The Agora, sued by the SEC, FTC, and two state AGs, reaches hundreds of millions of people across social media with misleading promises of wealth and wellness.

The roughly fifty-seven minute video, titled “URGENT WARNING for Americans Born Before 1979”, begins with a white-haired man in a checkered shirt sitting in a blurred hallway. He speaks slowly: “With Donald Trump taking the White House and RFK Jr. now positioned to dismantle the uniparty’s corrupt FDA …. multibillion dollar drug conglomerates, some of Big Pharma’s oldest and most prominent, will be in a desperate race to flood our nation with poison.”

The man urges “seniors like you and me” to join the online “Health Sciences Institute,” where they can learn about alleged “remarkable medical breakthroughs” that the government and pharmaceutical companies “have been intentionally hiding.” (The Institute’s website contains a disclaimer stating that its content should not be interpreted as personal medical advice.) The man’s video is one of many of longform advertisements produced by The Agora and its sprawling conglomerate of subsidiaries, which have spent decades cashing in on Americans’ growing distrust in government, financial institutions and healthcare providers.

The Agora makes its money by selling subscriptions to “natural health” newsletters that are a vector for its wellness supplements business, as well as investment advice newsletters that can cost thousands of dollars a year. Across the internet, the company spends millions to place its outlandish claims in front of American social media users. A current spate of ads insist that President Trump will soon “unleash” a $150 trillion “secret trust” that has been hidden from the American people, and you can get rich from trading on it, if you just subscribe. The Agora has spent at least $500,000 promoting the claim on Meta’s platforms alone, according to the Meta ad library.

The Agora’s business is huge. It says it is a “1.5bn+ company,” and its subsidiaries pour millions each month into advertising on Facebook and Instagram. Agora-related channels have more than 100 million views on YouTube, and the company’s top-performing newsletters boast millions of subscribers. The consumer protection group Truth in Advertising estimated that it pulled in approximately $500 million in revenue in 2021 alone.

But a Forbes investigation into hundreds of Agora-linked ads, domains, and opaque social media accounts — and interviews with six people who have worked for Agora companies— reveal a company that has found success by misleading vulnerable people.

On websites maintained by TrustPilot and the Better Business Bureau, a sprawling network of companies under the Agora umbrella have amassed hundreds of one-star reviews. In them, customers describe spending thousands of dollars on lifetime subscriptions to newsletters that abruptly ended without refunds, and/or losing money by taking the newsletters’ investing advice. In one review, a former customer describes “wasting” more than $15,000 on Agora’s products — including a “special VIP membership” with exclusive newsletter updates, alerts, and videos, that cost more than $9,500. The customer declined to provide more detail when reached for comment.

“This is the perfect storm for a company like Agora to manipulate consumers in the U.S.”

One former employee of an Agora company said that after a week of onboarding at The Agora’s Baltimore offices, she began to worry the company’s business was predicated on taking advantage of older people. She said she looked up her own elderly family members in the company’s customer database to ensure that none of them were buying its products.

For more than three decades, regulators have tried to stop The Agora from engaging in what they have called “false promises” in its marketing. In 2003, the SEC sued several Agora subsidiaries for advertising insider trading tips, which caused a judge to order $1.5 million in restitution and civil penalties. (The judge found that Agora Inc., the parent company, had not engaged in wrongdoing.) In 2016, a different Agora subsidiary was sued by the attorneys general of Pennsylvania and Oregon for misleading consumers, falsely claiming that they could receive benefits from big tobacco settlements made many years before. The company settled with both states.

In 2019, the FTC sued several Agora entities over products that promised a sham cure for Type 2 diabetes, and information about a nonexistent government benefits program. In late 2021, the company settled with the FTC, and was forced to refund nearly 35,000 Americans who had paid for certain products. The refunds totaled more than $2 million. The company did not admit wrongdoing, and told the Baltimore Sun that it was relieved to get back to publishing new content for its customers.

