba Cloud, e-commerce platforms, and productivity products.

Alibaba’s AI portfolio combines deep infrastructure—covering model training, data systems, and cloud services—with applied intelligence in productivity, marketing, and consumer experiences. Its full-stack approach connects foundational models such as Tongyi Qwen to cloud platforms and application-layer integrations, linking developers, businesses, and end users within a unified AI ecosystem.

I. Umbrella, Foundations, and Infra

II. Developer, Data, and Ops Tools

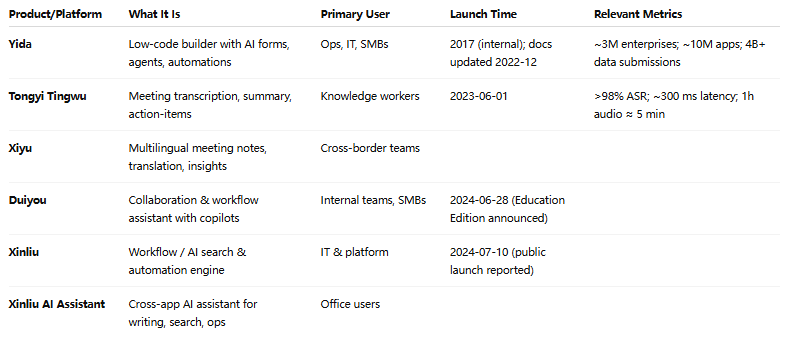

III. Productivity and Enterprise Applications

IV. Marketing, Creative, and Merchant Tools

V. Consumer Apps and Assistants

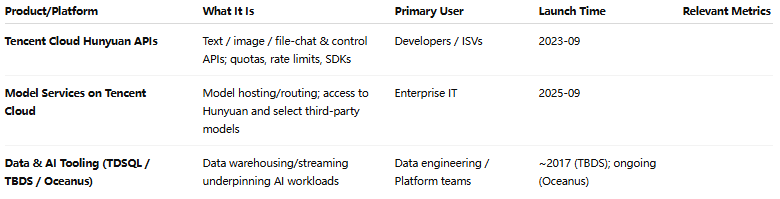

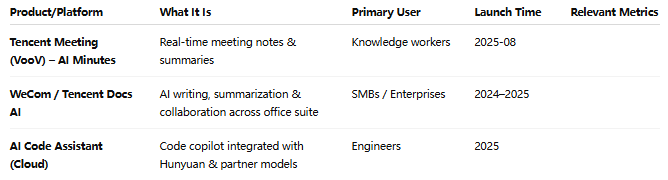

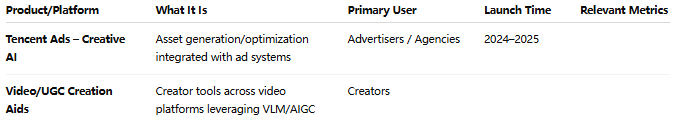

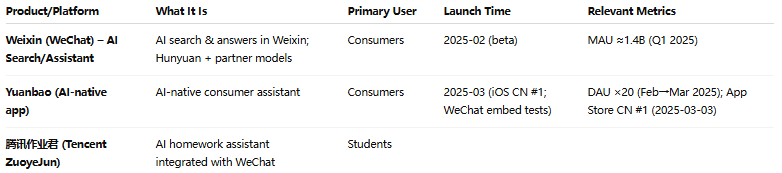

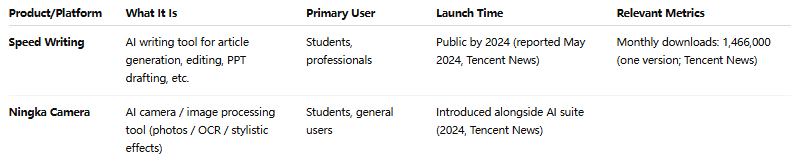

Tencent’s AI portfolio follows a full-stack, large-scale distribution strategy anchored by the Hunyuan family of large language models. These models are deeply integrated with Tencent Cloud and Weixin/WeChat products. The portfolio spans three main areas: foundational models and developer services (training and inference, APIs, and model hosting); enterprise productivity and vertical solutions (copilot features embedded in daily workflows); and marketing and commerce tools linked to Tencent’s advertising and payment systems.

