The United States has recently called out Indonesia’s national digital payment system QRIS (Quick Response Code Indonesian Standard) for being unfair. The Office of the US Trade Representative (USTR) assessed QRIS as a trade barrier in its the National Trade Estimate Report 2025. The report – which includes broader trade concerns – underpins the Trump administration’s plan to impose 32% tariff duty for Indonesian products as of July 2025.

QRIS synchronises Indonesia’s electronic money payments, digital wallets, and mobile banking into one national standard system. By scanning a QR code, payment takes only a matter of seconds, allowing a swift cashless transaction compared to using cards.

USTR report criticises how QRIS implementation limits access for international stakeholders — particularly US companies — and creates an imbalance in Indonesia’s digital payments market.

The report also cites Indonesia’s National Payment Gateway (GPN) as less transparent and limits foreign ownership. The card, which is for domestic use only, eases administrative financial burdens, encourages cashless payment and facilitate social disbursement of social assistance.

Putting the trade assessment aside, QRIS helps small businesses and low-income groups in Indonesia to access modern payment facilities, closing the gap that Visa and Mastercard cannot provide. Throughout 2024, more than 30 million small businesses and merchants across Indonesia have made transactions via QRIS.

Here are what readers need to know about QRIS and what may come for Indonesia after its labelling as a trade barrier.

How significant is QRIS?

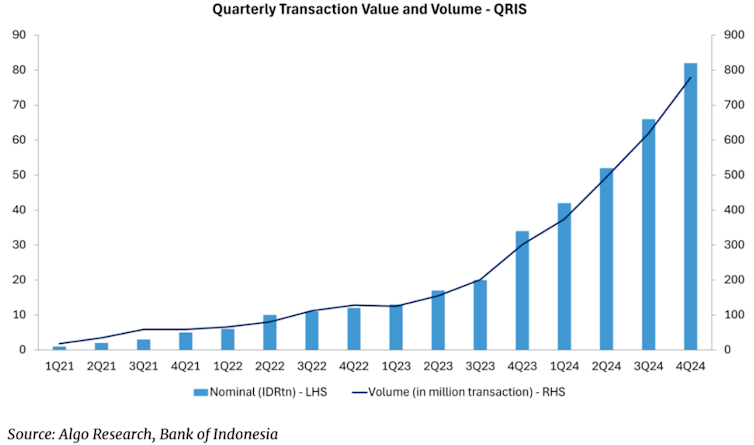

QRIS transaction value and popularity have skyrocketed since the central bank, Bank Indonesia, introduced it to the market in August 2019, months away before COVID-19 entered Indonesia. Throughout 2024 QRIS has recorded 2.2 billion transactions with a total value of Rp 242 trillion (around US$14.9 billion). This figure increased by 188% compared to the previous year.

In the first quarter of 2025, Bank Indonesia’s latest report noted that QRIS transactions surged to 2.6 billion with a transaction value reaching Rp 262 trillion (US$16 billion).

So, why does QRIS have such a huge reputation?

Massive digital adoption and user convenience factors triggered its growth, contributing to financial inclusion and supporting the growth and productivity of the Indonesian economy.

According to 2024 survey, the main reasons Indonesians use QRIS are its simplicity (49%) and transaction speed (42%). Promotion factors (33%) and the habit of not carrying cash (28%) also add to its appeal.

Wide outlet coverage (23%) and perceived security (22%) are also factors causing QRIS to be increasingly in demand. This practicality and growing digital habits in Indonesia are the main drivers of QRIS adoption.

From the merchant’s perspective, QRIS has advantages over card payments. The card system requires expensive EDC machines that cost Rp 3–5 million (US$180-310) per device.

Meanwhile, the merchant can receive payments via QRIS with just a single printed QR code, without needing extra equipment. QRIS transaction fees are also much lower at around 0.3% of transactions (even 0% for micro merchants), compared to 2–3% on cards.

QRIS is also compatible with all Indonesian and most of ASEAN countries e-wallets.

According to the Indonesian Payment System Association QRIS has become “the king of digital payment” channels for local transactions. Meanwhile, Visa–Mastercard’s position remains dominant for cross-border payments.

Risk of QRIS blocking

The USTR claims developed without input from international stakeholders may serve as an empty accusation.

Bank Indonesia designed QRIS to meet domestic needs while aligning with international standards like EMVCo standards carried by Europay, Mastercard, and Visa (EMV). The three global payment giants are also members of Indonesian Payment System Association and were involved in QRIS drafting process, accompanying the government and the central bank. Given how strictly regulated digital payment systems are, it’s hard to believe the US lacks information about QRIS.

However, the label of “trade barriers” has already been attached by the US and could ruin Indonesia’s negotiation process with other countries.

First, this issue could potentially hamper QRIS adoption in other countries. While Singapore, Malaysia, and Thailand have already facilitated QRIS into their national payment systems, further expansion into India and South Korea could be hampered by concerns about creating friction with Washington.

Second, the classification of QRIS as a trade barrier could also hinder the expansion of Indonesian small businesses into overseas markets. In fact, this standard was designed so that micro and small business actors can speed up the transaction process, including cross-border transactions with foreign buyers.

Advantage or disadvantage?

Both. It brings opportunities and challenges. The impact of USTR claim for Indonesia will depend largely on its negotiating strategy in the coming terms.

For now, the 32%-tariff sanction – affecting products from shoes, textiles, to nickel components – has been suspended until early July 2025. The two countries are continuing negotiations, including technical discussions on QRIS access since the US complaint aired.

But Indonesia can turn the US protest into an opportunity. The threat of tariffs forced the two countries into a two-month negotiation window.

Indonesia could trade off small adjustments to QRIS rules for larger rewards —such as lower tariffs on nickel products or new investment commitments from the US, especially in the fields of technology or the latest financial systems.

At least, Bank Indonesia has stated that “If America is ready, we are ready,” – a nod for possibility to prepare clearer guidelines for both countries. Arranging such documents will benefit all parties, including foreign and local business.

At last, Indonesia needs to share the success story of QRIS more widely. Currently, QRIS has served 56 million users, supports payments at more than 33 million outlets, and is seamlessly connected to several countries such as Malaysia, Singapore, and Thailand. This shows that the payment system is open, beneficial, and contributes to financial integration across countries and regions.

QRIS’s rapid growth, along with how the US feels threatened by it, shows huge potential for Indonesia’s digital finance. This can actually contribute to its bargaining position in the international arena in this digital era.

This article was originally published in Indonesian, translated into English with the help of machine translator and further edited by human editors.

.png)