Despite regulatory action, The Agora seems to have done little to change its ways — and it’s poised to continue its practices at a moment when Trump has gutted consumer protection enforcement, social media companies have taken their proverbial feet off the gas when it comes to taking down misleading messages, and mistrust in institutions is at an all-time high. As Bonnie Patten, Executive Director of the nonprofit consumer protection group Truth in Advertising (TINA), told Forbes, “This is the perfect storm for a company like Agora to manipulate consumers in the U.S.”

The Agora did not respond to repeated requests for interviews or to a request for comment.

Bill Bonner and Addison Wiggin, The Agora’s founders, have been selling doomsday investment advice since 1979 — the advent of the internet itself. In the early 2000s, the pair co-authored two New York Times bestsellers, Financial Reckoning Day and Empire of Debt. Bonner later became a Business Insider contributor, and Wiggin a Forbes contributor (he has not published since 2015). Today, from a block of swanky rowhomes in downtown Baltimore, the company they built offers more than a hundred investment and “natural” health-focused newsletters, which are distributed through a network of more than 20 publisher subsidiaries.

Bonner and The Agora’s current CEO, Erika Nolan, did not respond to interview requests or requests for comment on this story. Wiggin initially responded and scheduled an interview with Forbes, but didn’t show up. He then said in an email that he had forwarded our correspondence to the Agora Companies legal team, and did not respond to additional requests for an interview.

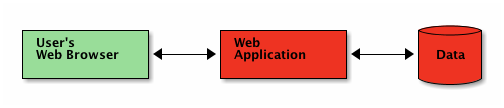

Many people’s first encounters with The Agora start with a Facebook or Instagram ad teasing some shocking new risk or discovery. Its strategy is known as “direct response copywriting”: writing advertisements that convince someone to buy something on the spot. When they click on the ad, they’re taken to a page hosting a longform video, known internally at Agora as a VSL, or “video sales letter,” which can run for an hour or longer. Each features a finance or health “guru” — a personality that The Agora has cultivated as a face of its operations.

The Agora has tapped numerous public figures to become “gurus” across its lifetime, making use of their reputations to convert potential customers. Agora gurus have included Robert Kiyosaki, the now-bankrupt motivational speaker and author of Rich Dad, Poor Dad; James Altucher, a cryptocurrency podcaster who founded the former finance social network, StockPickr and authored the financial self-help book Choose Yourself; and Whitney Tilson, a Democratic candidate for New York City mayor who previously helped found Teach For America. (Kiyosaki, Altucher, and Tilson did not respond to interview requests.)

In the Agora playbook, “gurus” first sell viewers on a modestly priced newsletter subscription. In one current promotion, a balding man in a sport coat sits in front of an American flag and a shelf of gold-leaf lettered books explaining that President Trump can and will run for a third term. (Legally, he cannot.). The man says he’s coming forward at great personal risk, to reveal trading secrets that will make you rich, if you sign up for his newsletter for $49.00.

Once a guru makes that initial sale, known as the “front end,” the purchaser starts receiving pitches for Agora’s “back end”, which involves opportunities to, say, join a $10,000 exclusive investment club, or attend a $2,000 stock-picking webinar.

The “back end” is where Agora makes its real money. In addition to a panoply of special-offer newsletters and exclusive clubs, Agora subsidiaries also sell dietary supplements and other wellness products, through more than a dozen brands. Offerings include colorfully named cocktails like Memotex (for memory), Virasurge (sexual function) and Ultra Vital Gold (anti-aging). One Agora company also sells a water purifier called Turapür that promises to “transform average tap water into the antioxidant fountain of energy.”

In an Ask Me Anything video on YouTube in 2017, one Agora employee explained how the system works. “One of the promotions that you may have seen is that a German scientist discovered a cure for cancer in 1944, and the powers that be have hidden it from us until now,” Agora marketing director Matt Lazas explained. “We use a model of big ideas and longform sales newsletters to acquire the customers, and then on the back end, we have a whole stable of supplements that we monetize those customers on.” Lazas did not respond to a request for comment.