Tencent takes a pragmatic approach to AI, embedding it into services already used by hundreds of millions of people rather than focusing on standalone launches. The Hunyuan models are central, but distribution and execution drive adoption: WeChat and Tencent Cloud convert model advances into everyday utilities for consumers and efficiency tools for businesses. The emphasis is on reliability, speed, and unit economics rather than model size. AI features appear as assistants within chats, meetings, and documents, reducing friction and encouraging usage. Tencent also opens parts of its stack through cloud APIs and selected partnerships while maintaining control over rollout and safety. This strategy leverages scale and integration to translate AI into sustained engagement and revenue.

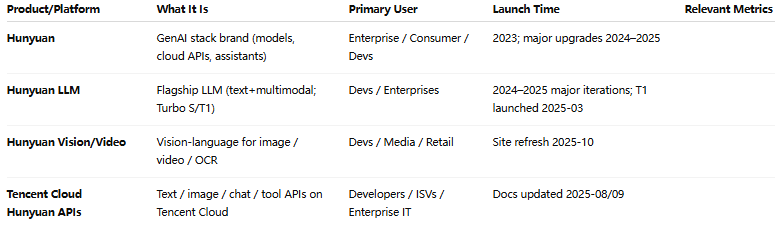

I. Umbrella, Foundations, and Infra

II. Developer, Data, and Ops Tools

III. Productivity and Enterprise Applications

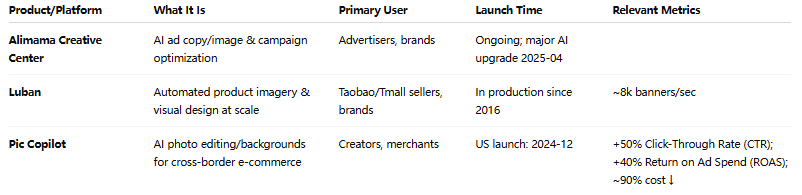

IV. Marketing, Creative, and Merchant Tools

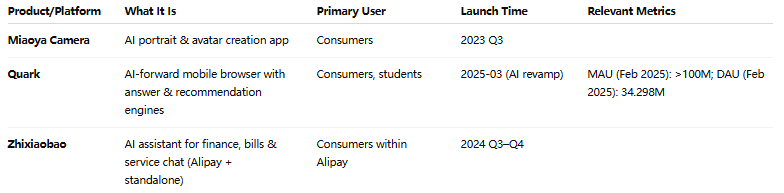

V. Consumer Apps and Assistants

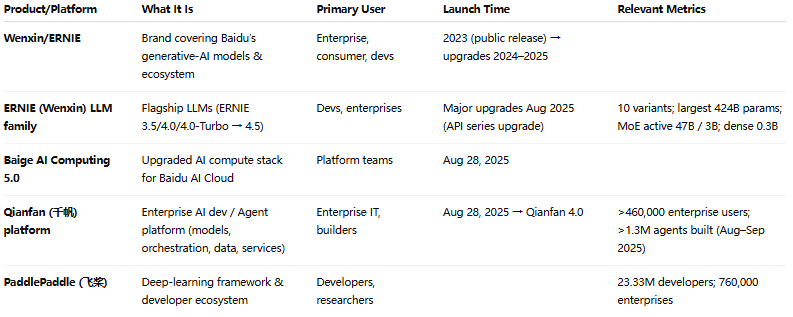

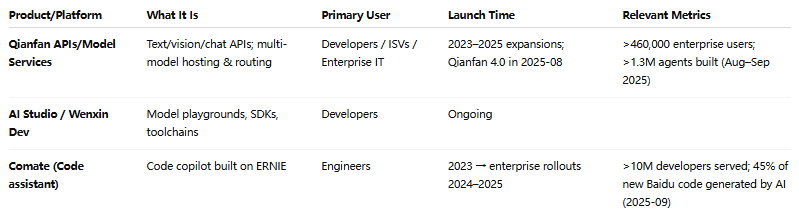

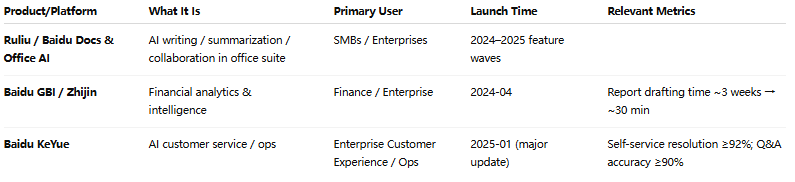

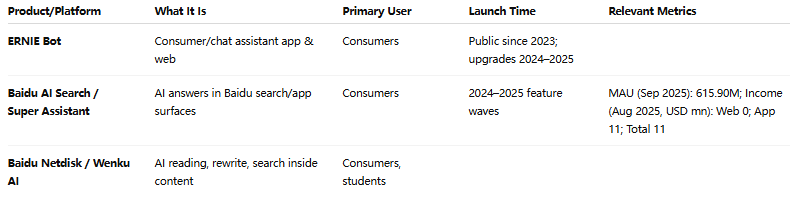

Baidu’s AI portfolio is a fully integrated stack that connects foundational models such as ERNIE/Wenxin with cloud delivery through Qianfan on Baidu AI Cloud, a large developer ecosystem built on PaddlePaddle, and production applications for both enterprises and consumers. The strategy is to turn model advances into agent-driven workflows by tightly linking models, data, tools, and deployment, allowing customers to build, host, and operate AI services within a unified platform. Distribution flows through Baidu’s search and app surfaces as well as enterprise channels, while the commercial model combines cloud consumption with solution-based contracts.

