content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

A trio of Senate Democrats has introduced legislation that would not only blacklist President Nayib Bukele and his inner circle but also order a forensic probe of El Salvador’s Bitcoin strategy. Filed on 12 June by Senators Chris Van Hollen (D-Md.), Tim Kaine (D-Va.) and Alex Padilla (D-Calif.), the El Salvador Accountability Act of 2025 (S. 2058) sits before the Senate Foreign Relations Committee.

Dems Target El Salvadors Bitcoin Strategy

The bill would trigger full economic-blockading powers under the International Emergency Economic Powers Act, freeze US-controlled assets of thirteen named Salvadoran officials—including Bukele, Vice-President Félix Ulloa and the president of the Central Reserve Bank—and revoke their visas. It also compels US directors at the World Bank, International Monetary Fund (IMF) and other multilaterals to vote against new loans to San Salvador while cutting off direct US assistance.

Section 5 is the measure’s Bitcoin fulcrum. Within 90 days of enactment, the Secretary of State, in consultation with Treasury, must deliver “a report on the actions of officials of the Government of El Salvador, including President Nayib Bukele, to use cryptocurrency as a mechanism for gross corruption, graft, and sanctions evasion,” together with wallet addresses, exchange counterparties and an estimate of the state’s Bitcoin stash.

That language resurrects concerns first formalized in the bipartisan Accountability for Cryptocurrency in El Salvador (ACES) Act of 2022, which ordered a risk assessment of Bukele’s original 2021 Bitcoin Law. In January this year, Bukele’s super-majority quietly stripped Bitcoin of its legal-tender status—part of an IMF rescue deal—though the asset remains accepted for payments and sits on the treasury’s balance sheet.

The sponsors insist the sanctions push is foremost a human-rights response. “Under President Bukele, tens of thousands of Salvadorans and even US residents remain jammed in megaprisons without due process,” Kaine said on introduction. Van Hollen added that Bukele is “taking American taxpayer dollars to imprison people as part of a scheme to violate their constitutional rights,” while Padilla called the crackdown “abhorrent” and said economic penalties are “a necessary step.”

Yet the text’s Bitcoin provisions signal Washington’s broader anxiety that a dollarized economy holding un-audited Bitcoin reserves could morph into a sanctions-evasion node—particularly if the Trump administration were to soften scrutiny. The bill would force the State and Treasury departments to expose addresses, custodians and governance arrangements for the Salvadoran wallets.

Related Reading: Bitcoin Volatility Hits Bull Cycle Low – Bollinger Bands Signal Potential Breakout

Bukele, never shy on social media, greeted the proposal with characteristic derision. “HAHAHAHAHAHAHA the Dems are just salty…” he wrote on X shortly after the bill went public.

Because S. 2058 invokes §502B of the Foreign Assistance Act, any committee member can force it to the floor if the State Department fails to furnish the mandated reports—an arcane privilege the sponsors have already flagged they are prepared to use. Still, Republicans have yet to signal support, and the House remains an open question.

If the measure passes intact, the White House would have ten days to list sanctioned individuals and 90 days to deliver the report. Sanctions could not be lifted for at least four years, and only after a presidential certification that El Salvador has ceased both its mass-detention state of exception and any Bitcoin-enabled sanctions evasion, according to the proposed bill.

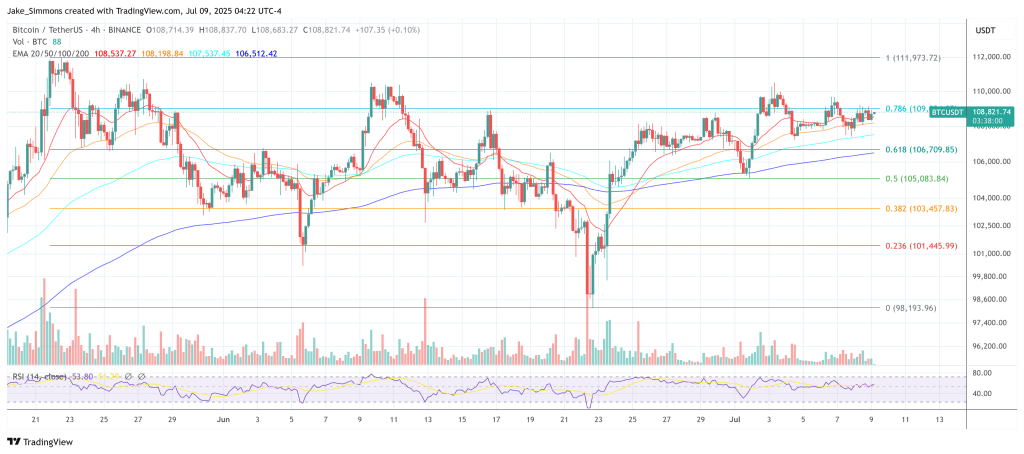

At press time, BTC traded at $108,821.

BTC price, 4-hour chart | Source: BTCUSDT on TradingView.com

BTC price, 4-hour chart | Source: BTCUSDT on TradingView.comFeatured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

.png)