The Agora has become a titan of social media, running millions of dollars’ worth of ads on Facebook and Instagram from opaque accounts with names like “America’s Secret Fund.”

"Over the last few weeks, roughly 30 million ounces of gold have been quietly moved from London vaults to the U.S.,” began one Agora ad running from a Meta page called Freedom Asset Advocates earlier this month. “My sources tell me this massive gold movement is tied to an upcoming shift in the global monetary system. The kind that happens once every 50-100 years ... I've identified 4 gold mining stocks perfectly positioned to potentially return 100x when this plays out." Meta spokesperson Erin Logan told Forbes that the company is now reviewing a list of Agora-related pages for violations of its policies, and the Ad Library showed that at least 11 pages running ads for Agora subsidiaries have now been “deleted or unpublished.”

On YouTube, a recent Agora ad promised “a new wave of AI wealth” that one guru said “will be 14x bigger than chatbots, generative AI, and quantum AI combined.” Placed from a channel with the handle @novileanlifedaily5807 and the title Opportunistic Trader, the ad had been viewed more than 840,000 times. A Google text ad promises a “proven method” to make “300%+ Stock Gains at 9:30 AM.” Google removed both ads after receiving a Forbes inquiry about them.

Both Meta (which owns Facebook and Instagram) and Google (which owns YouTube) have slackened their enforcement of policies banning harmful misinformation in recent months. Meta has removed many of The Agora’s ads, and some of the pages and accounts that run them. But it has continued to run hundreds more. Earlier this year, the Wall Street Journal found that Meta rarely severs ties completely with big-money advertisers, and the platform acknowledged that it was facing “an epidemic of scams” of increasing complexity. The New York Times recently reported that YouTube had relaxed its enforcement of policies that have for years banned harmful misinformation from its platform.

In many ways, The Agora’s social media strategy mirrors its corporate structure. Today, The Agora says it includes more than 20 companies, though at various points in its 45-year history, it has included even more than that. On LinkedIn, one former staffer described a phenomenon that he deemed “The Octopus Model.” Operating as a cluster of subsidiaries, rather than a centralized company, drives internal competition, he explained — and it also means that when the company gets in trouble, the trouble often doesn’t go all the way to the top. “Neither Bill Bonner nor Mark Ford [another Agora leader] has ever been arrested or accused of fraud or wrongdoing,” he wrote to conclude his “Octopus Model” description.

Bonnie Patten at Truth In Advertising also commented on Agora’s tentacled strategy — but she chose a slightly more colorful creature to compare it to: “Agora is a multi-headed hydra. They have dozens and dozens of publications that they are using to deceive and manipulate consumers.”

In a text message, Wiggin told Forbes that he thought the Octopus Model “sounds less promising than the ‘free market’ model Agora historically used.” Asked what The Agora’s ‘free market’ model was, Wiggin sent Forbes Google search results for two economists at George Mason University before acknowledging that neither has ever been affiliated with The Agora. Forbes asked Wiggin about The Agora’s specific history with free market principles, to which he replied, “I probably would [share] but I don’t know you.”

Wiggin noted that he hadn’t been party to the SEC or FTC lawsuits, and said a message from Forbes was the first he’d heard of Truth in Advertising.

Agora founder Bill Bonner now conducts much of his business — and the occasional Agora retreat — from a chateau in France that he and his wife bought and remodeled in 2009. Since then, Bonner has hosted copywriting events and Agora staff at the chateau. He opened a library in the house for members of The Agora’s “Oxford Club,” and gives those same members the option to rent out the entire property (prices are only visible to Oxford Club members).