Baidu builds on its search foundation to transform user queries into a continuous upgrade engine for AI. The company trains ERNIE and related models, integrating improvements directly into products already used by consumers and enterprises, including AI search, coding assistants, and industry analytics. Development and deployment run within Baidu AI Cloud via Qianfan and in-house developer tools, shortening the path from research to production and keeping costs in check. The focus is on reliability, latency, and accessible pricing rather than headline model size. AI adoption is driven by Baidu’s own traffic scale, with the data-to-product loop designed to convert research progress into sustained usage and enterprise demand.

I. Umbrella, Foundations, and Infra

II. Developer, Data, and Ops Tools

III. Productivity and Enterprise Applications

IV. Marketing, Creative, and Merchant Tools

V. Consumer Apps and Assistants

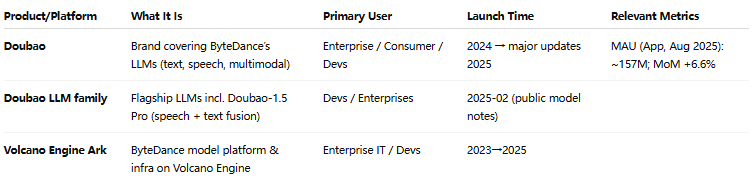

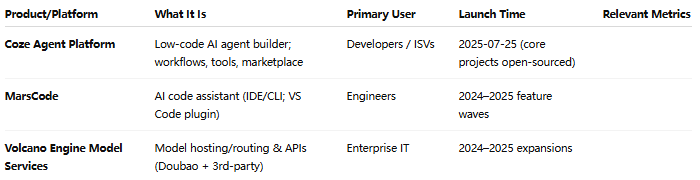

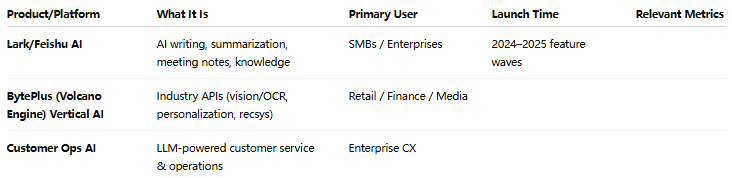

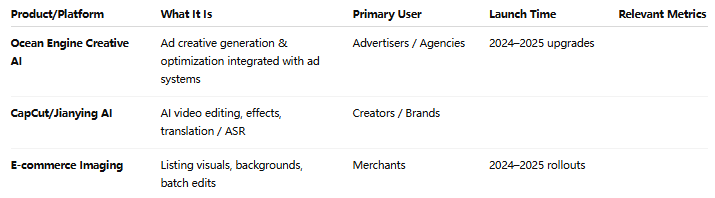

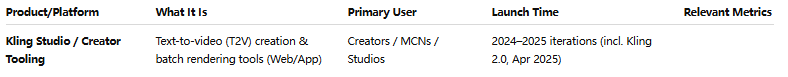

ByteDance’s AI portfolio centers on the Doubao family of models, delivered through Volcano Engine for training, inference, and API access. Built on this foundation are agent and developer tools that integrate with ByteDance’s creative, marketing, and commerce systems. AI capabilities appear across consumer and enterprise products as creation, recommendation, and assistant features. The approach focuses on unified model management, cost efficiency, rapid iteration, and large-scale online experimentation, with performance measured through conversion and subscription metrics.

