Folks have been claiming that we’re in an AI bubble for the past 18 months or so (hand waving). Given enough time, the claim that we’re in a bubble usually turns out to be right.

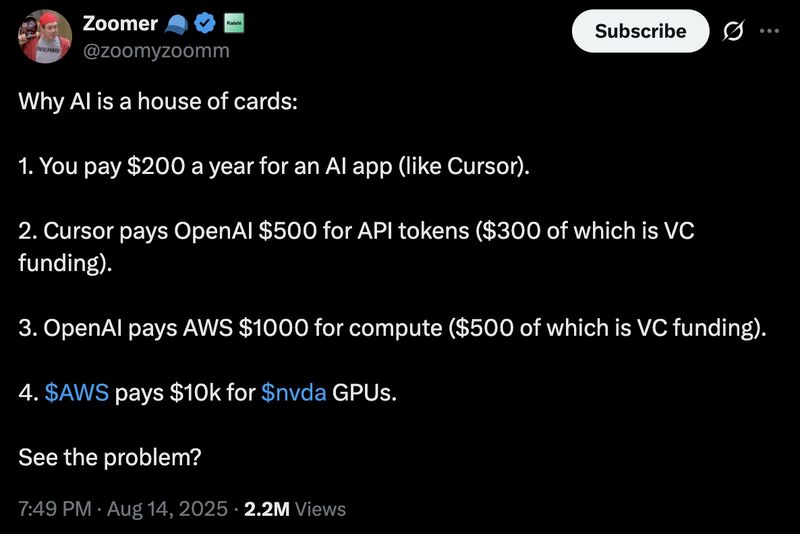

But the more interesting claim is that AI is a house of cards – basically unprofitable the whole way down – and we’re due for a massive unwinding.

There is almost certainly some truth to this, but there is a funny implication that the participants are irrationally setting themselves up for failure. I don’t think that’s the case at all.

We’ve seen this before

We’ve seen this sort of thing play out a few times now: in ridesharing, content streaming, semiconductor manufacturing, cloud computing, and other industries.

In each case, there’s a huge opportunity with economies of scale. Investors fund it aggressively, and companies build aggressively to capture share (unprofitably).

Then, there’s an unwinding – but it’s not always a crisis. Prices go up, but input costs also go down. Many companies die along the way. Some companies capture big market shares and become the new incumbents.

Input costs are the boring part of the story

The input costs going down part doesn’t get enough attention… probably because it’s the less explosive, dramatic story.

But there are lots of forces at work here: cheaper models, better model orchestration, more efficient GPUs, training amortization, and more. All of these make the (admittedly hairy) unit economics picture look a little better.

But it still could be bad?

It’s certainly possible – but we don’t need to freak out just because an big, growing industry is unprofitable. That is fairly normal.

The most likely outcome, as I see it, is a relatively boring story that won’t make headlines:

- Prices will go up some

- Input costs will go down some

- Some companies will capture huge share along the way

posted 22 oct 2025

.png)