In addition to Bonner’s chateau, The Agora also maintains a burgeoning empire around the world. In the U.K., it has operated under the subsidiary Southbank Research, offering access to many of the same “gurus” it advertises in the US. In India, Agora affiliate EquityMaster offers dozens more newsletters with names like Hidden Treasure, Double Income, and Lazy Millionaire, with prices that reach up to more than a hundred thousand rupees. Additional Agora branches offer similar products in Germany, Japan, Ireland, Australia, and France. The company has also purchased and restored more than a dozen historic buildings in Baltimore, though it expressed plans to sell some of those properties early last year.

“If a Democrat’s in office, sell on fear; if a Republican’s in office, sell on greed.”

In the U.S. The Agora’s business has often dabbled in politics. It has rented the email lists of prominent conservative political influencers like Mike Huckabee and Newt Gingrich, and has also employed at least one conservative political figure directly as a guru: Trumpworld figure Sebastian Gorka was among the newsletter authors for Stansberry Research, a former Agora subsidiary, in 2020 and 2021.

Last year, Paradigm Press, another Agora subsidiary, ran ads on Facebook and Instagram depicting Vice President Kamala Harris with devil horns, forcibly injecting children with vaccines. Just days before the election, with voting underway, Agora ads told Americans that actually, the election might be, or might have been, cancelled or postponed — and that, of course, their newsletters would tell you how to capitalize on it.

Two former Agora employees recalled a slogan that they said was popular in the company’s Baltimore offices: “if a Democrat’s in office, sell on fear; if a Republican’s in office, sell on greed.” The Agora’s publications have expressed varying opinions on the policies of Donald Trump — from comically positive to apocalyptically negative — but they all seem to agree that Trump is good for content.

Not all The Agora’s products have a political angle. In addition to its core copywriting business, The Agora also runs an “administrative services” company, sells “stock screening” software, , and manages a luxury resort in Nicaragua that offers timeshares, holotropic breathwork workshops, and a “Path to Vitality Longevity Experience.” In the course of reporting this story, Forbes set up a new email address to sign up for two free Agora newsletters. Several emails sent to the address promised that attendees of a promoted event would learn a “daily teaspoon secret that crushes” Type 2 diabetes, a “lost arthritis cure shown to reverse pain in 82% of patients,” and a “resurrection” cancer treatment (“15 times more powerful than chemotherapy, radiation and surgery”). The event was free, but it upsold attendees on a $2,460 “Masterplan For Fighting Disease.”

Another email promotion promised to reveal a “Natural Cancer Flush” which “[S]imply flushes it out. The cancer starts dying off.” Viewers of this promotion are upsold on an “Ultimate Cancer-Defeating Protocol” produced by Dr. Richard Gerhauser, and available for just $279.

The “Cancer-Defeating Protocol” is not Gerhauser’s first rodeo with The Agora. In fact, it appears to echo another Agora product that ended in disrepute.

In 2019, Dr. Gerhauser was sued by the FTC alongside several Agora entities over a different “protocol”: his “Doctor’s Guide to Reversing Diabetes in 28 Days.” At the time, the consumer protection agency’s spokesperson said that Gerhauser and Agora “stole money from older adults with lies,” and the agency ultimately required Agora to issue refunds for “Doctor’s Guide” customers.

Forbes contacted the FTC about Gerhauser’s “cancer-defeating protocol,” but it declined to comment on the company’s current conduct. Gerhauser did not respond to a request for comment.

More from Forbes

ForbesHow This Chicago Private Equity Firm Scored The Biggest Exit Of 2025By Hank TuckerForbesRed States–And AI–Are Big Losers From Trump’s Clean Energy MassacreBy Christopher HelmanForbesAn Arms Dealer Joins Silicon Valley’s Military BoomBy David JeansForbesThis Startup Built A Hospital In India To Test Its AI SoftwareBy Amy FeldmanForbesWhy The U.S. Should Copy Canada To Fix Its Broken Air Traffic Control SystemBy Jeremy Bogaisky

.png)