ByteDance applies a productized, cost-efficient model strategy and scales it through major consumer platforms including Douyin, TikTok, CapCut, and the Doubao app. For developers, it reduces friction with tools such as Coze and Volcano Engine Ark, and by open-sourcing Coze, extends agent use cases beyond its own ecosystem. The company plans significant 2025 investment in computing infrastructure to lower inference costs and maintain predictable latency and quality. ByteDance’s guiding principle is to make AI usable, measurable, and scalable—building affordable, reliable models, deploying them quickly across high-traffic platforms, and providing easy-to-assemble tools that attract external developers.

I. Umbrella, Foundations, and Infra

II. Developer, Data, and Ops Tools

III. Enterprise & Productivity Apps

IV. Marketing, Creative, and Merchant Tools

V. Consumer Apps and Assistants

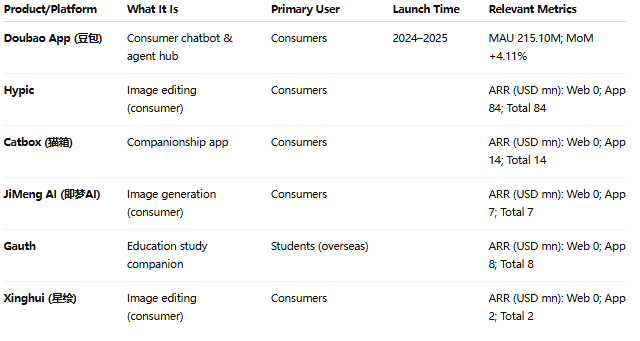

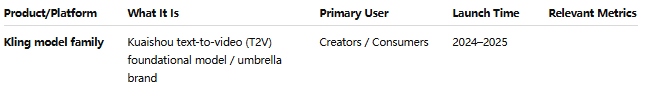

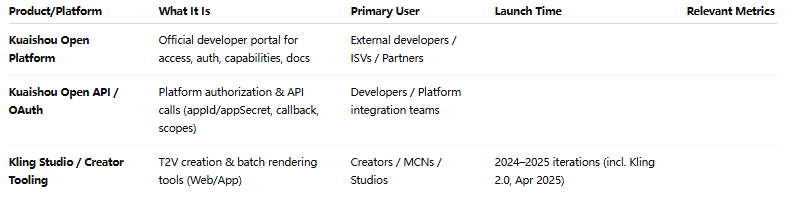

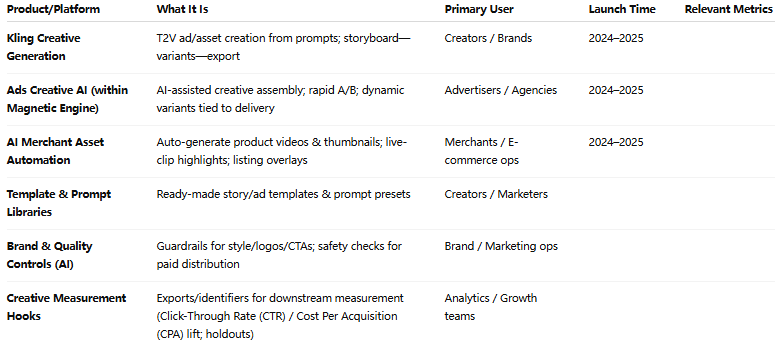

Kuaishou’s AI portfolio centers on the Kling text-to-video model and is integrated across its core applications—Kuaishou, Kwai, and SnackVideo. The system supports creators in producing short videos, assists advertisers in generating and testing ad creatives, and enables merchants to create product visuals. Performance data is continuously fed back into the tools to improve output quality over time. Operations focus on platform-scale reliability, cost control, and governance measures such as brand compliance and content safety. The portfolio connects models, creation tools, and distribution channels to drive engagement, conversion, and monetization.

Kuaishou’s AI strategy positions the platform as a video production engine directly tied to business results. It concentrates on a single strength—turning ideas into short videos—and integrates that capability across creator tools, ad workflows, and merchant content pipelines where impact is measured through watch time, clicks, and sales. Feedback from these metrics refines performance, and because creation and distribution occur within Kuaishou’s own ecosystem, costs remain controlled and brand standards consistent. The focus is on delivering high-quality, revenue-moving video outcomes quickly to both professional and everyday users.

