“So is this just bootstrapping with a bit of cash?” I got this message from few founders after I shared last week’s newsletter on seedstrapping.

It’s one way to look at it. But there’s more to it than that.

I like how Josh Payne put it:

Seed-strapping is just one step away from bootstrapping. You raise a single round of funding at the pre-seed or seed stage and scale profitably from there. You get all the validation from being connected to incredible investors. You get all of their network, all of the mentorship, all of their help – with very little dilution.

Josh lived it (also coined the term seedstrapping). He founded StackCommerce in 2012, raised a $1 million seed round from Amplify.LA and a handful of angels and then went on to build the business without raising again. By 2020, StackCommerce had reached around $80 million in gross revenue. One year later, Josh sold a majority stake to TPG’s Integrated Media Company.

Josh's story is one of profitable growth, limited dilution and a controlled exit — a clear example of what more and more people now call seedstrapping: raising once, building sustainably and keeping strategic options open.

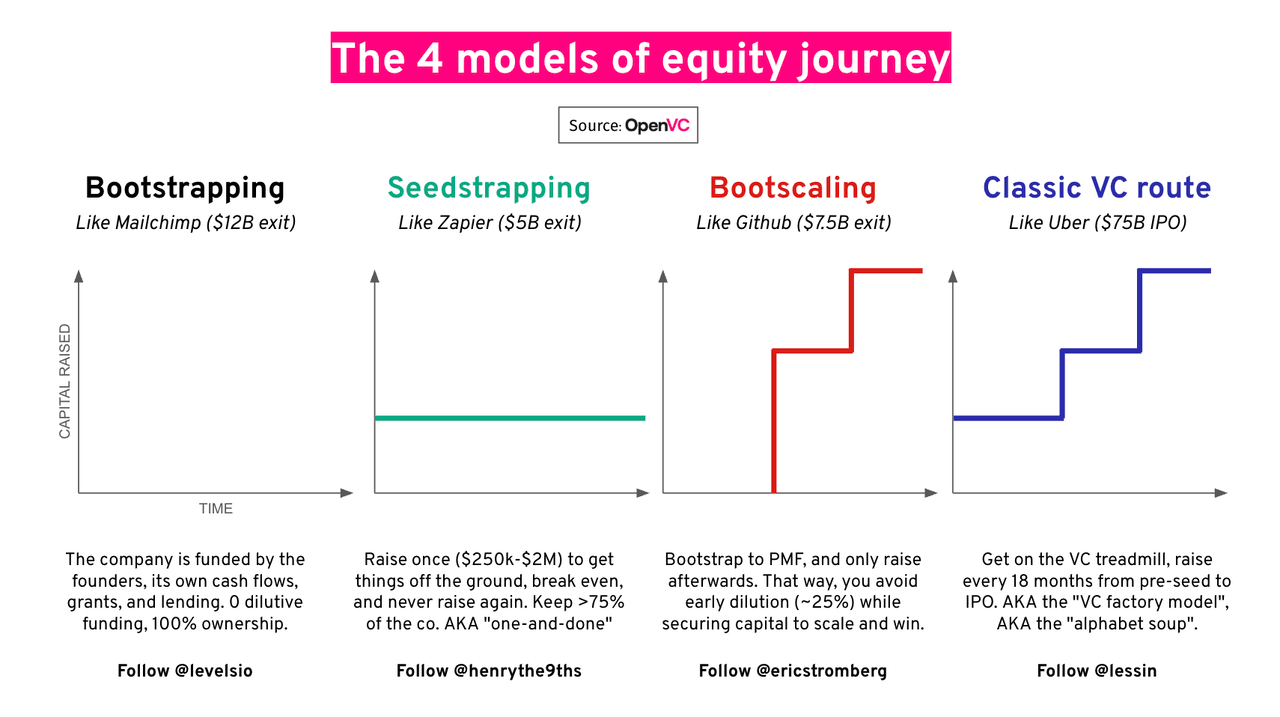

Here's another good comparison of seedstrapping vs. bootstrapping and the vc route (+ bootscaling) from OpenVC team:

Most comparisons I have seen frame bootstrapping, VC, and seedstrapping as funding options. In my view, they’re much more than that. They shape how you build your company, how you make decisions and what kind of business you end up running.

Having bootstrapped my first company (shut down after one year), worked with two VC-backed SaaS businesses as an early employee and co-founder, and now invested in two startups that build with the seedstrap mentality - I’ve seen firsthand how different the mindset, incentives, and trajectory can be for each one.

