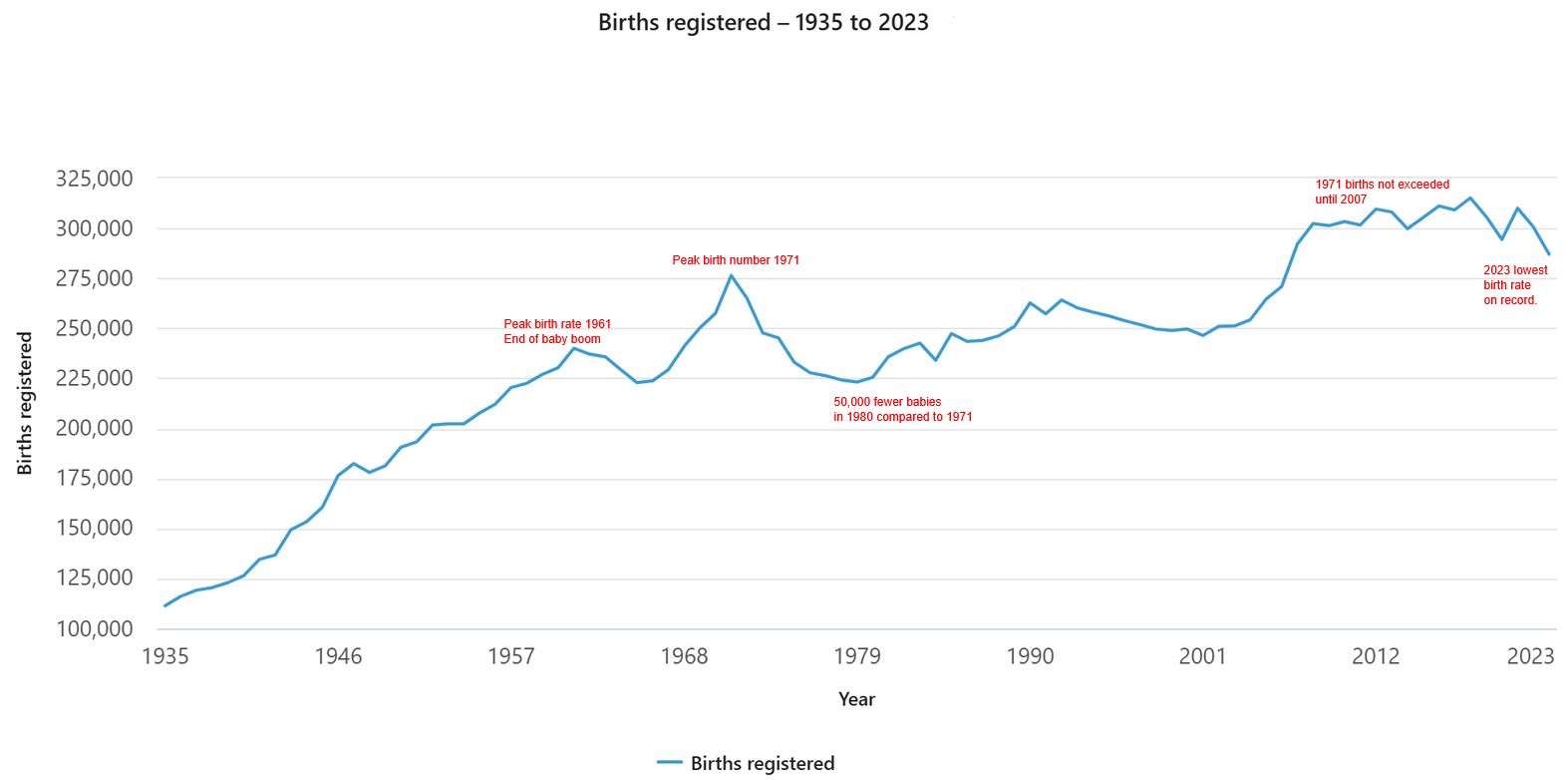

It's been nearly 12 years since I wrote this blog about the age pension and when it might be changed or abolished. A lot has happened since that time, and we are now in 2025, just a year before the first of the big changes mentioned in that article. The headline was a bit of an attention-grabber. I did say it was unlikely that we'd see a total abolition of the pension, but more like a winding-back and stricter means testing for new entrants. The timing for that would start when it was politically expedient to do so - when the peak of the baby boomer population bulge has moved through the population and is already past pension age. Well next year, 2026 is an auspicious year. It's when those born in the highest birth-rate year ever seen in Australia (1961, fertility rate 3.55) will be turning 65. Fertility rates have never been as high since and probably will never be again, currently standing at less than half that, at 1.50. While I did think there would be some movement from 2026, the big changes I mentioned in the first article I didn't expect until after 2036. The reason for this is that it coincides with the peak births number (rather than rate) year of 1971 (about 276,000 births) reaching the milestone of 65 years of age. Even if we said 67, that brings it to 2038. 1971 is clearly in Generation X territory, rather than baby boomers (in speaking of generations, for some reason the baby boomers are generally taken to span about 20 years while Generation X is only 15 years, so there are still more baby boomers overall). In 1971 we had 276,371 births in Australia. The most recent figure from 2023 was 286,998 registered births, only around 4% higher, though the population has more than doubled from 13.2 million to 27.2 million in that time. Of course one of the major changes to the pension eligibility has already happened - eligibility age has now been lifted from 65 to 67, which happened gradually between 2017 and 2023, and had already been announced before the 2013 blog. There have currently been no announcements about raising it further. Because it affects people's long-term planning, governments do give a lot of notice about these changes before they take effect. There are also some fascinating external effects. For instance, there is evidence that increasing the pension age has a negative effect on fertility, as it reduces the availability of grandparents to provide child care. By 2026, I also thought there might be further announcements about the Superannuation Preservation Age- which was raised from 55 to 60 way back in the late 1990s for people born after 1964, and has remained there since. The first people affected by this full change have just turned 60. That hasn't changed further, though there are always murmurings about it increasing to be in line with the pension age. This would make sense if the government is wanting to shift the burden of funding retirement on to individuals who have increasingly been under the compulsory super scheme for much of their working lives. Compulsory superannuation started in Australia in 1992, with initially a 3% employer contribution. It's currently at 11.5% and rising to 12% next year. So you could say anyone born from the early 1970s has been covered by compulsory super close to their entire working life - albeit not necessarily at the highest levels. Despite more people having access to superannuation, the Age Pension remains the biggest line item in the federal budget. In 2025-26 (based on the March 2025 budget papers - budget paper 1) it is expected to be $65 billion - up from about $40 billion in 2012-13. The other two items mentioned in my previous article - Financial Support for People with a Disability (NDIS) has risen from $15 billion to $24 billion, but Support For Families (mainly Family Tax Benefit) has remained about the same at $18 billion as families are having fewer children. Most of the changes I anticipated were in the 2036 basket - still over a decade away, but I'm a little surprised that at 2025 we haven't heard much about any of them really. The reason for 2036 is that if the restrictions are placed on new entrants to the system - it won't be until 2036 that we start having fewer numbers of people reaching pension age each year, as the 1971 cohort passes through age 65. But we are all living longer, so the total numbers on the pension will still increase. Maybe more slowly though, as more people have access to super. What are your thoughts? Will the age pension still be around in future, and what can demographics tell us?

.png)