I. Umbrella, Foundations, and Infra

II. Developer, Data, and Ops Tools

III. Enterprise & Productivity Apps

IV. Marketing, Creative, and Merchant Tools

V. Consumer Apps and Assistants

PLAUD is a hardware-and-software AI company based in Shenzhen, China, founded in 2021. The company develops wearable AI note-taking devices that capture, transcribe, and summarise spoken and written content into concise, structured outputs. Its flagship products, the Plaud Note and Plaud NotePin, integrate AI-driven transcription, summarisation, and workflow tools designed for meetings, interviews, calls, and other real-world use cases.

The devices operate in tandem with the Plaud companion app and cloud platform, supporting multi-language transcription, speaker identification, and workflow templates. One use case is PLAUD is compliant with HIPAA, SOC 2, GDPR and EN 18031 standards and allows healthcare professionals who need secure recording, transcription, and summarisation of medical consultations.

The company monetises through hardware sales and subscription services for transcription and summarisation. It reports meaningful annual recurring revenue (approximately $125 million) and is expanding into academic-PDF summarisation, team knowledge spaces with admin controls, and developer APIs and SDKs with transparent pricing and service-level commitments.

Butterfly Effect is a technology company founded in China and now headquartered in Singapore. Although it is not counted among Chinese AI companies in this year’s rankings, it is included here as a notable case study due to its recent reorganization and relocation. The company was China-founded and China-funded, making it a representative example of China-linked AI firms expanding overseas.

Its star product, Manus, is a general-purpose AI agent that plans tasks, uses tools, and produces finished outputs such as slides, web pages, spreadsheets, and visualizations instead of chat transcripts. Manus launched on an invite-only basis in March 2025, with strong early demand and resale of invite codes online.

In China, Butterfly Effect announced on March 11 2025 that it would deploy Alibaba’s Qwen model for its China-facing assistant, while its earlier product, Monica, completed registration in Beijing. By mid-2025, the company had shifted its headquarters to Singapore and scaled back operations in China, citing regulatory limits on foreign models and a focus on overseas profitability.

Manus remains the core offering, featuring a Broad Research mode that coordinates over one hundred sub-agents for large-scale research and analysis. The product emphasizes end-to-end task completion, multi-agent scaling, and parallel localized and global deployments. In April 2025, Butterfly Effect raised US $75 million led by Benchmark, with participation from Tencent Holdings, ZhenFund, and HSG Capital, valuing the company at about US $500 million. It reports approximately US $91 million in revenue, with Manus contributing the majority.

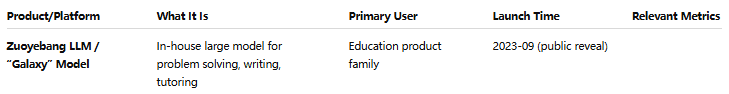

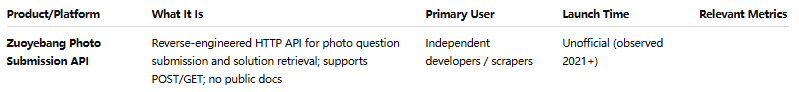

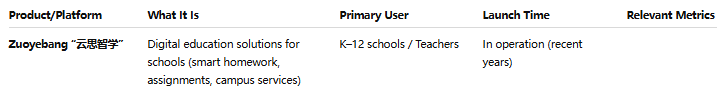

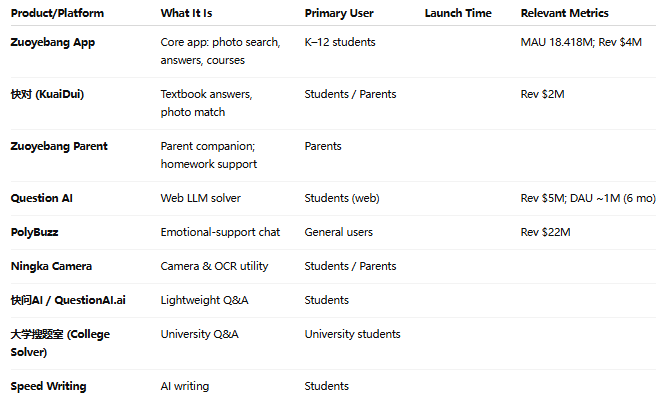

Zuoyebang is a Beijing-based edtech company serving K–12 and university learners. Its AI strategy centers on camera-first homework solving, intelligent tutoring, and study assistance delivered through a core learning app with supporting web and mobile tools. The ecosystem includes parent features and adjacent utilities such as Q&A, scanning, and OCR for text recognition. AI is positioned as a practical tool to speed up problem solving and improve study outcomes, not as a broad multi-suite platform.