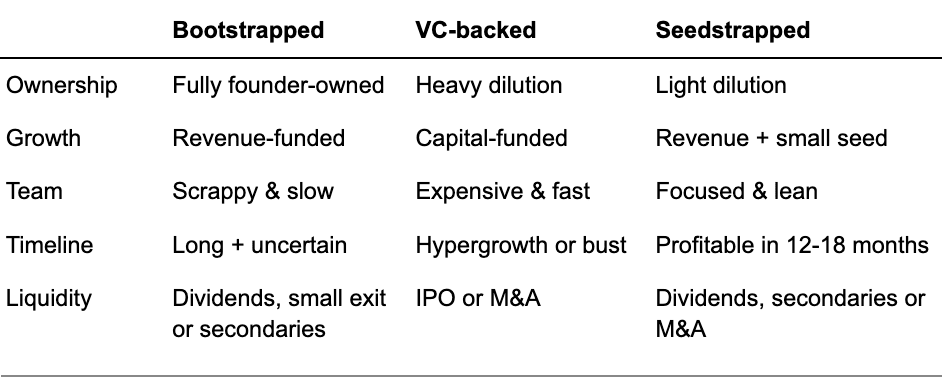

Here’s how I look at the 3 options:

Let’s break each of these down:

Bootstrapped: You own 100% and have full control - but you also bear 100% of the risk and funding burden.

VC-backed: You often give up 50%+ over multiple rounds. Control may shift early. The board expands, expectations rise, and you'll spend as much time on managing investors' motivations as on your own vision.

Seedstrapped: You part with just enough equity (15-25%) to bring on aligned angels or micro-funds - but stay firmly in control.

Bootstrapped: Every € of growth comes from customer revenue. You need to be frugal, creative and most likely will grow slowly - though with AI this may change.

VC-backed: You grow fast using investor capital - often before the business model is proven. VCs expect you to triple triple double double double (T2D3) over the 5 years after your first institutional round.

Seedstrapped: You raise a meaningful round (€200k - €1m) to cover your costs for the next 12-18 months and to accelerate validation and early traction - aim to grow with revenue after that.

Bootstrapped: You often don’t pay yourself a salary and delay key hires, so have to do everything yourself.

VC-backed: You can hire top talent early but most founders overhire. Been there, done that and keep seeing this over and over with most founders I talk to.

Seedstrapped: You and your founding team have an salary good enough to go all go full-time + hire a 1-2 key hires, but the team stays lean and ROI-focused.

Bootstrapped: The bootstrapping journey for most founders is long and uncertain - often 5+ years to any meaningful traction and size.

VC-backed: You’re expected to show hypergrowth in 12-24 months (see "Growth") or else you risk not being able to raise more funds from VCs and run out of cash.

Seedstrapped: You aim to move from default dead to default alive (ie. reach breakeven) in 12-18 months.

Bootstrapped: Great for lifestyle businesses or small exits - but hard to scale or sell big for vast majority of founders.

VC-backed: The goal is binary: go huge or go bust. The main path to Exit is via IPOs or M&A. Secondaries and dividends are rare, though the former has become more popular with IPO windows shut.

Seedstrapped: You can take dividends, sell full or part of the business (at good valuation since you're growing profitably), raise more, or just keep growing. You keep your options open.

It's important to say that none of these is easier or better. Each one comes with hard trade-offs.

Also, and this took me years — and several companies — to realise, this isn’t about how much you raise or how fast you want to grow.

It’s all about WHY you want to raise. It’s about your intention and mindset.

How you fund your business shapes far more than your cash in the bank or cap table. It shapes your decisions. The way you show up every Monday morning.

If you want full control and are OK growing slowly, bootstrapping makes sense. If your market rewards speed and you’re ready to give up control to scale fast, VC is the right tool.

Seedstrapping may, at first, look like a compromise between the two . However, this is not a "VC-lite" or "bootstrapping with a bit of cash." It's a conscious strategy.

If you're building with a profitable mindset and want to primarily grow your business through customer money, but need funds to get the team full-time on the idea, seedstrapping could be the option you’re looking for.

Finally, it may be the best path to keep your doors open. So many founders I meet end up locked into a path they didn’t fully choose - either because they raised too much, too soon and now have to swing for a home run… or because they waited too long, and the window to scale closed.

If you're thinking about seedstrapping but unsure if it's a fit - I'll share a simple founder's checklist in the next edition to help you decide.

Until then,

Zdenko

--

PS: I’d love to hear from founders building this way. If you’re thinking of seedstrapping (or tried a version of it) let me know in the comments or DM.

.png)