Hardware related to digital infrastructure is making up an ever larger proportion of US imports by value, reflecting how a surge of artificial intelligence investment is impacting the world’s largest economy.

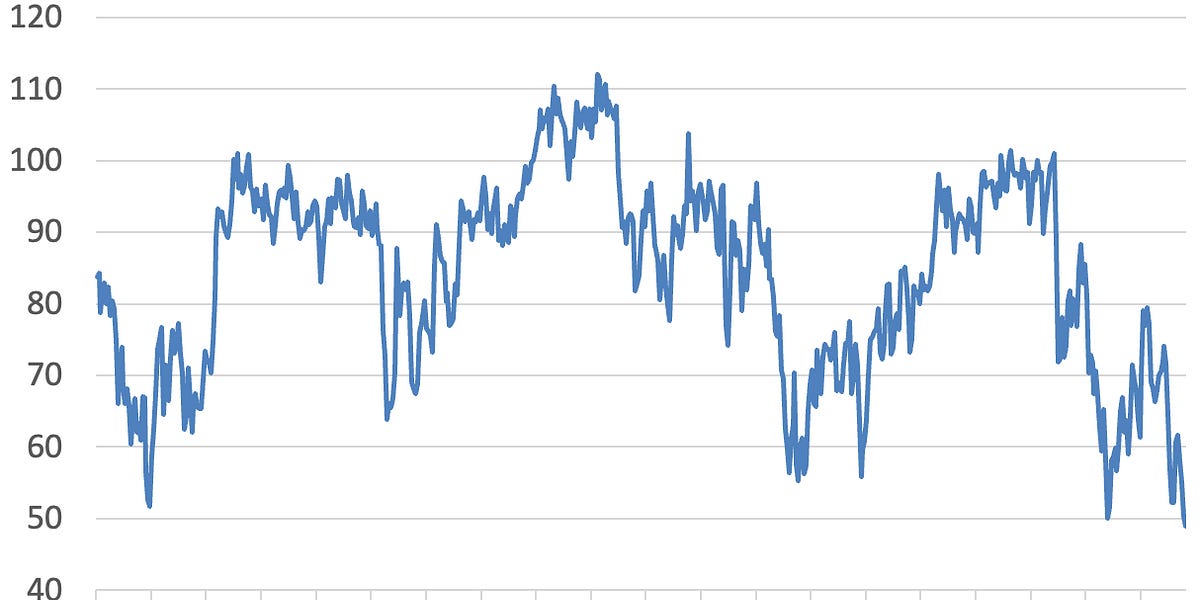

Between January and July 2025, the US imported $125.8bn worth of automatic data processing machines, which include semiconductor-heavy components such as graphics processing units, up by 69 per cent on the same period last year, according to the latest US Census Bureau data.

Data processing machines share of total US imports by value between January and July stands at a record high of 6.1 per cent, up from 4.3 per cent for the whole of 2024. This trend is reflected in other data centre equipment.

Total imports of data processing machines and other data centre-related equipment like wires, integrated circuit chips, electronic parts, transformers and cooling systems rose to more than $295bn between January and July 2025, up by 44 per cent from the previous corresponding period. These products accounted for 14.4 per cent of total US imports value.

This has outstripped growth in all other imports, according to fDi analysis of imports across six broad harmonised system codes, the international standard for classifying traded products.

Shifting value chains

Several countries are benefiting from the data centre trade boom. US imports of data processing machines from Mexico surged to $45.9bn in the seven months to July, almost double the $23.4bn in the same period of 2024. Mexico is a key re-export hub for original design manufacturers due to its tariff free access under the USMCA agreement. Research in April by Bernstein analysts suggested most of Nvidia’s US AI server shipments come from Mexico.

Imports from Taiwan and Vietnam both more than doubled over the same timeframe. Imports from China halved to $9.38bn.

Some US suppliers have moved more manufacturing to Mexico to manage tariffs on China, says Atul Roy, head of telecoms infrastructure at Cordiant Capital, a Canada-headquartered investment firm with stakes in multiple US data centres.

Certain electronics, including data-processing machines and integrate circuit chips, have been exempt from “reciprocal” tariffs set out in April 2025.

However, due to the broader tariff uncertainty, “the supply chain generally got slowed down more than disrupted, which then results into delays in project delivery”, adds Roy, noting this is particularly the case for large data centre equipment orders.

Some data centre suppliers have also rerouted goods from China to other countries with lower US tariffs. Others are using US foreign trade zones to wait until tariffs become more favourable.

A lot of “creative solutions” are being used to import data centre equipment into the US, says Ruth Moritz, general manager of global relocation at Interstate International, a logistics management firm. “Freight forwarders or custom brokers importing ... are using delayed releases and timing of certain [pieces] in order to get them in time to [when data centres] need them,” she adds.

Going local

US-based manufacturers have also set up to serve this soaring demand with local production.

Supermicro, a Silicon Valley-based data centre equipment supplier, is investing in its US manufacturing operations. “To meet the unprecedented AI demand, we are expanding out-of-state to the midwest to support hyper data centres and enterprise requirements,” a spokesperson tells fDi.

Vertiv, another US data centre supplier, has expanded its factory in South Carolina. In June, Jabil pledged to invest $500mn in US manufacturing for cloud and AI data centre infrastructure. Cooling equipment producer Carrier Global plans to invest $1bn into US factories by 2030.

“There’s a resurgence in trying to get a lot of those parts processed or made here in the US,” says Moritz.

A boom in data centre investment has underpinned the tremendous growth in demand of data centre equipment. Private fixed investment in US information processing equipment and software reached an all-time high of $1.35tn in the second quarter of 2025, according to the US Bureau of Economic Analysis. IMF economist Pierre-Olivier Gourinchas said last week that “a very significant AI-related, tech-related investment surge” has contributed to the surprising strength of the US economy.

The original article was updated to clarify Cordiant Capital is a Canada-headquartered investment firm with stakes in multiple US data centres.

.png)