Zuoyebang’s product shortens the path from a photo of a question to a clear, step-by-step solution. A self-developed model tuned for problem solving and explanation powers the experience, using camera capture, textbook mapping, and structured guidance instead of open-ended chat. The company’s strength lies in its tight alignment with local curricula, a large feedback base for refinement, and connected tools for parents and schools that keep the service rooted in daily homework routines.

I. Umbrella, Foundations, and Infra

II. Developer, Data, and Ops Tools

III. Enterprise & Productivity Apps

IV. Marketing, Creative, and Merchant Tools

V. Consumer Apps and Assistants

Several Chinese companies beyond Zuoyebang provide AI-powered learning products focused on homework assistance, photo-based question solving, and tutoring support. These applications mainly target K–12 students and are delivered through mobile platforms. Most do not publicly disclose their foundational model architectures or offer developer-facing APIs, but a number of them have achieved significant adoption in the domestic education market.

Gauth is ByteDance’s flagship education AI app, offering instant homework help via photo-based question solving. It ranks among the top AI apps in China by active users and monetization, and serves as a direct competitor to Zuoyebang.

小猿搜题 (Xiaoyuan Souti) is a long-standing K–12 photo-solve education app.

Solvely (学之乎) is an AI-powered question-answering app that emerged more recently. It offers photo upload and solution functionality and is featured in app charts as a rising AI education tool.

斑马AI (Zebra AI) focuses on early education with interactive lessons, using animated content and voice to support learning in younger children. The app emphasizes AI-led guidance for preschool and primary-level learners.

鹿老师 (Deer Teacher) is an AI study companion offering personalized tutoring features. The app supports photo-based question solving.

题拍拍 (TiPaiPai) offers a lightweight photo-based Q&A service. Its user experience closely mirrors Zuoyebang and Xiaoyuan Souti.

腾讯作业君 (Tencent ZuoyeJun) is Tencent’s own AI-powered homework assistant, embedded within the WeChat ecosystem. It supports smart Q&A, guided solving, and AI-based content recommendations for students.

网易有道 (Youdao NYSE:DAO) operates a suite of AI education tools, including Youdao Dictionary and AI Tutor apps

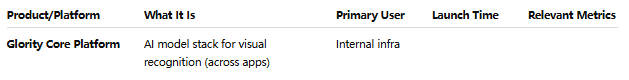

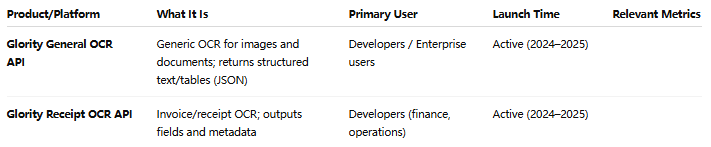

Glority is a consumer AI company that develops visual recognition tools for nature, education, and wellness. Its apps use image classification to identify objects, provide brief explanations, and offer simple learning aids, monetizing through freemium subscriptions. The company’s AI portfolio includes core vision models trained on labeled data; shared modules such as OCR, knowledge cards, guidance and reminders, and safety checks; and a suite of consumer apps built on the same capture–identify–explain workflow. Distribution runs mainly through Glority’s own applications rather than public APIs, with a focus on accuracy, localization, and subscription-based revenue.

Glority follows a consumer-first, mobile-native AI strategy centered on narrowly defined visual-recognition use cases that scale globally. Instead of offering public APIs or enterprise software, it prioritizes end-user experience and monetizes through subscriptions, turning image-to-answer interactions into practical, everyday utilities. With ARR ranked just behind PLAUD and ahead of education peers, Glority relies on a lean, single-purpose app portfolio optimized for broad reach and repeat engagement.

I. Umbrella, Foundations, and Infra

II. Developer, Data, and Ops Tools

III. Enterprise & Productivity Apps

IV. Consumer Apps and Assistants

.png)